In this age of technology, in which screens are the norm The appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education or creative projects, or simply adding personal touches to your space, Rrsp Employer Contribution Tax Return have become an invaluable source. Through this post, we'll dive to the depths of "Rrsp Employer Contribution Tax Return," exploring the different types of printables, where they are available, and how they can be used to enhance different aspects of your life.

Get Latest Rrsp Employer Contribution Tax Return Below

Rrsp Employer Contribution Tax Return

Rrsp Employer Contribution Tax Return -

What is employer RRSP matching First it s important to understand how a basic GRSP works it enables employees to direct a portion of every pay cheque into a registered

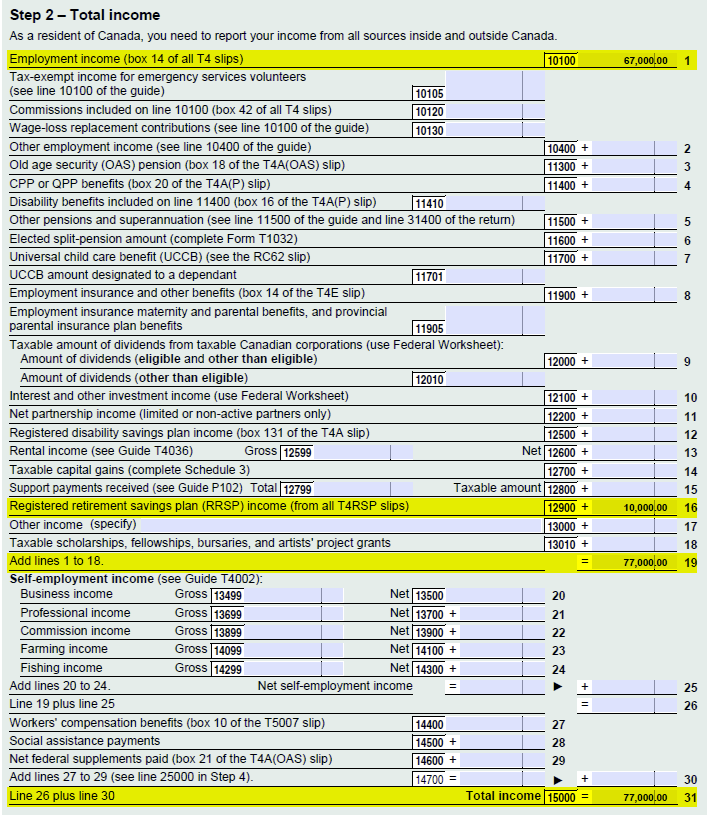

Yes the extra matching contribution your employer puts into your group RRSP plan is considered employment income and so yes it would be included in the income reported

Rrsp Employer Contribution Tax Return provide a diverse range of downloadable, printable documents that can be downloaded online at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and many more. The great thing about Rrsp Employer Contribution Tax Return is their versatility and accessibility.

