In this digital age, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education project ideas, artistic or simply to add personal touches to your space, Rebate Under Section 87a For Ay 2023 24 In Old Regime have proven to be a valuable resource. The following article is a dive deeper into "Rebate Under Section 87a For Ay 2023 24 In Old Regime," exploring what they are, where to find them, and how they can enhance various aspects of your daily life.

Get Latest Rebate Under Section 87a For Ay 2023 24 In Old Regime Below

Rebate Under Section 87a For Ay 2023 24 In Old Regime

Rebate Under Section 87a For Ay 2023 24 In Old Regime -

Tax Planning Section 87A Tax Rebate FY 2023 24 Is Sec 87A Tax Rebate Available under New Old Tax Regimes In Budget 2023 24 Finance Minister Nirmala

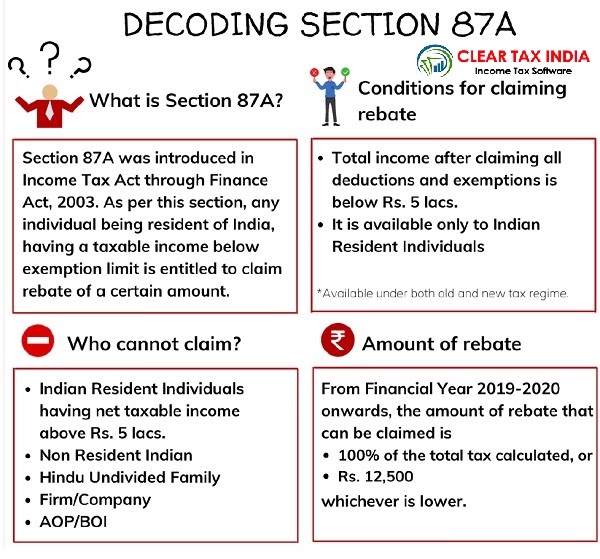

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

Printables for free include a vast range of printable, free content that can be downloaded from the internet at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages, and more. One of the advantages of Rebate Under Section 87a For Ay 2023 24 In Old Regime is their versatility and accessibility.

More of Rebate Under Section 87a For Ay 2023 24 In Old Regime

New Income Tax Slab 2023 24

New Income Tax Slab 2023 24

No change has been made in the tax rebate under Section 87A available under the old tax regime for FY 2023 24 Also read Revised income tax slabs rates for

If the net taxable income is up to INR 5 00 000 under old regime or INR 7 00 000 under new regime from AY 2024 25 then the taxpayer is eligible to claim a

Rebate Under Section 87a For Ay 2023 24 In Old Regime have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization Your HTML0 customization options allow you to customize printables to your specific needs whether you're designing invitations to organize your schedule or decorating your home.

-

Educational Worth: These Rebate Under Section 87a For Ay 2023 24 In Old Regime offer a wide range of educational content for learners of all ages, making these printables a powerful tool for parents and teachers.

-

It's easy: Instant access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Rebate Under Section 87a For Ay 2023 24 In Old Regime

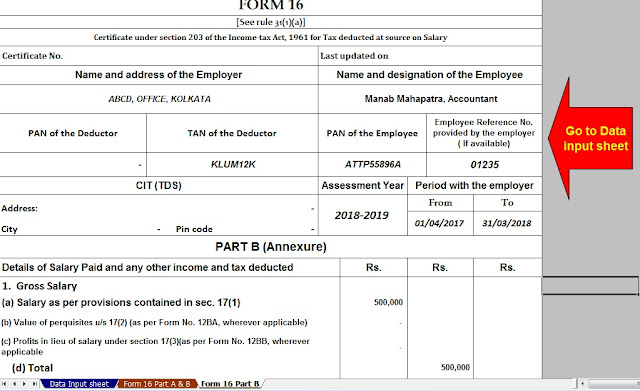

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

Feb 7 2023 How much tax rebate is available under Section 87A Rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023

Till March 31 2023 FY 2022 23 section 87A tax rebate under old and new tax regime was available for taxable income up to Rs 5 lakh Hence opting for old or new tax regime

If we've already piqued your interest in Rebate Under Section 87a For Ay 2023 24 In Old Regime Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of needs.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast variety of topics, including DIY projects to planning a party.

