In this day and age where screens rule our lives however, the attraction of tangible printed items hasn't gone away. For educational purposes such as creative projects or simply adding an individual touch to the home, printables for free have become an invaluable source. With this guide, you'll take a dive deep into the realm of "South Dakota Sales Tax Rate Changes," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your life.

Get Latest South Dakota Sales Tax Rate Changes Below

South Dakota Sales Tax Rate Changes

South Dakota Sales Tax Rate Changes -

After weeks of heavy critiques on legislation that would temporarily lower the overall sales tax rate for four years Gov Kristi Noem signaled her approval of HB 1137 by signing the bill

PIERRE S D On July 1 2023 South Dakota s tax rate will decrease from 4 5 percent to 4 2 percent Governor Kristi Noem and the Department of Revenue are working diligently to account for the three tenth percent sales tax decrease created by House Bill 1137

South Dakota Sales Tax Rate Changes provide a diverse array of printable documents that can be downloaded online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages and more. The appealingness of South Dakota Sales Tax Rate Changes lies in their versatility and accessibility.

More of South Dakota Sales Tax Rate Changes

South Dakota Sales Tax Rate To Drop Temporarily

South Dakota Sales Tax Rate To Drop Temporarily

This bill decreases the state sales and use tax rate from 4 5 to 4 2 effective July 1 2023 Additional rates affected by the change are the special jurisdiction tax excise tax on farm machinery and attachment units the amusement device tax and the motor vehicle gross receipts tax

A temporary sales tax cut enacted last year would be made permanent under a bill passed Friday by the South Dakota House of Representatives in line with a call by Gov Kristi Noem The Republican controlled House approved the bill brought by Republican state Rep Chris Karr in a 54 12 vote

South Dakota Sales Tax Rate Changes have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization We can customize printed materials to meet your requirements in designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Educational printables that can be downloaded for free can be used by students of all ages. This makes them a vital tool for parents and teachers.

-

The convenience of Access to a variety of designs and templates reduces time and effort.

