In a world where screens rule our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Be it for educational use as well as creative projects or simply to add an extra personal touch to your area, Relief U S 89 Income Tax Act have proven to be a valuable source. The following article is a dive to the depths of "Relief U S 89 Income Tax Act," exploring the different types of printables, where they are available, and ways they can help you improve many aspects of your lives.

Get Latest Relief U S 89 Income Tax Act Below

Relief U S 89 Income Tax Act

Relief U S 89 Income Tax Act -

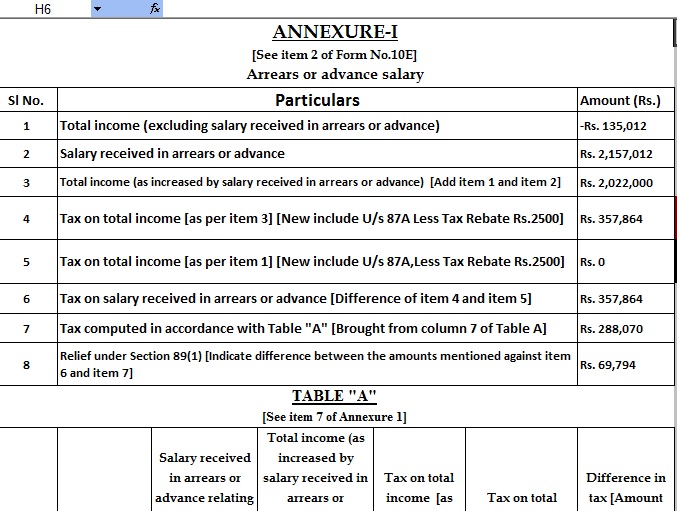

Section 89 1 An Overview What is Income Tax Arrears Above all Eligibility for Relief 1 Received Arrears 2 Taxable in the Year of Receipt How to Calculate Relief 1 Calculate Taxable Income 2 Calculate Tax on Total Income 3 Calculate Tax on Total Income Without Arrears 4 Find the Difference 5 Calculate Relief 6 Deduct Relief

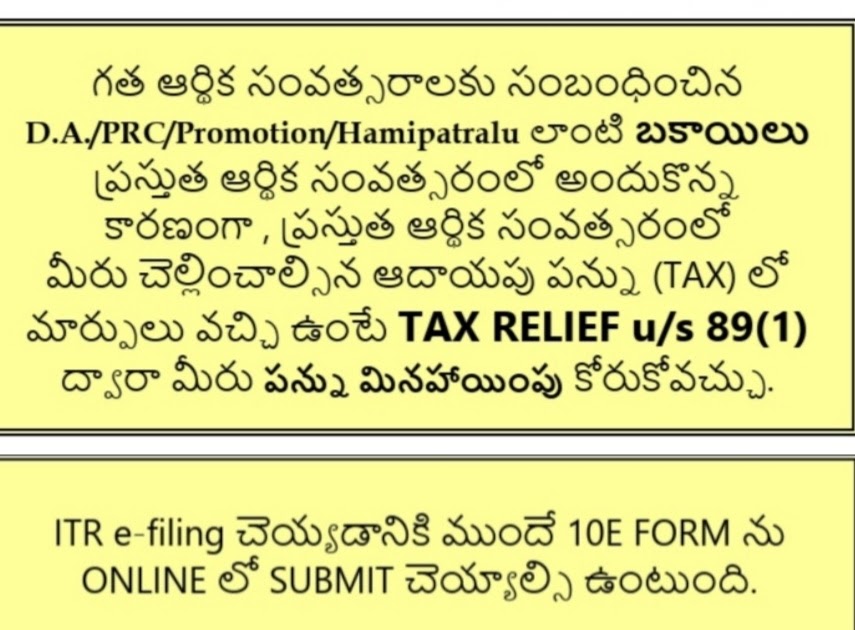

When will Relief under Section 89 1 of Income Tax Act 1961 become available Salary received in arrear or in advance Rule 21A 2 Receipt of Gratuity for Past Service Rule 21A 3 Commuted Pension Rule 21A 5 Compensation on termination of Employment Rule 21A 4 Steps to Follow while calculating Tax Relief under section

Relief U S 89 Income Tax Act cover a large selection of printable and downloadable content that can be downloaded from the internet at no cost. These printables come in different types, like worksheets, templates, coloring pages, and much more. The great thing about Relief U S 89 Income Tax Act is their flexibility and accessibility.

