Today, where screens dominate our lives yet the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses project ideas, artistic or just adding an element of personalization to your home, printables for free have become a valuable source. With this guide, you'll dive through the vast world of "Short Term Capital Gain Tax Deduction," exploring what they are, where to find them and how they can be used to enhance different aspects of your daily life.

Get Latest Short Term Capital Gain Tax Deduction Below

Short Term Capital Gain Tax Deduction

Short Term Capital Gain Tax Deduction -

Verkko 30 syysk 2023 nbsp 0183 32 Short term capital gains are the profits you make from selling an asset you ve held for one year or less The IRS treats short term capital gains like ordinary

Verkko 17 lokak 2023 nbsp 0183 32 Note Net short term capital gains are subject to taxation as ordinary income at graduated tax rates Limit on the Deduction and Carryover of Losses If

The Short Term Capital Gain Tax Deduction are a huge selection of printable and downloadable items that are available online at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and more. The appealingness of Short Term Capital Gain Tax Deduction is in their variety and accessibility.

More of Short Term Capital Gain Tax Deduction

Understanding Short Term Capital Gain Tax

Understanding Short Term Capital Gain Tax

Verkko 27 kes 228 k 2013 nbsp 0183 32 Updated February 24 2023 Reviewed by Lea D Uradu Fact checked by Suzanne Kvilhaug It s never fun to lose money on an investment but declaring a

Verkko 9 marrask 2023 nbsp 0183 32 Short term capital gains are taxed according to the relevant federal tax rate Long term capital gains are subject to 0 15 or 20 depending on your

Short Term Capital Gain Tax Deduction have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization: This allows you to modify printed materials to meet your requirements be it designing invitations planning your schedule or even decorating your home.

-

Education Value Downloads of educational content for free can be used by students of all ages. This makes them an essential source for educators and parents.

-

It's easy: Fast access many designs and templates saves time and effort.

Where to Find more Short Term Capital Gain Tax Deduction

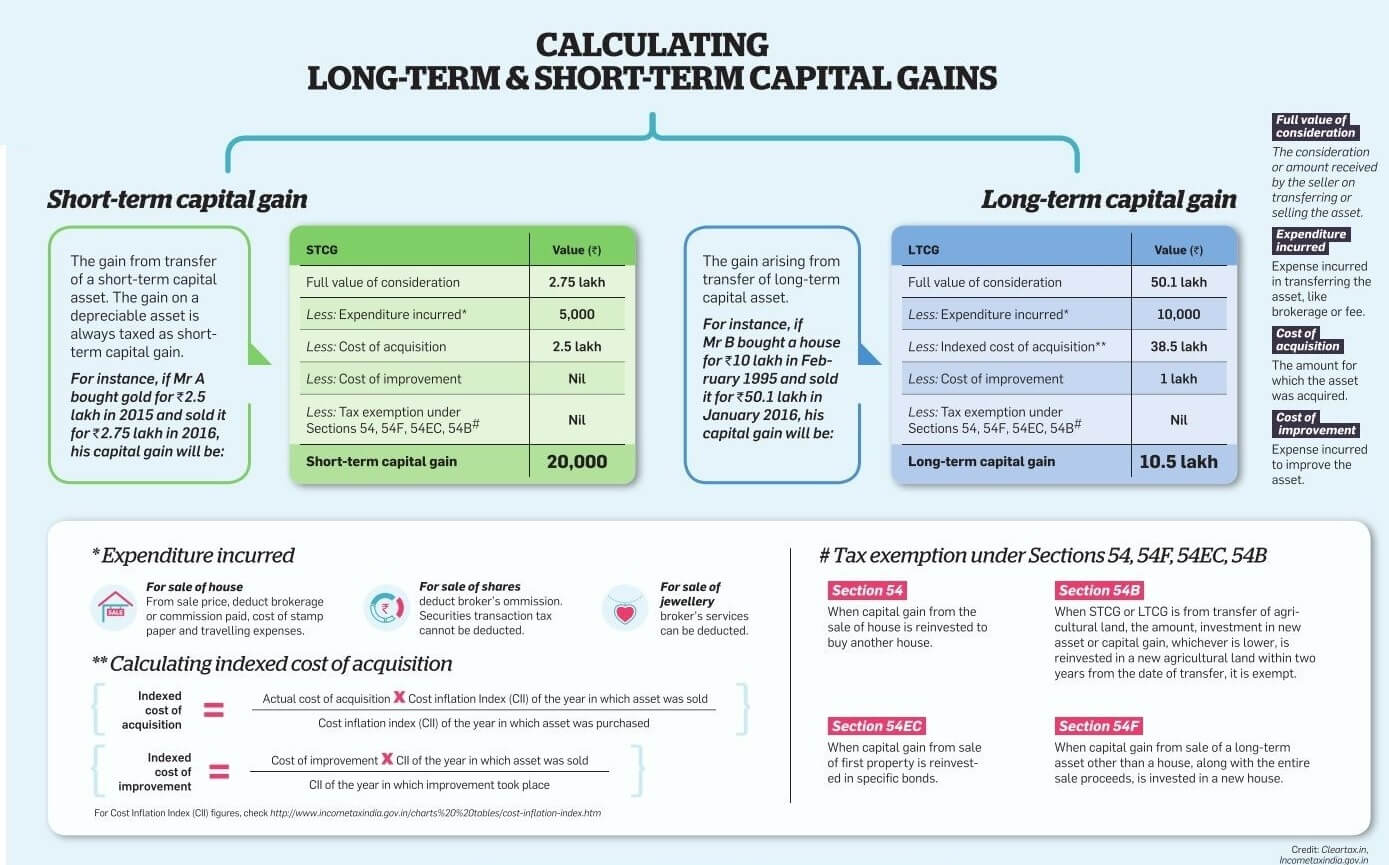

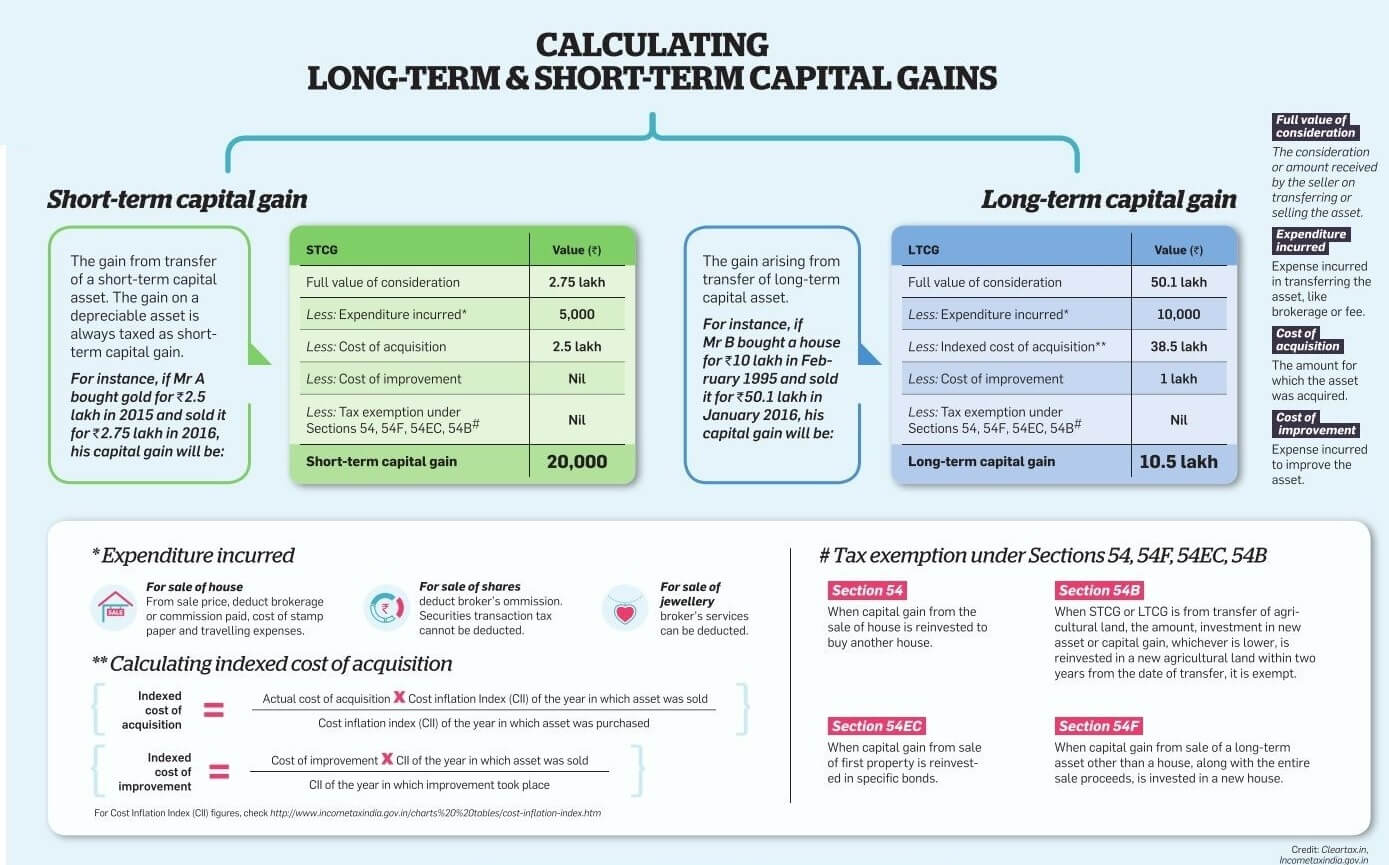

Comparing Long Term Vs Short Term Capital Gain Tax Rates Investopedia

Comparing Long Term Vs Short Term Capital Gain Tax Rates Investopedia

Verkko 24 maalisk 2023 nbsp 0183 32 Short term capital gains tax is levied on assets held for a period of 12 months or less Whether a gain is made from day trading or a capital asset held

Verkko 19 lokak 2023 nbsp 0183 32 Gains from the sale of assets you ve held for longer than a year are known as long term capital gains and they are typically taxed at lower rates than

Now that we've ignited your interest in Short Term Capital Gain Tax Deduction Let's take a look at where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Short Term Capital Gain Tax Deduction for a variety reasons.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free with flashcards and other teaching tools.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad selection of subjects, ranging from DIY projects to planning a party.

Maximizing Short Term Capital Gain Tax Deduction

Here are some fresh ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Short Term Capital Gain Tax Deduction are a treasure trove of fun and practical tools for a variety of needs and hobbies. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the world that is Short Term Capital Gain Tax Deduction today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use the free printables to make commercial products?

- It's based on the terms of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with Short Term Capital Gain Tax Deduction?

- Some printables may come with restrictions on their use. Make sure you read the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home using printing equipment or visit an area print shop for superior prints.

-

What program do I require to view printables free of charge?

- Most printables come as PDF files, which can be opened with free software such as Adobe Reader.

Know Everything About Short Term Capital Gain Tax MoneyInsight

Long Term Capital Gains Tax In Mutual Funds

Check more sample of Short Term Capital Gain Tax Deduction below

Section 111A ITR 2 Capital Gains Short Term Capital Gain Tax On

LONG TERM CAPITAL GAIN TAX

Long Term Capital Gain LTCG Tax On Stocks And Mutual Funds Budget

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks

Can Tax On Short Term Capital Gain Taxable U s 111A Be Saved On

Short Term Vs Long Term Capital Gains Below Infographics Details The

https://www.irs.gov/taxtopics/tc409

Verkko 17 lokak 2023 nbsp 0183 32 Note Net short term capital gains are subject to taxation as ordinary income at graduated tax rates Limit on the Deduction and Carryover of Losses If

https://www.investopedia.com/terms/s/short-term-gain.asp

Verkko 25 hein 228 k 2023 nbsp 0183 32 Short term gains are taxed at the taxpayer s top marginal tax rate or regular income tax bracket which can range from 10 to 37 Short term capital

Verkko 17 lokak 2023 nbsp 0183 32 Note Net short term capital gains are subject to taxation as ordinary income at graduated tax rates Limit on the Deduction and Carryover of Losses If

Verkko 25 hein 228 k 2023 nbsp 0183 32 Short term gains are taxed at the taxpayer s top marginal tax rate or regular income tax bracket which can range from 10 to 37 Short term capital

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks

LONG TERM CAPITAL GAIN TAX

Can Tax On Short Term Capital Gain Taxable U s 111A Be Saved On

Short Term Vs Long Term Capital Gains Below Infographics Details The

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras

Savant Mareste Distrage Capital Gains Calculator De Acord Cu Tip Sever

Savant Mareste Distrage Capital Gains Calculator De Acord Cu Tip Sever

Short Term Capital Gain Tax On Mutual Funds