In the digital age, where screens rule our lives but the value of tangible printed materials isn't diminishing. If it's to aid in education in creative or artistic projects, or simply to add personal touches to your space, Self Education Fees Deduction Income Tax have become an invaluable source. Through this post, we'll take a dive to the depths of "Self Education Fees Deduction Income Tax," exploring what they are, how to get them, as well as how they can add value to various aspects of your daily life.

Get Latest Self Education Fees Deduction Income Tax Below

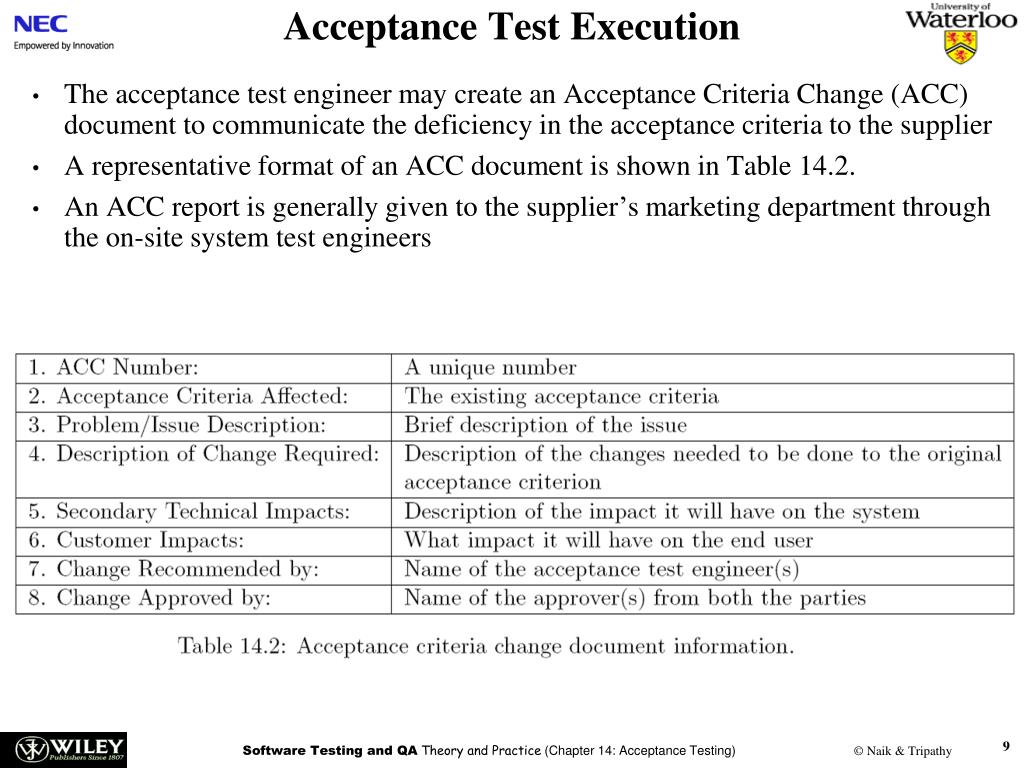

Self Education Fees Deduction Income Tax

Self Education Fees Deduction Income Tax -

Ti ng Vi t You may be able to deduct the cost of work related education expenses paid during the year if you re A self employed individual An

Deduction u s 80C for tuition school fees paid for education of children Page Contents Who is Eligible for Section 80C

Printables for free cover a broad collection of printable materials online, at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The great thing about Self Education Fees Deduction Income Tax lies in their versatility as well as accessibility.

More of Self Education Fees Deduction Income Tax

Tax Benefits On Tuition Fees School Fees Education Allowances

Tax Benefits On Tuition Fees School Fees Education Allowances

Qualified Ed Expenses Qualified Education Expenses Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible

Home News Tax Benefits for Education Information Center You can use the IRS s Interactive Tax Assistant tool to help determine if you re eligible for educational

Self Education Fees Deduction Income Tax have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Personalization You can tailor printing templates to your own specific requirements be it designing invitations making your schedule, or even decorating your home.

-

Education Value Downloads of educational content for free cater to learners from all ages, making them an invaluable instrument for parents and teachers.

