In this age of electronic devices, with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. For educational purposes such as creative projects or simply adding an extra personal touch to your home, printables for free are now a useful resource. This article will take a dive into the sphere of "Self Employment Tax Deduction Form 1040," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Self Employment Tax Deduction Form 1040 Below

Self Employment Tax Deduction Form 1040

Self Employment Tax Deduction Form 1040 -

Self employment income and taxes are reported annually on IRS Form 1040 Self employed workers not using tax software typically must also fill out the following schedules and include them

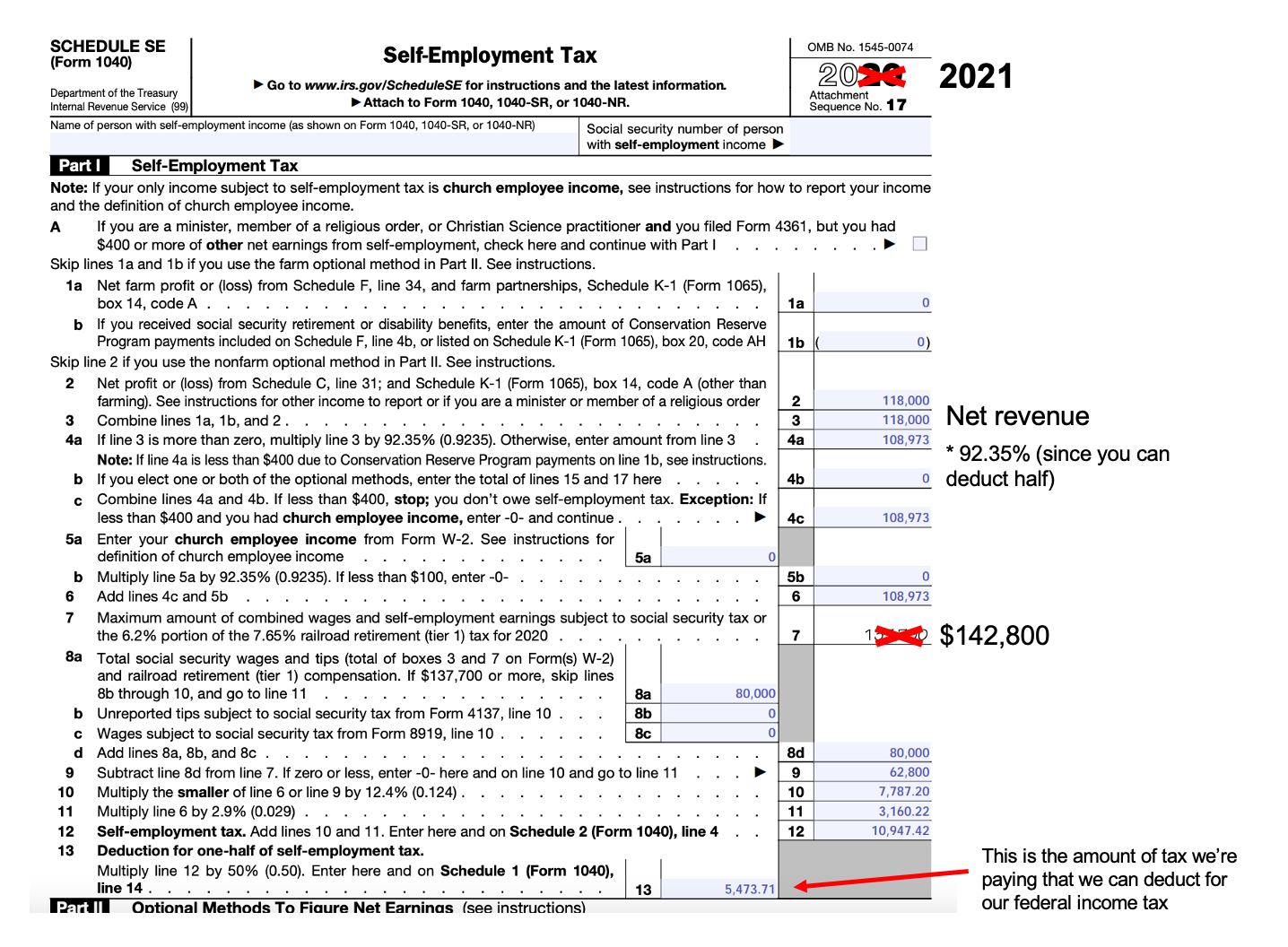

When figuring your adjusted gross income on Form 1040 Form 1040 SR or Form 1040 NR you can deduct one half of the self employment tax You calculate this deduction on Schedule SE attach Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF

