Today, where screens dominate our lives yet the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons, creative projects, or simply adding an individual touch to your home, printables for free are now a useful resource. With this guide, you'll take a dive into the world "Renewable Energy Tax Incentives," exploring their purpose, where they can be found, and how they can improve various aspects of your daily life.

Get Latest Renewable Energy Tax Incentives Below

Renewable Energy Tax Incentives

Renewable Energy Tax Incentives -

Most provisions of the Inflation Reduction Act of 2022 became effective 1 1 2023 The Inflation Reduction Act incentives reduce renewable energy costs for organizations like Green Power Partners businesses nonprofits educational institutions and

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

Renewable Energy Tax Incentives offer a wide range of printable, free resources available online for download at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and more. The benefit of Renewable Energy Tax Incentives is in their variety and accessibility.

More of Renewable Energy Tax Incentives

Arizona Incentives Renewable Energy Tax Incentive For Businesses In

Arizona Incentives Renewable Energy Tax Incentive For Businesses In

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet

Consumers can find financial incentives and assistance for energy efficient and renewable energy products and improvements in the form of rebates tax credits or financing programs Visit the following sections to search for incentives in your area and to learn more about financing options

Renewable Energy Tax Incentives have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization It is possible to tailor designs to suit your personal needs whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: Printing educational materials for no cost cater to learners of all ages. This makes them an invaluable tool for parents and educators.

-

It's easy: You have instant access numerous designs and templates saves time and effort.

Where to Find more Renewable Energy Tax Incentives

Inflation Reduction Act Renewable Energy Tax Incentives

Inflation Reduction Act Renewable Energy Tax Incentives

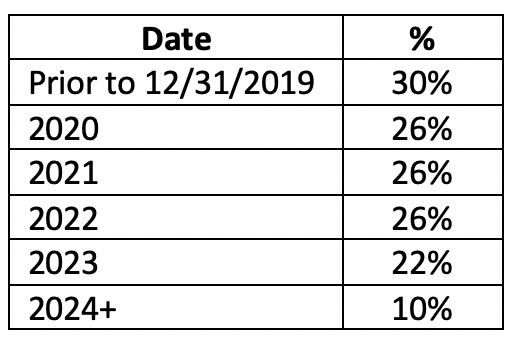

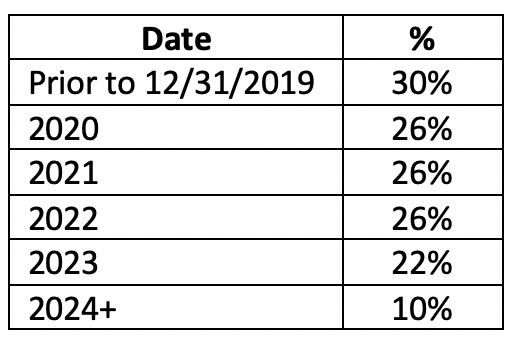

For investment in renewable energy projects including fuel cell solar geothermal small wind energy storage biogas microgrid controllers and combined heat and power properties

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

We hope we've stimulated your interest in Renewable Energy Tax Incentives Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Renewable Energy Tax Incentives for all objectives.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning tools.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad variety of topics, from DIY projects to party planning.

Maximizing Renewable Energy Tax Incentives

Here are some new ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Renewable Energy Tax Incentives are an abundance of fun and practical tools that cater to various needs and hobbies. Their accessibility and versatility make these printables a useful addition to each day life. Explore the vast array of Renewable Energy Tax Incentives to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can print and download these tools for free.

-

Does it allow me to use free printouts for commercial usage?

- It's contingent upon the specific rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations on usage. Make sure you read the conditions and terms of use provided by the author.

-

How do I print Renewable Energy Tax Incentives?

- Print them at home with a printer or visit any local print store for premium prints.

-

What software must I use to open printables that are free?

- Many printables are offered in PDF format, which can be opened using free software such as Adobe Reader.

Thompson Announces Bill Which Creates New Renewable Energy Tax

Tax Incentives Strengthen The Renewable Energy Investment Case For

Check more sample of Renewable Energy Tax Incentives below

Rebates Tax Incentives Residential Renewable Energy Tax Credit

Renewable Energy Tax Incentives Production And Investment Tax Credits

Renewable Energy Tax Incentives Selected Issues And Analyses Nova

Urban Solar

Renewable Energy Tax Incentives Production And Investment Tax Credits

Capital Account Implications For Renewable Energy Tax Credits Global

https://home.treasury.gov › news › press-releases

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

https://tax.thomsonreuters.com › blog › renewable...

Jump to How do renewable energy tax credits work What renewable energy tax incentives does the IRS offer for individuals vs businesses Overview of clean energy credits by energy type Helping clients with renewable energy credits

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

Jump to How do renewable energy tax credits work What renewable energy tax incentives does the IRS offer for individuals vs businesses Overview of clean energy credits by energy type Helping clients with renewable energy credits

Urban Solar

Renewable Energy Tax Incentives Production And Investment Tax Credits

Renewable Energy Tax Incentives Production And Investment Tax Credits

Capital Account Implications For Renewable Energy Tax Credits Global

Energy Efficient Tax Incentives For Commercial Buildings Windes

HVAC 911 Save Money Through Renewable Energy Tax Credits

HVAC 911 Save Money Through Renewable Energy Tax Credits

U S Tax Reforms Would Leave Renewable Energy Out In The Cold