Today, where screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Be it for educational use project ideas, artistic or simply to add an individual touch to the space, Solar Power Tax Credit Inflation Reduction Act have become an invaluable source. In this article, we'll dive deeper into "Solar Power Tax Credit Inflation Reduction Act," exploring their purpose, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Solar Power Tax Credit Inflation Reduction Act Below

Solar Power Tax Credit Inflation Reduction Act

Solar Power Tax Credit Inflation Reduction Act -

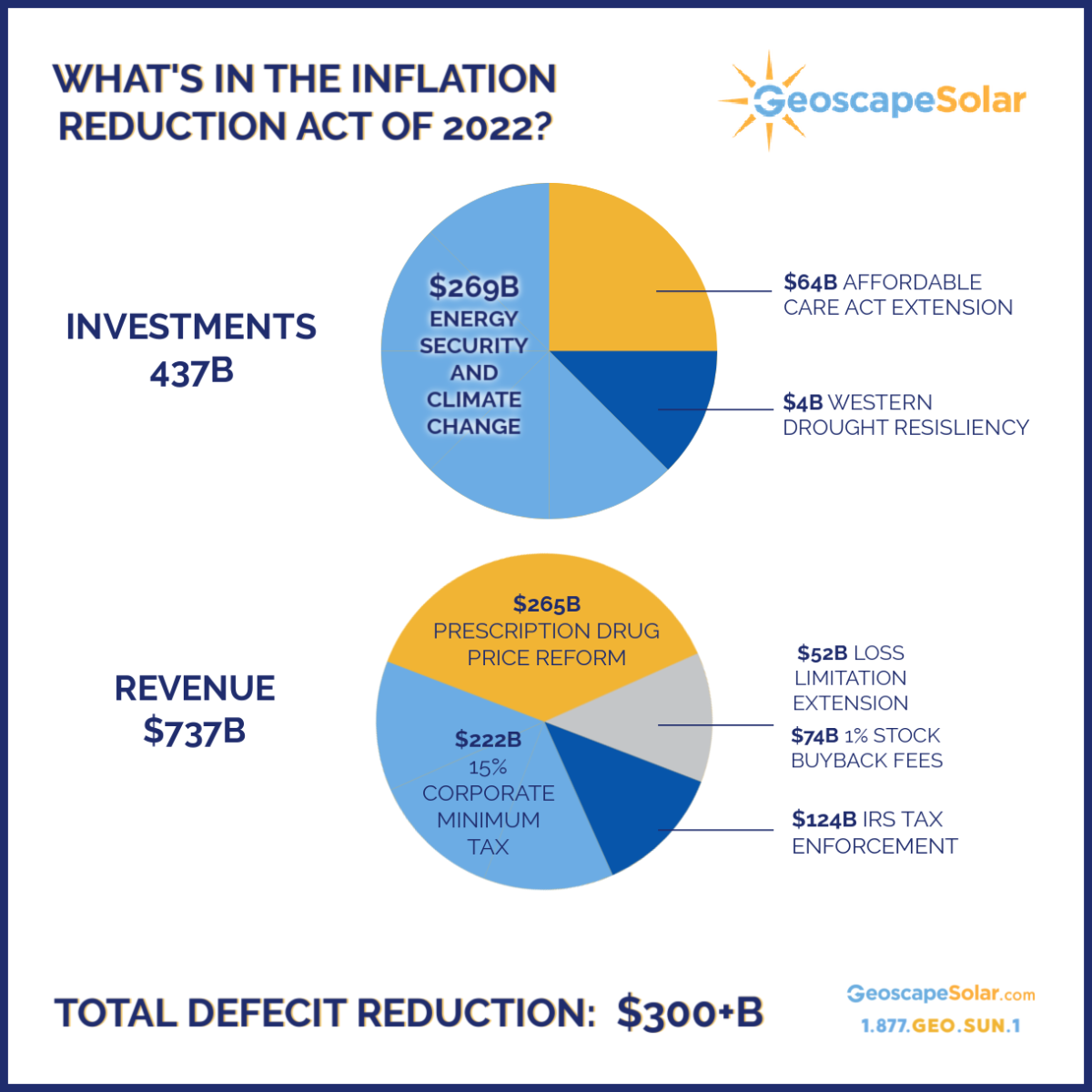

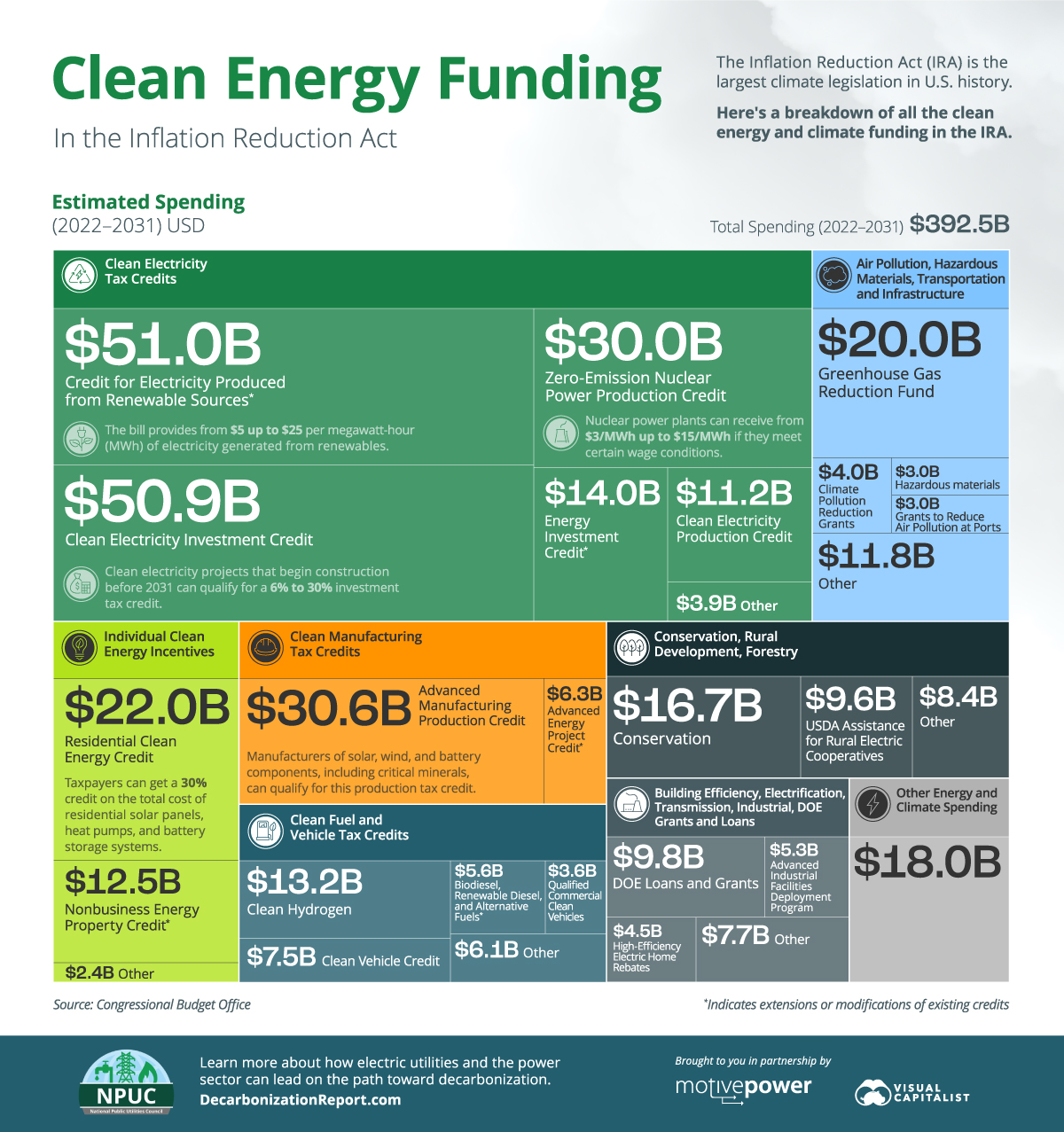

