In this age of electronic devices, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. If it's to aid in education such as creative projects or simply to add a personal touch to your area, Sars Tax Rate On Retirement Annuity are now a vital source. For this piece, we'll take a dive in the world of "Sars Tax Rate On Retirement Annuity," exploring the different types of printables, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Sars Tax Rate On Retirement Annuity Below

Sars Tax Rate On Retirement Annuity

Sars Tax Rate On Retirement Annuity -

When you invest in a retirement annuity you lower your taxable income for the year which could result in a tax refund from SARS Use the calculator below to see how increasing your retirement annuity contribution can

For pensions or annuities payable during March 2022 and for the periods thereafter your retirement fund administrators will use this rate to deduct PAYE from your pension or annuity The rate provided by SARS will be valid for the whole tax year unless circumstances that influence your year end tax liability change

The Sars Tax Rate On Retirement Annuity are a huge variety of printable, downloadable material that is available online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The attraction of printables that are free is their versatility and accessibility.

More of Sars Tax Rate On Retirement Annuity

What Is The Federal Tax Rate On Retirement Pensions JacAnswers

What Is The Federal Tax Rate On Retirement Pensions JacAnswers

The fixed tax rates issued to annuity providers have been calculated by SARS based on the latest available data they have from employers and annuity providers In calculating the fixed tax rates SARS took all sources of income as well as the annual tax rebates any retirement fund contributions and medical tax credits into account

Contributions to retirement funds are tax deductible within certain limits The maximum tax deduction you may make in a tax year is limited to the greater of 27 5 of taxable income or remuneration from your employer subject to

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

The ability to customize: You can tailor the templates to meet your individual needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free provide for students of all ages. This makes the perfect tool for parents and teachers.

-

Easy to use: immediate access many designs and templates, which saves time as well as effort.

Where to Find more Sars Tax Rate On Retirement Annuity

SARS Fixed Tax Rate On Retirement Incomes 2022 2023 Tax Year MD

SARS Fixed Tax Rate On Retirement Incomes 2022 2023 Tax Year MD

How do I calculate the taxes payable on my retirement annuity in South Africa Since 2020 SARS has been calculating the taxes payable on lump sums on the following figures R1 R500 000 0 of taxable income R500 000 R700 00 18 of taxable income R700 000 R1 050 000 R36 000 plus 27 of taxable income above

This SARS tax pocket guide provides a summary of the most important information relating to taxes duties and levies for 2024 25 INCOME TAX INDIVIDUALS AND TRUSTS Tax rates from 1 March 2024 to 28 February 2025 Individuals and special trusts Taxable Income R Rate of Tax 1 237 100

Now that we've ignited your interest in printables for free Let's look into where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Sars Tax Rate On Retirement Annuity for various goals.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast spectrum of interests, including DIY projects to party planning.

Maximizing Sars Tax Rate On Retirement Annuity

Here are some inventive ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Sars Tax Rate On Retirement Annuity are a treasure trove of practical and imaginative resources catering to different needs and interest. Their availability and versatility make them a great addition to the professional and personal lives of both. Explore the vast world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can download and print these tools for free.

-

Can I make use of free printables in commercial projects?

- It depends on the specific conditions of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright rights issues with Sars Tax Rate On Retirement Annuity?

- Some printables may have restrictions in their usage. Be sure to check the terms and conditions set forth by the author.

-

How do I print Sars Tax Rate On Retirement Annuity?

- Print them at home with your printer or visit a local print shop for premium prints.

-

What program do I need to open printables free of charge?

- The majority of printed documents are with PDF formats, which can be opened with free software such as Adobe Reader.

SARS Auto Assessment What Are The Risks SME TAX

Retirement Annuity Vs Pension Fund

Check more sample of Sars Tax Rate On Retirement Annuity below

Annuity Emporium Blog Expert Insights On Retirement Annuity Strategies

Federal Pay 2023 2023

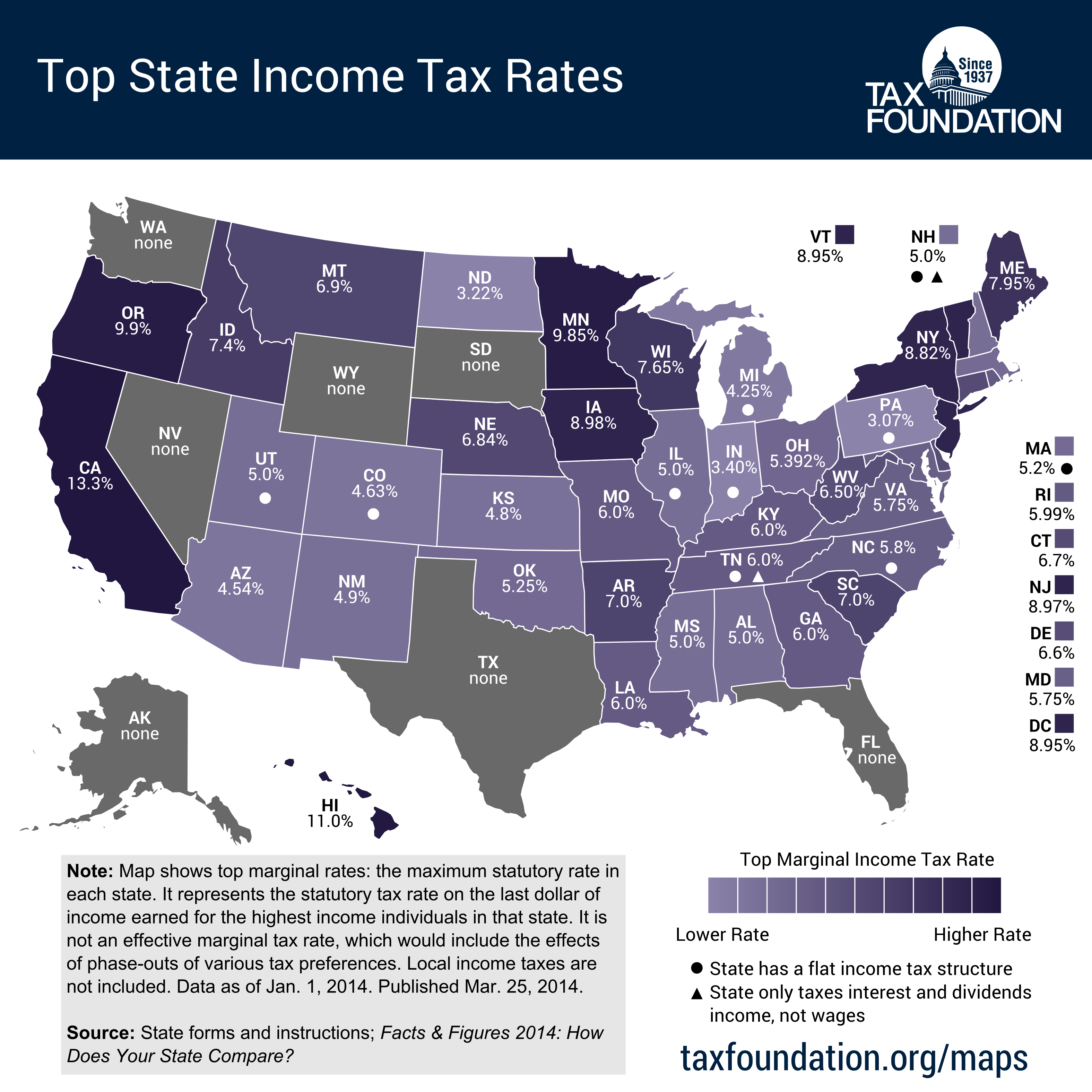

California Tops List Of 10 States With Highest Taxes

WITHDRAWAL RESIGNATION RETRENCHMENT BENEFITS LA Retirement Fund

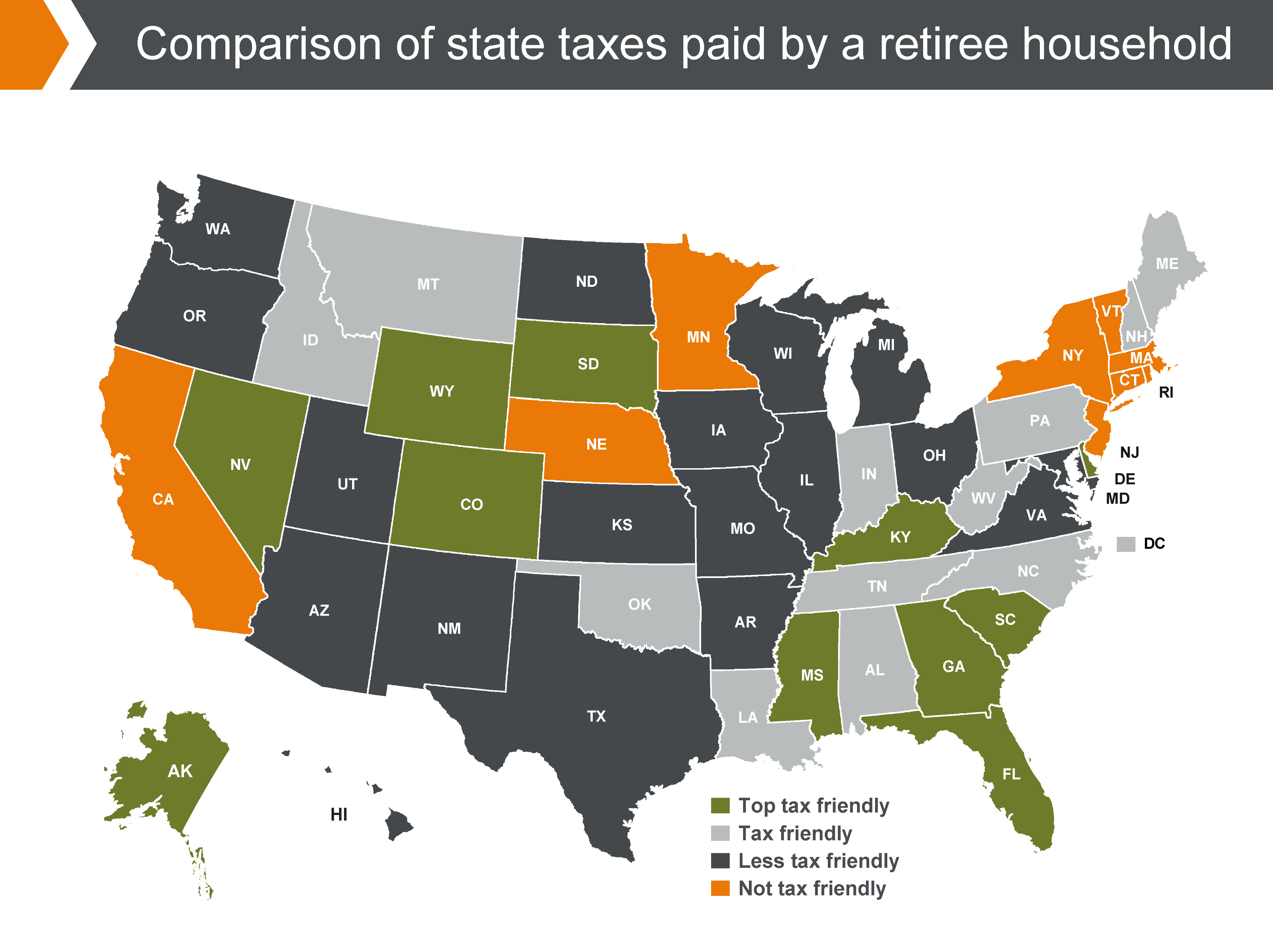

States With The Highest and Lowest Taxes For Retirees Money

How To Lower Your Tax Rate In Retirement YouTube

https://www.sars.gov.za/latest-news/tax-deductions...

For pensions or annuities payable during March 2022 and for the periods thereafter your retirement fund administrators will use this rate to deduct PAYE from your pension or annuity The rate provided by SARS will be valid for the whole tax year unless circumstances that influence your year end tax liability change

https://www.sars.gov.za/tax-rates/income-tax/...

Retirement fund lump sum withdrawal benefits consist of lump sums from a pension pension preservation provident provident preservation or retirement annuity fund on withdrawal including assignment in terms of a divorce order

For pensions or annuities payable during March 2022 and for the periods thereafter your retirement fund administrators will use this rate to deduct PAYE from your pension or annuity The rate provided by SARS will be valid for the whole tax year unless circumstances that influence your year end tax liability change

Retirement fund lump sum withdrawal benefits consist of lump sums from a pension pension preservation provident provident preservation or retirement annuity fund on withdrawal including assignment in terms of a divorce order

WITHDRAWAL RESIGNATION RETRENCHMENT BENEFITS LA Retirement Fund

Federal Pay 2023 2023

States With The Highest and Lowest Taxes For Retirees Money

How To Lower Your Tax Rate In Retirement YouTube

What You Need To Know About Tax Withdrawing Your Retirement Annuity

10 States That Score Highest For Retirement Security MarketWatch

10 States That Score Highest For Retirement Security MarketWatch

Federal Tax Brackets 2021 Spanishlader