In this day and age where screens dominate our lives but the value of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply adding personal touches to your space, Rent Tax Deduction Formula have proven to be a valuable source. The following article is a take a dive in the world of "Rent Tax Deduction Formula," exploring their purpose, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest Rent Tax Deduction Formula Below

Rent Tax Deduction Formula

Rent Tax Deduction Formula -

SUMMARY Option Taxpayers have the option to either declare rental income as final withholding tax of 15 or declare rental income in their annual tax return Exemption from Capital Gains Tax on property previous rented at Affordable Rents Declarations may be submitted manually or online

Actual rent paid minus 10 of salary 50 of basic salary for those living in metro cities 40 of basic salary for those living in non metro cities The remainder of your HRA is added back to your taxable salary Our calculator can easily help you figure out your HRA exemption

Rent Tax Deduction Formula cover a large assortment of printable resources available online for download at no cost. These printables come in different forms, like worksheets templates, coloring pages and many more. The value of Rent Tax Deduction Formula is their versatility and accessibility.

More of Rent Tax Deduction Formula

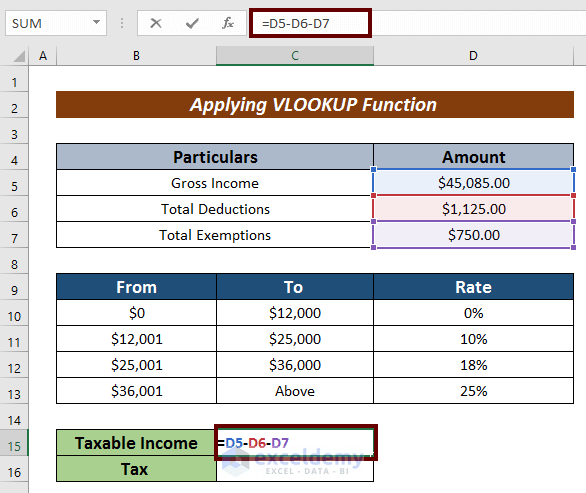

General Deduction Formula Practice Question General Deduction

General Deduction Formula Practice Question General Deduction

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

Actual Rent Paid 10 of Basic Salary INR 1 90 000 2 40 000 10 5 00 000 40 of the Basic Salary INR 2 00 000 40 5 00 000 INR 1 90 000 will be exempt from the total House Rent Allowance received and the remaining INR 60 000 2 50 000 1 90 000 will be taxable Use the HRA

Rent Tax Deduction Formula have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: You can tailor the design to meet your needs be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners from all ages, making them a great instrument for parents and teachers.

-

Affordability: Instant access to a variety of designs and templates can save you time and energy.

Where to Find more Rent Tax Deduction Formula

Mortgage Interest Tax Deduction What Is It How Is It Used

Mortgage Interest Tax Deduction What Is It How Is It Used

HRA calculation formula House rent allowance HRA is the amount of your salary that your employer pays you to assist with your rent The government allows you to deduct a portion or the whole amount from your taxable income according to Section 10 13A of the Income Tax Act The rule is straightforward

15 20 25 30 If you don t receive HRA you can still claim upto 60 000 deduction U S 80GG Maximize your tax savings Save upto 78 000 in taxes with ET Money Save taxes now HRA calculator How to Use HRA Calculator HRA tax exemption calculation HRA for Special Cases Documents to Claim HRA More

Now that we've ignited your curiosity about Rent Tax Deduction Formula we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Rent Tax Deduction Formula for various purposes.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- These blogs cover a broad spectrum of interests, including DIY projects to planning a party.

Maximizing Rent Tax Deduction Formula

Here are some fresh ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Rent Tax Deduction Formula are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and pursuits. Their access and versatility makes these printables a useful addition to both personal and professional life. Explore the vast collection of Rent Tax Deduction Formula and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printables for commercial purposes?

- It's based on the conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with Rent Tax Deduction Formula?

- Some printables could have limitations in their usage. Make sure to read the terms and conditions set forth by the author.

-

How do I print Rent Tax Deduction Formula?

- Print them at home with your printer or visit the local print shops for better quality prints.

-

What program do I require to view printables that are free?

- The majority of printed documents are in the format of PDF, which can be opened using free software such as Adobe Reader.

