In this day and age where screens rule our lives The appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education or creative projects, or simply to add the personal touch to your area, Sales Tax Refund Texas are now a vital resource. This article will take a dive deep into the realm of "Sales Tax Refund Texas," exploring what they are, how to find them and how they can improve various aspects of your life.

Get Latest Sales Tax Refund Texas Below

Sales Tax Refund Texas

Sales Tax Refund Texas -

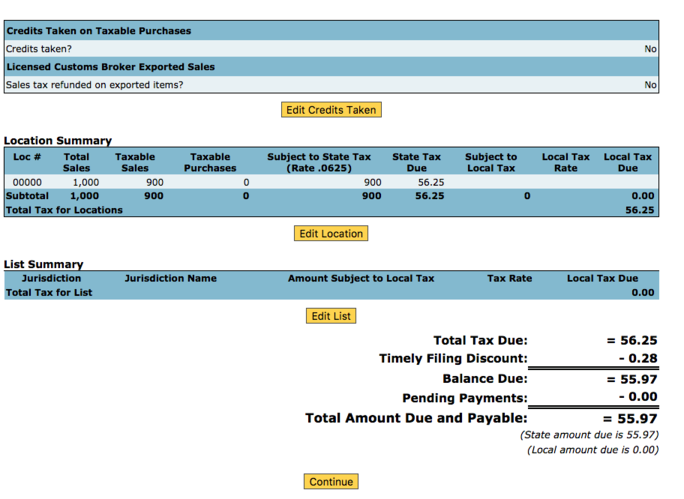

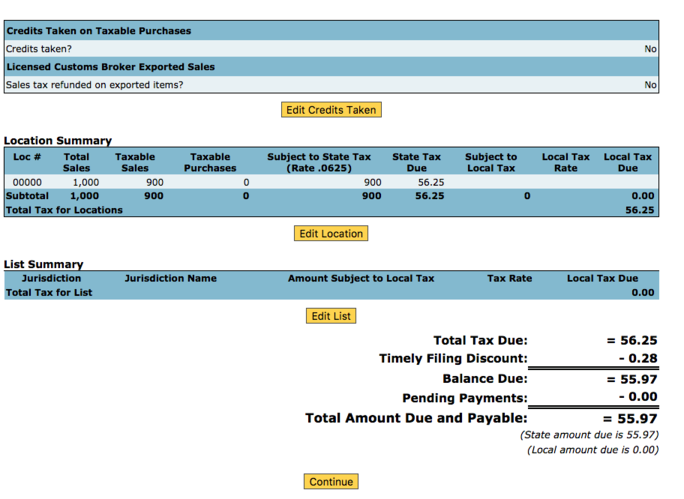

Close Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8 25 percent

Example You owe 100 000 in sales tax on your next return but you are due a 20 000 refund because you overpaid tax on a previous return You can report the 20 000 credit on the Credit and Customer Broker Schedule and report tax due of 80 000 on the long form return Be sure to keep good records to show why and how the reduction was made

The Sales Tax Refund Texas are a huge variety of printable, downloadable materials online, at no cost. These resources come in many types, such as worksheets templates, coloring pages and more. The value of Sales Tax Refund Texas is their flexibility and accessibility.

More of Sales Tax Refund Texas

Imposto De Volta Em Compras Nos Estados Unidos USA Tax Refund Texas

Imposto De Volta Em Compras Nos Estados Unidos USA Tax Refund Texas

You can electronically file an amended return using Webfile even if it reduces the tax due of the original return filed If you are amending paper returns for multiple periods submit all your returns in one envelope to Texas Comptroller of Public Accounts Attn Sales and Motor Vehicle Tax Refunds 111 E 17th Street Austin TX 78774 0100

Please choose one method of submitting your request and supporting documentation Mail to Comptroller of Public Accounts Email to refund request cpa texas gov Revenue Accounting Division Sales Motor Vehicle Tax Refunds Inquiries only refund status cpa texas gov 111 E 17th Street Austin TX 78774 0100 For

Sales Tax Refund Texas have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

customization This allows you to modify printing templates to your own specific requirements whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Use: The free educational worksheets cater to learners from all ages, making them a great source for educators and parents.

-

Convenience: immediate access a plethora of designs and templates can save you time and energy.

Where to Find more Sales Tax Refund Texas

Preserve Your Right To A Payroll Tax Refund Texas Employer Handbook

Preserve Your Right To A Payroll Tax Refund Texas Employer Handbook

Austin TX 78774 0100 Refund Claim Outcomes There are three possible outcomes to a refund claim approved incomplete or denied partially denied If you have questions about filing a Motor Vehicle Sales Tax refund claim or about a claim you have already submitted call the Comptroller s office at 800 531 5441 ext 34545 Quick Links

TaxFree Shopping has 12 convenient locations around the state of Texas 11 Convenient locations to process your sales tax refund Locations available in the Dallas Fort Worth area Houston San Marcos and McAllen

In the event that we've stirred your interest in Sales Tax Refund Texas and other printables, let's discover where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Sales Tax Refund Texas for different needs.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide variety of topics, everything from DIY projects to planning a party.

Maximizing Sales Tax Refund Texas

Here are some ideas create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Sales Tax Refund Texas are an abundance with useful and creative ideas that meet a variety of needs and pursuits. Their accessibility and flexibility make them a fantastic addition to your professional and personal life. Explore the many options that is Sales Tax Refund Texas today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free printables for commercial uses?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Sales Tax Refund Texas?

- Some printables may contain restrictions on usage. Always read the terms and conditions provided by the designer.

-

How can I print Sales Tax Refund Texas?

- You can print them at home using either a printer at home or in the local print shop for the highest quality prints.

-

What program do I need in order to open printables for free?

- The majority of printables are in PDF format. These can be opened with free software, such as Adobe Reader.

Your Tax Refund Is The Key To Homeownership

Quickbooks 2019 Tutorial For Beginners How To Enter A Sales Tax

Check more sample of Sales Tax Refund Texas below

How To Get Tax Refund In USA As Tourist Resident For Shopping FAQs

Texas Tax Back Store List Rosy Pike

FBR Introduces Sales Tax Refund Mechanism For Pharmaceuticals Sector

Texas Sales Tax Number Lookup TAX

Sales Tax Refund Claimants Public Notice Federal Board Of Revenue

Start Maximizing Your Tax Refund Millan Co P C

https://comptroller.texas.gov/taxes/sales/refunds/purchasers.php

Example You owe 100 000 in sales tax on your next return but you are due a 20 000 refund because you overpaid tax on a previous return You can report the 20 000 credit on the Credit and Customer Broker Schedule and report tax due of 80 000 on the long form return Be sure to keep good records to show why and how the reduction was made

https://taxfreetexas.herokuapp.com/requirements

Items must be purchased in Texas within 30 days of departure TaxFree recommends that visitors purchase items within the last two weeks before departure to allow for processing time Purchases must be taken with you when you depart Texas and the USA A minimum of 10 00 of Texas Sales Tax per store location is required

Example You owe 100 000 in sales tax on your next return but you are due a 20 000 refund because you overpaid tax on a previous return You can report the 20 000 credit on the Credit and Customer Broker Schedule and report tax due of 80 000 on the long form return Be sure to keep good records to show why and how the reduction was made

Items must be purchased in Texas within 30 days of departure TaxFree recommends that visitors purchase items within the last two weeks before departure to allow for processing time Purchases must be taken with you when you depart Texas and the USA A minimum of 10 00 of Texas Sales Tax per store location is required

Texas Sales Tax Number Lookup TAX

Texas Tax Back Store List Rosy Pike

Sales Tax Refund Claimants Public Notice Federal Board Of Revenue

Start Maximizing Your Tax Refund Millan Co P C

Texas Internal Revenue Service Income Tax PNG Clipart Arm Boy

Tax Percentage Calculator SubhanAleisha

Tax Percentage Calculator SubhanAleisha

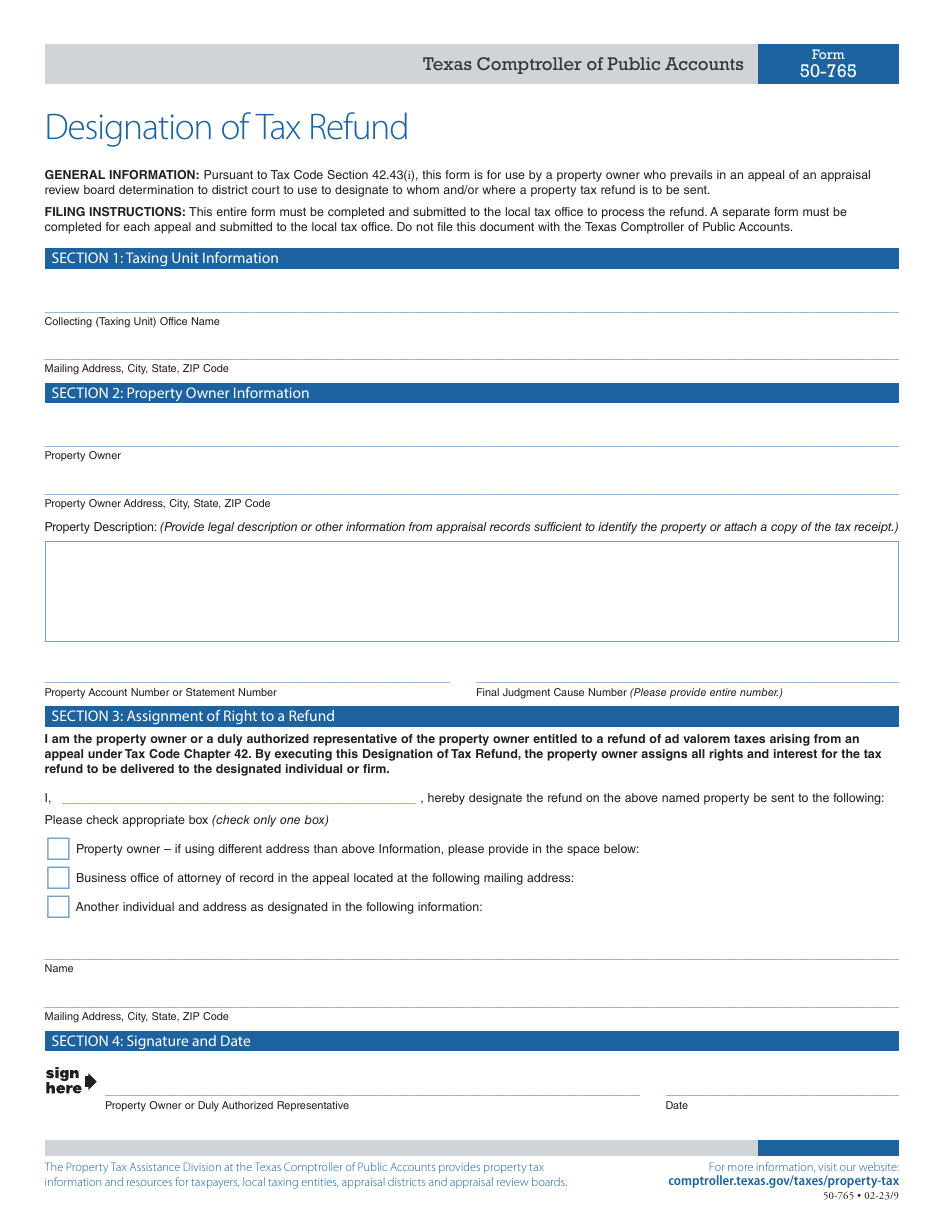

Form 50 765 Download Fillable PDF Or Fill Online Designation Of Tax