In this age of technology, where screens dominate our lives however, the attraction of tangible printed materials hasn't faded away. For educational purposes, creative projects, or just adding some personal flair to your area, Relief U S 89 1 Of Income Tax Act have proven to be a valuable resource. With this guide, you'll dive deeper into "Relief U S 89 1 Of Income Tax Act," exploring the benefits of them, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Relief U S 89 1 Of Income Tax Act Below

Relief U S 89 1 Of Income Tax Act

Relief U S 89 1 Of Income Tax Act -

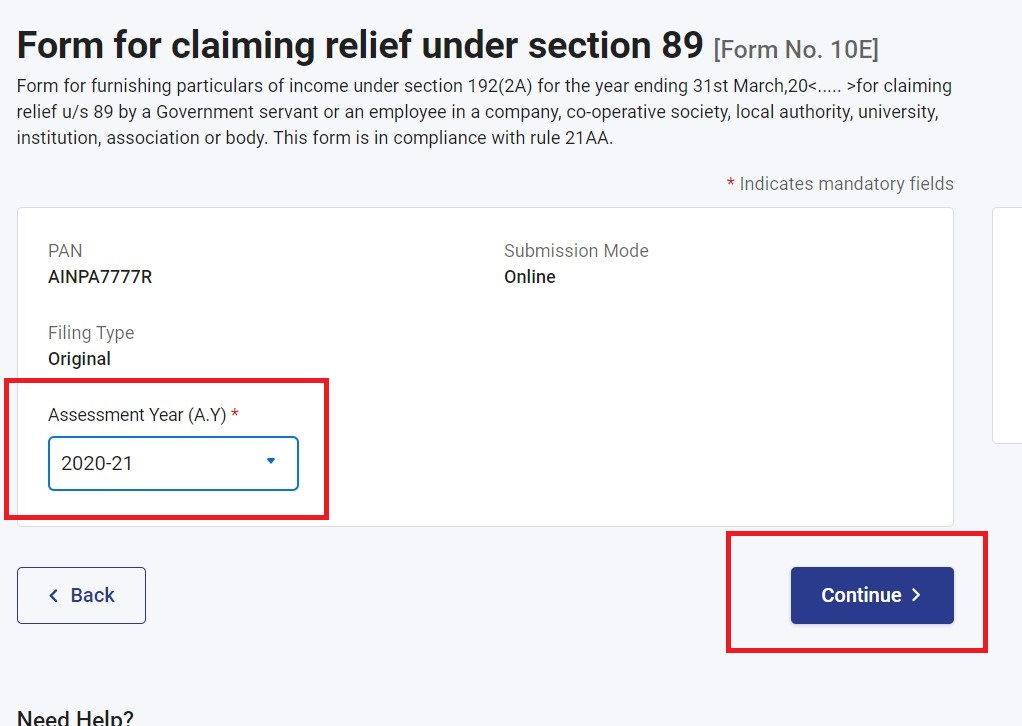

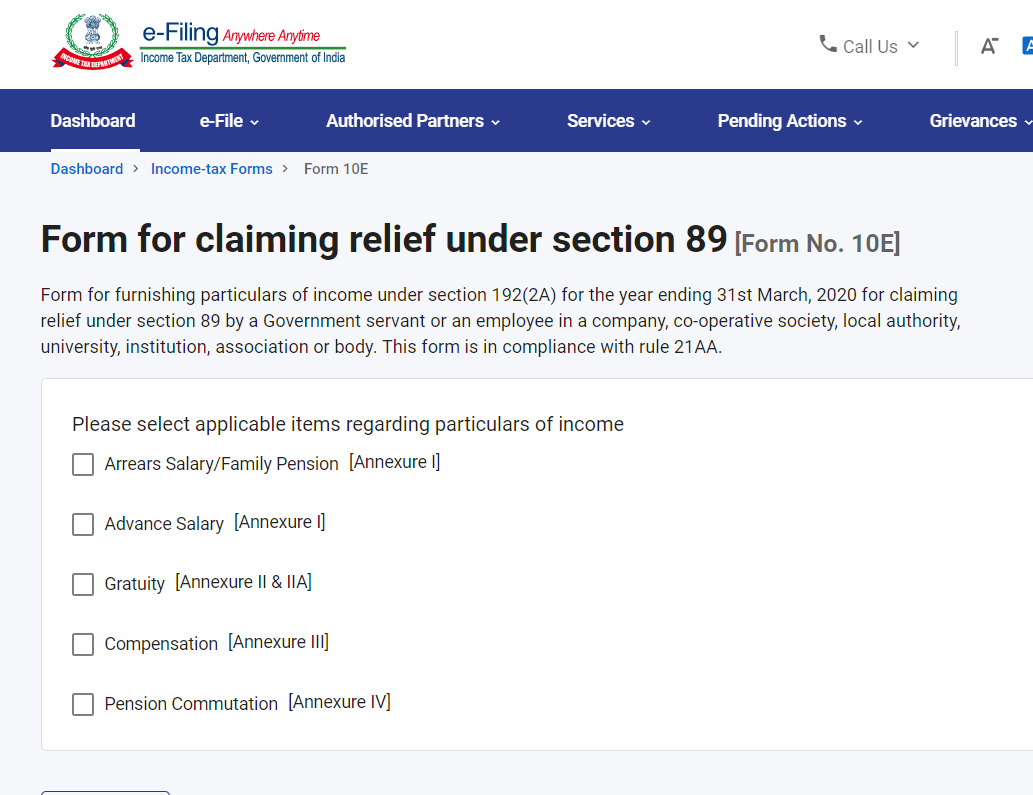