-

Easy to use: Instant access to a plethora of designs and templates will save you time and effort.

Where to Find more Self Education Fees Deduction Income Tax

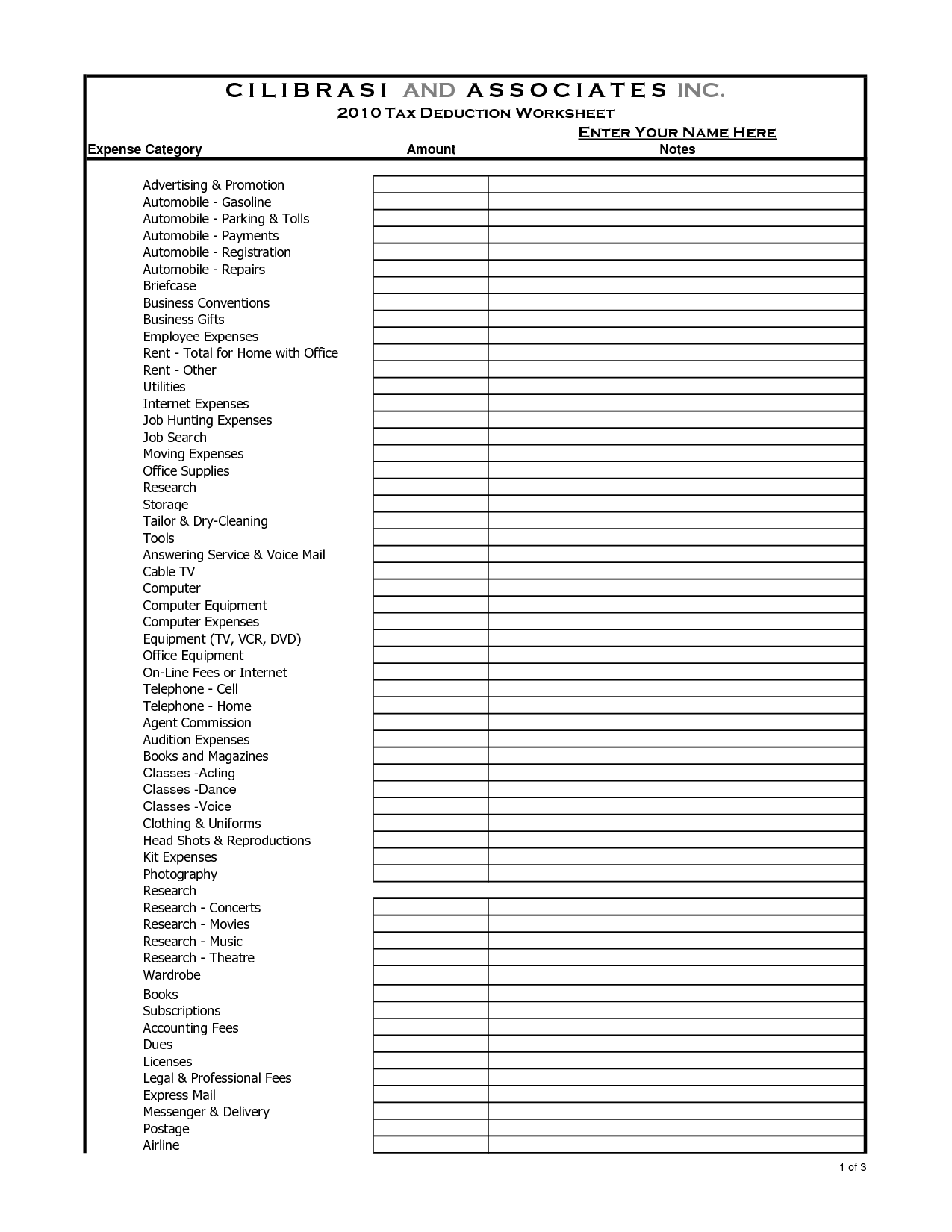

16 Tax Organizer Worksheet Worksheeto

16 Tax Organizer Worksheet Worksheeto

Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan

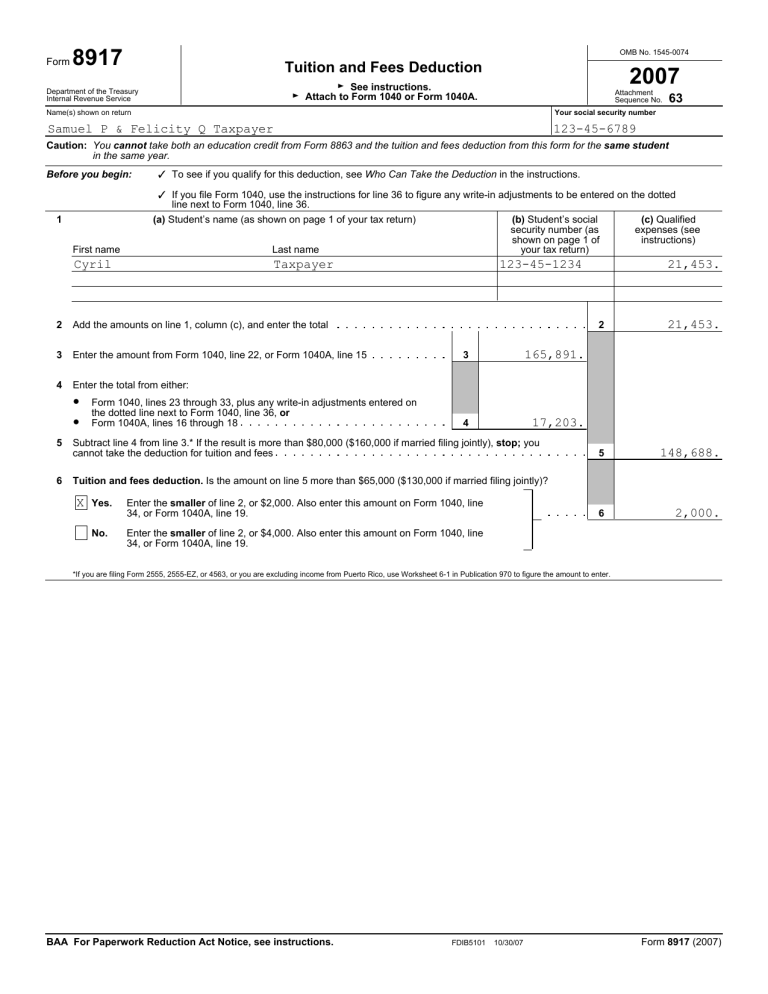

The deduction was 100 of qualified higher education expenses with a maximum of 4 000 2 000 or 0 depending on the amount of your modified AGI and filing status The phaseout for this deduction began at

After we've peaked your interest in Self Education Fees Deduction Income Tax Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Self Education Fees Deduction Income Tax for various applications.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets with flashcards and other teaching tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a wide variety of topics, that includes DIY projects to planning a party.

Maximizing Self Education Fees Deduction Income Tax

Here are some fresh ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Self Education Fees Deduction Income Tax are a treasure trove of creative and practical resources that can meet the needs of a variety of people and pursuits. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the plethora of Self Education Fees Deduction Income Tax to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can print and download these items for free.

-

Can I use the free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with Self Education Fees Deduction Income Tax?

- Some printables may come with restrictions in their usage. Always read the terms and conditions offered by the author.

-

How can I print printables for free?

- Print them at home using a printer or visit the local print shop for more high-quality prints.

-

What software do I need to open printables that are free?

- The majority of printables are in the format of PDF, which can be opened using free software such as Adobe Reader.

School Fees Deduction Under 80c

Write Offs For The Self Employed For All The Visual Learners Out

Check more sample of Self Education Fees Deduction Income Tax below

Tuition And Fees Deduction

Tuition And Fees Deduction Vs Education Credit What Are The

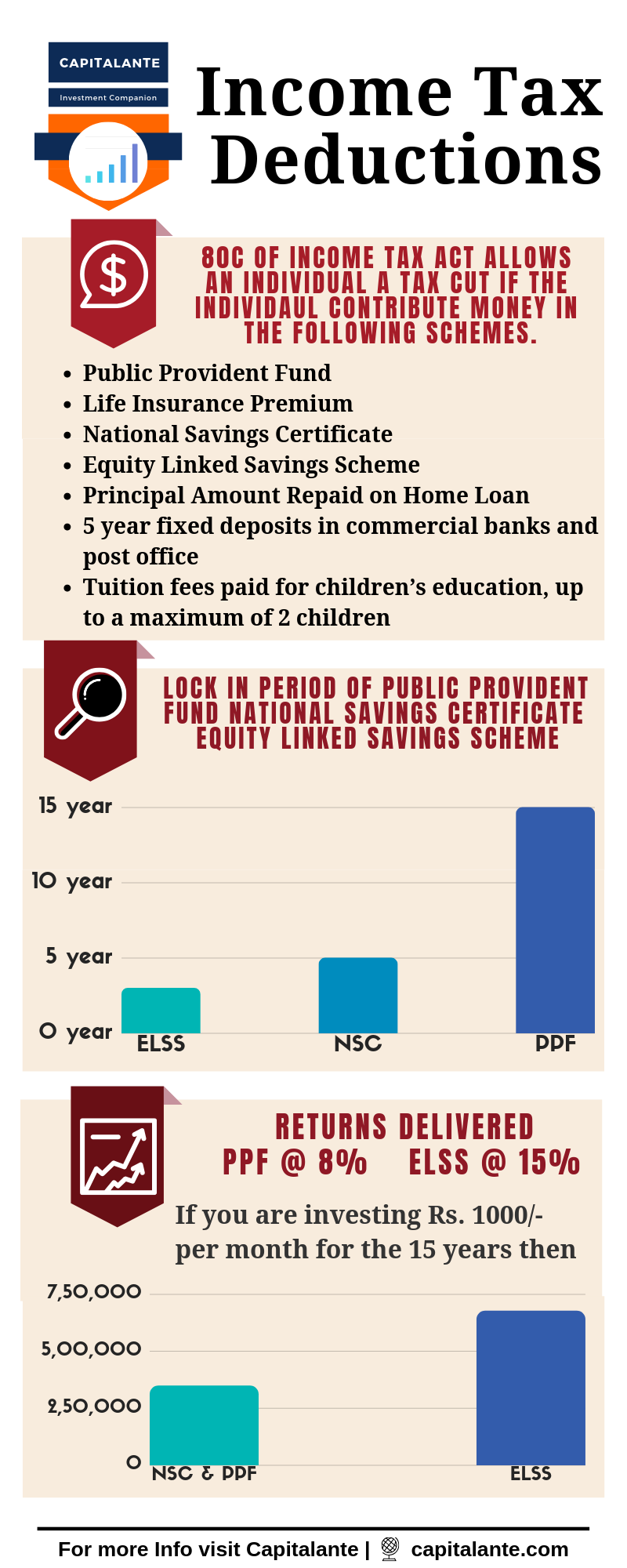

Income Tax Deductions In India Capitalante

Tuition And Fees Deduction 2023 How Many Discounts Can You Get Marca

Tuition Fees Deduction India

2021 Tuition And Fees Deduction

https://taxguru.in/income-tax/deductio…

Deduction u s 80C for tuition school fees paid for education of children Page Contents Who is Eligible for Section 80C

https://www.hrblock.com.au/tax-academy/claiming...

Self education expenses are deductible when the course you undertake leads to a formal qualification and meets the following conditions The course must have a sufficient

Deduction u s 80C for tuition school fees paid for education of children Page Contents Who is Eligible for Section 80C

Self education expenses are deductible when the course you undertake leads to a formal qualification and meets the following conditions The course must have a sufficient

Tuition And Fees Deduction 2023 How Many Discounts Can You Get Marca

Tuition And Fees Deduction Vs Education Credit What Are The

Tuition Fees Deduction India

2021 Tuition And Fees Deduction

Tuition Deduction V Education Credit Get Answers To All Your

2018 Tuition And Fees Deduction Form

2018 Tuition And Fees Deduction Form

How To Claim The Tuition And Fees Deduction Tuition Deduction Tax