Today, where screens dominate our lives but the value of tangible printed items hasn't gone away. In the case of educational materials as well as creative projects or simply to add an element of personalization to your area, Solar Tax Credit Form Irs have become an invaluable resource. In this article, we'll take a dive through the vast world of "Solar Tax Credit Form Irs," exploring their purpose, where they are, and how they can add value to various aspects of your life.

Get Latest Solar Tax Credit Form Irs Below

Solar Tax Credit Form Irs

Solar Tax Credit Form Irs -

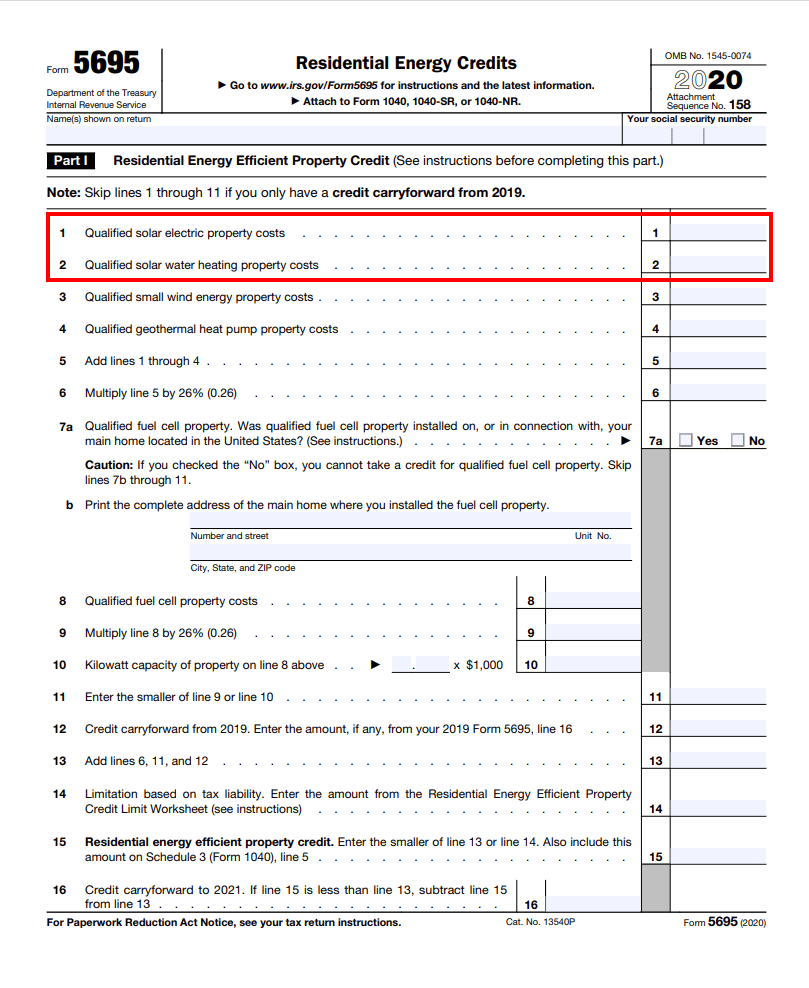

To claim the solar tax credit you ll have to fill out IRS Form 5695 You can claim the tax credit if you receive other clean energy incentives for the same project although this might

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Printables for free cover a broad variety of printable, downloadable items that are available online at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and more. The great thing about Solar Tax Credit Form Irs lies in their versatility as well as accessibility.

More of Solar Tax Credit Form Irs

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes You can download a copy of Form 5695 PDF on the IRS website The form is updated every year so

Step by step instructions for using IRS Form 5695 to claim the 30 federal solar tax credit

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring print-ready templates to your specific requirements whether it's making invitations planning your schedule or even decorating your house.

-

Educational Use: Free educational printables cater to learners of all ages, which makes them a useful tool for teachers and parents.

-

Accessibility: Fast access a myriad of designs as well as templates will save you time and effort.

Where to Find more Solar Tax Credit Form Irs

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

To claim your tax credit for solar panels you must file Form 5695 Residential Energy Credits along with Form 1040 for the year the panels were installed You ll need the following

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar

We hope we've stimulated your curiosity about Solar Tax Credit Form Irs and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Solar Tax Credit Form Irs to suit a variety of needs.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Solar Tax Credit Form Irs

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Solar Tax Credit Form Irs are an abundance filled with creative and practical information which cater to a wide range of needs and desires. Their accessibility and flexibility make them a great addition to both professional and personal life. Explore the world of Solar Tax Credit Form Irs today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Solar Tax Credit Form Irs truly absolutely free?

- Yes, they are! You can print and download these documents for free.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions in their usage. You should read the terms and conditions provided by the author.

-

How do I print Solar Tax Credit Form Irs?

- You can print them at home using a printer or visit a local print shop to purchase better quality prints.

-

What program do I require to open printables that are free?

- The majority of printables are in PDF format. They can be opened with free software, such as Adobe Reader.

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Check more sample of Solar Tax Credit Form Irs below

Irs Solar Tax Credit 2022 Form

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Tax Credit ITC Sungenia Solar

How To File Solar Tax Credit IRS Form 5695 Green Ridge Solar

IRS Form 5695 Solar Electric Tax Credits For Solar Panel Systems

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

https://www.irs.gov/forms-pubs/about-form-5695

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

How To File Solar Tax Credit IRS Form 5695 Green Ridge Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

IRS Form 5695 Solar Electric Tax Credits For Solar Panel Systems

How To Claim The Federal Solar Tax Credit SAVKAT Inc

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Everything You Need To Know About The Federal Solar Tax Credit

Everything You Need To Know About The Federal Solar Tax Credit

Arizona Solar Tax Credit Form Donny Somers