In this day and age where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes as well as creative projects or simply adding an extra personal touch to your space, Rebate Under Section 89 1 Of Income Tax are now a vital resource. This article will take a dive through the vast world of "Rebate Under Section 89 1 Of Income Tax," exploring what they are, where to get them, as well as how they can enhance various aspects of your life.

Get Latest Rebate Under Section 89 1 Of Income Tax Below

Rebate Under Section 89 1 Of Income Tax

Rebate Under Section 89 1 Of Income Tax -

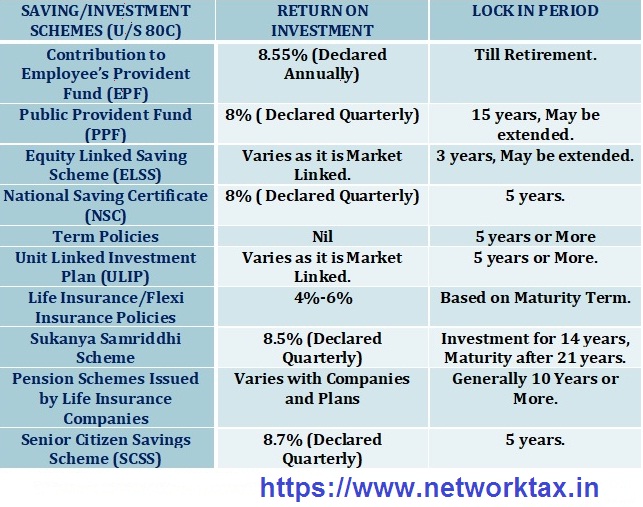

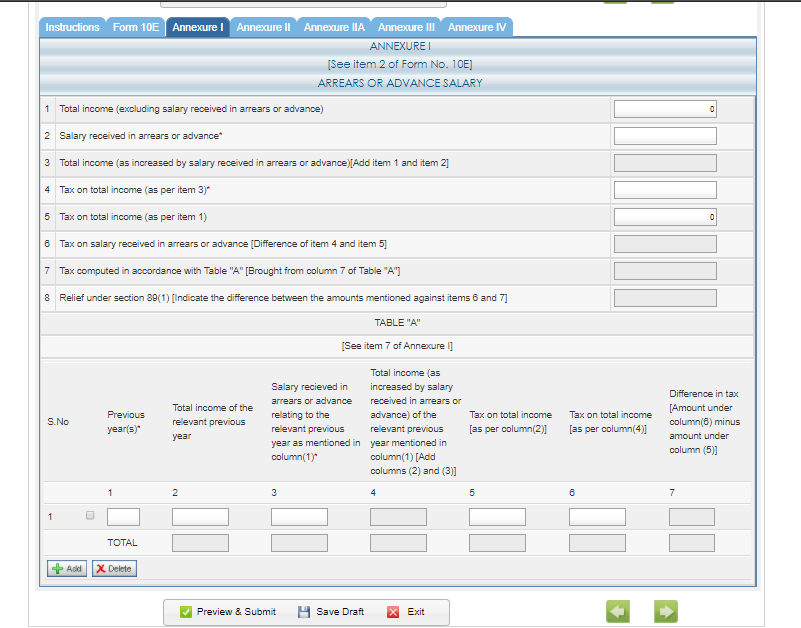

Web 27 f 233 vr 2020 nbsp 0183 32 However the Income Tax Act provides assessees relief in those situations u s 89 1 Relief under Section 89 1 Relief under section 89 1 for arrears of salary

