In this digital age, in which screens are the norm, the charm of tangible printed products hasn't decreased. Whatever the reason, whether for education, creative projects, or simply to add an element of personalization to your home, printables for free are a great source. We'll dive deep into the realm of "Section 80c To 80u Deduction," exploring what they are, how to locate them, and how they can enhance various aspects of your daily life.

Get Latest Section 80c To 80u Deduction Below

Section 80c To 80u Deduction

Section 80c To 80u Deduction -

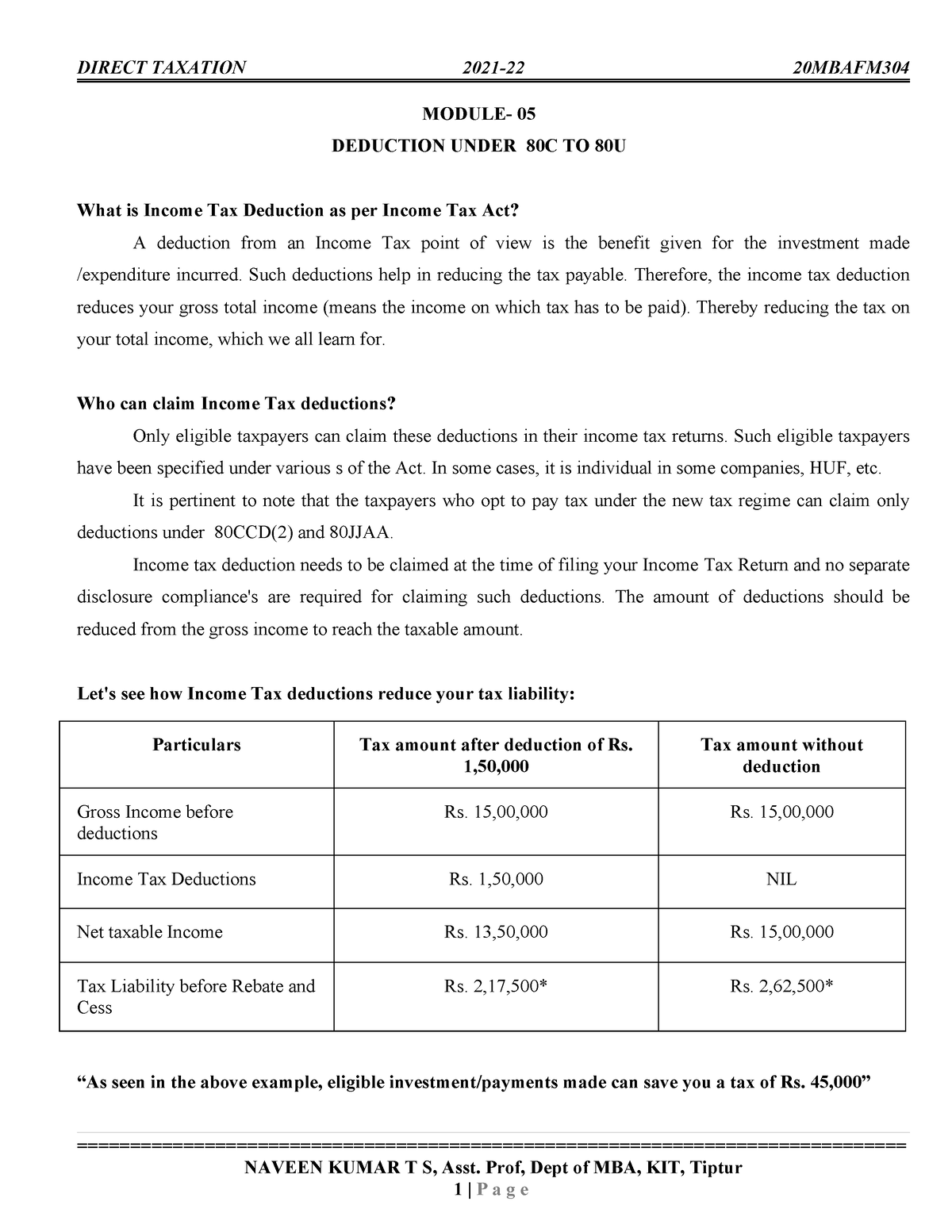

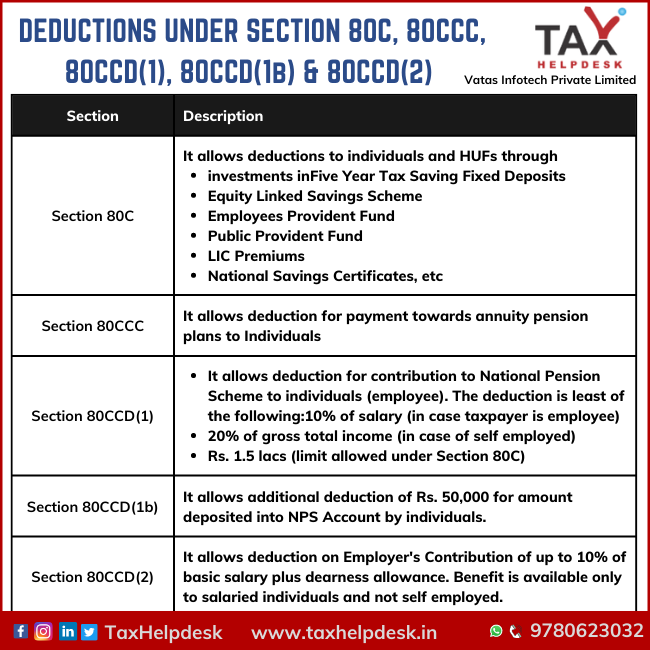

Sections 80C to 80U are provisions in the Indian Income Tax Act that offer tax deductions to individuals and businesses These sections cover a wide range of expenses investments and contributions that qualify for deductions helping taxpayers reduce their taxable income and maximize savings

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Section 80c To 80u Deduction offer a wide variety of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in various formats, such as worksheets, templates, coloring pages, and more. The appealingness of Section 80c To 80u Deduction lies in their versatility as well as accessibility.

More of Section 80c To 80u Deduction

Income Tax Deduction U s 80C 80U Rajput Jain Associates

Income Tax Deduction U s 80C 80U Rajput Jain Associates

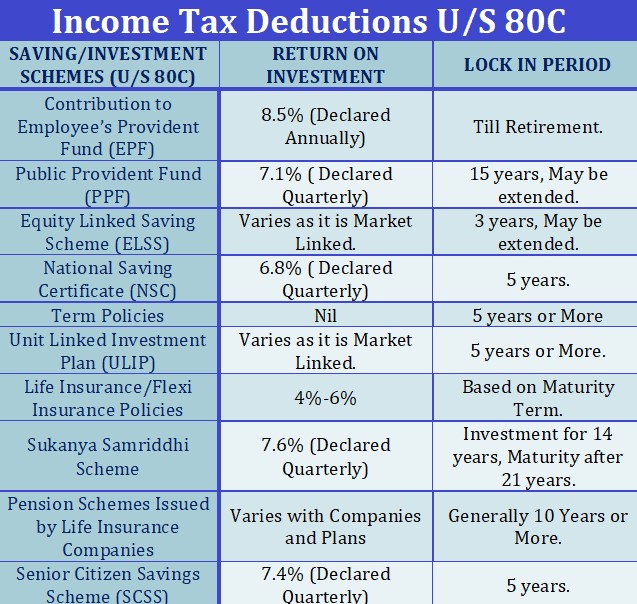

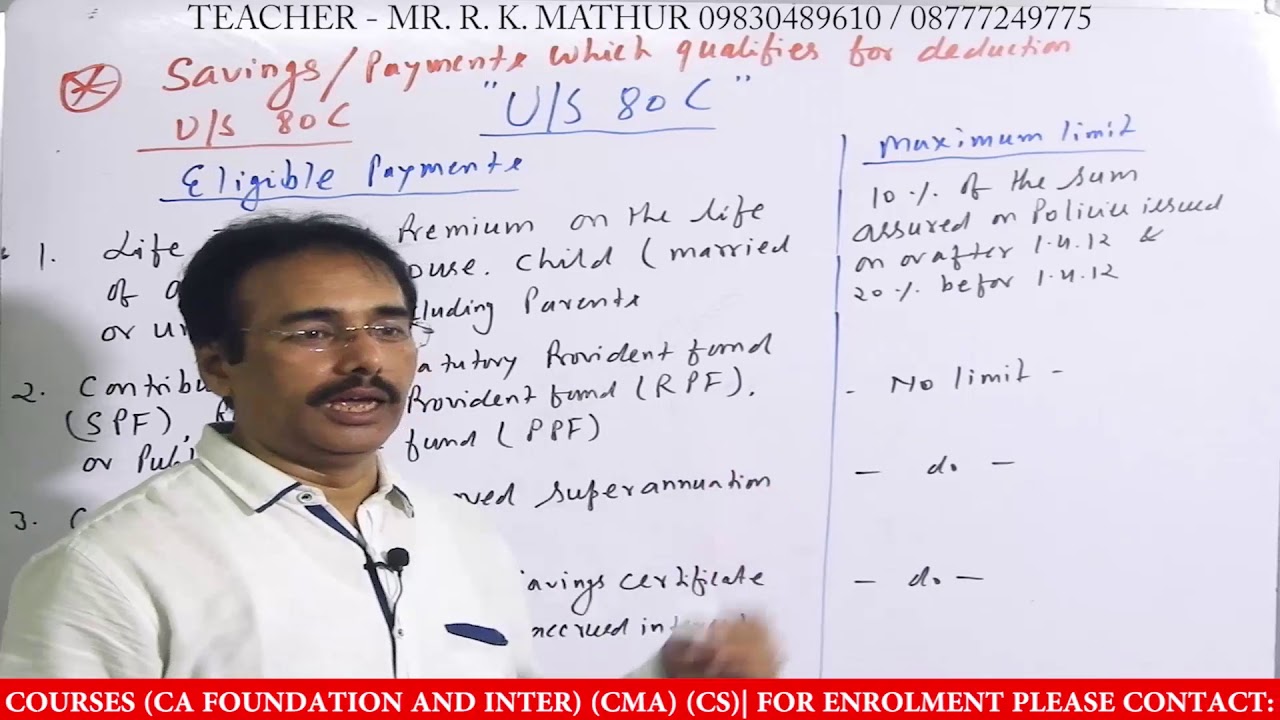

Under section 80C a deduction of Rs 1 50 000 can be claimed from your total income In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF

If you are someone who has opted for the old existing tax regime then once you have filled in all your income details in ITR 1 form you will have to fill in the details related to tax saving deductions available under sections 80C to 80U of the Income Tax Act 1961 These deductions can be claimed from income before levying of income tax

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: This allows you to modify the design to meet your needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Benefits: Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them a vital instrument for parents and teachers.

-

Convenience: You have instant access a variety of designs and templates saves time and effort.

Where to Find more Section 80c To 80u Deduction

Deduction US 80C Deduction Under Section 80C Everything About

Deduction US 80C Deduction Under Section 80C Everything About

Deduction Limit The maximum deduction limit under Section 80C is INR 1 5 lakh in a financial year This limit is the combined maximum for Section 80C 80CCC about pension fund contributions and 80CCD 1 about the National Pension Scheme

Most taxpayers claim deductions under Sections 80C 80CCC 80CCD and 80D 80C covers investment schemes like ELSS PPF ULIPs while 80CCD is for contributions towards pension funds 80D is exclusively for medical insurance and preventive health checkups

We've now piqued your interest in printables for free Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of motives.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets including flashcards, learning tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad variety of topics, including DIY projects to planning a party.

Maximizing Section 80c To 80u Deduction

Here are some innovative ways for you to get the best of Section 80c To 80u Deduction:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Section 80c To 80u Deduction are an abundance filled with creative and practical information that meet a variety of needs and passions. Their accessibility and flexibility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the many options of Section 80c To 80u Deduction today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Section 80c To 80u Deduction really cost-free?

- Yes, they are! You can print and download these files for free.

-

Can I utilize free printables for commercial use?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with Section 80c To 80u Deduction?

- Certain printables might have limitations regarding usage. Be sure to review the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home with printing equipment or visit a local print shop for more high-quality prints.

-

What program do I need in order to open printables for free?

- A majority of printed materials are in PDF format. They can be opened with free software like Adobe Reader.

Module 05 Deduction Under Section 80C TO 80U Theory StuDocu

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Check more sample of Section 80c To 80u Deduction below

A Quick Look At Deductions Under Section 80C To Section 80U

Income Tax Deduction Under Section 80C To 80U Salary Employees YouTube

Deduction Under Section 80C A Complete List BasuNivesh

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction Under Section 80C

Section 80U Tax Deductions For Disabled Individuals Tax2win

https://cleartax.in

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

https://taxguru.in › income-tax

Article explains Income Tax Deduction Available to Individual and HUF under Section 80C Section 80CCG Section 80D Section 80DD Section 80DDB Section 80E Section 80EE Section 80G Section 80GG Section 80GGB Section 80RRB Section 80TTA Section 80TTB and Section 80U of Income Tax Act 1961 Deduction Under Sections 80C to 80U

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Article explains Income Tax Deduction Available to Individual and HUF under Section 80C Section 80CCG Section 80D Section 80DD Section 80DDB Section 80E Section 80EE Section 80G Section 80GG Section 80GGB Section 80RRB Section 80TTA Section 80TTB and Section 80U of Income Tax Act 1961 Deduction Under Sections 80C to 80U

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Income Tax Deduction Under Section 80C To 80U Salary Employees YouTube

Deduction Under Section 80C

Section 80U Tax Deductions For Disabled Individuals Tax2win

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deduction U s 80C To 80U Deduction U s 80C imp A Y 2022 23