Self Employment Tax Deduction Form 1040 provide a diverse range of downloadable, printable materials online, at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages and much more. The value of Self Employment Tax Deduction Form 1040 is in their variety and accessibility.

More of Self Employment Tax Deduction Form 1040

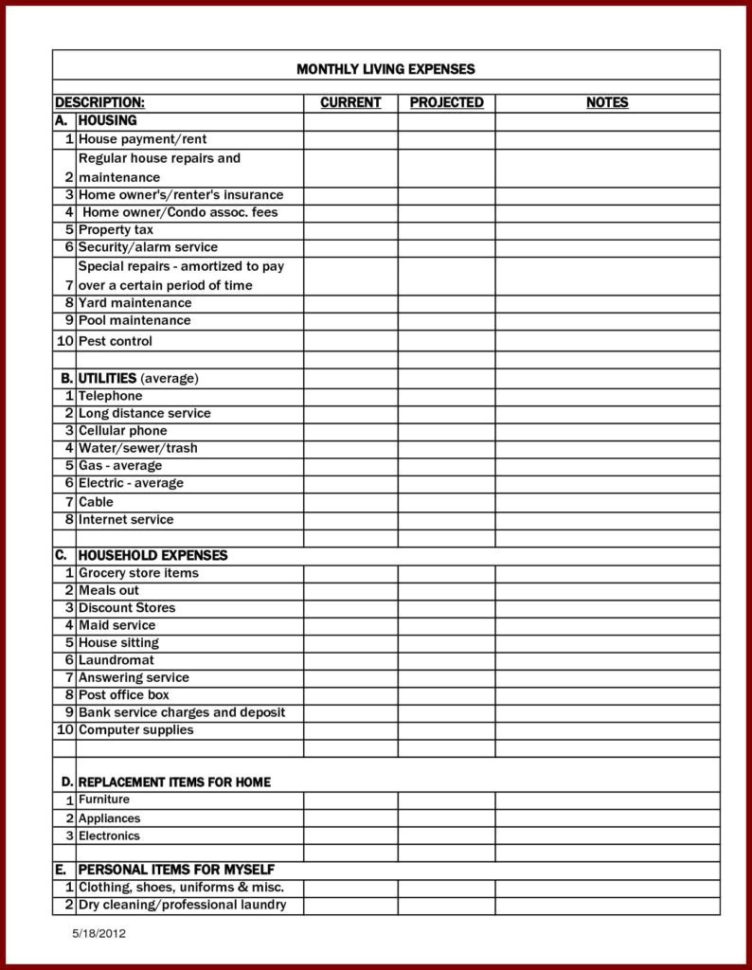

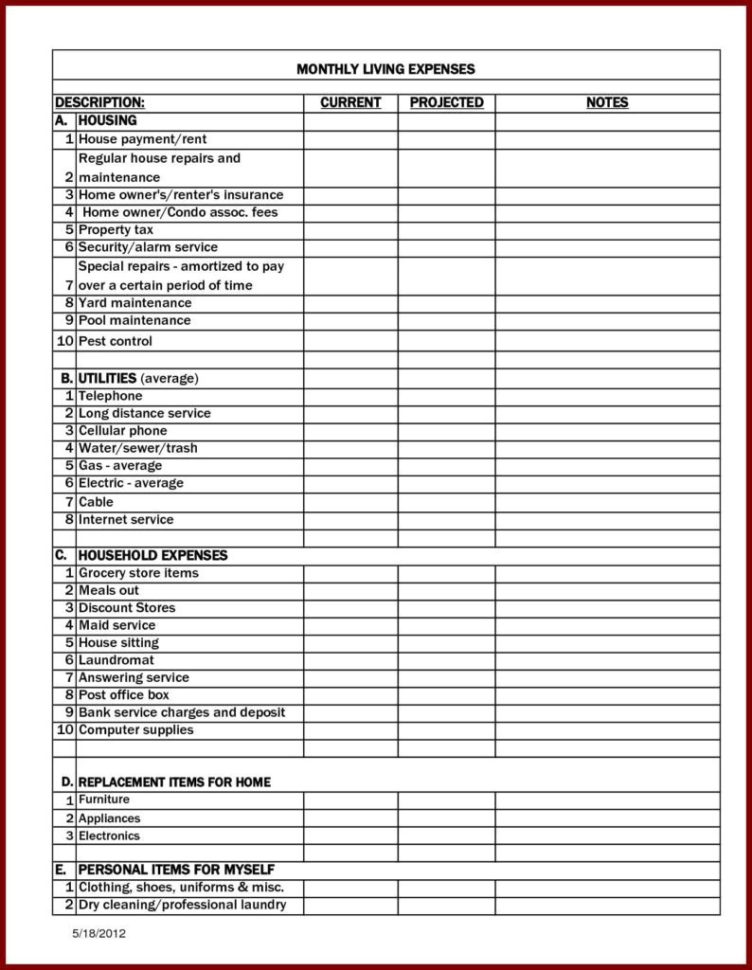

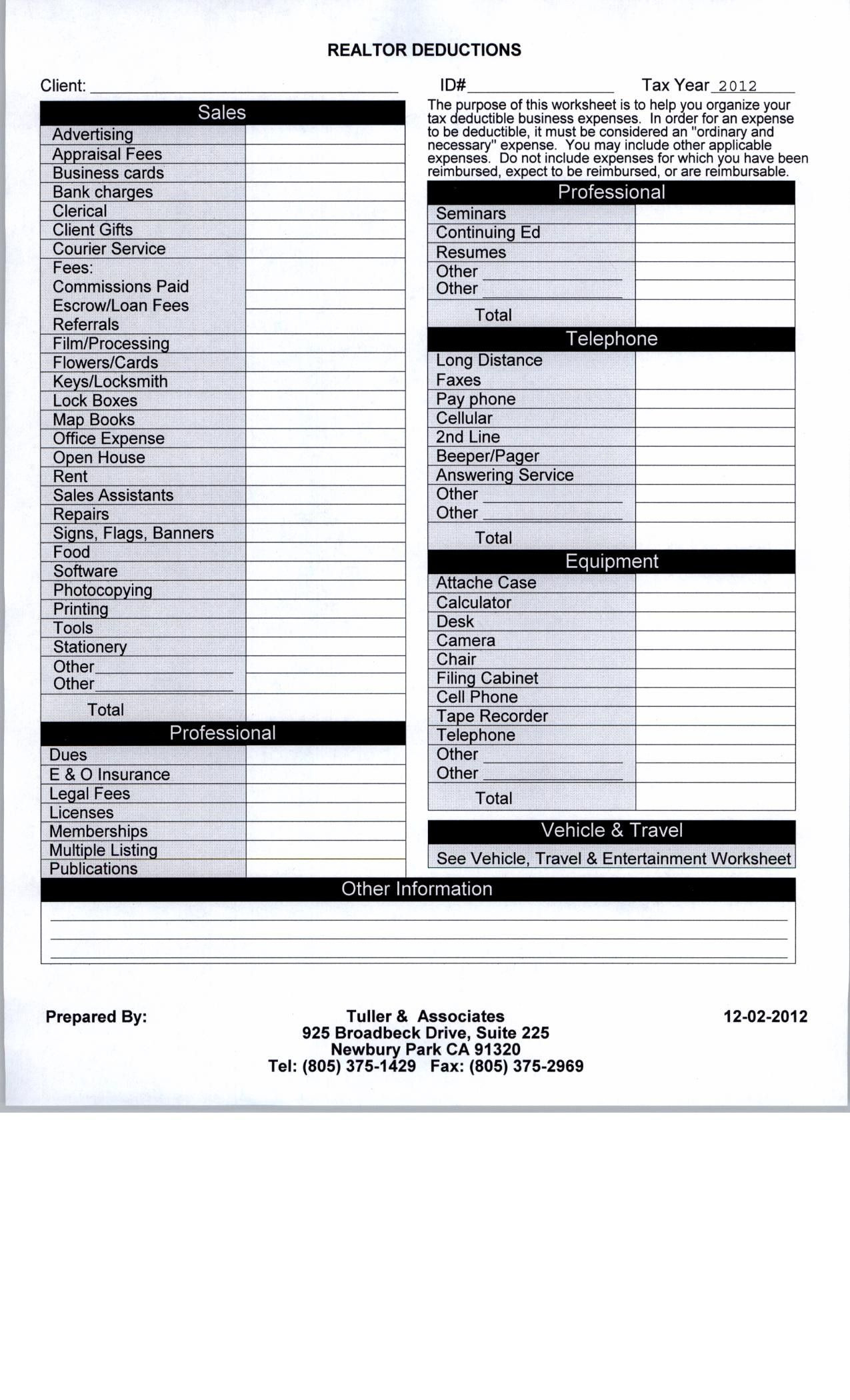

Self Employed Tax Deductions Worksheet Db excel

Self Employed Tax Deductions Worksheet Db excel

What is Schedule SE Individuals use IRS Schedule SE to figure out how much self employment tax they owe Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return

You re allowed to deduct 50 of what you pay in self employment tax as an income tax deduction on Form 1040 This deduction is available whether or not you itemize deductions

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization The Customization feature lets you tailor designs to suit your personal needs in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Education-related printables at no charge cater to learners of all ages. This makes them a valuable source for educators and parents.

-

Affordability: The instant accessibility to various designs and templates will save you time and effort.

Where to Find more Self Employment Tax Deduction Form 1040

Worksheet For Tax Deductions

Worksheet For Tax Deductions

If you made more than 400 through self employment in the current tax year you ll need to file schedule SE Learn how to complete Schedule SE on your tax returns

So if your self employment tax amounts to 3 500 for the year for instance at tax time 1 750 would be deductible on your Form 1040

Now that we've ignited your interest in Self Employment Tax Deduction Form 1040 We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of objectives.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad variety of topics, from DIY projects to party planning.

Maximizing Self Employment Tax Deduction Form 1040

Here are some new ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Self Employment Tax Deduction Form 1040 are an abundance filled with creative and practical information that can meet the needs of a variety of people and interests. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the endless world of Self Employment Tax Deduction Form 1040 to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these resources at no cost.

-

Are there any free templates for commercial use?

- It's based on specific rules of usage. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations in use. Be sure to check the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with your printer or visit an area print shop for top quality prints.

-

What software will I need to access printables at no cost?

- Most printables come in the format PDF. This is open with no cost software, such as Adobe Reader.

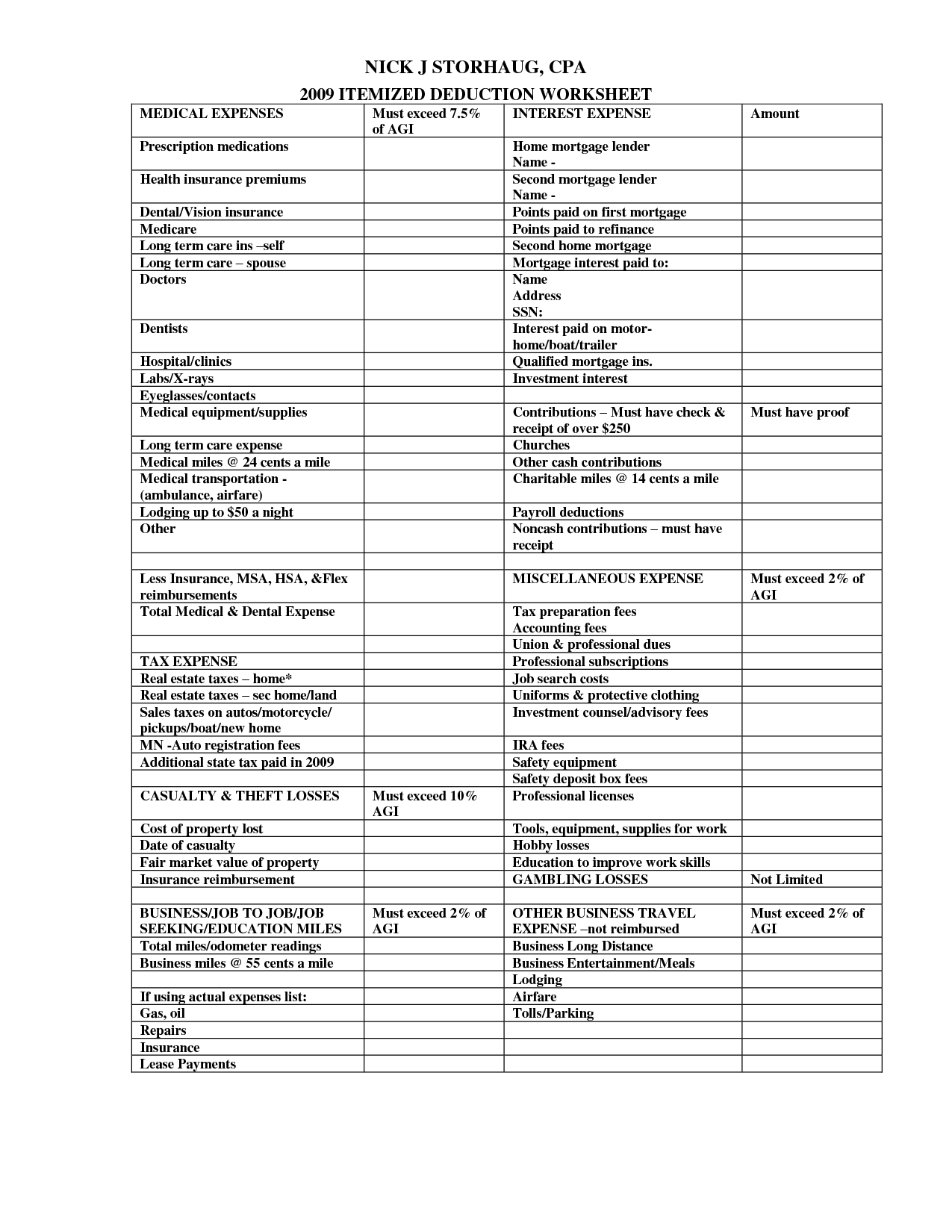

5 Itemized Tax Deduction Worksheet Worksheeto

The 2017 Small Business Tax Changes Guide

Check more sample of Self Employment Tax Deduction Form 1040 below

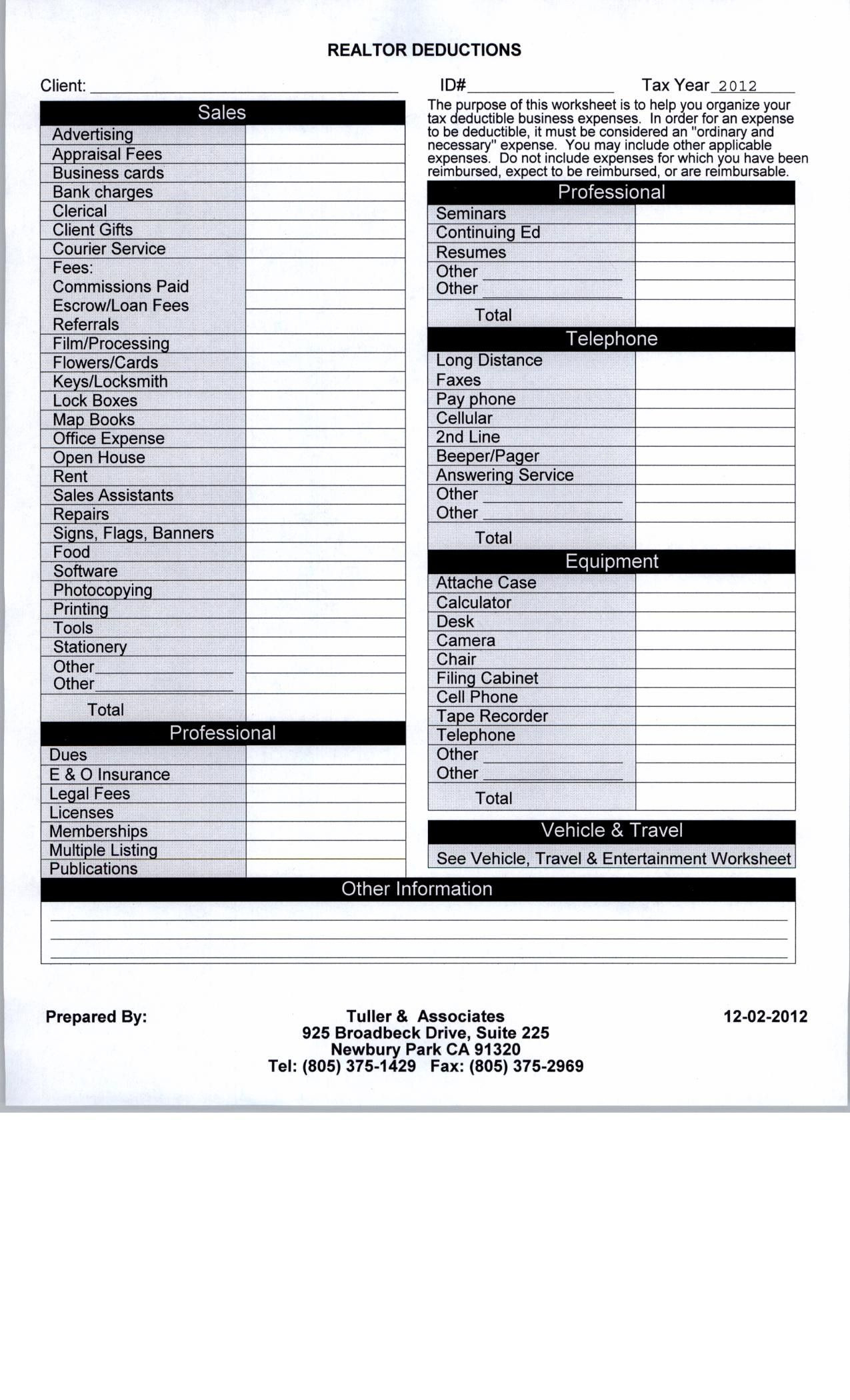

12 Self Employed Tax Worksheet Worksheeto

Self Employment Tax Deduction Form 1040 CROHFY

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Free Business Expense Spreadsheet And Self Employed Business Tax

Maximize Your Self Employment Tax Deductions With This Worksheet

2016 Self Employment Tax And Deduction Worksheet Db excel

https://www.irs.gov/taxtopics/tc554

When figuring your adjusted gross income on Form 1040 Form 1040 SR or Form 1040 NR you can deduct one half of the self employment tax You calculate this deduction on Schedule SE attach Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF

https://www.irs.gov/instructions/i1040sse

Use Schedule SE Form 1040 to figure the tax due on net earnings from self employment The Social Security Administration SSA uses the information from Schedule SE to figure your benefits under the social security program

When figuring your adjusted gross income on Form 1040 Form 1040 SR or Form 1040 NR you can deduct one half of the self employment tax You calculate this deduction on Schedule SE attach Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF

Use Schedule SE Form 1040 to figure the tax due on net earnings from self employment The Social Security Administration SSA uses the information from Schedule SE to figure your benefits under the social security program

Free Business Expense Spreadsheet And Self Employed Business Tax

Self Employment Tax Deduction Form 1040 CROHFY

Maximize Your Self Employment Tax Deductions With This Worksheet

2016 Self Employment Tax And Deduction Worksheet Db excel

Tax Deduction Template

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

9 Self Employment Tax Deductions To Optimize Your Tax Return Tax