In the age of digital, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes such as creative projects or simply adding an individual touch to your home, printables for free have become an invaluable source. For this piece, we'll dive through the vast world of "Section 80d Deduction For Parents," exploring what they are, where you can find them, and ways they can help you improve many aspects of your life.

Get Latest Section 80d Deduction For Parents Below

Section 80d Deduction For Parents

Section 80d Deduction For Parents -

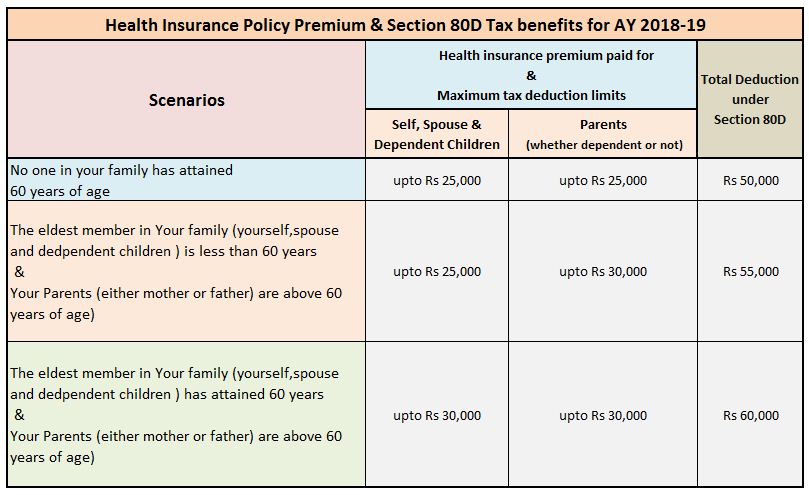

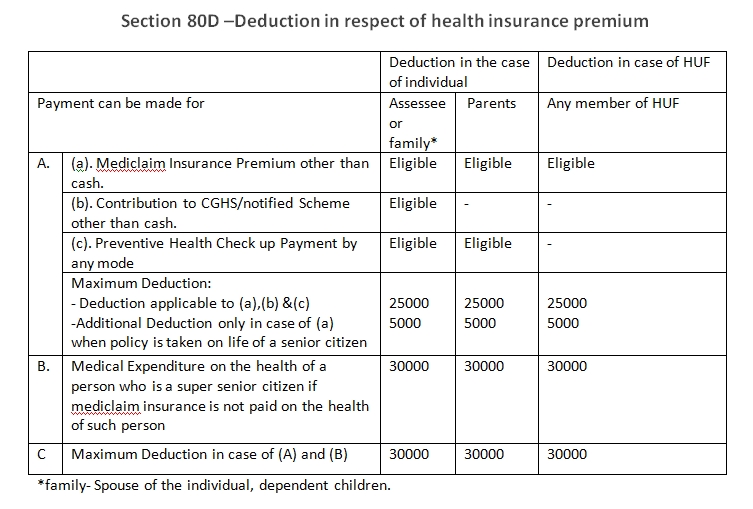

Section 80D allows for a Rs 5 000 deduction for costs made for preventative health check ups This deduction will be limited to Rs 25 000 Rs 50 000 whichever is greater

Tax Deduction The Income Tax Act provides a tax deduction under Section 80D for expenses incurred on preventive health check ups Taxpayers can claim up to 5 000 per financial year for themselves their spouses

Section 80d Deduction For Parents encompass a wide range of downloadable, printable resources available online for download at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and many more. The great thing about Section 80d Deduction For Parents is in their variety and accessibility.

More of Section 80d Deduction For Parents

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Deduction under section 80D is allowable in respect of premium paid to insure the health of any member of the family The maximum deduction available to a HUF would be 25 000 and in case any member is a senior

Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children

Section 80d Deduction For Parents have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize printables to your specific needs whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: These Section 80d Deduction For Parents offer a wide range of educational content for learners from all ages, making these printables a powerful tool for parents and educators.

-

Affordability: instant access various designs and templates saves time and effort.

Where to Find more Section 80d Deduction For Parents

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Under Section 80D a taxpayer can claim a deduction of up to Rs 50 000 for the medical expenses incurred on behalf of a senior citizen parent The deduction amount is the same for each

Payments eligible as deduction under Section 80D An individual or HUF can claim a deduction under Section 80D for the payments mentioned below Medical insurance premium paid for self spouse dependent children

We've now piqued your interest in Section 80d Deduction For Parents We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Section 80d Deduction For Parents for all uses.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Section 80d Deduction For Parents

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Section 80d Deduction For Parents are a treasure trove with useful and creative ideas designed to meet a range of needs and passions. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the wide world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can download and print these resources at no cost.

-

Do I have the right to use free printouts for commercial usage?

- It's based on the rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using Section 80d Deduction For Parents?

- Some printables could have limitations regarding their use. Be sure to check the conditions and terms of use provided by the creator.

-

How can I print Section 80d Deduction For Parents?

- You can print them at home with an printer, or go to any local print store for premium prints.

-

What program do I need to open printables for free?

- The majority of printables are in the PDF format, and can be opened using free software, such as Adobe Reader.

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

Deduction Under Section 80D Ultimate Guide

Check more sample of Section 80d Deduction For Parents below

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80D Tax Benefit For Health Medical Treatment Premium AY

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Epf Contribution Table For Age Above 60 2019 Frank Lyman

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Section 80D Income Tax Act Dialabank Best Offers

https://tax2win.in › guide

Tax Deduction The Income Tax Act provides a tax deduction under Section 80D for expenses incurred on preventive health check ups Taxpayers can claim up to 5 000 per financial year for themselves their spouses

https://economictimes.indiatimes.co…

Cannot buy health insurance for your parents and don t have money to invest under section 80C for the purpose of tax saving You can still save tax under section 80D by claiming a deduction for medical expenditure

Tax Deduction The Income Tax Act provides a tax deduction under Section 80D for expenses incurred on preventive health check ups Taxpayers can claim up to 5 000 per financial year for themselves their spouses

Cannot buy health insurance for your parents and don t have money to invest under section 80C for the purpose of tax saving You can still save tax under section 80D by claiming a deduction for medical expenditure

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Section 80D Tax Benefit For Health Medical Treatment Premium AY

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Section 80D Income Tax Act Dialabank Best Offers

80D Tax Deduction Under Section 80D On Medical Insurance

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche