In this age of electronic devices, where screens rule our lives and the appeal of physical printed objects isn't diminished. If it's to aid in education in creative or artistic projects, or simply adding an individual touch to your area, Sovereign Gold Bond Investment Tax Exemption Under Section 80c have become an invaluable resource. This article will dive into the world of "Sovereign Gold Bond Investment Tax Exemption Under Section 80c," exploring the different types of printables, where you can find them, and how they can enrich various aspects of your daily life.

Get Latest Sovereign Gold Bond Investment Tax Exemption Under Section 80c Below

Sovereign Gold Bond Investment Tax Exemption Under Section 80c

Sovereign Gold Bond Investment Tax Exemption Under Section 80c -

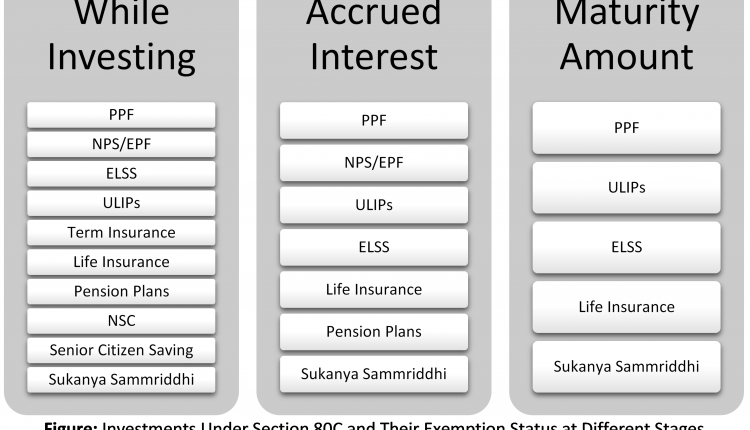

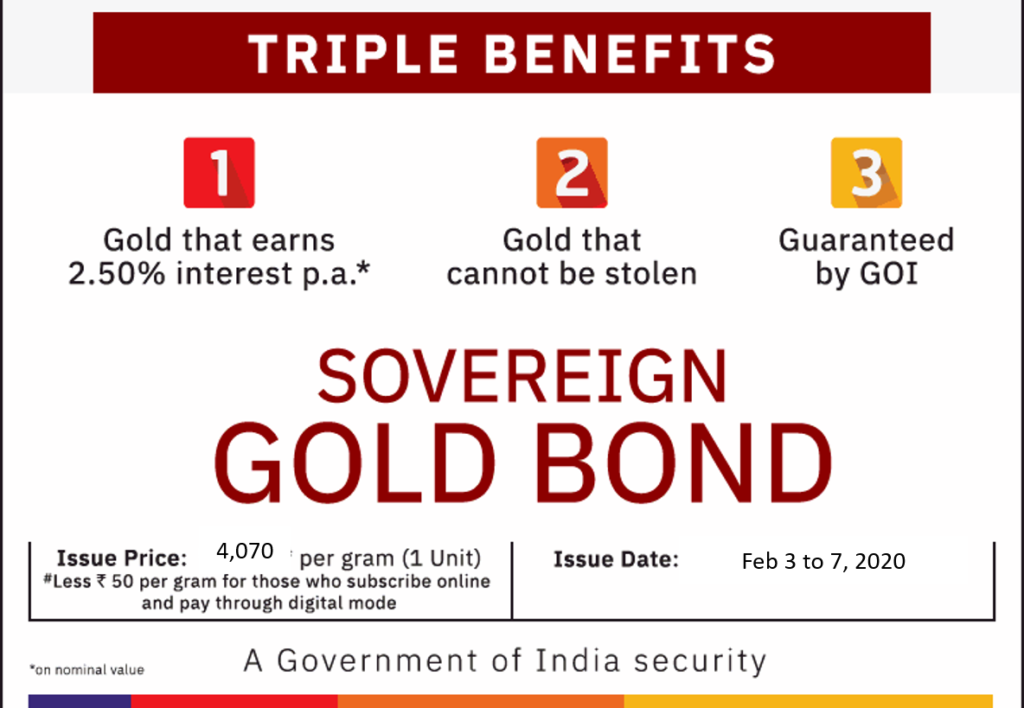

As per Section 47 viic of Income Tax Act any capital gain earned on redemption of these bonds is exempt for taxation to an individual The exemption is

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total

Printables for free include a vast assortment of printable materials that are accessible online for free cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The beauty of Sovereign Gold Bond Investment Tax Exemption Under Section 80c is in their variety and accessibility.

More of Sovereign Gold Bond Investment Tax Exemption Under Section 80c

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

If you sell the SGB after 8 years of the lock in period the whole capital gain profit on an asset will be exempted from the taxable

Nope FDs are not tax exempt Only investments in long term FDs are eligible for tax deduction under 80C And even that deduction is subject to overall limit of 1 50 Lakh

Sovereign Gold Bond Investment Tax Exemption Under Section 80c have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization The Customization feature lets you tailor printables to your specific needs whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational Benefits: Education-related printables at no charge cater to learners of all ages. This makes them a valuable tool for parents and teachers.

-

Easy to use: Fast access the vast array of design and templates is time-saving and saves effort.

Where to Find more Sovereign Gold Bond Investment Tax Exemption Under Section 80c

Sovereign Gold Bond Scheme How To Apply Returns Calculator And

Sovereign Gold Bond Scheme How To Apply Returns Calculator And

SGB investments do not qualify for tax deduction benefits under Section 80C of the Income Tax Act The interest earned on SGB deposits is also not tax

This is an exclusive income tax benefit offered on gold bonds to encourage investors to shift to non physical gold 3 This exemption from capital gains tax is not

If we've already piqued your curiosity about Sovereign Gold Bond Investment Tax Exemption Under Section 80c we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Sovereign Gold Bond Investment Tax Exemption Under Section 80c for a variety reasons.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Sovereign Gold Bond Investment Tax Exemption Under Section 80c

Here are some innovative ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Sovereign Gold Bond Investment Tax Exemption Under Section 80c are an abundance of innovative and useful resources that cater to various needs and interest. Their access and versatility makes them a wonderful addition to both professional and personal lives. Explore the vast collection of Sovereign Gold Bond Investment Tax Exemption Under Section 80c to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes they are! You can download and print these resources at no cost.

-

Can I make use of free printables for commercial uses?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations on usage. Be sure to read the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using either a printer or go to an in-store print shop to get premium prints.

-

What software must I use to open Sovereign Gold Bond Investment Tax Exemption Under Section 80c?

- The majority of printables are in the format of PDF, which can be opened with free software such as Adobe Reader.

Gold Madhan s Money Tricks

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Check more sample of Sovereign Gold Bond Investment Tax Exemption Under Section 80c below

Sovereign Gold Bond February 2020 How To Buy Tax Benefits

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Secure Your Future By Investing Wisely Invest In Public Provident

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Exemption Eligibility Available Under Section 54F For The House

Sovereign Gold Bond

https://profitsolo.com/sovereign-gold-bond-tax...

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total

https://www.icicidirect.com/.../articles/taxation-on-sovereign-gold-bonds

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Exemption Eligibility Available Under Section 54F For The House

Sovereign Gold Bond

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Sovereign Gold Bond Scheme 2021 2022 Calendar