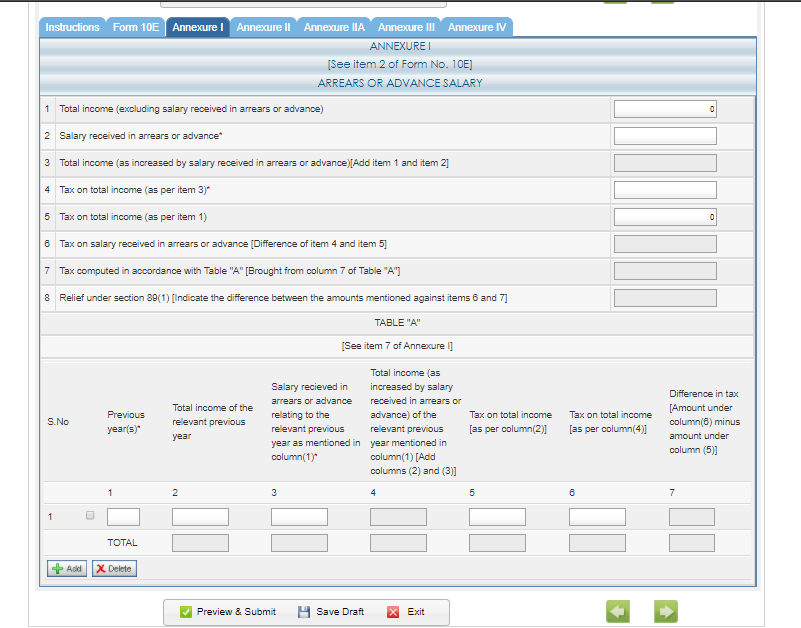

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15

The Rebate Under Section 89 1 Of Income Tax are a huge assortment of printable content that can be downloaded from the internet at no cost. These resources come in many styles, from worksheets to coloring pages, templates and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Rebate Under Section 89 1 Of Income Tax