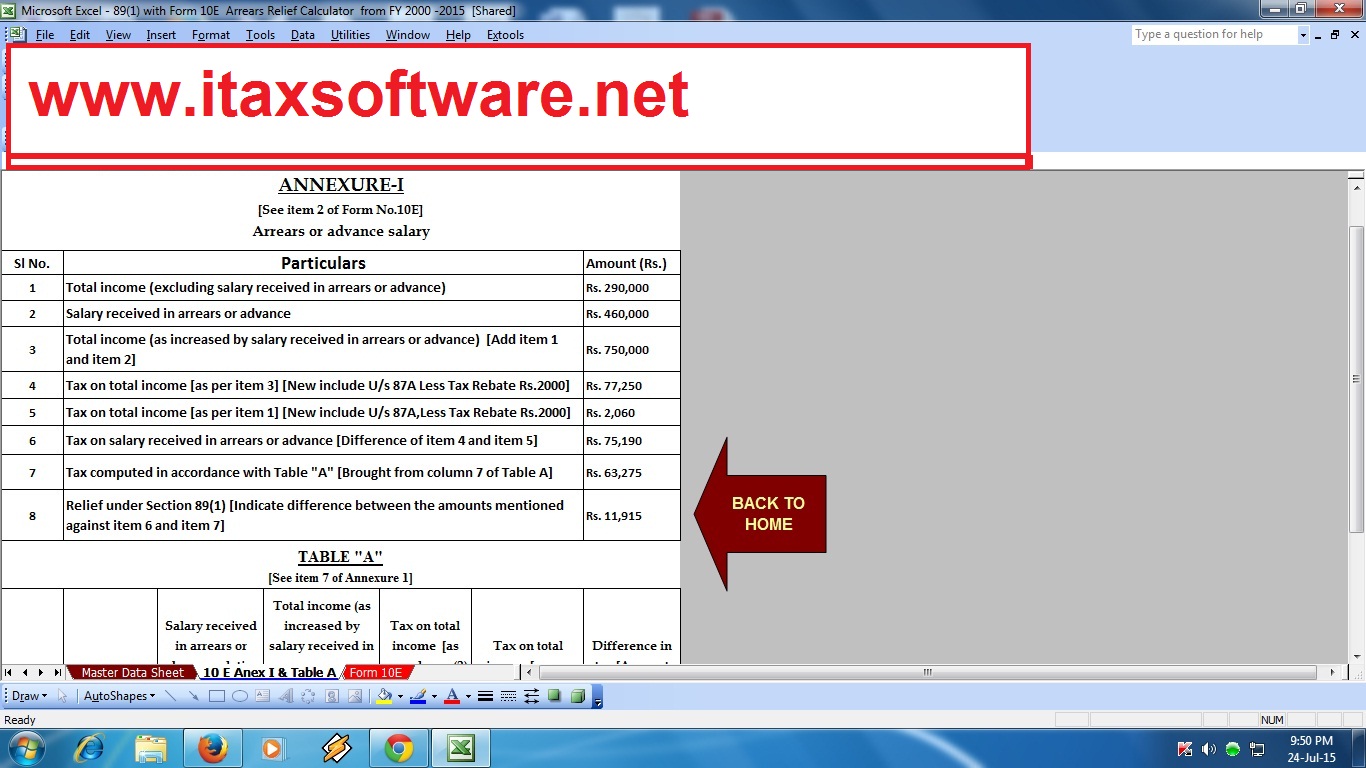

A step by step guide Receiving arrears may elevate your tax burden by moving you into a higher tax bracket Section 89 1 of the Income Tax Act 1961

Section 89 1 of the Income Tax Act in India offers a tax relief benefit to taxpayers who receive income in arrears or advance Here s how it benefits you

Relief U S 89 1 Of Income Tax Act cover a large selection of printable and downloadable content that can be downloaded from the internet at no cost. They are available in numerous designs, including worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their variety and accessibility.

More of Relief U S 89 1 Of Income Tax Act

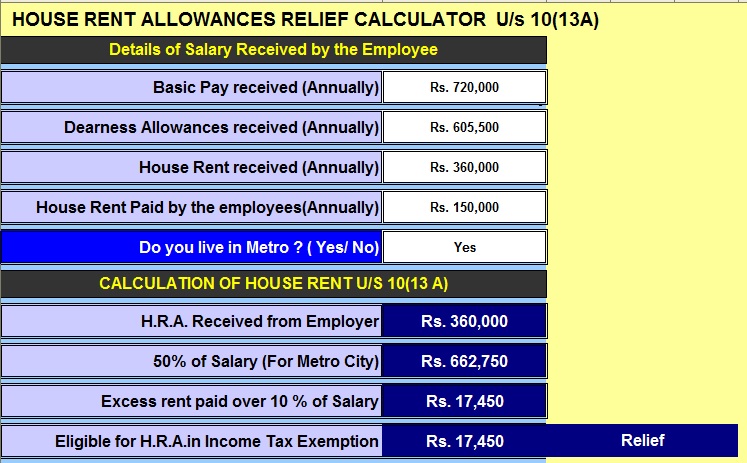

How To Calculate Relief U s 89 1 Of The Income Tax Act

How To Calculate Relief U s 89 1 Of The Income Tax Act

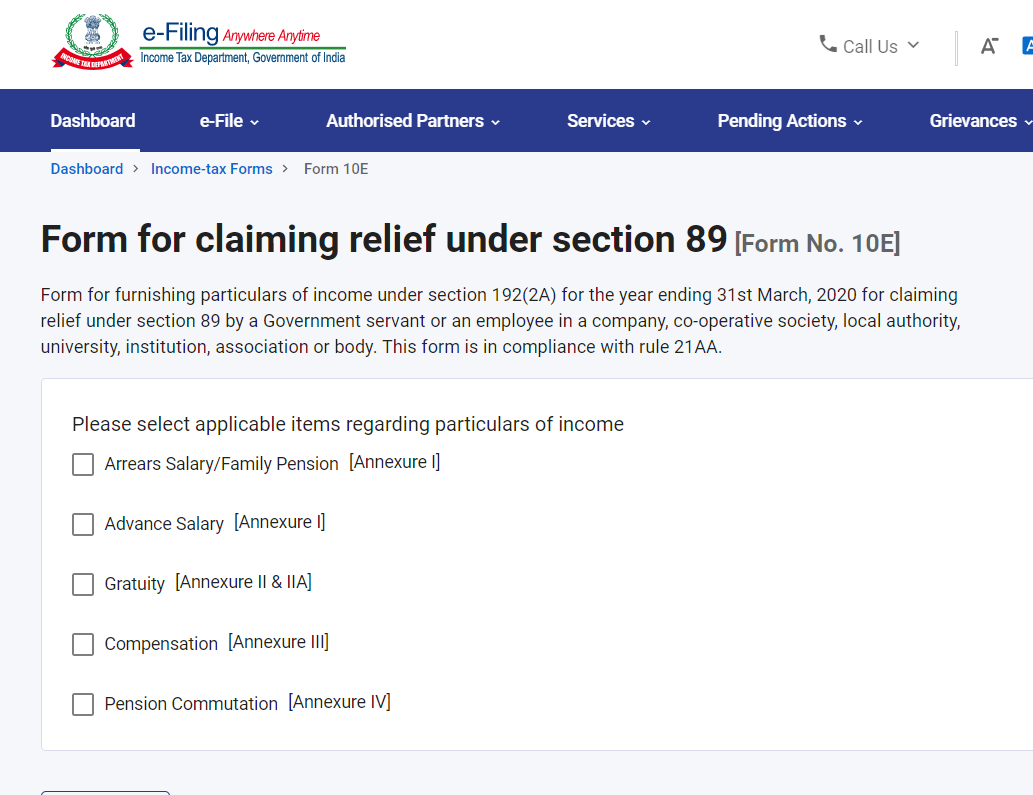

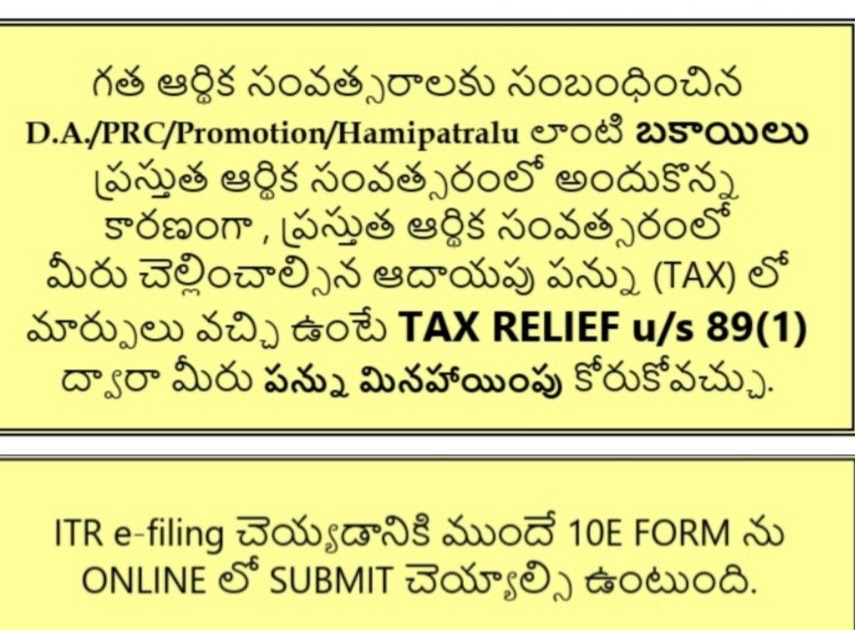

An employee can claim Section 89 relief if during the year he is liable to pay tax in respect of the following receipts a Advance Salary b Arrears of salary

Section 89 of the Income Tax Act 1961 provides relief to taxpayers who receive arrears of salary or profits in lieu of salary in a particular financial year This

Relief U S 89 1 Of Income Tax Act have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization We can customize printing templates to your own specific requirements when it comes to designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value These Relief U S 89 1 Of Income Tax Act are designed to appeal to students of all ages, making these printables a powerful device for teachers and parents.

-

Simple: You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Relief U S 89 1 Of Income Tax Act