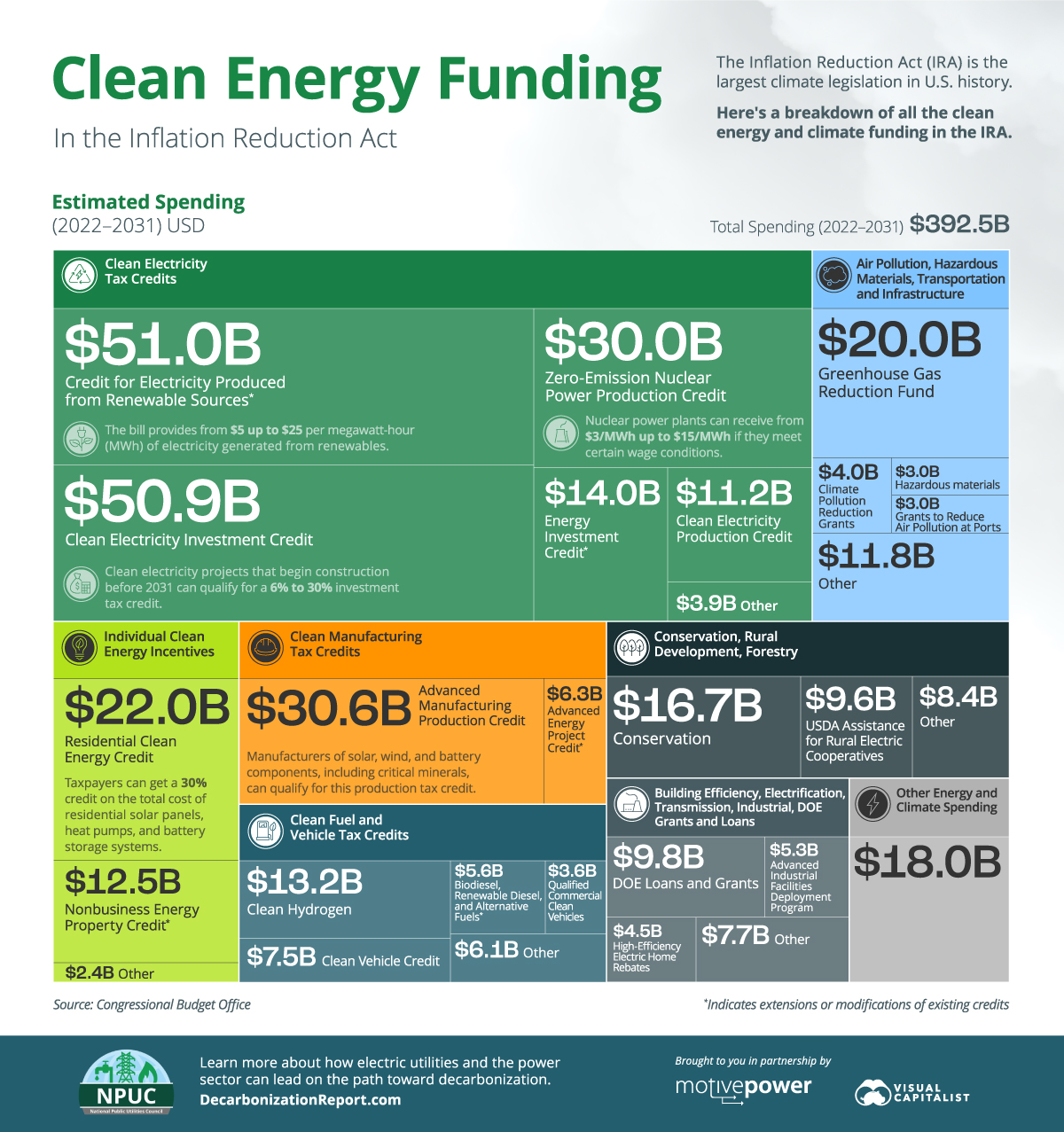

One of the most valuable incentives in the Inflation Reduction Act is the extension of the 30 Residential Clean Energy credit commonly known as the solar investment tax credit or ITC This incentive was scheduled to step down from 26 in 2022 to 22 in 2023 before going away entirely for consumers in 2024