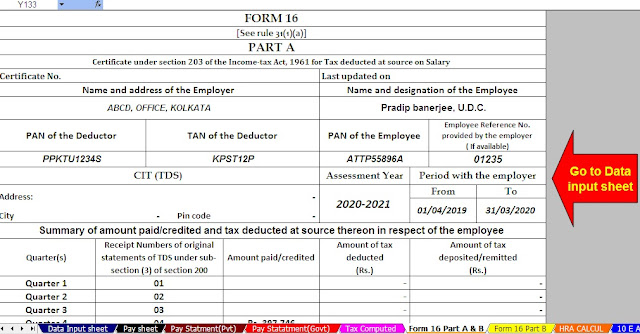

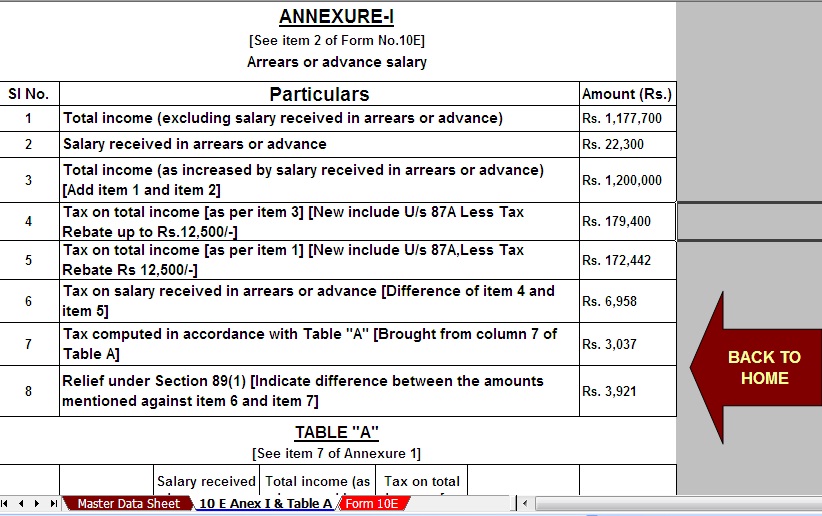

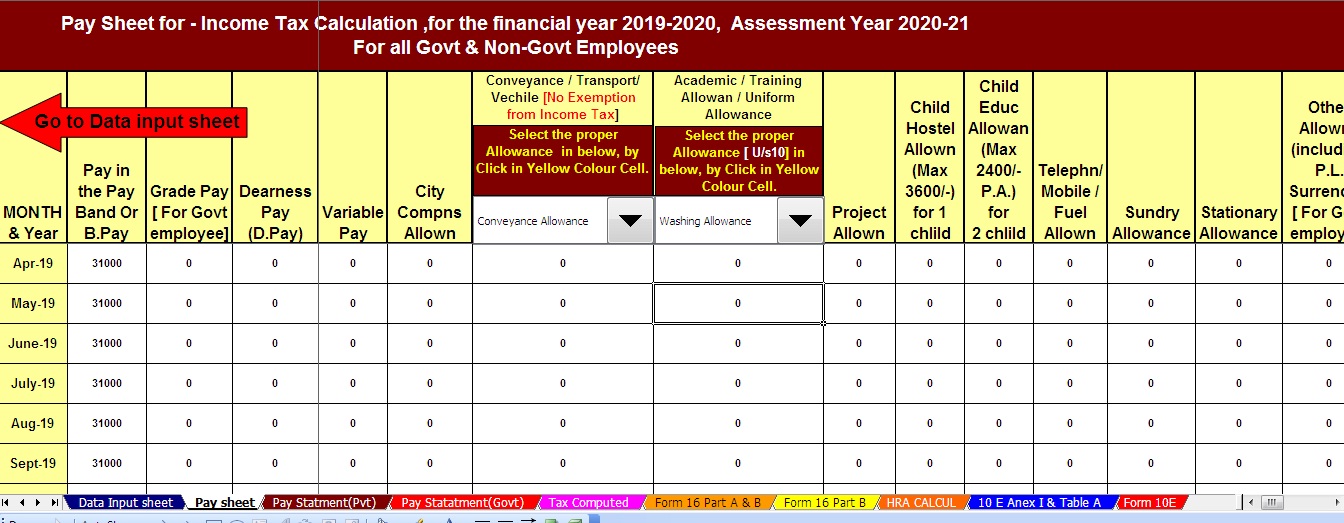

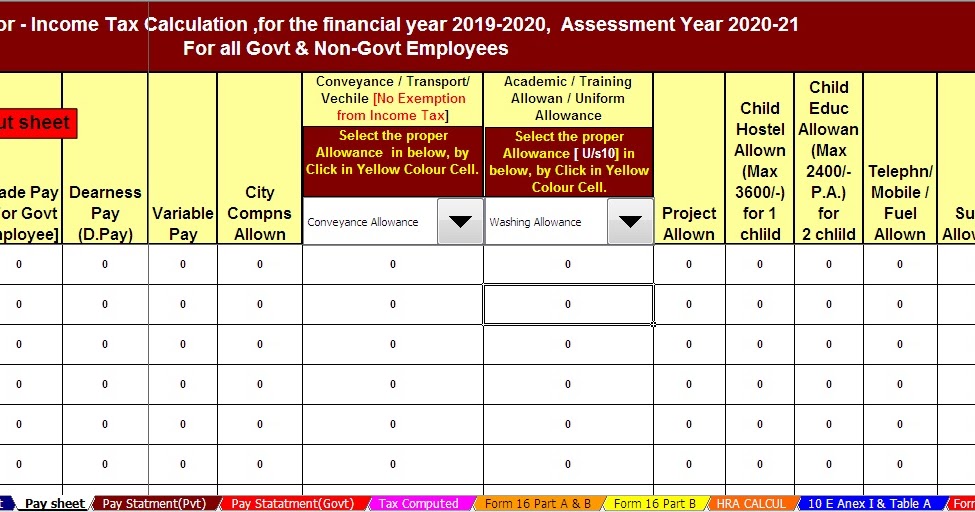

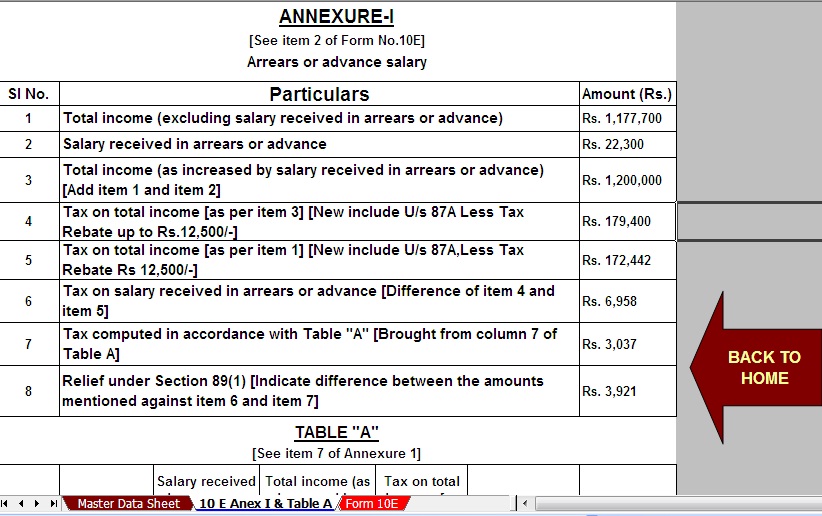

Income Tax Arrears Relief Calculator U s 89 1 Income Tax Form 10E

Income Tax Arrears Relief Calculator U s 89 1 Income Tax Form 10E

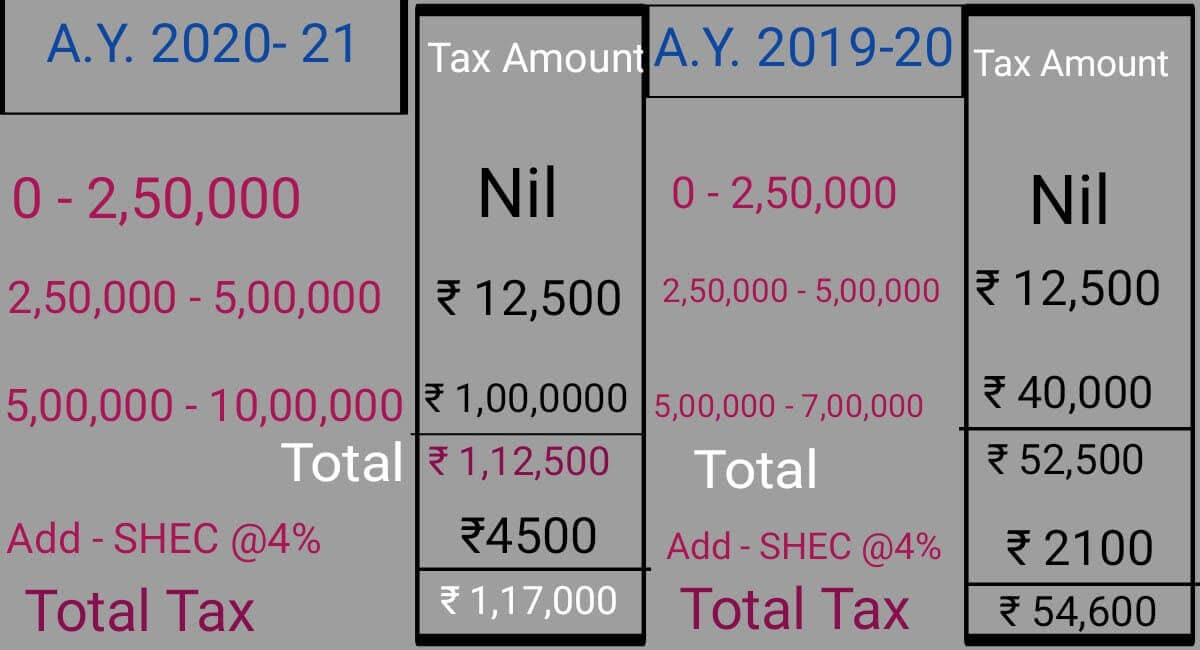

Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is

Web 11 mai 2023 nbsp 0183 32 How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: They can make the templates to meet your individual needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Value: Downloads of educational content for free are designed to appeal to students of all ages, which makes them an invaluable aid for parents as well as educators.

-

It's easy: Instant access to numerous designs and templates helps save time and effort.

Where to Find more Rebate Under Section 89 1 Of Income Tax

Relief Under Section 89 L Section 89 Of Income Tax Act L Relief Under 89 1

Relief Under Section 89 L Section 89 Of Income Tax Act L Relief Under 89 1

Web The excess between the tax on additional salary as calculated under step 1 and 2 shall be the relief admissible under section 89 If there is no excess no relief is admissible If the

