In this day and age with screens dominating our lives however, the attraction of tangible, printed materials hasn't diminished. No matter whether it's for educational uses for creative projects, simply to add the personal touch to your space, Salary Tax Deduction Calculator Ontario are a great resource. We'll take a dive into the world of "Salary Tax Deduction Calculator Ontario," exploring what they are, how to find them and how they can add value to various aspects of your life.

Get Latest Salary Tax Deduction Calculator Ontario Below

Salary Tax Deduction Calculator Ontario

Salary Tax Deduction Calculator Ontario -

2023 Ontario Income Tax Calculator Plug in a few numbers and we ll give you visibility into your tax bracket marginal tax rate average tax rate and payroll tax deductions along with an estimate of your tax refunds and taxes owed in 2023 File your tax return today Your maximum refund is guaranteed Get started Employment income

If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions

Salary Tax Deduction Calculator Ontario provide a diverse array of printable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and many more. The value of Salary Tax Deduction Calculator Ontario is in their variety and accessibility.

More of Salary Tax Deduction Calculator Ontario

Salary Tax Deduction Complaint Letter 4 Templates

Salary Tax Deduction Complaint Letter 4 Templates

Calculate your income tax in Ontario and salary deduction in Ontario to calculate and compare salary after tax for income in Ontario in the 2024 tax year

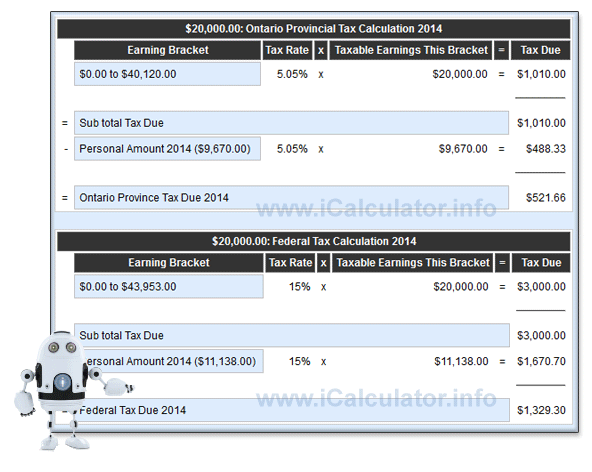

The Salary Tax Calculator for Ontario Income Tax calculations Updated for 2024 with income tax and social security Deductables The Ontario Tax Calculator includes tax years from 2014 to 2024 with full salary deductions and tax calculations

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor print-ready templates to your specific requirements be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Education-related printables at no charge cater to learners from all ages, making them an invaluable aid for parents as well as educators.

-

Easy to use: You have instant access a variety of designs and templates helps save time and effort.

Where to Find more Salary Tax Deduction Calculator Ontario

Use The Sales Tax Deduction Calculator Simple Accounting

Use The Sales Tax Deduction Calculator Simple Accounting

Ontario Income Tax Calculator 2021 Estimate your net salary after tax paycheck deductions capital gains taxes RRSP savings CRA taxes owed and more After Tax Income 0 Total Income Federal Tax Provincial Tax Total Tax After Tax Income Average Tax Rate Marginal Tax Rate 0 0 Show Assumptions Disclaimer

The Annual Salary Calculator is updated with the latest income tax rates in Ontario for 2021 and is a great calculator for working out your income tax and salary after tax based on a Annual income The calculator is designed to be used online with mobile desktop and tablet devices

If we've already piqued your interest in printables for free Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Salary Tax Deduction Calculator Ontario designed for a variety objectives.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a broad selection of subjects, starting from DIY projects to planning a party.

Maximizing Salary Tax Deduction Calculator Ontario

Here are some creative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Salary Tax Deduction Calculator Ontario are a treasure trove of fun and practical tools which cater to a wide range of needs and needs and. Their availability and versatility make them an essential part of both professional and personal life. Explore the many options of Salary Tax Deduction Calculator Ontario now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I download free printables to make commercial products?

- It's based on specific conditions of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may have restrictions on use. Be sure to check the terms and condition of use as provided by the author.

-

How can I print Salary Tax Deduction Calculator Ontario?

- You can print them at home using your printer or visit a local print shop for the highest quality prints.

-

What software do I need to run Salary Tax Deduction Calculator Ontario?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software like Adobe Reader.

2022 2023 Ontario Income Tax Calculator TurboTax Canada

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

Check more sample of Salary Tax Deduction Calculator Ontario below

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

Salary Tax Calculator 2023 2024 PELAJARAN

Zru nos Do Toho Ob ianstvo Tax Return Calculator Ontario 2019

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Calculate Salary Allowances And Tax Deduction In Excel By Learning

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

https://salaryaftertax.com/ca

If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions

https://www.canada.ca/.../payroll-deductions-online-calculator.html

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions It will confirm the deductions you include on your official statement of earnings You assume the risks associated with using this calculator

If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions It will confirm the deductions you include on your official statement of earnings You assume the risks associated with using this calculator

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Salary Tax Calculator 2023 2024 PELAJARAN

Calculate Salary Allowances And Tax Deduction In Excel By Learning

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

Janice Plut Minor Ontario Tax Calculator Cobor i In Fiecare Zi Te

Zru nos Do Toho Ob ianstvo Tax Return Calculator Ontario 2019

Zru nos Do Toho Ob ianstvo Tax Return Calculator Ontario 2019

What Is Provincial Tax Canada Tax ICalculator