Where to Find more South Dakota Sales Tax Rate Changes

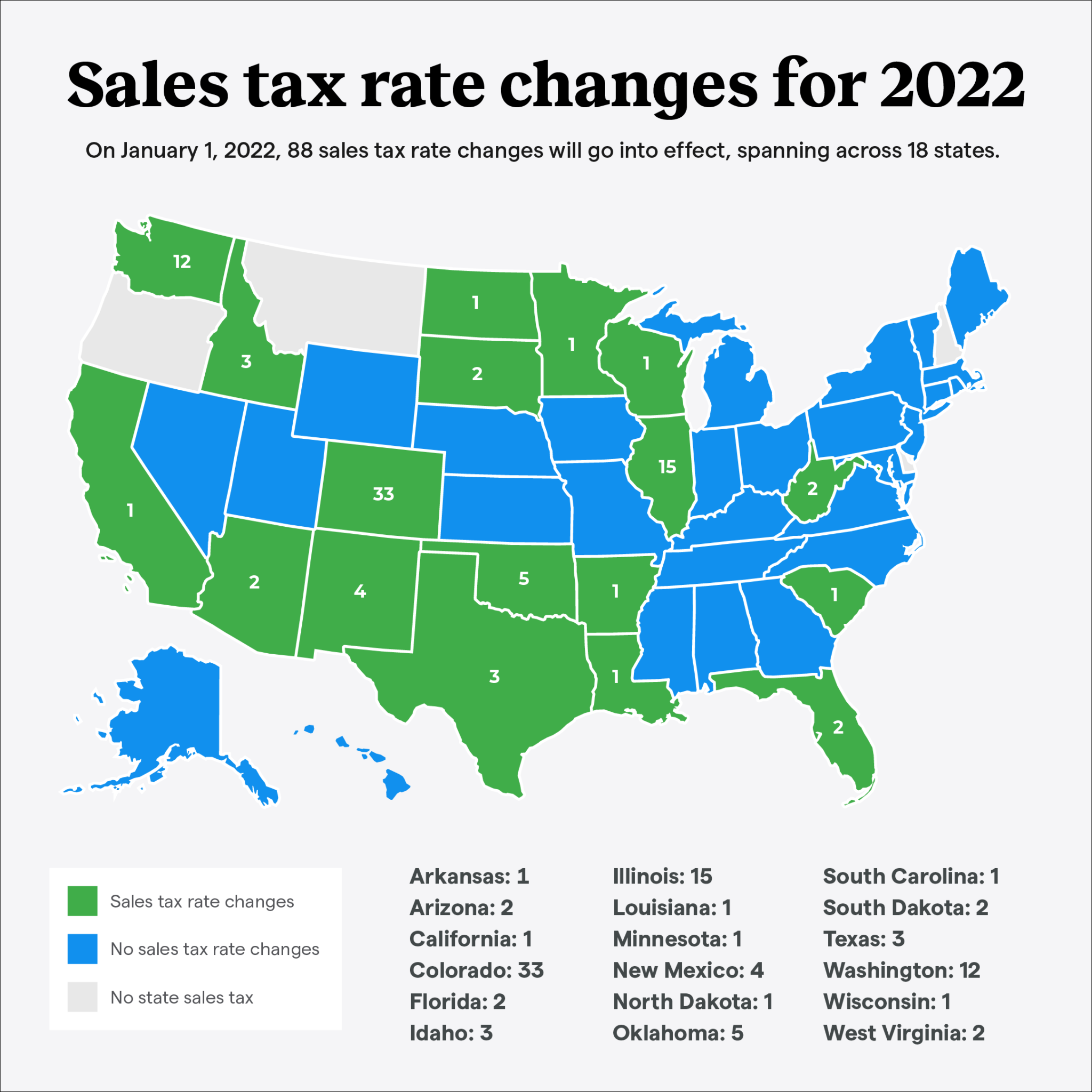

Sales Tax Rate Changes For 2022 TaxJar

Sales Tax Rate Changes For 2022 TaxJar

Over the past year there have been eight local sales tax rate changes in South Dakota This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply

South Dakota s state sales and use tax rate will drop from 4 5 to 4 2 starting July 1 2023 It will return to 4 5 beginning July 1 2027 The new rate of 4 2 will apply to all sales in the state previously subject to the higher rate The sales tax rate change is due to the enactment of House Bill 1137 As introduced the measure sought

After we've peaked your interest in printables for free we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection with South Dakota Sales Tax Rate Changes for all applications.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a broad selection of subjects, everything from DIY projects to planning a party.

Maximizing South Dakota Sales Tax Rate Changes

Here are some new ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

South Dakota Sales Tax Rate Changes are a treasure trove of fun and practical tools that meet a variety of needs and interest. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the vast collection of South Dakota Sales Tax Rate Changes today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes they are! You can print and download these free resources for no cost.

-

Does it allow me to use free printing templates for commercial purposes?

- It depends on the specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may have restrictions on usage. Always read the terms and conditions provided by the creator.

-

How can I print South Dakota Sales Tax Rate Changes?

- You can print them at home using your printer or visit the local print shops for superior prints.

-

What software do I need to run printables free of charge?

- The majority of printed documents are in PDF format, which can be opened using free software like Adobe Reader.

Surpreme Court Rules In South Dakota V Wayfair And What That May Mean

Bill Introduced To End South Dakota Sales Tax On Food

Check more sample of South Dakota Sales Tax Rate Changes below

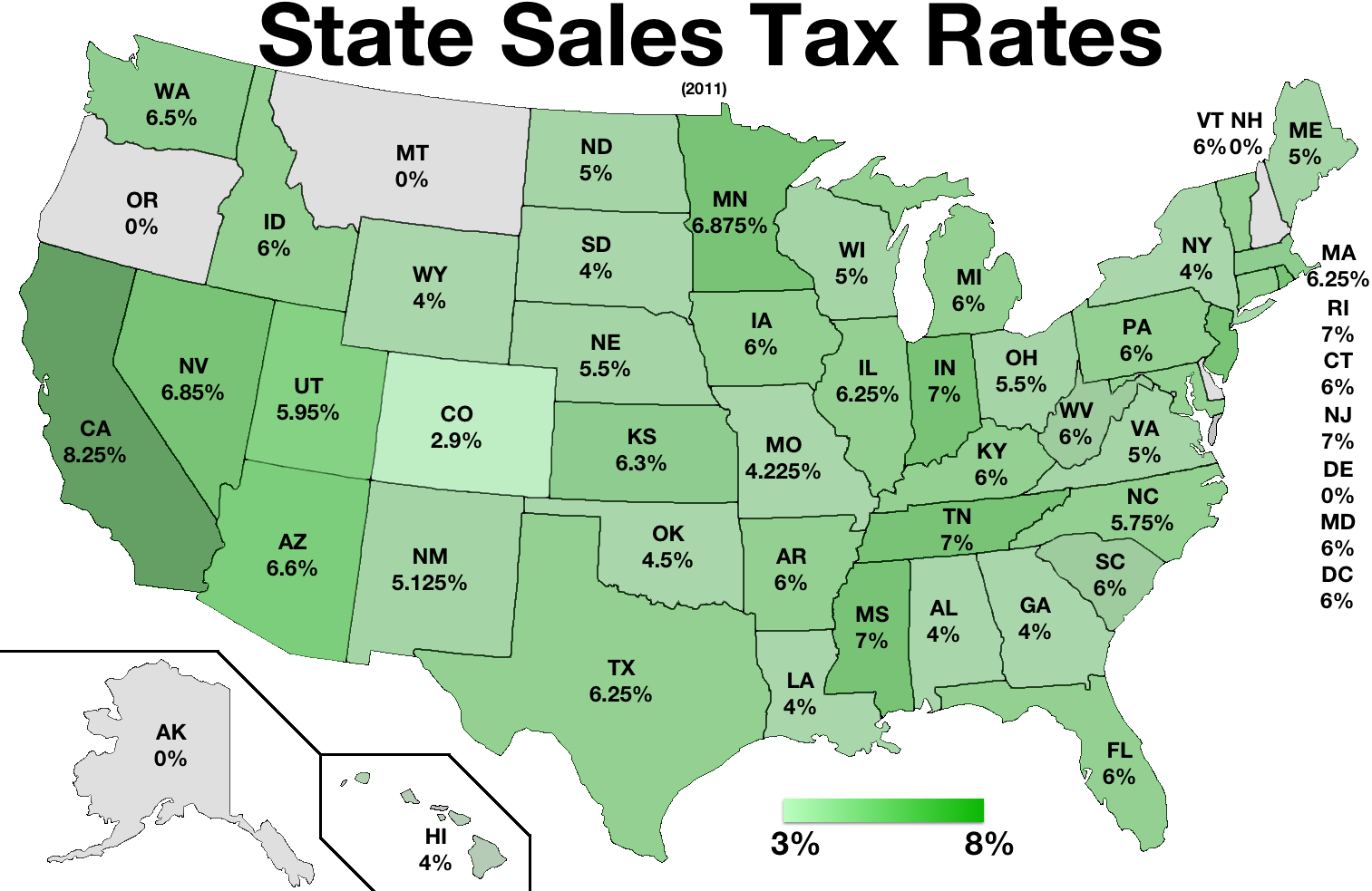

North Dakota Sales Tax Sales Tax North Dakota ND Sales Tax Rate

South Dakota Sales Tax Rate On Vehicles Tax Preparation Classes

/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

Norman Barba

State And Local Public Finance Taxing Professional Services Beating

South Dakota Sales Tax Rate On Vehicles Olimpia Shrader

Does South Dakota Have Income Tax INCOMEARTA

https://dor.sd.gov › newsroom › department-of-revenue...

PIERRE S D On July 1 2023 South Dakota s tax rate will decrease from 4 5 percent to 4 2 percent Governor Kristi Noem and the Department of Revenue are working diligently to account for the three tenth percent sales tax decrease created by House Bill 1137

https://dor.sd.gov › businesses › taxes › sales-use-tax

The state sales and use tax rate is 4 2 For additional information on sales tax please refer to our Sales Tax Guide PDF See Sales Tax Guide Quick Navigation Who Needs A License How To Get A License Remote Sellers and Marketplace Providers Sales Tax Facts Exemptions from Sales Tax Exempt Entities Exemption Certificate What is Use

PIERRE S D On July 1 2023 South Dakota s tax rate will decrease from 4 5 percent to 4 2 percent Governor Kristi Noem and the Department of Revenue are working diligently to account for the three tenth percent sales tax decrease created by House Bill 1137

The state sales and use tax rate is 4 2 For additional information on sales tax please refer to our Sales Tax Guide PDF See Sales Tax Guide Quick Navigation Who Needs A License How To Get A License Remote Sellers and Marketplace Providers Sales Tax Facts Exemptions from Sales Tax Exempt Entities Exemption Certificate What is Use

State And Local Public Finance Taxing Professional Services Beating

/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

South Dakota Sales Tax Rate On Vehicles Tax Preparation Classes

South Dakota Sales Tax Rate On Vehicles Olimpia Shrader

Does South Dakota Have Income Tax INCOMEARTA

North Dakota Sales Tax Calculator Step By Step Business

Jackqueline Kemp

Jackqueline Kemp

How South Dakota Sales Tax Calculator Works Step By Step Guide 360 Taxes