In a world when screens dominate our lives and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education as well as creative projects or simply to add the personal touch to your area, Relief U S 89 Income Tax are a great resource. For this piece, we'll dive deep into the realm of "Relief U S 89 Income Tax," exploring what they are, how to get them, as well as what they can do to improve different aspects of your life.

Get Latest Relief U S 89 Income Tax Below

Relief U S 89 Income Tax

Relief U S 89 Income Tax -

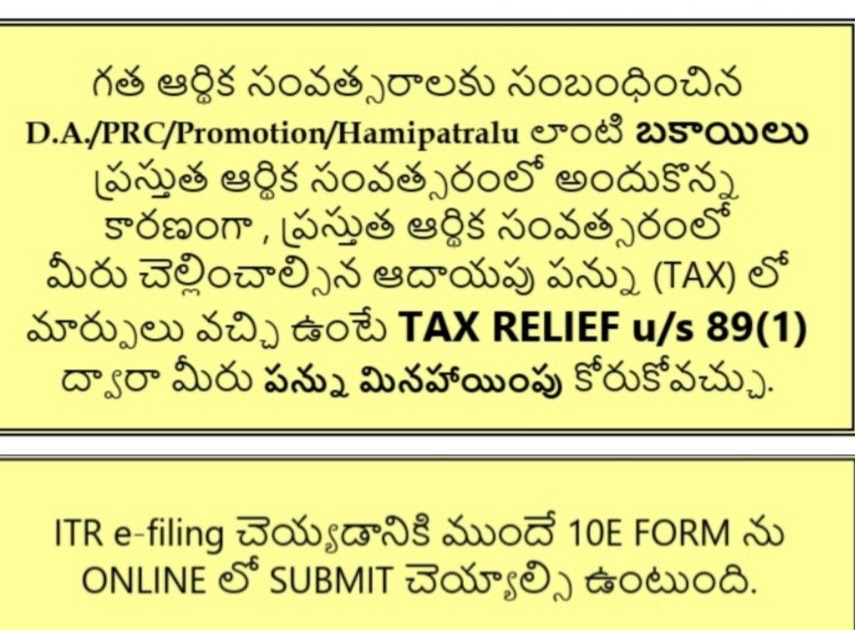

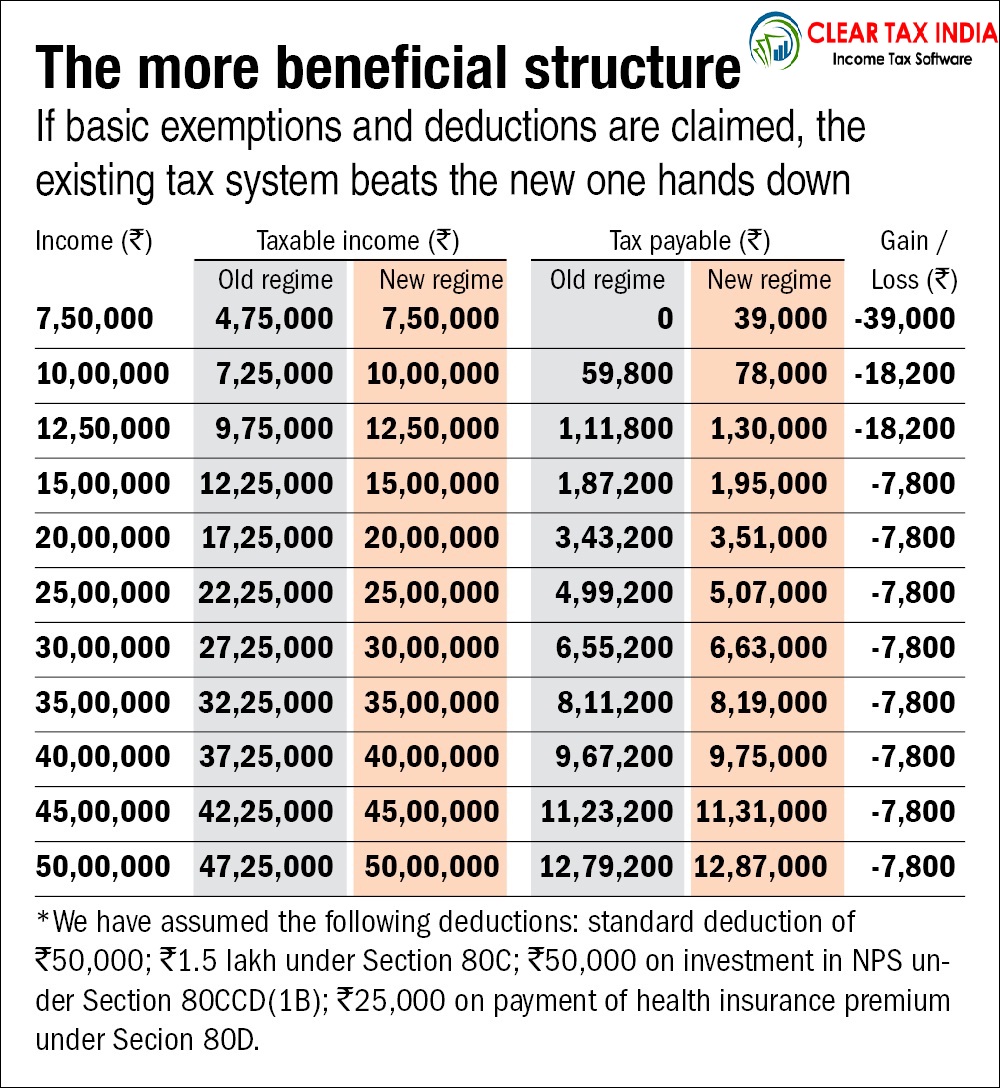

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a

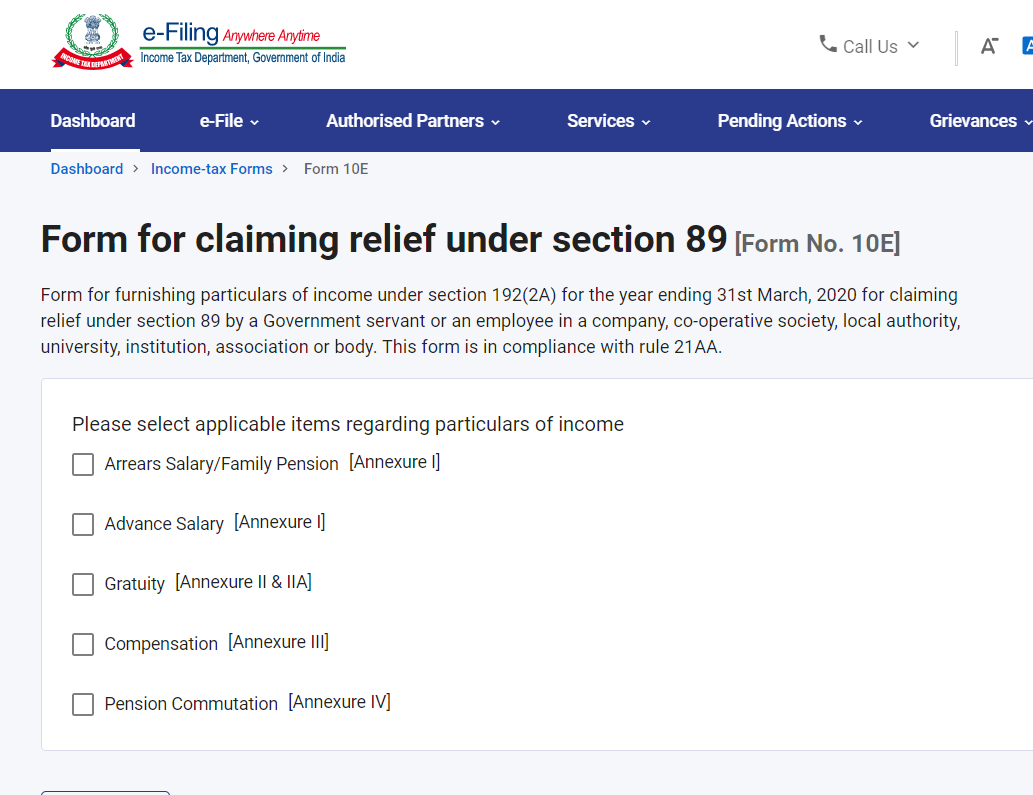

An employee can claim Section 89 relief if during the year he is liable to pay tax in respect of the following receipts a Advance Salary b Arrears of salary c Family Pension d Withdrawal from a PF account before

Relief U S 89 Income Tax encompass a wide collection of printable material that is available online at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages, and many more. The appealingness of Relief U S 89 Income Tax is their flexibility and accessibility.

More of Relief U S 89 Income Tax

2 Relief U s 89 Income Tax Bcom Mcom Nta Net Jrf YouTube

2 Relief U s 89 Income Tax Bcom Mcom Nta Net Jrf YouTube

Relief Under Section 89 helps you to claim salary arrears Our comprehensive guide covers everything from eligibility to filing Form 10E online

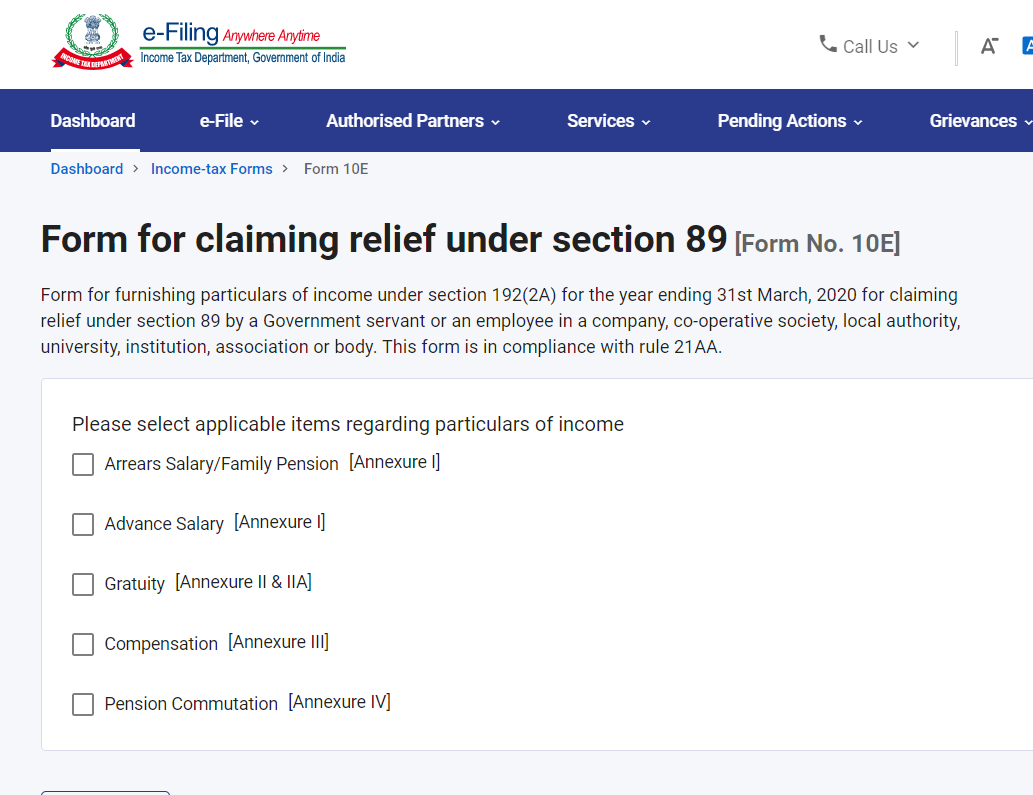

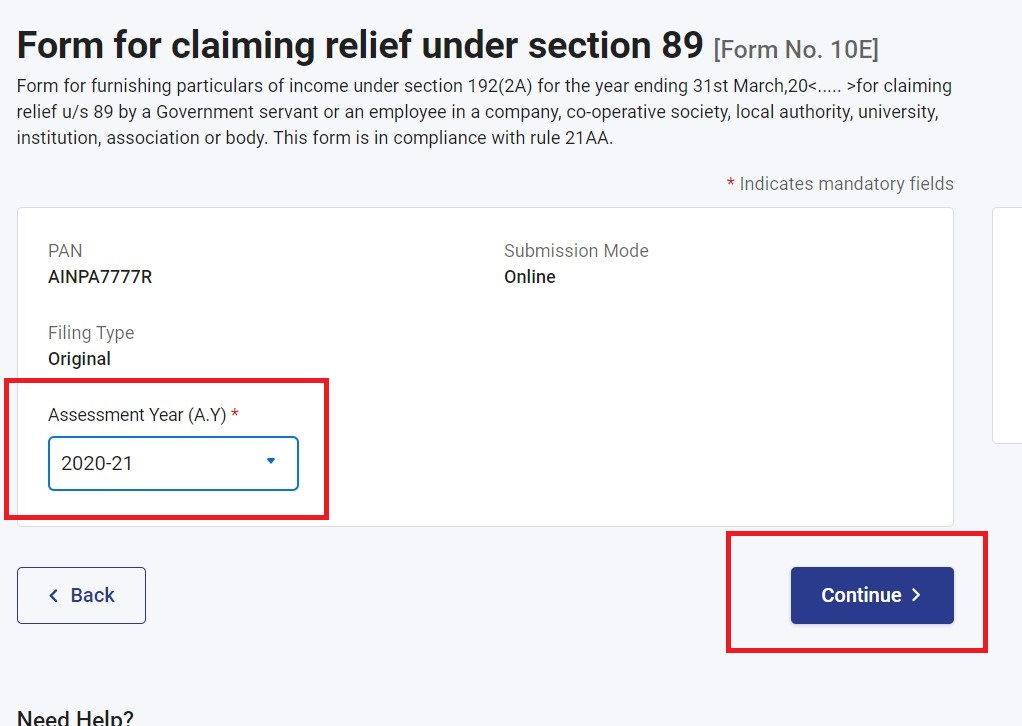

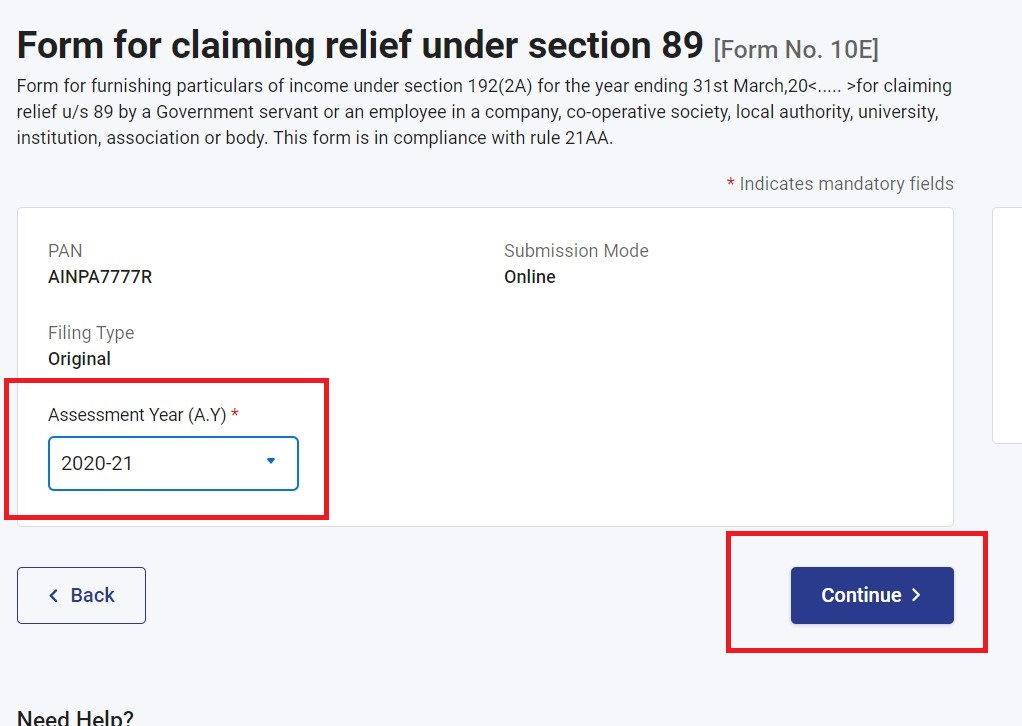

If you want to claim tax relief under Section 89 1 of the Income Tax Act 1961 you must fill out Form 10E You can claim tax relief for salary received in the form of arrears under Section 89 1 of the Income Tax Act Part B of

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor printables to fit your particular needs such as designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free provide for students of all ages. This makes these printables a powerful tool for parents and educators.