More of Relief U S 89 Income Tax Act

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

3 1 Purpose The Income Tax Act u s 89 provides relief to an assesse for any salary or profit in lieu of salary or family pension received by an assesse in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a rate higher than that at which it would otherwise have been assessed

Detailed insights into Section 89 of the Income Tax Act 1961 which offers tax relief on arrears or advance salary pension or compensation Learn about eligibility conditions and more

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

The ability to customize: It is possible to tailor printing templates to your own specific requirements, whether it's designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free can be used by students from all ages, making them a useful tool for parents and educators.

-

It's easy: Fast access numerous designs and templates, which saves time as well as effort.

Where to Find more Relief U S 89 Income Tax Act

How To Calculate Relief U s 89 1 Of The Income Tax Act

How To Calculate Relief U s 89 1 Of The Income Tax Act

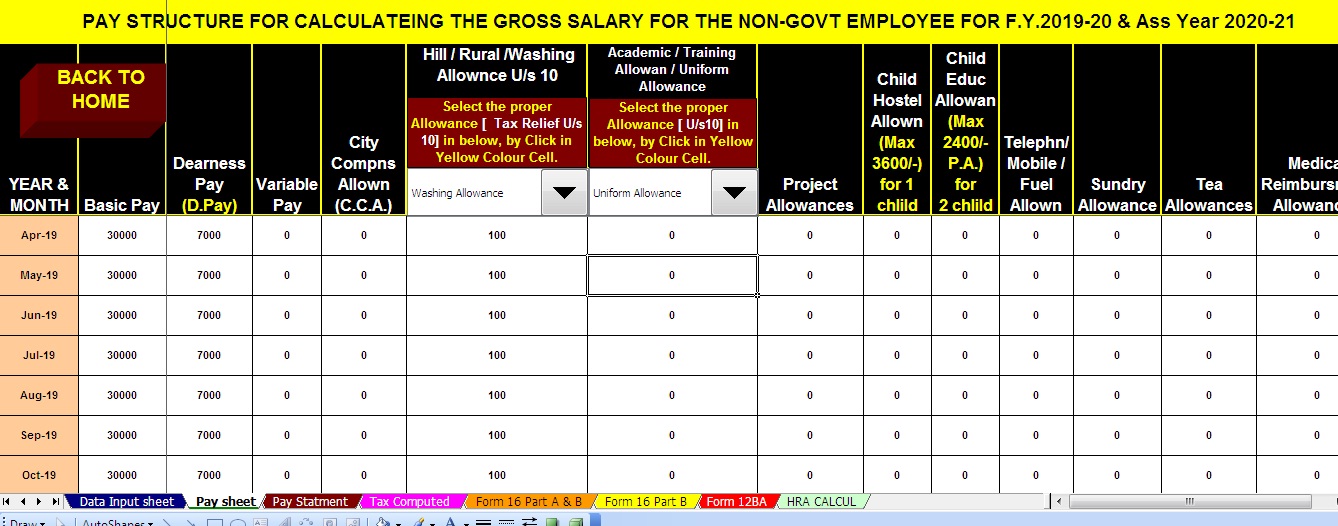

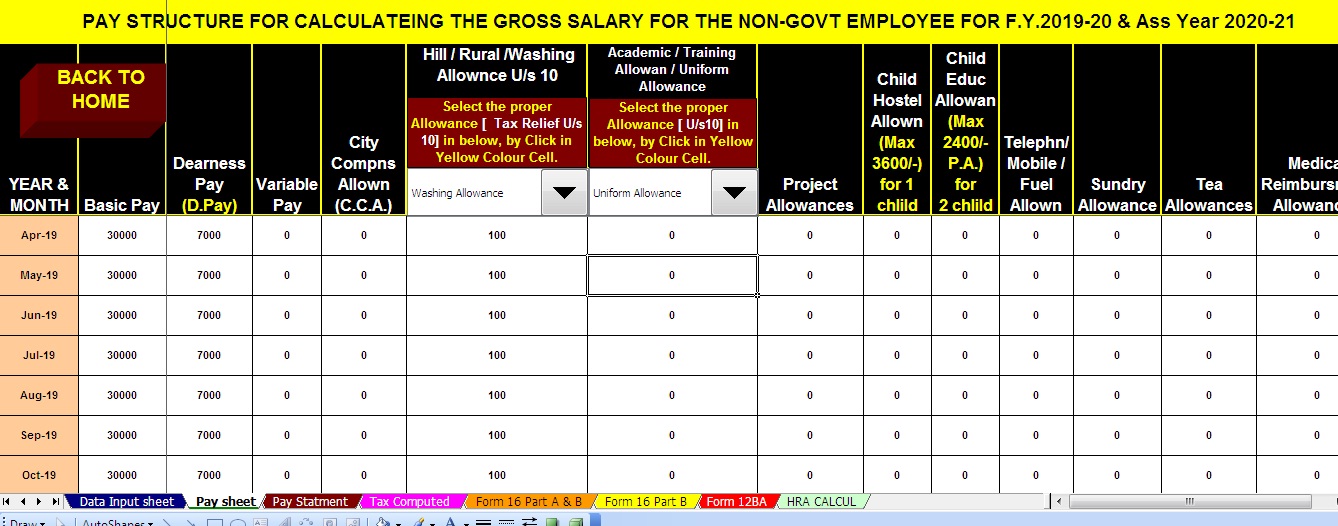

Admin Download 89 1 Arrears Relief Calculator From F Y 2000 01 to F Y 2022 23 If you are in arrears in the 2022 2023 tax year relating to the previous year s then your tax liability will be higher due to the arrears but you know that you can split out your delayed income in the relevant years on a national

