In a world where screens rule our lives however, the attraction of tangible printed materials hasn't faded away. Whatever the reason, whether for education or creative projects, or simply to add the personal touch to your space, Section 80c And 80ccc Limit have proven to be a valuable source. In this article, we'll take a dive in the world of "Section 80c And 80ccc Limit," exploring what they are, where to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest Section 80c And 80ccc Limit Below

Section 80c And 80ccc Limit

Section 80c And 80ccc Limit -

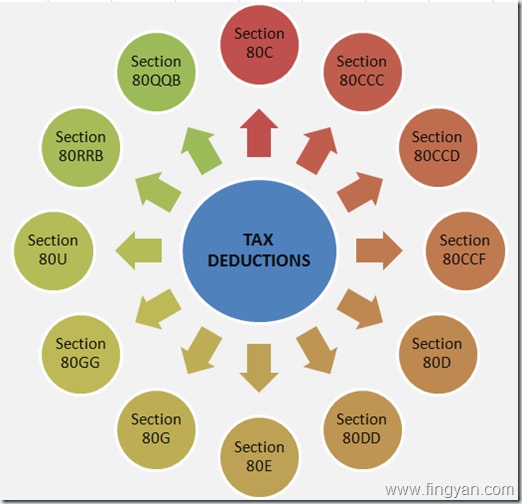

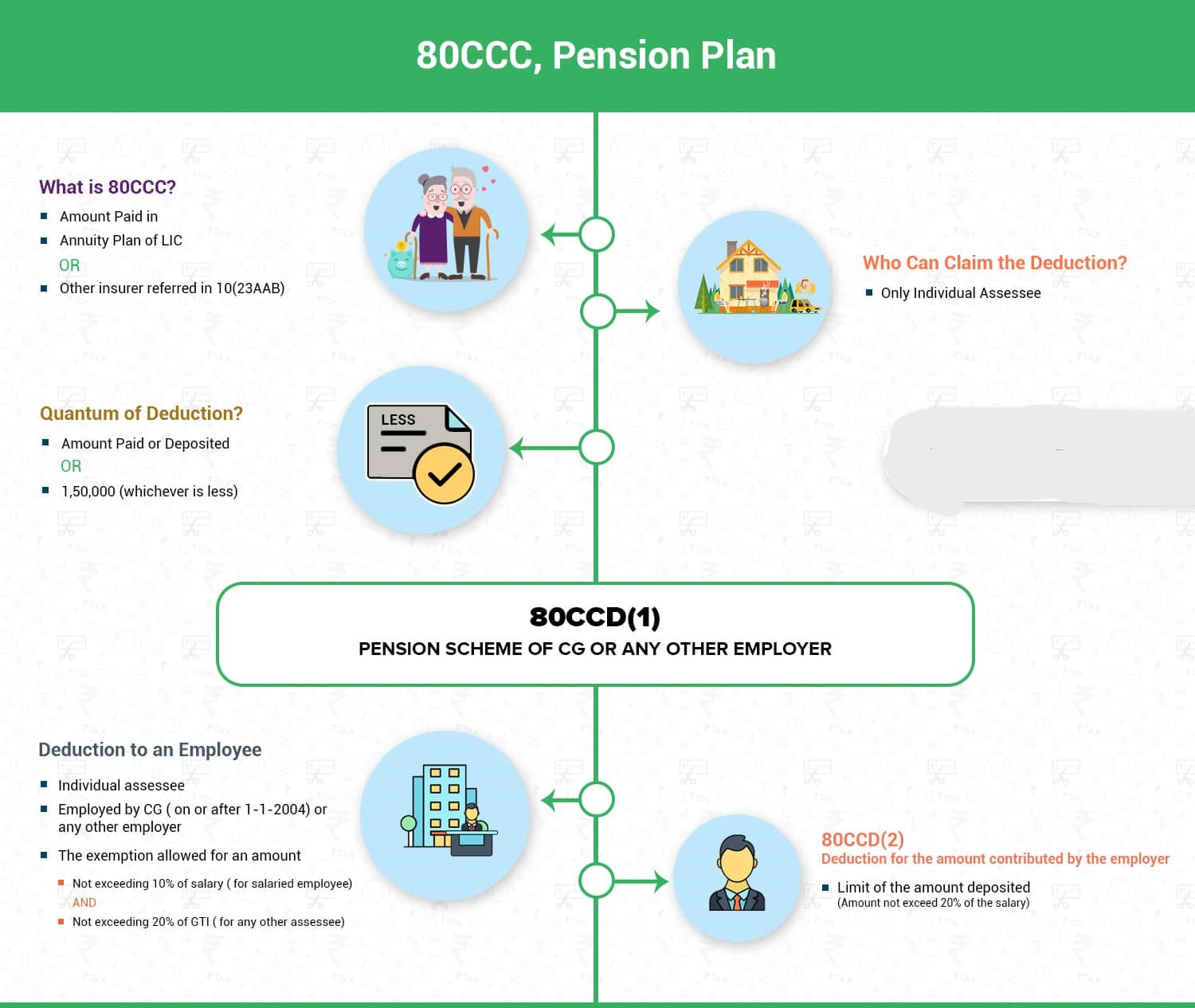

Section 80CCE thereby limits the total exemption limit up to 1 5 lakh per annum What is the maximum tax exemption under Section 80C You can claim a

Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section

Section 80c And 80ccc Limit include a broad range of downloadable, printable materials online, at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages and much more. The attraction of printables that are free is in their variety and accessibility.

More of Section 80c And 80ccc Limit

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

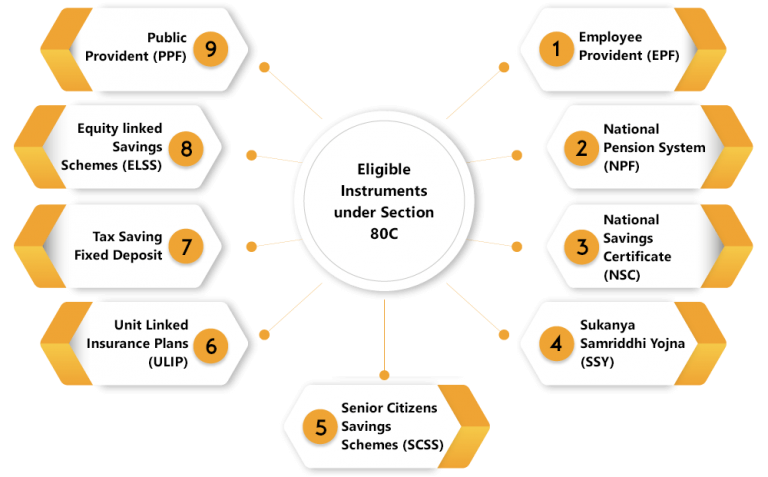

1 Section 80C Tax Deduction Under section 80C of the income tax you are eligible to claim deductions up to Rs 1 50 000 on your taxable income from tax

Limit on deductions under sections 80C 80CCC and 80CCD 80CCE The aggregate amount of deductions under section 80C section 80CCC and sub

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize printables to your specific needs in designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value Educational printables that can be downloaded for free provide for students of all ages, which makes them a great instrument for parents and teachers.

-

Simple: Instant access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Section 80c And 80ccc Limit

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

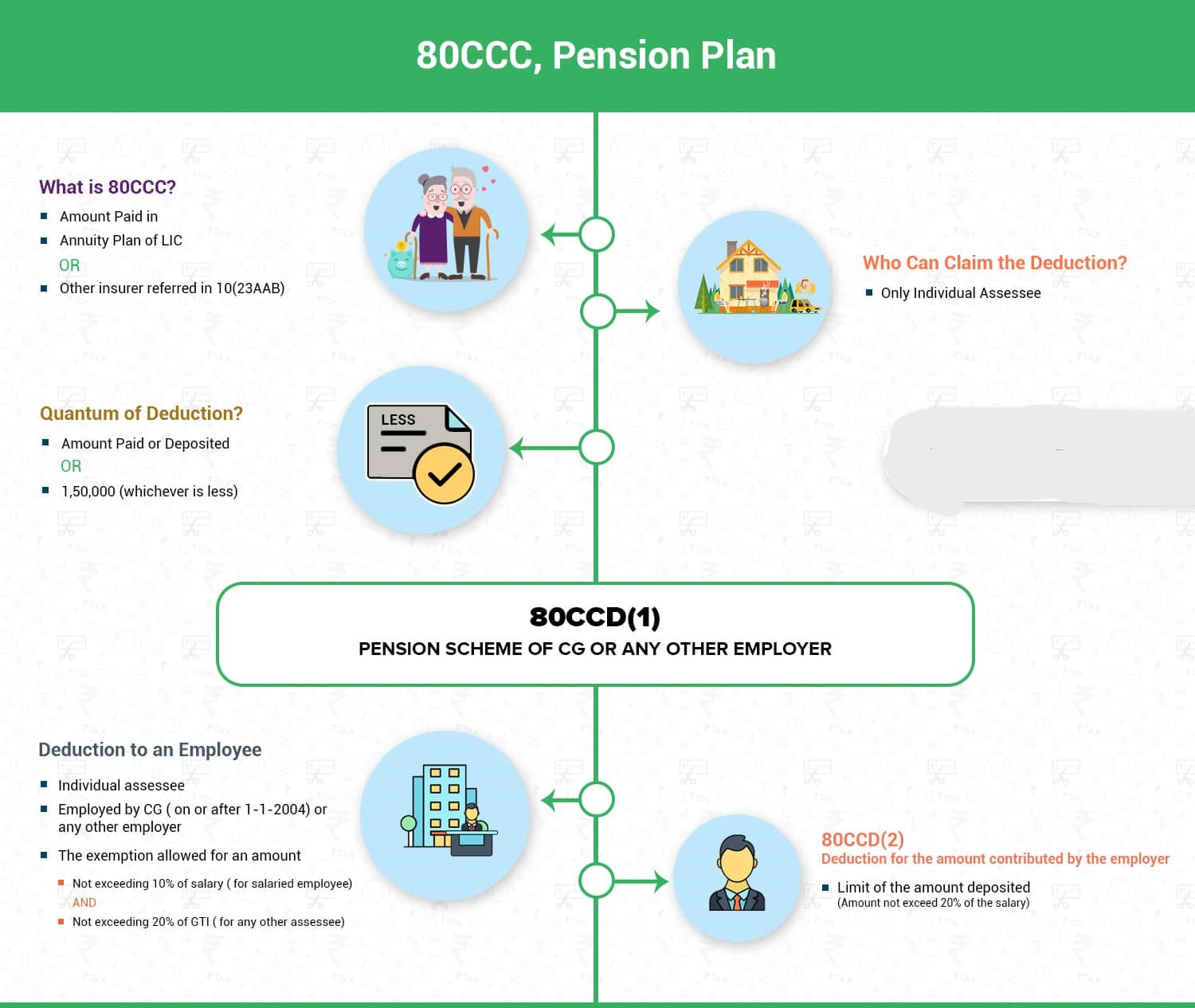

Section 80CCC lets you claim a deduction of Rs 1 5 lakh Section 80CCC deduction limit is combined with sections 80C and 80CCD That is by

Since he hasn t reached the Rs 1 5 lakh limit under Section 80CCE combining Section 80CCD 1 and Section 80C Mr A must claim Rs 2 000 as

If we've already piqued your interest in Section 80c And 80ccc Limit Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of needs.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a broad array of topics, ranging including DIY projects to party planning.

Maximizing Section 80c And 80ccc Limit

Here are some ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Section 80c And 80ccc Limit are an abundance of innovative and useful resources for a variety of needs and desires. Their accessibility and flexibility make these printables a useful addition to the professional and personal lives of both. Explore the many options that is Section 80c And 80ccc Limit today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Section 80c And 80ccc Limit really for free?

- Yes they are! You can print and download these files for free.

-

Can I utilize free printables for commercial purposes?

- It depends on the specific usage guidelines. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations regarding usage. Make sure to read the terms and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home using any printer or head to a local print shop to purchase superior prints.

-

What software do I require to open printables at no cost?

- Many printables are offered with PDF formats, which can be opened with free software, such as Adobe Reader.

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

Section 80C Income Tax Deduction Under Section 80C 80C Limit Tax2win

Check more sample of Section 80c And 80ccc Limit below

Income Tax Deductions Under Section 80C 80CCC 80CCD 80D 100Utils

NRI Deductions Are Allowed Deduction Not Allowed RJA

7 Tax Provisions That Are Relevant To You Beyond Just Section 80C

Tianzi Mountains China 100Utils

FinancialBytes How To Save Income Tax Under Section 80C NewsBytes

A Complete Guide On Income Tax Deductions Under Section 80C 80CCC

https://cleartax.in/s/80c-80-deductions

Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section

https://cleartax.in/s/section-80ccc

The deduction limits available under Section 80CCC are clubbed together with Section 80C and Section 80CCD 1 to determine the total

Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section

The deduction limits available under Section 80CCC are clubbed together with Section 80C and Section 80CCD 1 to determine the total

Tianzi Mountains China 100Utils

NRI Deductions Are Allowed Deduction Not Allowed RJA

FinancialBytes How To Save Income Tax Under Section 80C NewsBytes

A Complete Guide On Income Tax Deductions Under Section 80C 80CCC

Deduction Of 80C 80CCC 80CCD Under Income Tax

Do 80CCC And 80CCD Come Under 80C Or They Are Extra Investment Benefits

Do 80CCC And 80CCD Come Under 80C Or They Are Extra Investment Benefits

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c