In this age of electronic devices, when screens dominate our lives The appeal of tangible printed objects hasn't waned. Be it for educational use as well as creative projects or simply adding an element of personalization to your area, Self Employed Tax Credit Irs Form 7202 have become a valuable source. This article will dive deeper into "Self Employed Tax Credit Irs Form 7202," exploring what they are, where they are available, and the ways that they can benefit different aspects of your lives.

Get Latest Self Employed Tax Credit Irs Form 7202 Below

Self Employed Tax Credit Irs Form 7202

Self Employed Tax Credit Irs Form 7202 -

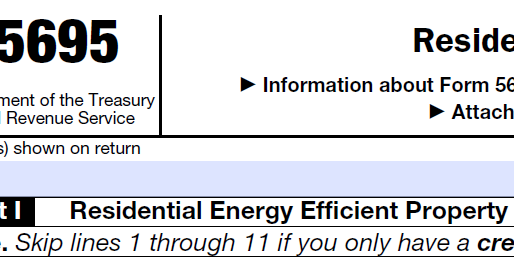

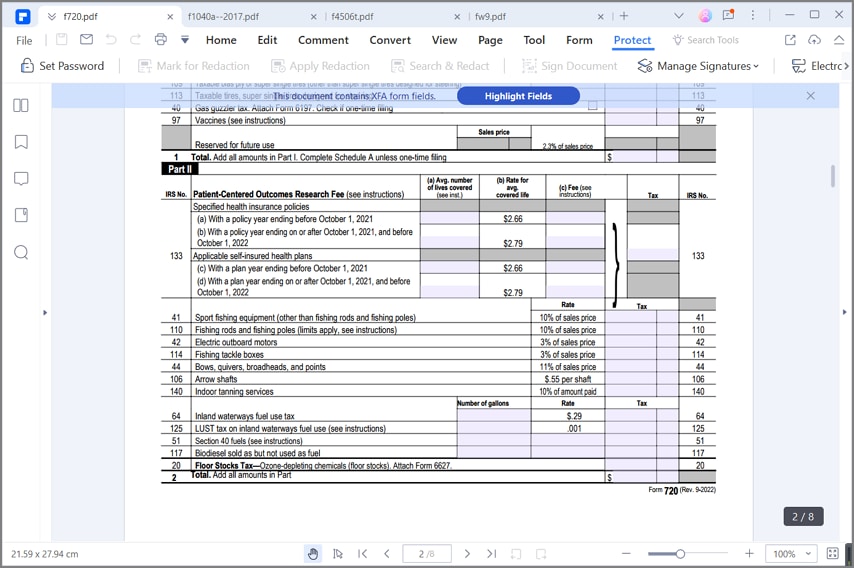

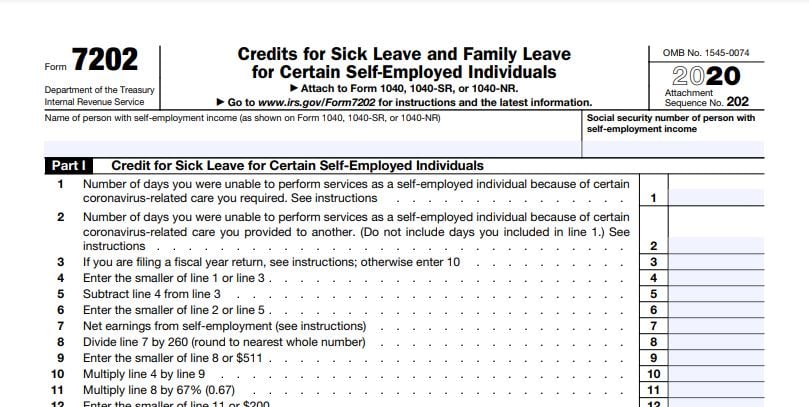

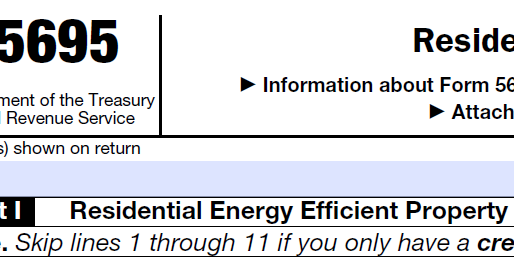

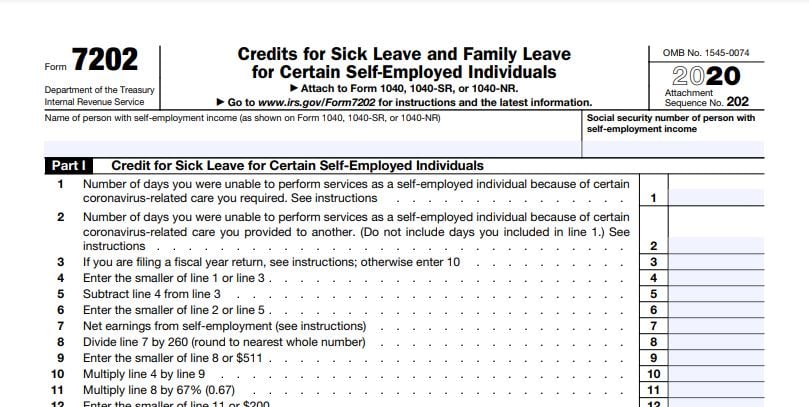

The self employed tax credit under the FFCRA provides eligible self employed individuals with tax credits for qualified sick and family leave To claim these credits self employed individuals must complete IRS Form 7202 and meet certain eligibility requirements

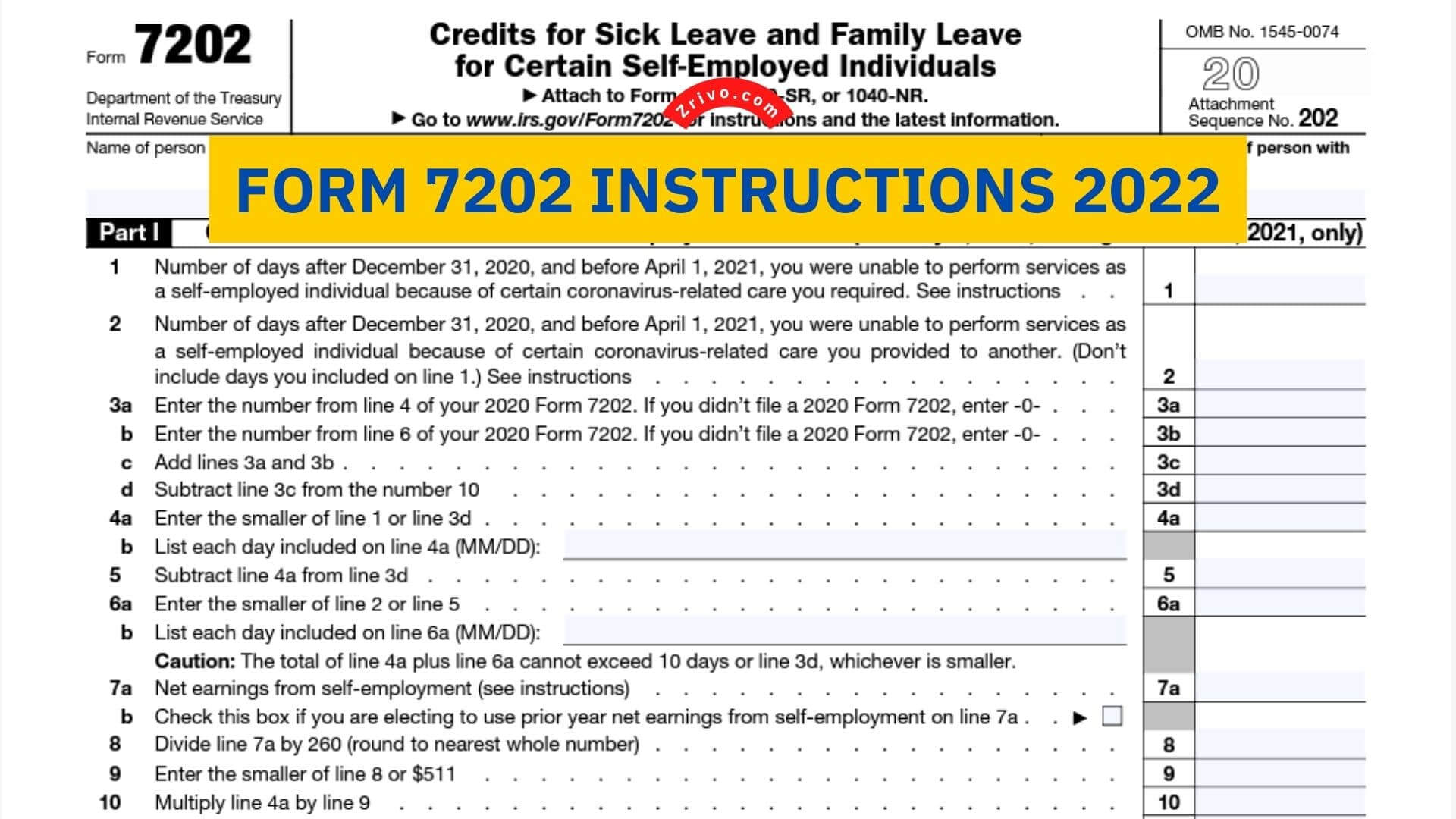

Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self employed individual due to certain COVID 19 related circumstances between January 1 2021 and September 30 2021 Each eligible self employed individual must file a separate Form 7202

Self Employed Tax Credit Irs Form 7202 provide a diverse range of downloadable, printable resources available online for download at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and many more. The great thing about Self Employed Tax Credit Irs Form 7202 is in their variety and accessibility.

More of Self Employed Tax Credit Irs Form 7202

COVID 19 Sick And Family Leave Tax Credits For Self Employed

COVID 19 Sick And Family Leave Tax Credits For Self Employed

Self employed people can claim these value COVID credits using IRS Form 7202 Credits for Sick Leave and Family Leave for Certain Self Employed Individuals This is a one page form that walks you through the math so you can calculate your self employed COVID tax

IRS Form 7202 allows self employed individuals to claim tax credits for sick and family leave provided under the Families First Coronavirus Response Act FFCRA for tax years 2020 and 2021 This form allows eligible individuals to recover a portion of the wages lost while unable to work due to COVID 19 related reasons

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: We can customize print-ready templates to your specific requirements in designing invitations, organizing your schedule, or decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes them a useful resource for educators and parents.

-

Convenience: Fast access a myriad of designs as well as templates can save you time and energy.

Where to Find more Self Employed Tax Credit Irs Form 7202

IRS Form 7202 Examples

IRS Form 7202 Examples

Eligible self employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202 Credits for Sick Leave and Family Leave for Certain Self Employed Individuals

IRS Form 7202 allows you to file for Credits for Sick Leave and Family Leave for Certain Self Employed Individuals Essentially if you worked for an employer this year you might have been

We hope we've stimulated your interest in printables for free, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Self Employed Tax Credit Irs Form 7202 for various applications.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs are a vast variety of topics, that includes DIY projects to party planning.

Maximizing Self Employed Tax Credit Irs Form 7202

Here are some creative ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home for the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Self Employed Tax Credit Irs Form 7202 are a treasure trove with useful and creative ideas that meet a variety of needs and passions. Their access and versatility makes them a valuable addition to both personal and professional life. Explore the many options of Self Employed Tax Credit Irs Form 7202 today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printables for commercial uses?

- It depends on the specific usage guidelines. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using Self Employed Tax Credit Irs Form 7202?

- Some printables may contain restrictions regarding usage. Check the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home with a printer or visit a print shop in your area for superior prints.

-

What software must I use to open Self Employed Tax Credit Irs Form 7202?

- Most printables come in PDF format, which can be opened with free software such as Adobe Reader.