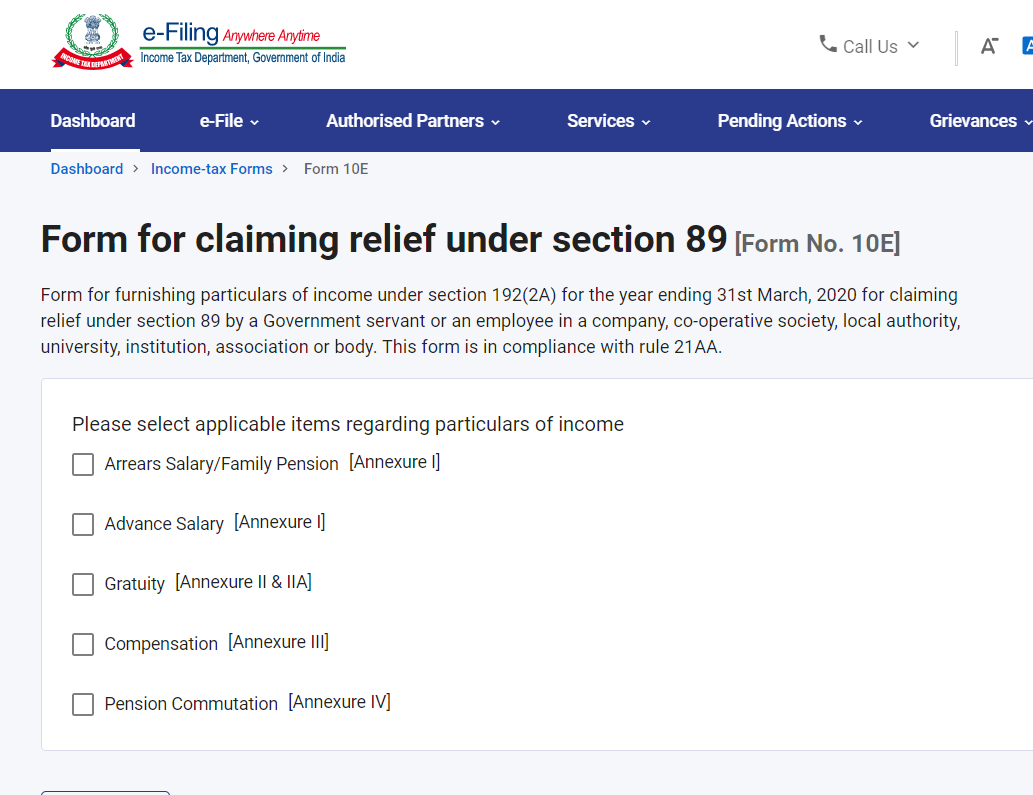

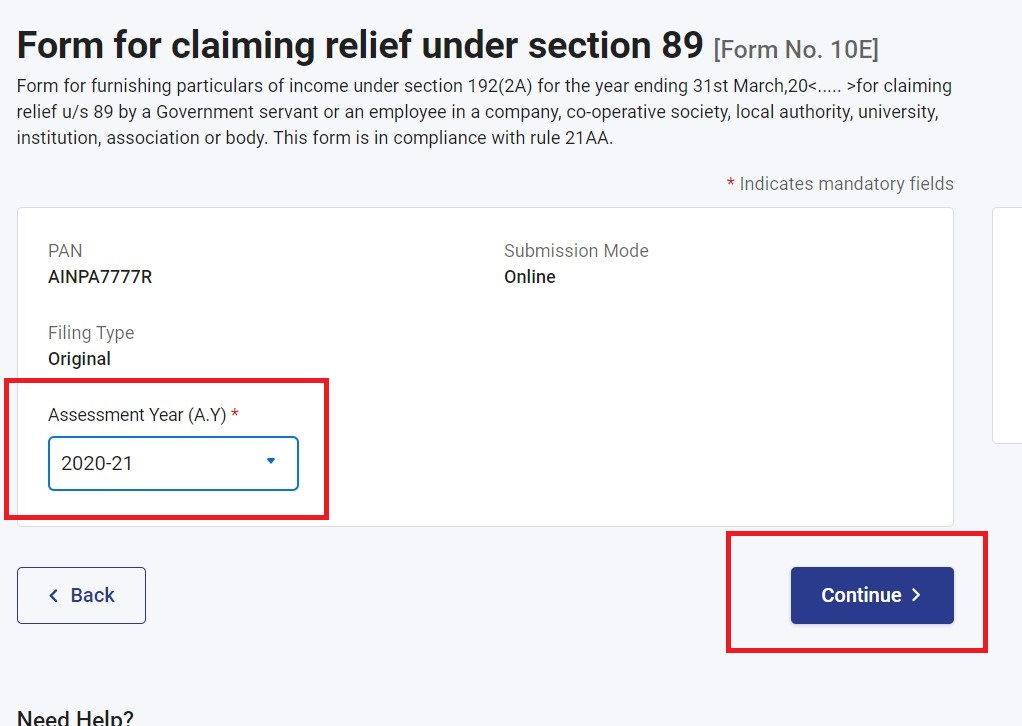

Section 89 1 provides tax relief for delayed salary received in the form of arrears or received a family pension in arrears Who should file Form 10E An individual should file Form 10E if he she has received the following income during the previous financial year Arrears of salary Family pension in arrears Advance salary Gratuity

After we've peaked your interest in Relief U S 89 Income Tax Act and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Relief U S 89 Income Tax Act for various goals.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free including flashcards, learning materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide variety of topics, from DIY projects to party planning.

Maximizing Relief U S 89 Income Tax Act

Here are some unique ways to make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Relief U S 89 Income Tax Act are a treasure trove of useful and creative resources that can meet the needs of a variety of people and preferences. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast collection of Relief U S 89 Income Tax Act today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can print and download these files for free.

-

Can I download free printables for commercial uses?

- It is contingent on the specific rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using Relief U S 89 Income Tax Act?

- Certain printables could be restricted regarding usage. You should read the terms and regulations provided by the creator.

-

How do I print Relief U S 89 Income Tax Act?

- Print them at home with an printer, or go to the local print shop for premium prints.

-

What software must I use to open printables free of charge?

- Many printables are offered with PDF formats, which is open with no cost programs like Adobe Reader.

Relief Under Section 89 1 Income Under The Head Salaries

How To Calculate Relief U s 89 1 Of The Income Tax Act

Check more sample of Relief U S 89 Income Tax Act below

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

Relief U S 89 1 Short Taxation CA Inter CA IPCC Shrey Rathi

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https:// taxguru.in /income-tax/tax-relief-section...

When will Relief under Section 89 1 of Income Tax Act 1961 become available Salary received in arrear or in advance Rule 21A 2 Receipt of Gratuity for Past Service Rule 21A 3 Commuted Pension Rule 21A 5 Compensation on termination of Employment Rule 21A 4 Steps to Follow while calculating Tax Relief under section

https:// tax2win.in /guide/taxability-arrear-salary-relief-us-89

These advances or arrears can affect your taxes and are reflected in the year of the receipt In that case relief under Section 89 1 of the Income Tax Act 1961 can help you save from this additional tax burden Let us

When will Relief under Section 89 1 of Income Tax Act 1961 become available Salary received in arrear or in advance Rule 21A 2 Receipt of Gratuity for Past Service Rule 21A 3 Commuted Pension Rule 21A 5 Compensation on termination of Employment Rule 21A 4 Steps to Follow while calculating Tax Relief under section

These advances or arrears can affect your taxes and are reflected in the year of the receipt In that case relief under Section 89 1 of the Income Tax Act 1961 can help you save from this additional tax burden Let us

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Relief U S 89 1 Short Taxation CA Inter CA IPCC Shrey Rathi

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

Section 89 Of Income Tax Act How To Claim Relief