Maximizing Rebate Under Section 87a For Ay 2023 24 In Old Regime

Here are some fresh ways of making the most use of Rebate Under Section 87a For Ay 2023 24 In Old Regime:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Rebate Under Section 87a For Ay 2023 24 In Old Regime are an abundance of practical and imaginative resources catering to different needs and preferences. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the plethora that is Rebate Under Section 87a For Ay 2023 24 In Old Regime today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate Under Section 87a For Ay 2023 24 In Old Regime really completely free?

- Yes, they are! You can print and download these items for free.

-

Does it allow me to use free printables for commercial uses?

- It's all dependent on the conditions of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Are there any copyright violations with Rebate Under Section 87a For Ay 2023 24 In Old Regime?

- Some printables could have limitations concerning their use. You should read these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home using the printer, or go to a print shop in your area for the highest quality prints.

-

What program must I use to open printables that are free?

- Most PDF-based printables are available in the format PDF. This can be opened with free software, such as Adobe Reader.

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Check more sample of Rebate Under Section 87a For Ay 2023 24 In Old Regime below

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Section 87A What Is The Income Tax Rebate Available Under Section 87A

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

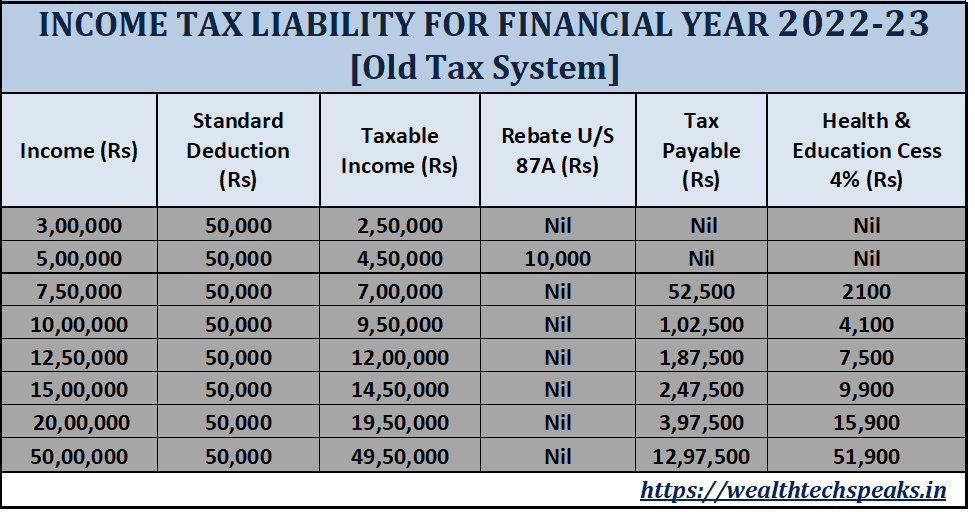

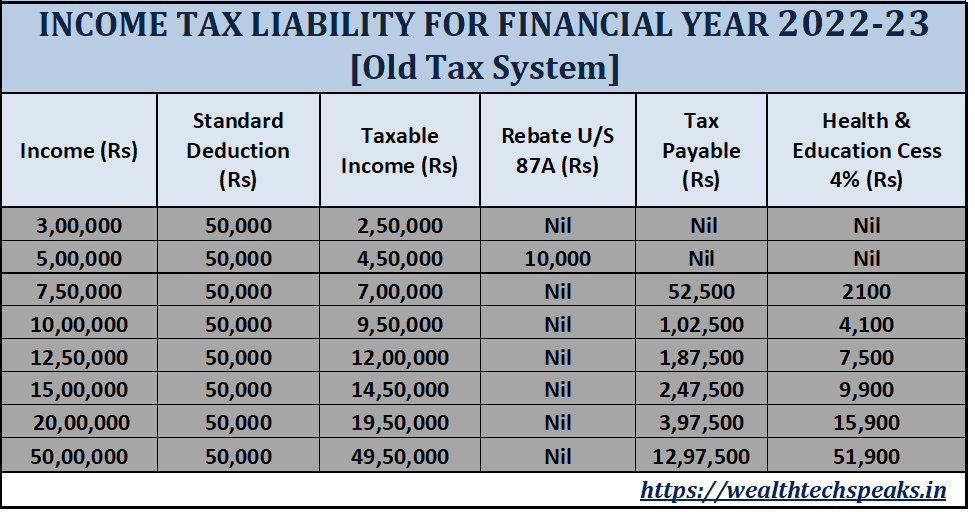

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

https://taxguru.in/income-tax/marginal-relief-u …

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

https://tax2win.in/guide/section-87a

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old

Section 87A What Is The Income Tax Rebate Available Under Section 87A

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh