In this digital age, where screens dominate our lives but the value of tangible, printed materials hasn't diminished. Be it for educational use in creative or artistic projects, or simply to add an individual touch to the area, Solar Energy Tax Credit Extension have proven to be a valuable source. For this piece, we'll dive to the depths of "Solar Energy Tax Credit Extension," exploring the different types of printables, where to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Solar Energy Tax Credit Extension Below

Solar Energy Tax Credit Extension

Solar Energy Tax Credit Extension -

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming

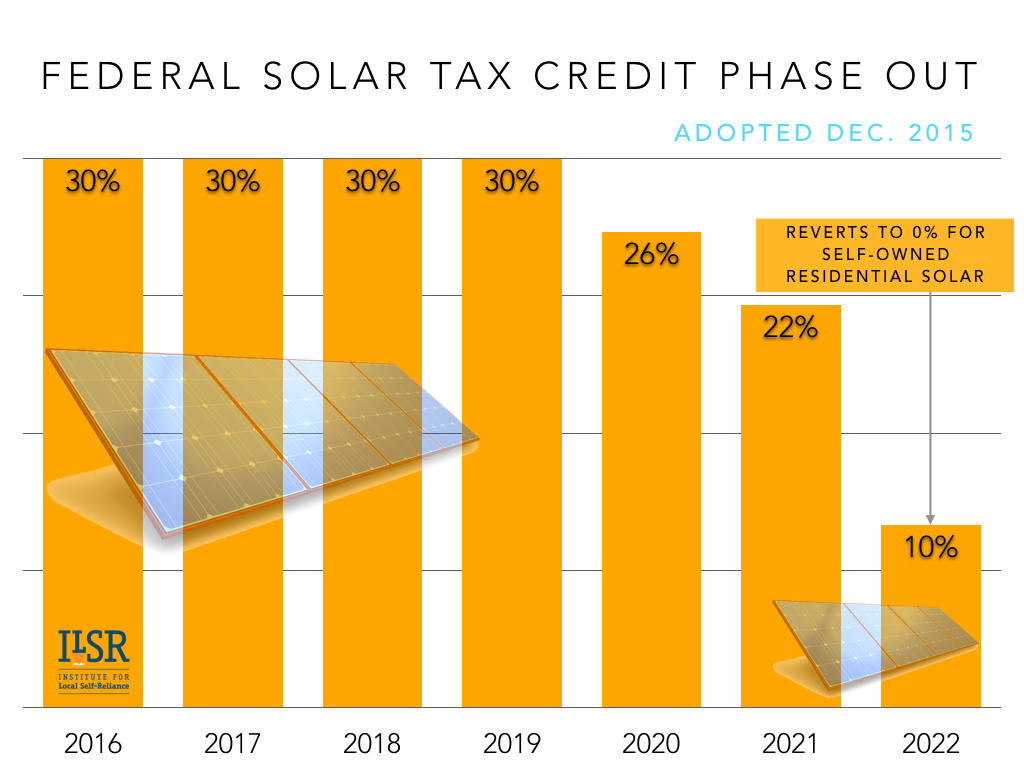

The bill calls for a 10 year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034 The tax credit applies to individuals

Solar Energy Tax Credit Extension cover a large variety of printable, downloadable documents that can be downloaded online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and many more. The benefit of Solar Energy Tax Credit Extension lies in their versatility as well as accessibility.

More of Solar Energy Tax Credit Extension

Solar Tax Credit Extension

Solar Tax Credit Extension

Extends the Residential Clean Energy Credit ensuring that households will be able to continue receiving a tax credit to cover up to 30 percent of the costs of installing

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery

The Solar Energy Tax Credit Extension have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Personalization The Customization feature lets you tailor the design to meet your needs in designing invitations making your schedule, or even decorating your house.

-

Education Value Printables for education that are free offer a wide range of educational content for learners from all ages, making them an invaluable tool for parents and teachers.

-

It's easy: Fast access the vast array of design and templates reduces time and effort.

Where to Find more Solar Energy Tax Credit Extension

Solar Energy Tax Credit Andrews Tax Accounting

Solar Energy Tax Credit Andrews Tax Accounting

The U S Congress is close to enacting legislation that will provide a two year extension of the solar Investment Tax Credit ITC and additional funding for research and development

The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting Americans from

We hope we've stimulated your interest in Solar Energy Tax Credit Extension Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Solar Energy Tax Credit Extension to suit a variety of applications.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Solar Energy Tax Credit Extension

Here are some ideas create the maximum value of Solar Energy Tax Credit Extension:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets for teaching at-home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Solar Energy Tax Credit Extension are an abundance of practical and innovative resources that can meet the needs of a variety of people and hobbies. Their access and versatility makes them a valuable addition to each day life. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright rights issues with Solar Energy Tax Credit Extension?

- Some printables may have restrictions regarding usage. Be sure to read the conditions and terms of use provided by the creator.

-

How do I print Solar Energy Tax Credit Extension?

- Print them at home using an printer, or go to any local print store for the highest quality prints.

-

What program will I need to access printables free of charge?

- The majority are printed in PDF format. They can be opened with free software, such as Adobe Reader.

Congress Gets Renewable Tax Credit Extension Right Institute For

The Federal Solar Tax Credit Extension Can We Win If We Lose

Check more sample of Solar Energy Tax Credit Extension below

Federal Solar Energy Tax Credit Sapling

Solar Investment Tax Credit Extended At 26 For Two Additional Years

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Federal Solar Tax Credit Guide For 2023 Forbes Home

30 Solar Energy Tax Credit Ask A CPA YouTube

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.pv-magazine.com › us-to...

The bill calls for a 10 year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034 The tax credit applies to individuals

https://www.energy.gov › eere › solar › …

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

The bill calls for a 10 year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034 The tax credit applies to individuals

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

Federal Solar Tax Credit Guide For 2023 Forbes Home

Solar Investment Tax Credit Extended At 26 For Two Additional Years

30 Solar Energy Tax Credit Ask A CPA YouTube

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar Tax Credits Solar Tribune

How Does The Solar Tax Credit Work SolarPower Guide Article

How Does The Solar Tax Credit Work SolarPower Guide Article

New Mexico s Solar Energy Tax Credit Passes Legislature