More of Rrsp Employer Contribution Tax Return

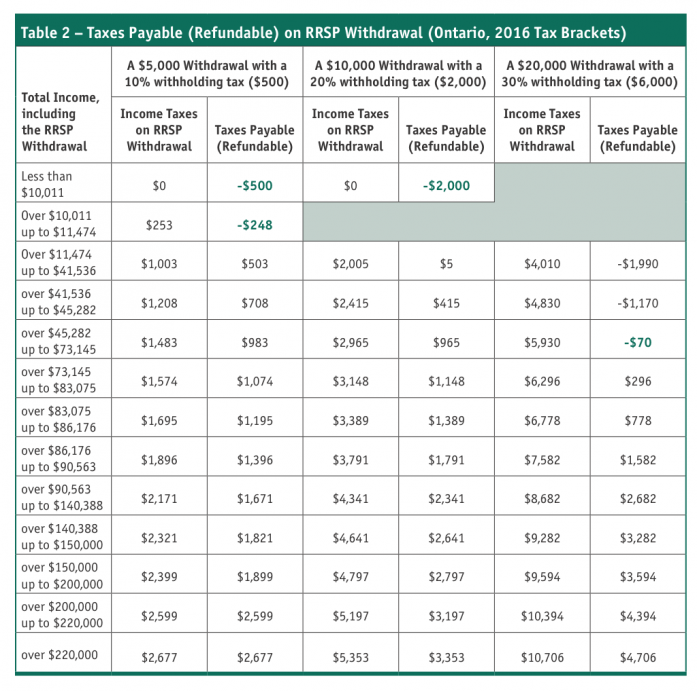

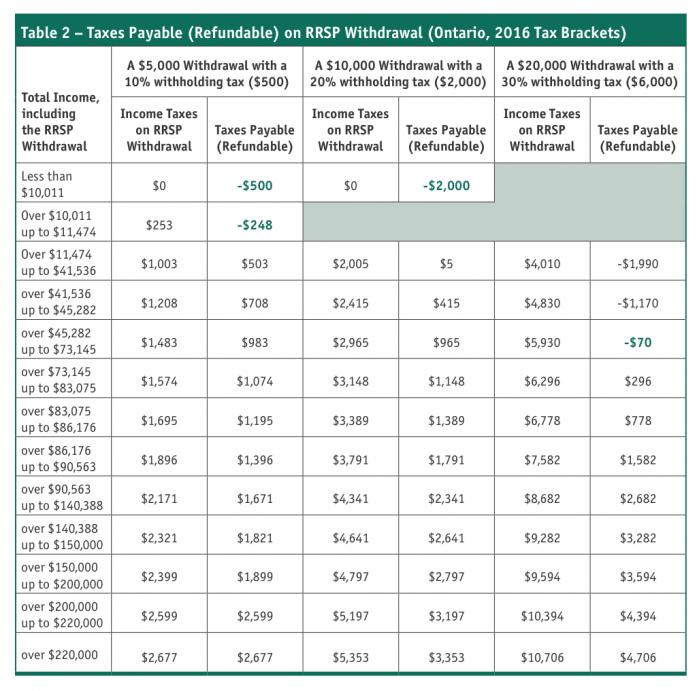

Understanding The RRSP Withdrawal Withholding Tax Canadian MoneySaver

Understanding The RRSP Withdrawal Withholding Tax Canadian MoneySaver

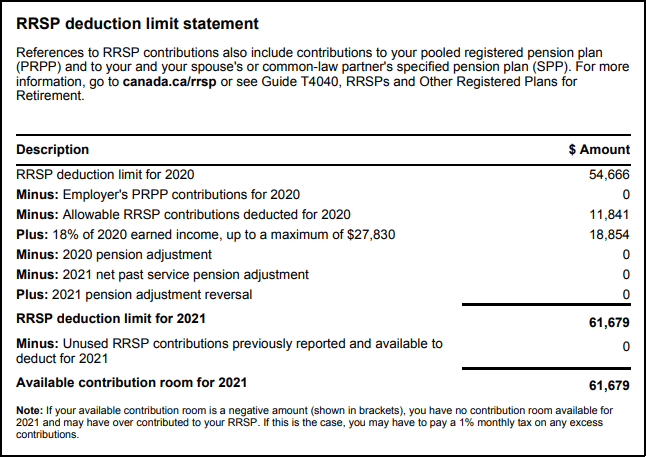

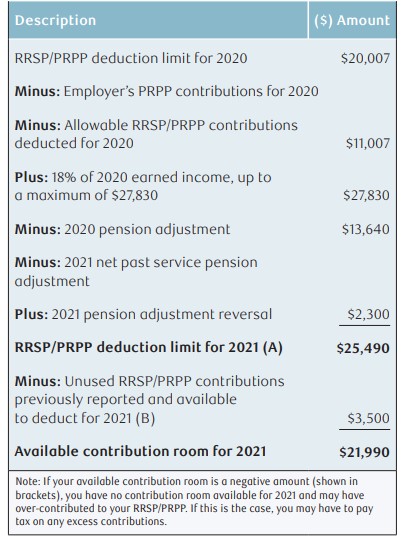

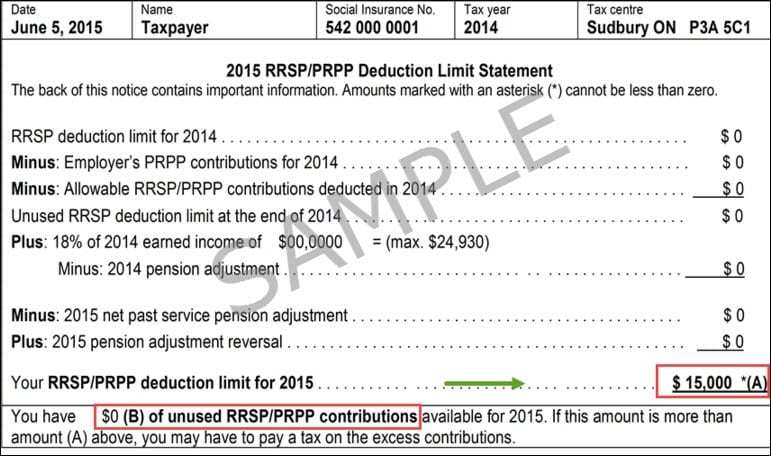

For 2024 the RRSP contribution limit is 31 560 Contributions to an RRSP reduce the amount of income tax individuals must pay each year so the Canada Revenue Agency

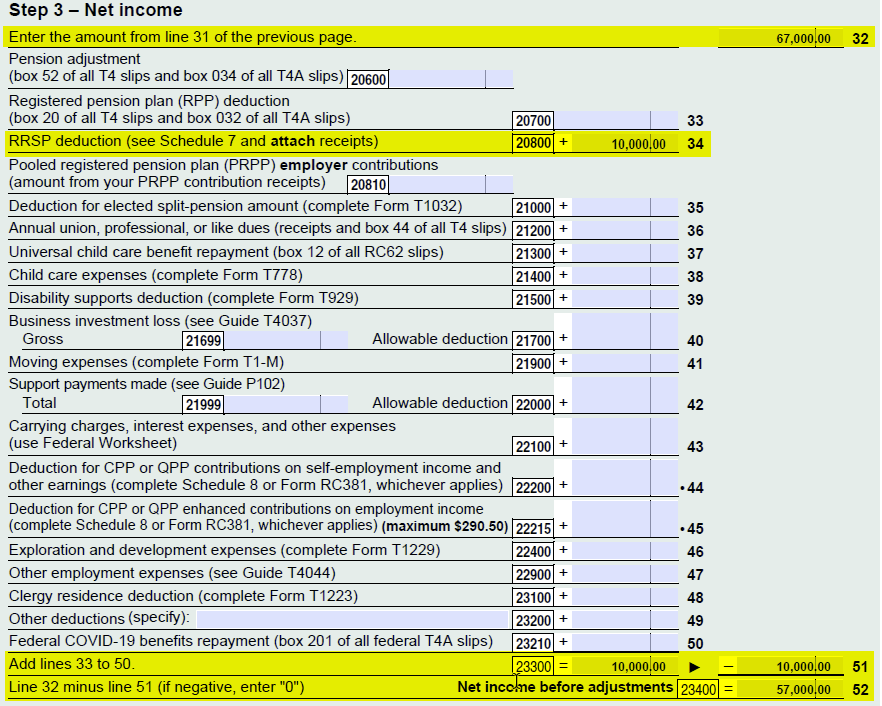

RRSP contributions are deductible and can reduce your taxes Deduct them on line 20800 of your tax return There is a maximum annual limit on how much you can

Rrsp Employer Contribution Tax Return have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: This allows you to modify printed materials to meet your requirements be it designing invitations planning your schedule or even decorating your house.

-

Educational value: Education-related printables at no charge are designed to appeal to students of all ages. This makes them a vital aid for parents as well as educators.

-

It's easy: instant access a plethora of designs and templates reduces time and effort.

Where to Find more Rrsp Employer Contribution Tax Return

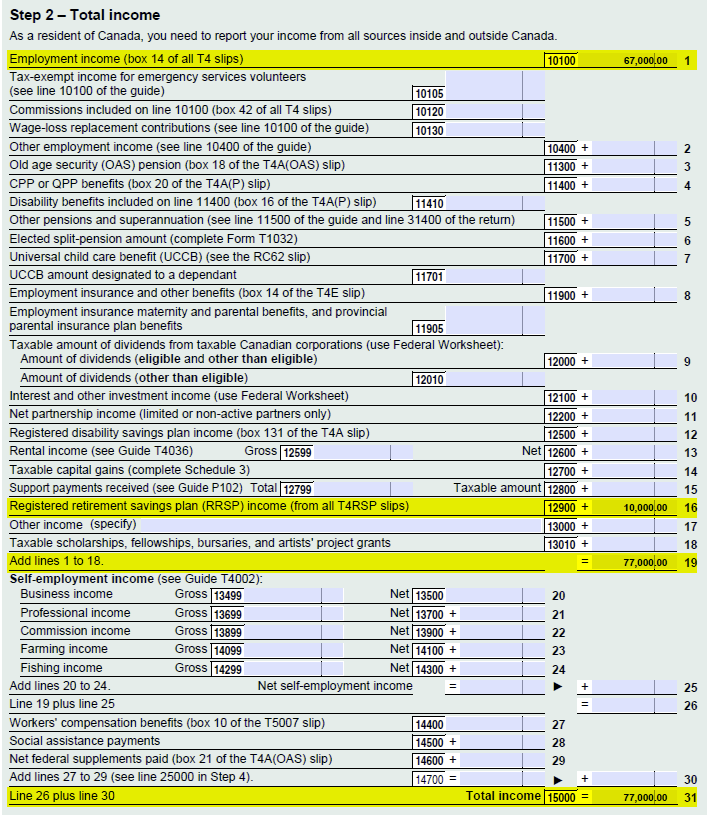

RRSP Contribution Deduction On Tax Return Example PlanEasy PlanEasy

RRSP Contribution Deduction On Tax Return Example PlanEasy PlanEasy

Employer s contributions to the RRSP are included in the employee s income but are then deducted as part of the RRSP contributions deduction Annual

First contributions to an RRSP are tax deductible in the year that you deposit the money into the plan Second funds inside an RRSP are fully tax sheltered

Now that we've ignited your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Rrsp Employer Contribution Tax Return for all objectives.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast spectrum of interests, including DIY projects to planning a party.

Maximizing Rrsp Employer Contribution Tax Return

Here are some ideas ensure you get the very most use of Rrsp Employer Contribution Tax Return:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Rrsp Employer Contribution Tax Return are an abundance of practical and innovative resources for a variety of needs and passions. Their availability and versatility make them an invaluable addition to each day life. Explore the plethora of Rrsp Employer Contribution Tax Return to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rrsp Employer Contribution Tax Return really available for download?

- Yes you can! You can download and print these files for free.

-

Can I make use of free printables for commercial purposes?

- It depends on the specific conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright violations with Rrsp Employer Contribution Tax Return?

- Certain printables might have limitations in use. Be sure to check the terms of service and conditions provided by the author.

-

How do I print printables for free?

- You can print them at home using any printer or head to any local print store for better quality prints.

-

What software is required to open printables free of charge?

- A majority of printed materials are in PDF format, which can be opened with free software, such as Adobe Reader.

RRSP Contribution Limit For 2023 Another Loonie

Don t Miss The RRSP And TFSA 2020 Deadline W B White Insurance Ltd

Check more sample of Rrsp Employer Contribution Tax Return below

The So Wealth Management Group RRSP Contribution VS Deduction Limit

The RRSP Contribution Deadline Key Dates You Need To Know FISCHER

2021 RRSP CONTRIBUTION DEADLINE SJ Chartered Accountants

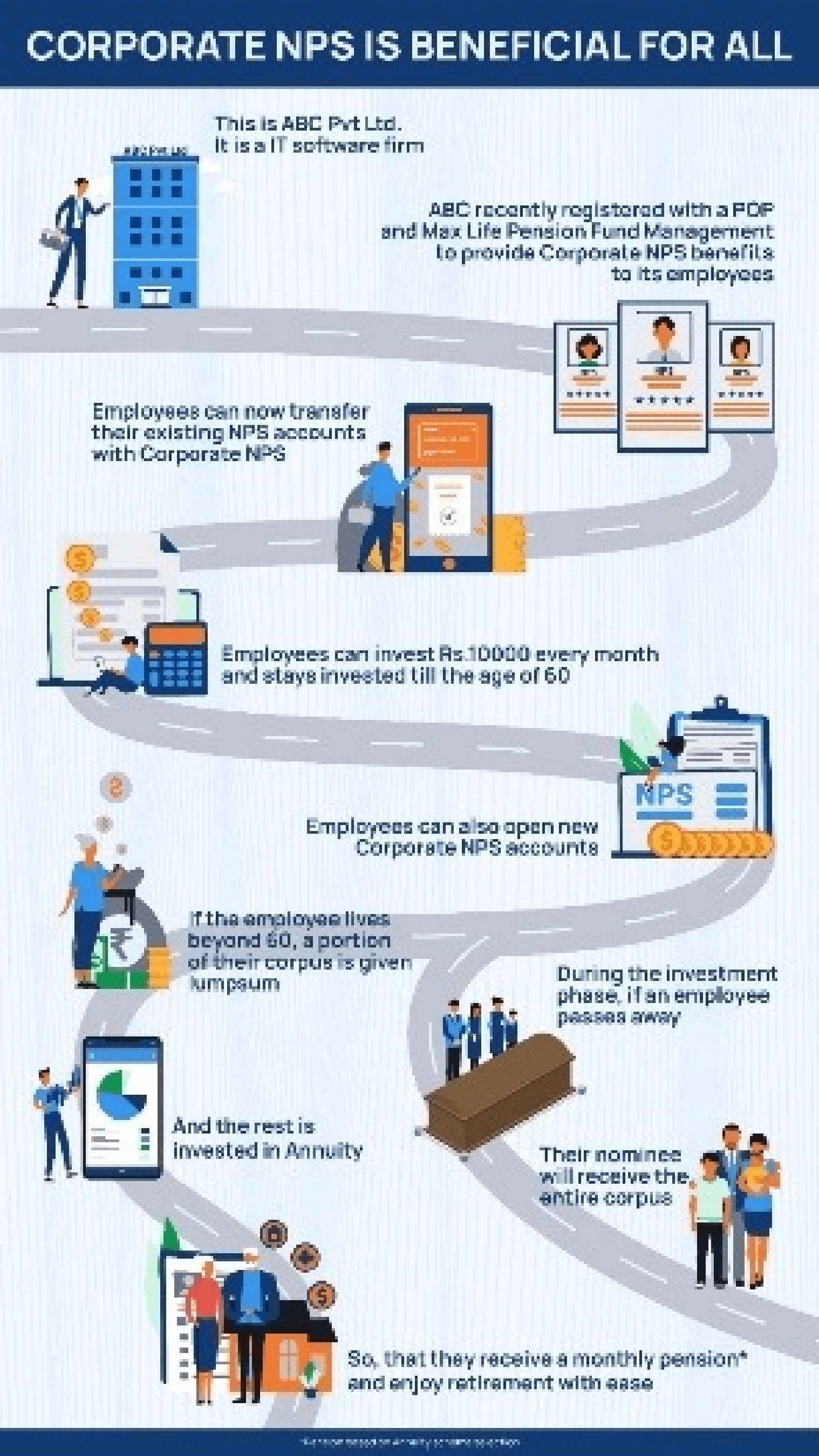

Nps Solutions

RRSP Withdrawal On Tax Return Example PlanEasy PlanEasy

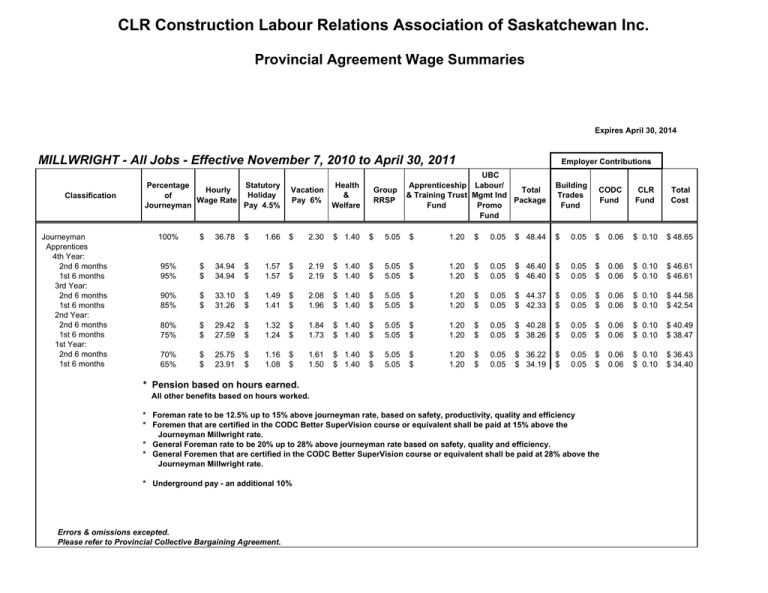

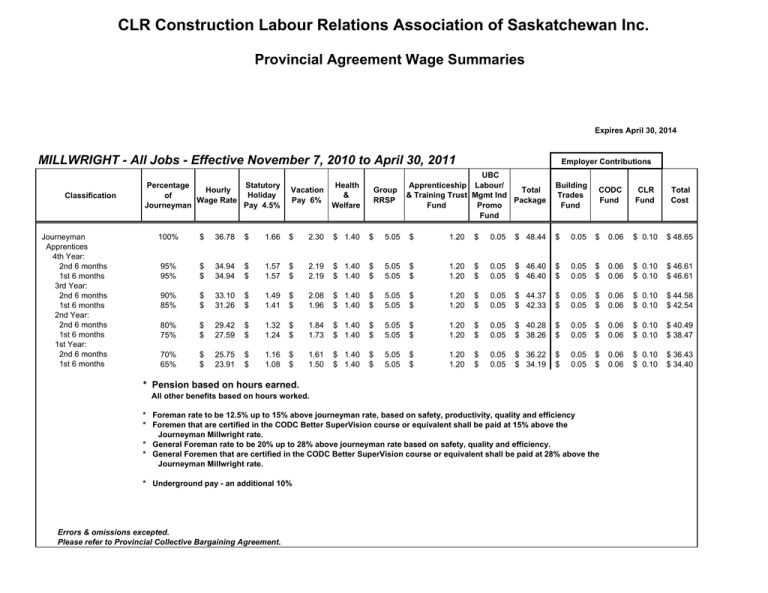

Millwright Industrial Wage Summaries 2010

https://money.stackexchange.com/questions/24313

Yes the extra matching contribution your employer puts into your group RRSP plan is considered employment income and so yes it would be included in the income reported

https://money.stackexchange.com/questions/46326

Actually it turns out that any money an employer has contributed to your RRSP on your behalf instead of paying you with gets deducted from the amount

Yes the extra matching contribution your employer puts into your group RRSP plan is considered employment income and so yes it would be included in the income reported

Actually it turns out that any money an employer has contributed to your RRSP on your behalf instead of paying you with gets deducted from the amount

Nps Solutions

The RRSP Contribution Deadline Key Dates You Need To Know FISCHER

RRSP Withdrawal On Tax Return Example PlanEasy PlanEasy

Millwright Industrial Wage Summaries 2010

How Much Can I Contribute To My RRSP My65plus

2023 RRSP Guide RRSP Deadlines Contribution Limits And More Retire

2023 RRSP Guide RRSP Deadlines Contribution Limits And More Retire

Optimizing Your RRSP Contribution Strategy To Build Your Retirement