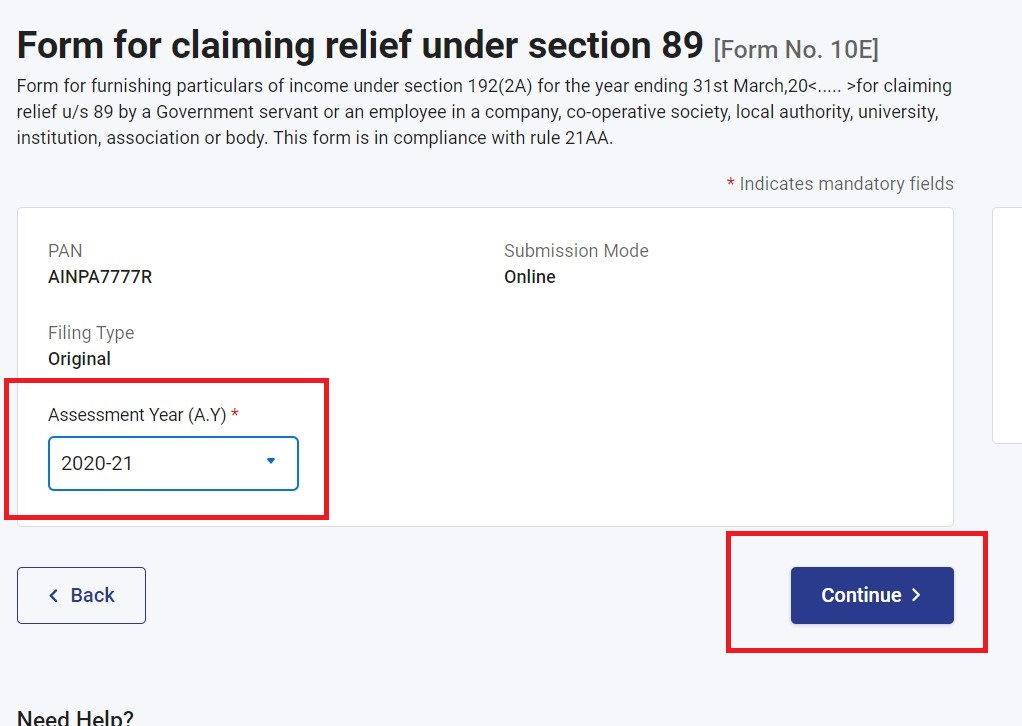

Web 8 mai 2023 nbsp 0183 32 It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax tax relief

Now that we've piqued your curiosity about Rebate Under Section 89 1 Of Income Tax We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Rebate Under Section 89 1 Of Income Tax for a variety motives.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast spectrum of interests, including DIY projects to planning a party.

Maximizing Rebate Under Section 89 1 Of Income Tax

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Rebate Under Section 89 1 Of Income Tax are a treasure trove filled with creative and practical information for a variety of needs and desires. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the wide world of Rebate Under Section 89 1 Of Income Tax today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I use the free printables in commercial projects?

- It's determined by the specific terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with Rebate Under Section 89 1 Of Income Tax?

- Some printables may come with restrictions on their use. Be sure to read the terms and conditions offered by the creator.

-

How can I print Rebate Under Section 89 1 Of Income Tax?

- You can print them at home using any printer or head to the local print shop for superior prints.

-

What software will I need to access Rebate Under Section 89 1 Of Income Tax?

- A majority of printed materials are with PDF formats, which can be opened using free software, such as Adobe Reader.

Relief Under Section 89 Of Income Tax Act In Hindi 89

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Check more sample of Rebate Under Section 89 1 Of Income Tax below

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Relief Under Section 89 1 For Arrears Of Salary MyITreturn Help Center

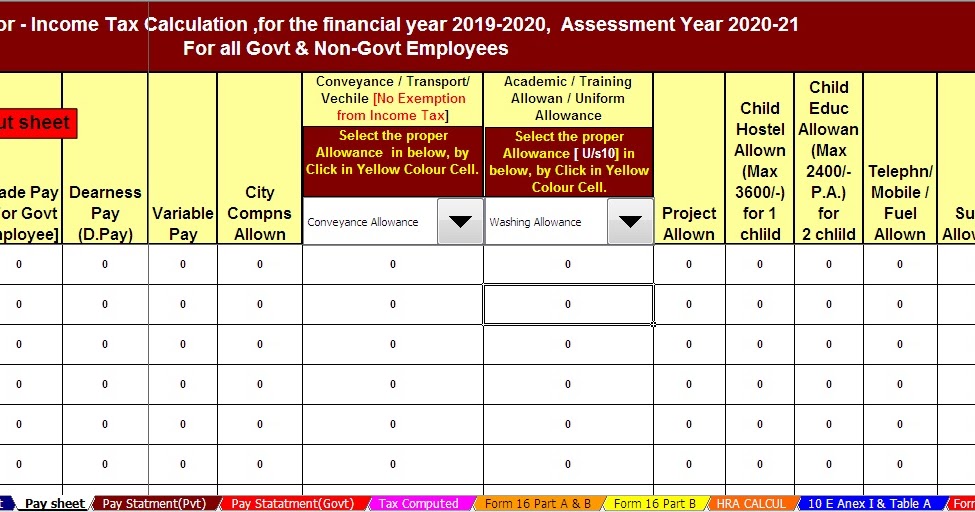

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Taxability Of Arrear Of Salary Relief Under Section 89 1 With

Theme Presentation1

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://incometaxindia.gov.in/Pages/tools/relief-under-section-89.aspx

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15

https://taxguru.in/income-tax/tax-relief-section-89-income-tax-act...

Web 4 janv 2022 nbsp 0183 32 If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief under section 89 1 of Income

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15

Web 4 janv 2022 nbsp 0183 32 If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief under section 89 1 of Income

Taxability Of Arrear Of Salary Relief Under Section 89 1 With

Relief Under Section 89 1 For Arrears Of Salary MyITreturn Help Center

Theme Presentation1

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

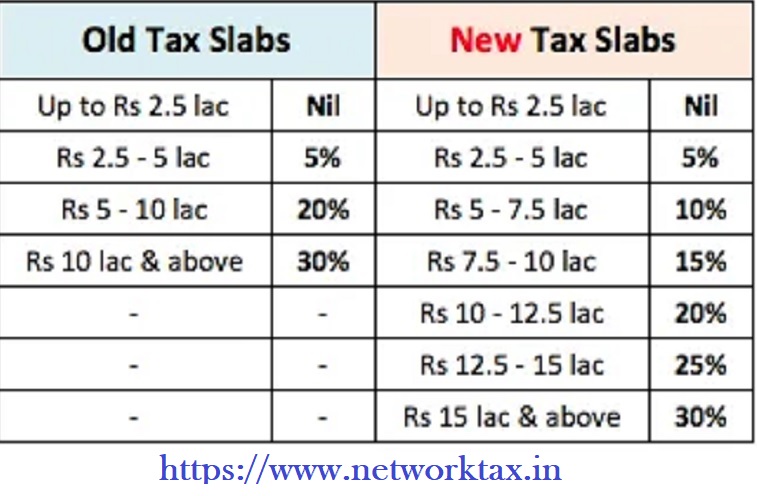

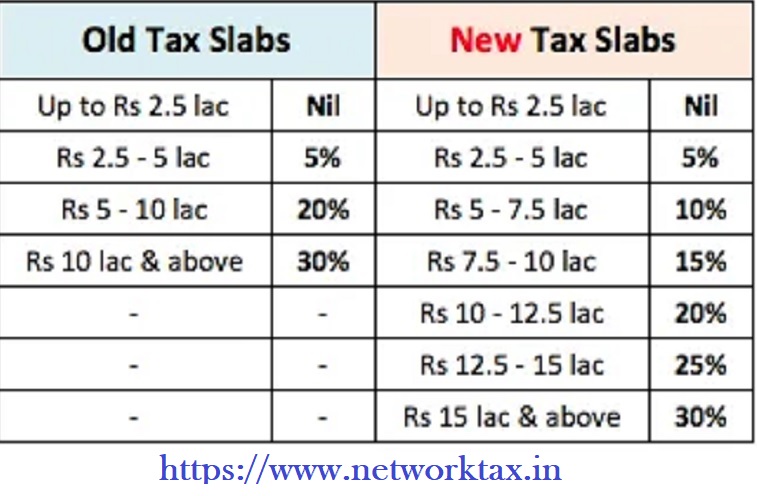

Rebate Relief Section 87A Section 89 1 Income Tax

Budget 2023 Summary Of Direct Tax Proposals

Budget 2023 Summary Of Direct Tax Proposals

How To Calculate Relief U s 89 1 Of The Income Tax Act