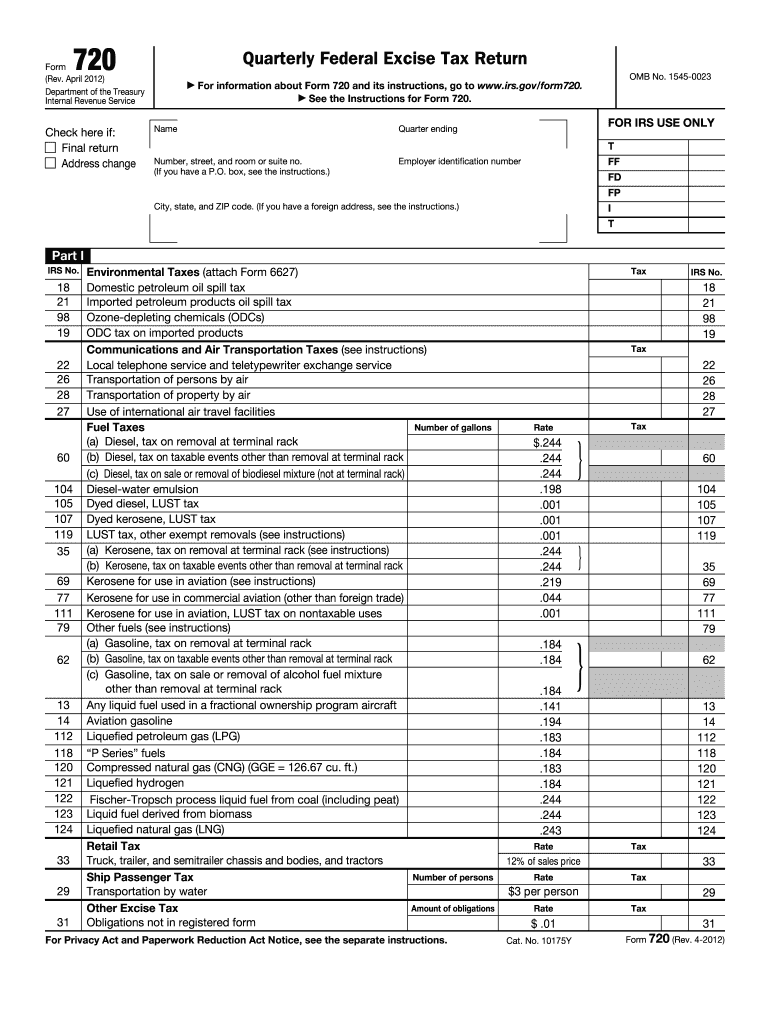

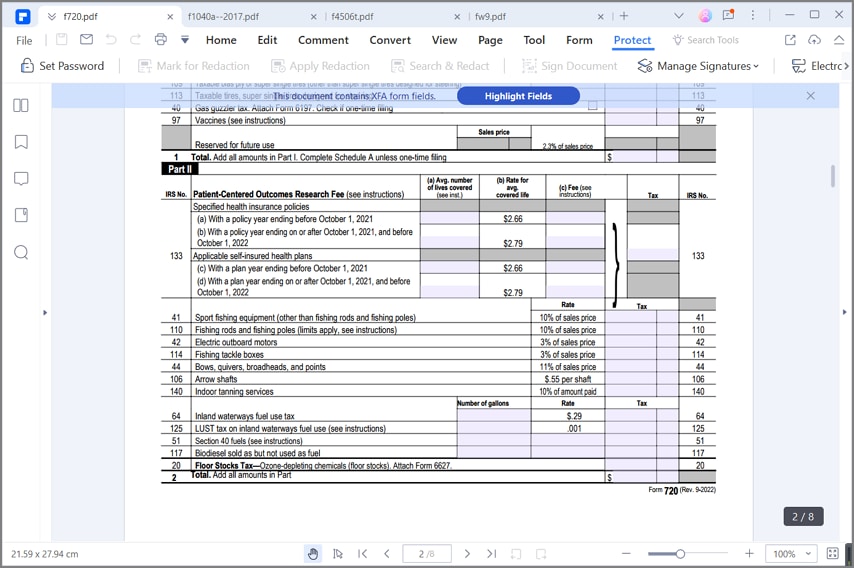

E file Form 7202 T Not Allowed Will It Be R IRS

Tax Update Usa Tax Forms Tax Independent Contractor

Check more sample of Self Employed Tax Credit Irs Form 7202 below

Form 7202 Instructions 2023 2024

Form 7202 Self Employed Audit Risk Form 7202 Tax Return Evidence The

Form 7202 Instructions Fill Online Printable Fillable Blank

Heated Up How To Claim The 300 Stove Tax Credit

IRS Form 7202 Examples

Form 7202 For 2023 Printable Forms Free Online

https://www.irs.gov/pub/irs-prior/i7202--2021.pdf

Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self employed individual due to certain COVID 19 related circumstances between January 1 2021 and September 30 2021 Each eligible self employed individual must file a separate Form 7202

https://www.thetaxadviser.com/issues/2023/dec/...

For sick and family leave that occurred between Jan 1 2021 and Sept 30 2021 an amendment to claim the credit is eligible to be filed up to April 18 2025 Example scenarios Form 7202 Sample Forms 7202 provide examples of the credit with self employment earnings of 25 000 and 200 000 in 2020 Editor Notes

Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self employed individual due to certain COVID 19 related circumstances between January 1 2021 and September 30 2021 Each eligible self employed individual must file a separate Form 7202

For sick and family leave that occurred between Jan 1 2021 and Sept 30 2021 an amendment to claim the credit is eligible to be filed up to April 18 2025 Example scenarios Form 7202 Sample Forms 7202 provide examples of the credit with self employment earnings of 25 000 and 200 000 in 2020 Editor Notes

Heated Up How To Claim The 300 Stove Tax Credit

Form 7202 Self Employed Audit Risk Form 7202 Tax Return Evidence The

IRS Form 7202 Examples

Form 7202 For 2023 Printable Forms Free Online

Form 7202 For 2023 Printable Forms Free Online

Best Tax Software For The Self Employed Of October 2022 2022

Best Tax Software For The Self Employed Of October 2022 2022

Form 7202 Sick And Family Leave Tax Credit Self Employed YouTube