-

Affordability: Quick access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Relief U S 89 Income Tax

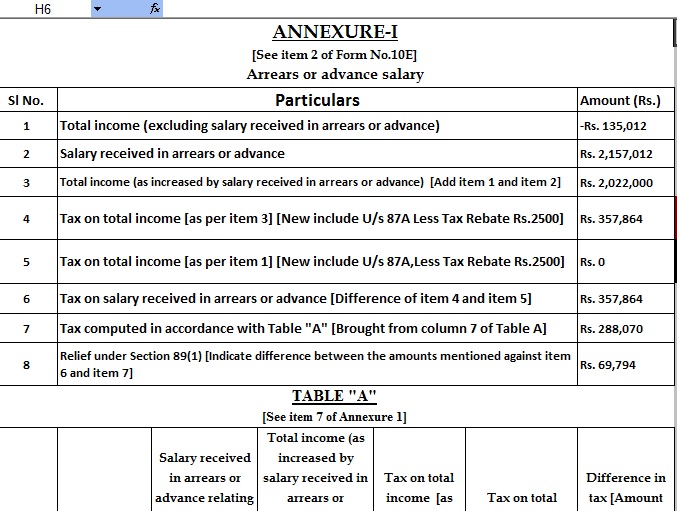

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Relief u s 89 can be claimed for receiving any portion of salary as an advance salary For understanding how to calculate the tax benefit under section 89 you can refer to the detailed calculation explained in the article

Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax

In the event that we've stirred your curiosity about Relief U S 89 Income Tax We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Relief U S 89 Income Tax designed for a variety needs.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide range of topics, starting from DIY projects to party planning.

Maximizing Relief U S 89 Income Tax

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Relief U S 89 Income Tax are a treasure trove of innovative and useful resources catering to different needs and hobbies. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the vast collection of Relief U S 89 Income Tax today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes they are! You can print and download these materials for free.

-

Can I use the free printables for commercial uses?

- It's determined by the specific usage guidelines. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions in use. Be sure to read the terms and regulations provided by the author.

-

How can I print Relief U S 89 Income Tax?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What program do I require to open printables at no cost?

- Most PDF-based printables are available in PDF format. They can be opened with free software such as Adobe Reader.

What Is Relief U s 89 1 Tax Relief On Arrear U s 89 1 AY 21 22

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

Check more sample of Relief U S 89 Income Tax below

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

How To Calculate Relief U s 89 1 Of The Income Tax Act

Relief U S 89 1 Short Taxation CA Inter CA IPCC Shrey Rathi

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

How To Calculate Relief U s 89 1 Of The Income Tax Act

Income Tax Relief Under Section 89 1 Read With Rule 21A With

https://taxguru.in › income-tax

An employee can claim Section 89 relief if during the year he is liable to pay tax in respect of the following receipts a Advance Salary b Arrears of salary c Family Pension d Withdrawal from a PF account before

https://learn.quicko.com

An employee who has received arrears in salary can save tax on such additional income in the following ways Calculate the relief u s 89 1 File Form 10E to claim relief u s 89 1

An employee can claim Section 89 relief if during the year he is liable to pay tax in respect of the following receipts a Advance Salary b Arrears of salary c Family Pension d Withdrawal from a PF account before

An employee who has received arrears in salary can save tax on such additional income in the following ways Calculate the relief u s 89 1 File Form 10E to claim relief u s 89 1

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

How To Calculate Relief U s 89 1 Of The Income Tax Act

How To Calculate Relief U s 89 1 Of The Income Tax Act

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

Relief Under Section 89 1 Hindi relief U s 89 1 How To Calculate

New Income Tax Portal Form 10e And Relief U s 89 Income Tax Return