Relief Under Section 89 1 Income Under The Head Salaries

Relief Under Section 89 1 Income Under The Head Salaries

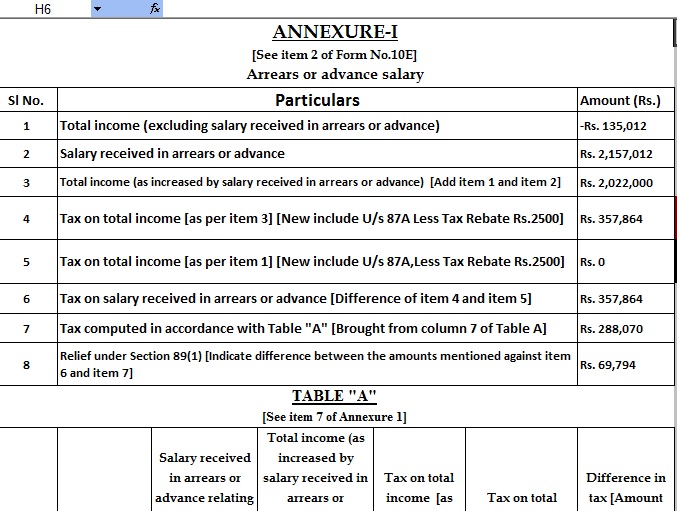

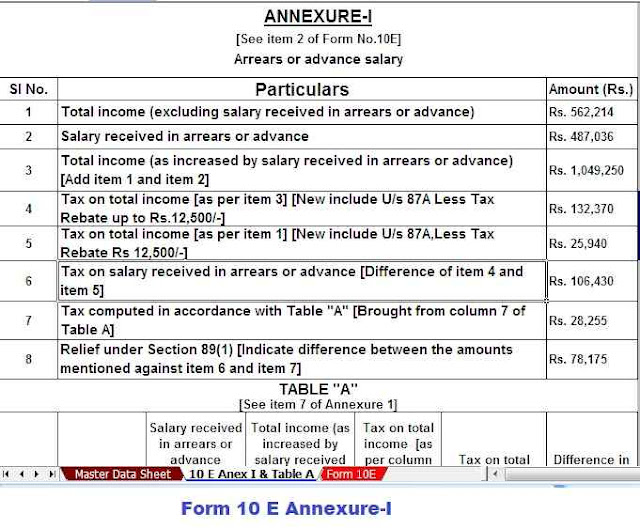

Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is

If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief under section 89 1 of Income

We hope we've stimulated your curiosity about Relief U S 89 1 Of Income Tax Act and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Relief U S 89 1 Of Income Tax Act for a variety objectives.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets with flashcards and other teaching tools.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Relief U S 89 1 Of Income Tax Act

Here are some ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home, or even in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Relief U S 89 1 Of Income Tax Act are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and pursuits. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the wide world of Relief U S 89 1 Of Income Tax Act right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Relief U S 89 1 Of Income Tax Act really free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use free printing templates for commercial purposes?

- It depends on the specific terms of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright violations with Relief U S 89 1 Of Income Tax Act?

- Some printables could have limitations regarding their use. Make sure you read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home with printing equipment or visit the local print shop for more high-quality prints.

-

What program must I use to open printables at no cost?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

How To Calculate Relief U s 89 1 Of The Income Tax Act

Check more sample of Relief U S 89 1 Of Income Tax Act below

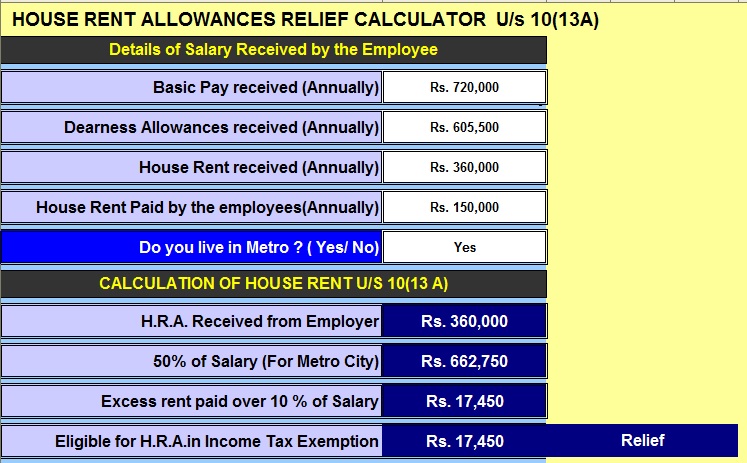

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

DOWNLOAD 89 1 RELIEF CALCULATOR FREE FY 2022 23 AY 2023 24 SIMPLE

relief calculator for Arrears received in FY 2022-23 ay 2023-24.png)

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://tax2win.in/guide/taxability-arrear-salary-relief-us-89

Section 89 1 of the Income Tax Act in India offers a tax relief benefit to taxpayers who receive income in arrears or advance Here s how it benefits you

https://www.incometax.gov.in/iec/foportal/hel…

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total

Section 89 1 of the Income Tax Act in India offers a tax relief benefit to taxpayers who receive income in arrears or advance Here s how it benefits you

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total

relief calculator for Arrears received in FY 2022-23 ay 2023-24.png)

DOWNLOAD 89 1 RELIEF CALCULATOR FREE FY 2022 23 AY 2023 24 SIMPLE

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

What Is The Procedure Of Calculation Of Arrears Relief U s 89 1 With