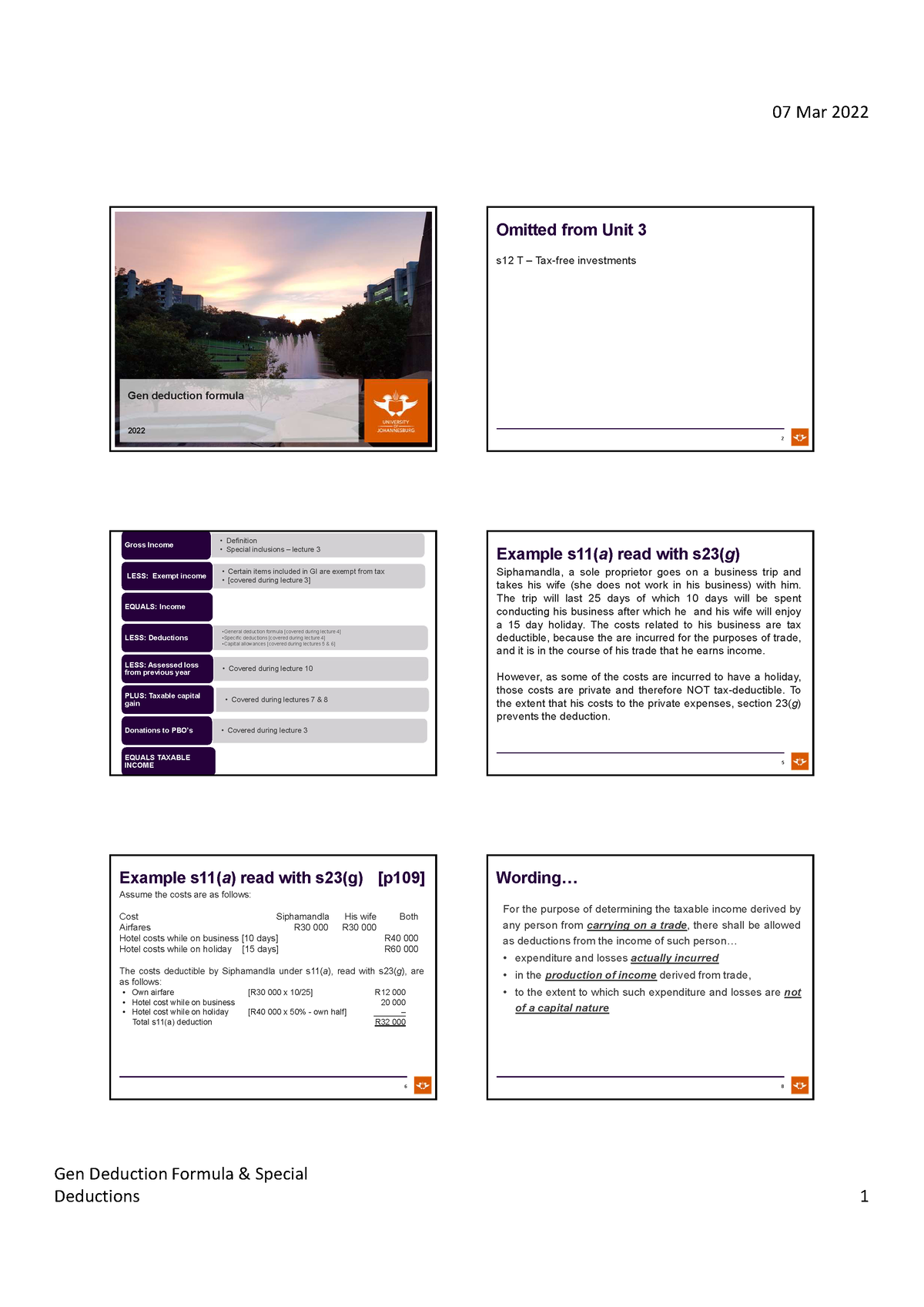

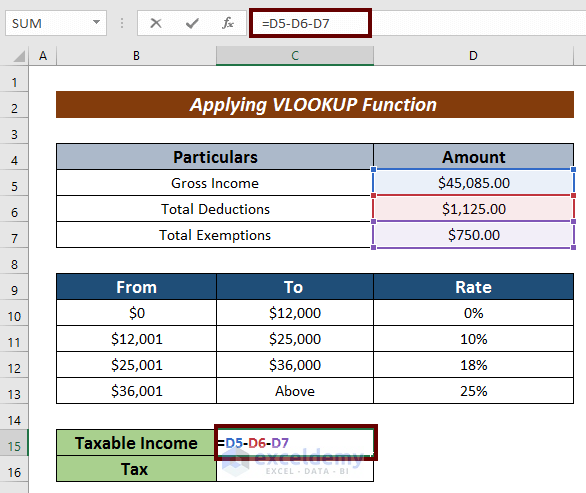

HRA Exemption Calculator In Excel House Rent Allowance Calculation

The Truth About Room rent Limits In Health Insurance Proportionate

Check more sample of Rent Tax Deduction Formula below

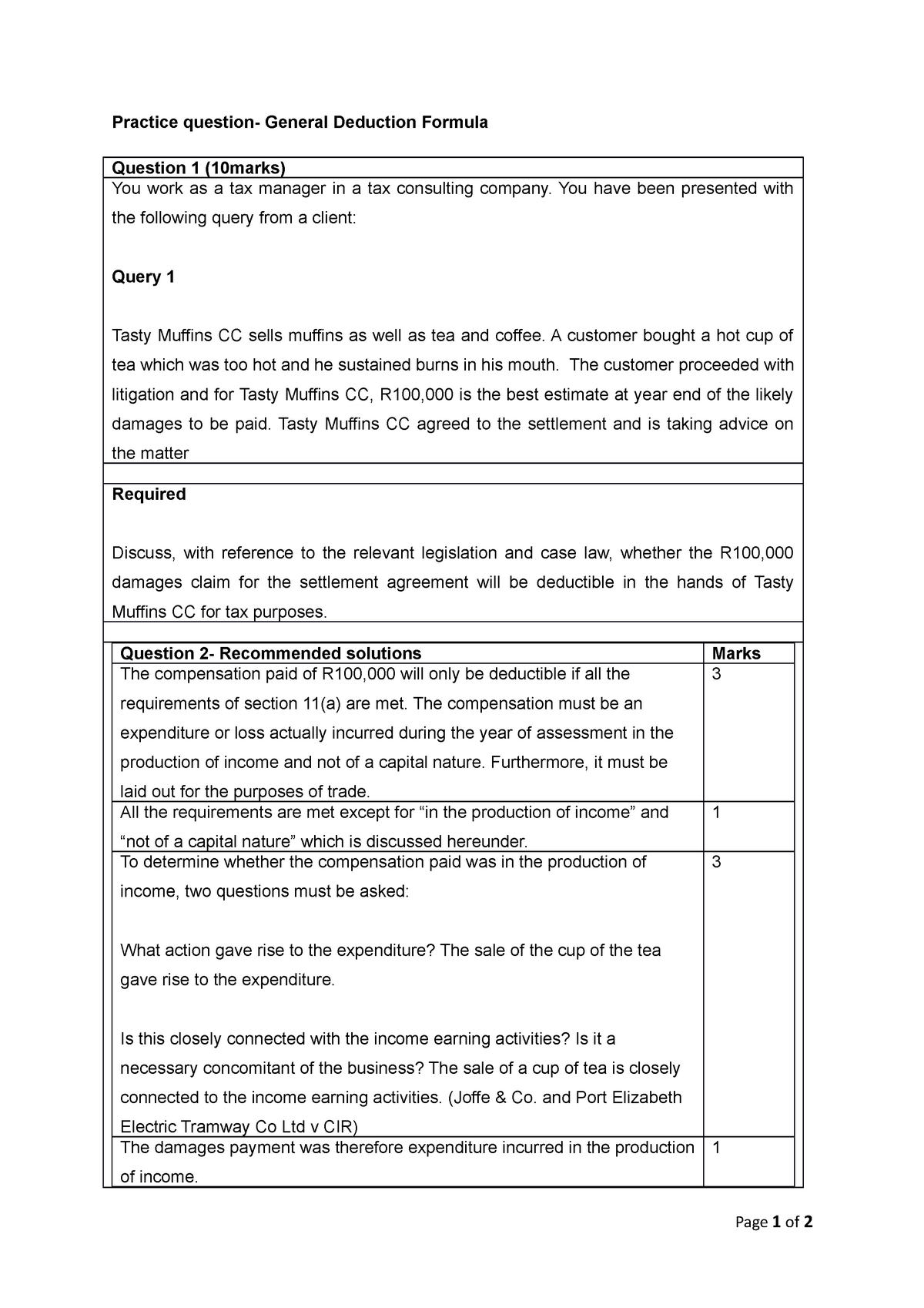

General Deduction Formula Special Deductions Gen Deduction Formula

Here Are The States That Provide A Renter s Tax Credit Rent Blog

Nursing Home Rent Tax Deduction

TAX Free Mobile Phone Top ups Till Further Notice

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://cleartax.in/paytax/hracalculator

Actual rent paid minus 10 of salary 50 of basic salary for those living in metro cities 40 of basic salary for those living in non metro cities The remainder of your HRA is added back to your taxable salary Our calculator can easily help you figure out your HRA exemption

https://cleartax.in/s/hra-house-rent-allowance

How to calculate HRA Exemption The lowest of the following amounts can be claimed as HRA exemption Actual HRA received 50 of basic salary DA for those living in metro cities Delhi Kolkata Mumbai or Chennai 40 of basic salary DA for those living in non metros Actual rent paid 10 of basic salary

Actual rent paid minus 10 of salary 50 of basic salary for those living in metro cities 40 of basic salary for those living in non metro cities The remainder of your HRA is added back to your taxable salary Our calculator can easily help you figure out your HRA exemption

How to calculate HRA Exemption The lowest of the following amounts can be claimed as HRA exemption Actual HRA received 50 of basic salary DA for those living in metro cities Delhi Kolkata Mumbai or Chennai 40 of basic salary DA for those living in non metros Actual rent paid 10 of basic salary

TAX Free Mobile Phone Top ups Till Further Notice

Here Are The States That Provide A Renter s Tax Credit Rent Blog

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Standard Deduction 2020 Self Employed Standard Deduction 2021

How To Calculate Income Tax On Salary In Pakistan With Example 2023

Employee Bonus Excel Template Incentive Plan Calculation Excel

Employee Bonus Excel Template Incentive Plan Calculation Excel

How To Calculate Current Tax Haiper