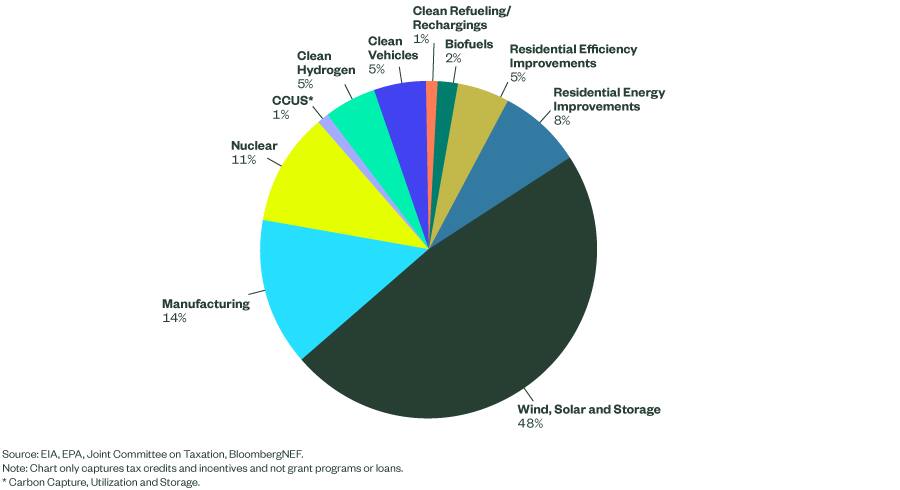

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

Solar Power Tax Credit Inflation Reduction Act encompass a wide collection of printable materials online, at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages and much more. The appeal of printables for free is in their variety and accessibility.

More of Solar Power Tax Credit Inflation Reduction Act

The Inflation Reduction Act And Residential Energy Certasun

The Inflation Reduction Act And Residential Energy Certasun

Solar power projects eligible for the full 30 tax credit can increase their tax credit by an additional 10 to 40 in total by purchasing domestically produced hardware

Applicable entities can use direct pay for 12 of the Inflation Reduction Act s tax credits including for generating clean electricity through solar wind and battery storage projects

Solar Power Tax Credit Inflation Reduction Act have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Individualization You can tailor print-ready templates to your specific requirements when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Education Value The free educational worksheets are designed to appeal to students of all ages, which makes them a valuable tool for parents and teachers.

-

Easy to use: immediate access many designs and templates is time-saving and saves effort.

Where to Find more Solar Power Tax Credit Inflation Reduction Act

IRS Tax Credit For Year 2022 And 2023 DIY Solar Power Forum

IRS Tax Credit For Year 2022 And 2023 DIY Solar Power Forum

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient

We hope we've stimulated your interest in printables for free Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Solar Power Tax Credit Inflation Reduction Act designed for a variety needs.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free or flashcards as well as learning materials.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a broad array of topics, ranging that includes DIY projects to party planning.

Maximizing Solar Power Tax Credit Inflation Reduction Act

Here are some inventive ways in order to maximize the use of Solar Power Tax Credit Inflation Reduction Act:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Solar Power Tax Credit Inflation Reduction Act are a treasure trove of practical and innovative resources which cater to a wide range of needs and needs and. Their accessibility and flexibility make them an essential part of any professional or personal life. Explore the vast array of Solar Power Tax Credit Inflation Reduction Act and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes you can! You can download and print these tools for free.

-

Are there any free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables might have limitations on use. Be sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with a printer or visit a local print shop for superior prints.

-

What software do I require to view Solar Power Tax Credit Inflation Reduction Act?

- Most printables come in PDF format. They is open with no cost software, such as Adobe Reader.

The Inflation Reduction Act What It Means For Business Owners And The

Inflation Reduction Act Of 2022 The Hollander Group

Check more sample of Solar Power Tax Credit Inflation Reduction Act below

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Inflation Reduction Act Business Tax Incentives Virginia CPA

How The 179D Deduction Will Change Under The Inflation Reduction Act

Breaking Down Clean Energy Funding In The Inflation Reduction Act

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://home.treasury.gov › news › press-releases

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

https://www.irs.gov

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered apprenticeship

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as

Breaking Down Clean Energy Funding In The Inflation Reduction Act

Inflation Reduction Act Business Tax Incentives Virginia CPA

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Credit Overview In Inflation Reduction Act

The Inflation Reduction Act Is A Victory For Working People AFL CIO

The Inflation Reduction Act Is A Victory For Working People AFL CIO

Inflation Reduction Act Impact On Energy Transition