In the digital age, with screens dominating our lives, the charm of tangible printed products hasn't decreased. If it's to aid in education in creative or artistic projects, or simply adding an element of personalization to your space, Solar Tax Credit 2023 Irs are now a useful resource. For this piece, we'll dive deeper into "Solar Tax Credit 2023 Irs," exploring the different types of printables, where they can be found, and how they can enrich various aspects of your daily life.

Get Latest Solar Tax Credit 2023 Irs Below

Solar Tax Credit 2023 Irs

Solar Tax Credit 2023 Irs -

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to jump ahead Federal solar tax

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Solar Tax Credit 2023 Irs provide a diverse selection of printable and downloadable material that is available online at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and many more. The appeal of printables for free is their flexibility and accessibility.

More of Solar Tax Credit 2023 Irs

Residential Solar Tax Credit For Solar Gate Operators Nice HySecurity

Residential Solar Tax Credit For Solar Gate Operators Nice HySecurity

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

59 State Filing Fee 59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 42 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website

Solar Tax Credit 2023 Irs have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements when it comes to designing invitations and schedules, or even decorating your house.

-

Education Value These Solar Tax Credit 2023 Irs provide for students of all ages, which makes these printables a powerful tool for parents and teachers.

-

An easy way to access HTML0: Fast access numerous designs and templates reduces time and effort.

Where to Find more Solar Tax Credit 2023 Irs

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

If you buy and install a solar energy system at your home by the end of 2032 you are eligible for a federal tax credit for 30 percent of the cost including the panels related equipment

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

In the event that we've stirred your interest in Solar Tax Credit 2023 Irs Let's find out where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Solar Tax Credit 2023 Irs for all purposes.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free or flashcards as well as learning materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Solar Tax Credit 2023 Irs

Here are some innovative ways in order to maximize the use of Solar Tax Credit 2023 Irs:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Solar Tax Credit 2023 Irs are an abundance of fun and practical tools that cater to various needs and interests. Their availability and versatility make they a beneficial addition to each day life. Explore the vast array of Solar Tax Credit 2023 Irs today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes they are! You can print and download these items for free.

-

Can I use free printing templates for commercial purposes?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with Solar Tax Credit 2023 Irs?

- Certain printables might have limitations on use. Make sure to read the terms and conditions set forth by the designer.

-

How can I print Solar Tax Credit 2023 Irs?

- Print them at home using the printer, or go to an area print shop for better quality prints.

-

What program do I require to open Solar Tax Credit 2023 Irs?

- Most PDF-based printables are available as PDF files, which can be opened with free software such as Adobe Reader.

IRS Releases Guidance On Low income Solar Tax Credit Booster Pv

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Check more sample of Solar Tax Credit 2023 Irs below

Irs Solar Tax Credit 2022 Form

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

How To Claim The Solar Tax Credit IRS Form 5695

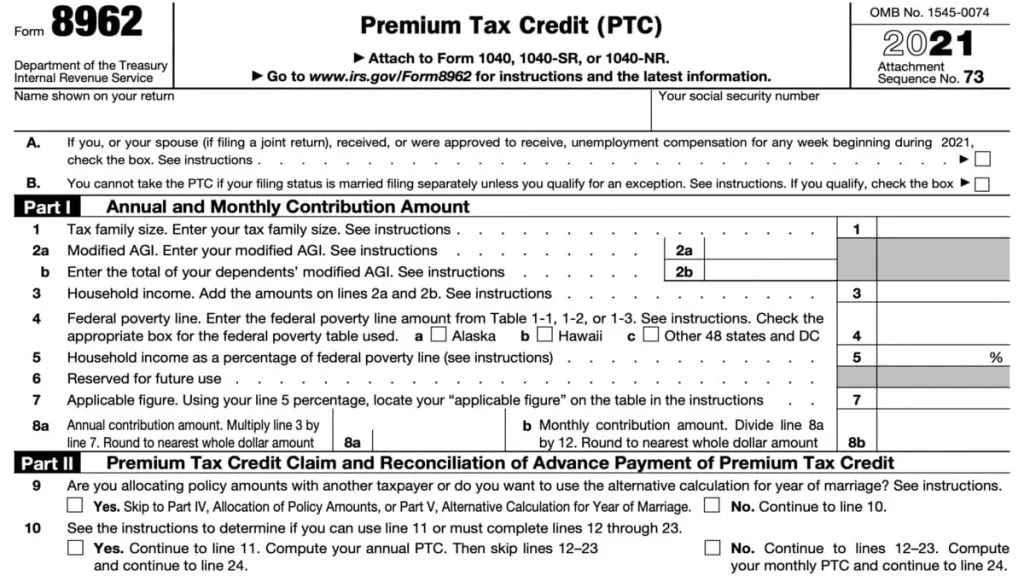

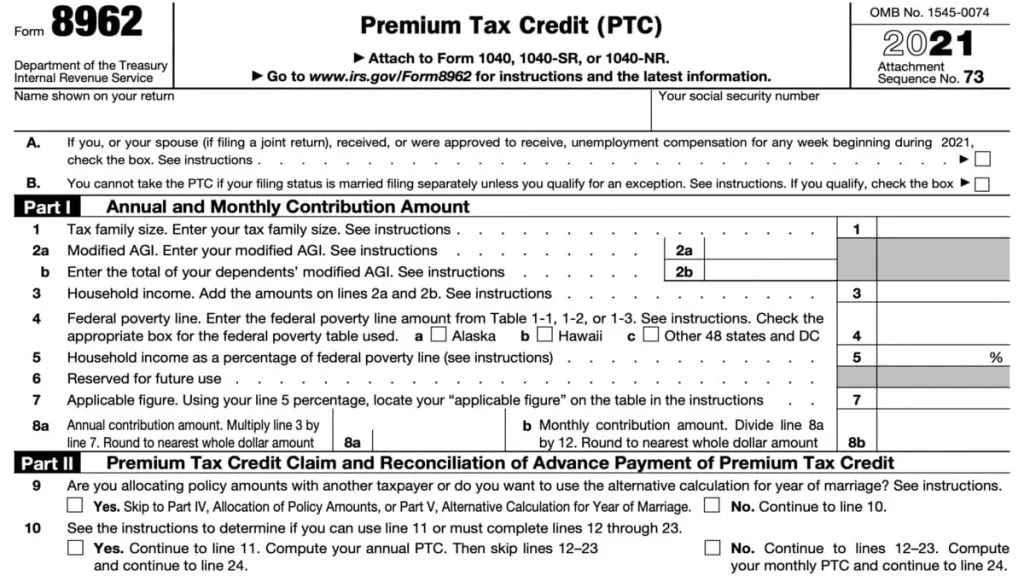

8962 Form 2023 2024 Premium Tax Credit IRS Forms TaxUni

LA Solar Group

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

www.irs.gov/credits-deductions/residential...

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

www.irs.gov/instructions/i5695

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

8962 Form 2023 2024 Premium Tax Credit IRS Forms TaxUni

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

LA Solar Group

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

How To Claim The Solar Tax Credit IRS Form 5695

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

2023 Residential Clean Energy Credit Guide ReVision Energy