In this age of technology, where screens rule our lives but the value of tangible printed material hasn't diminished. No matter whether it's for educational uses such as creative projects or just adding an individual touch to the space, Sovereign Gold Bond Tax Exemption Under Section 80c are now a useful source. With this guide, you'll take a dive into the world of "Sovereign Gold Bond Tax Exemption Under Section 80c," exploring what they are, how you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Sovereign Gold Bond Tax Exemption Under Section 80c Below

Sovereign Gold Bond Tax Exemption Under Section 80c

Sovereign Gold Bond Tax Exemption Under Section 80c -

A Under Section 193 iv of the Income Tax Act interest on government securities is not subject to TDS Q5 Under what section are only individuals allowed taxation benefits on SGB A Under

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds

Sovereign Gold Bond Tax Exemption Under Section 80c provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These resources come in various styles, from worksheets to templates, coloring pages, and many more. The appealingness of Sovereign Gold Bond Tax Exemption Under Section 80c lies in their versatility and accessibility.

More of Sovereign Gold Bond Tax Exemption Under Section 80c

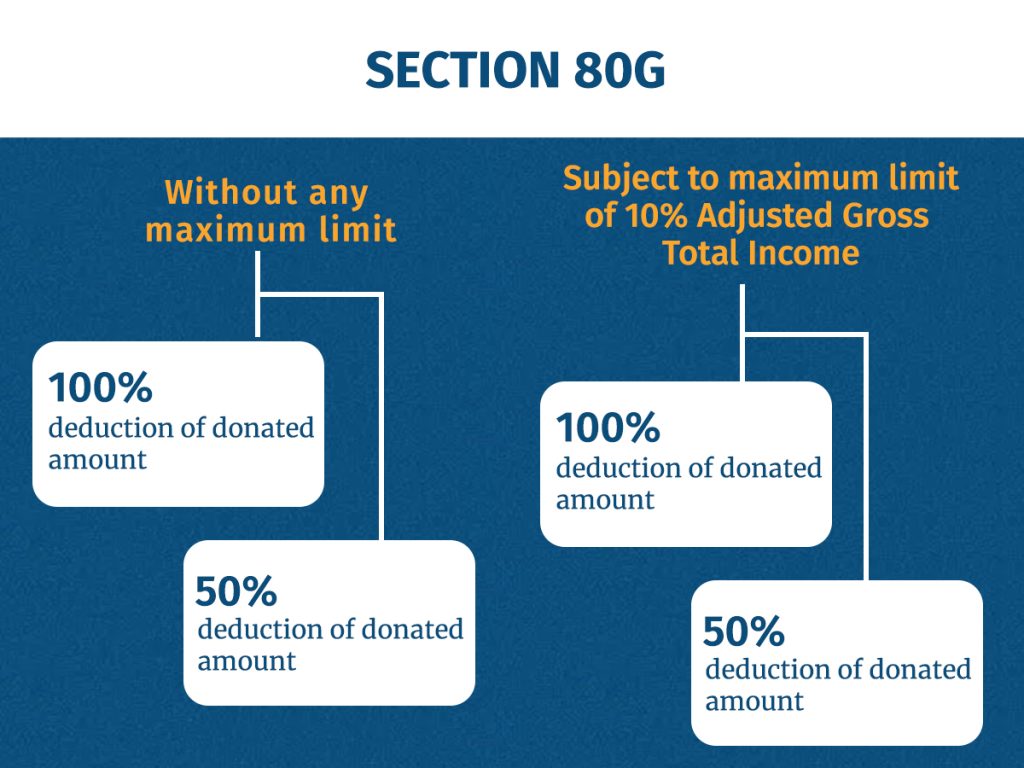

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs Image Source

As per an Economic Times news report long term capital gains will be taxed at 20 with an indexation benefit if the SGB is redeemed after the lock in period of 5

Sovereign Gold Bond Tax Exemption Under Section 80c have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: This allows you to modify printables to fit your particular needs, whether it's designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Free educational printables cater to learners of all ages. This makes them an essential aid for parents as well as educators.

-

Simple: instant access numerous designs and templates saves time and effort.

Where to Find more Sovereign Gold Bond Tax Exemption Under Section 80c

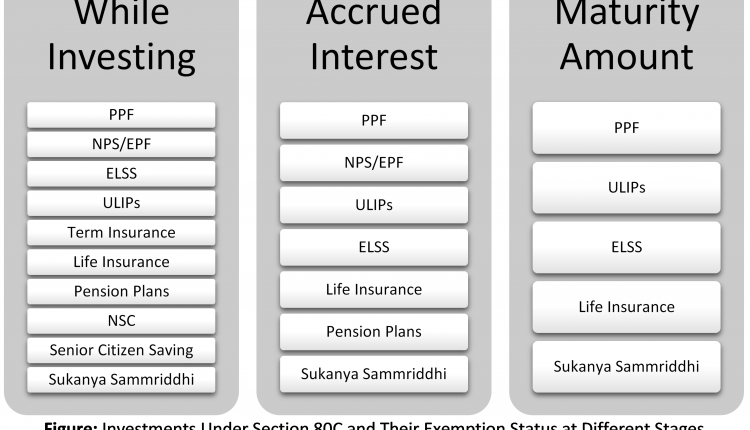

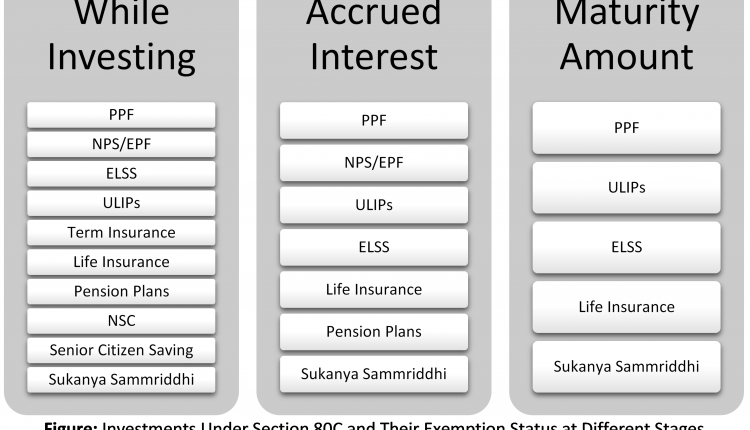

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

Income tax rules on sovereign gold bonds 1 The interest received on your gold bond holdings is taxable The interest income is clubbed with your income and

Home News Business Personal Finance How sovereign gold bonds are taxed A complete guide Although Sovereign Gold Bonds are tax free if you hold them till maturity they are taxable if

Now that we've piqued your interest in Sovereign Gold Bond Tax Exemption Under Section 80c we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Sovereign Gold Bond Tax Exemption Under Section 80c to suit a variety of purposes.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Sovereign Gold Bond Tax Exemption Under Section 80c

Here are some new ways that you can make use use of Sovereign Gold Bond Tax Exemption Under Section 80c:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Sovereign Gold Bond Tax Exemption Under Section 80c are an abundance with useful and creative ideas which cater to a wide range of needs and passions. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the vast array of Sovereign Gold Bond Tax Exemption Under Section 80c and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Sovereign Gold Bond Tax Exemption Under Section 80c truly completely free?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables for commercial purposes?

- It is contingent on the specific conditions of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables might have limitations concerning their use. Be sure to review these terms and conditions as set out by the creator.

-

How do I print Sovereign Gold Bond Tax Exemption Under Section 80c?

- You can print them at home using either a printer or go to a print shop in your area for better quality prints.

-

What software do I need to open printables that are free?

- The majority of printables are in PDF format, which can be opened with free software, such as Adobe Reader.

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

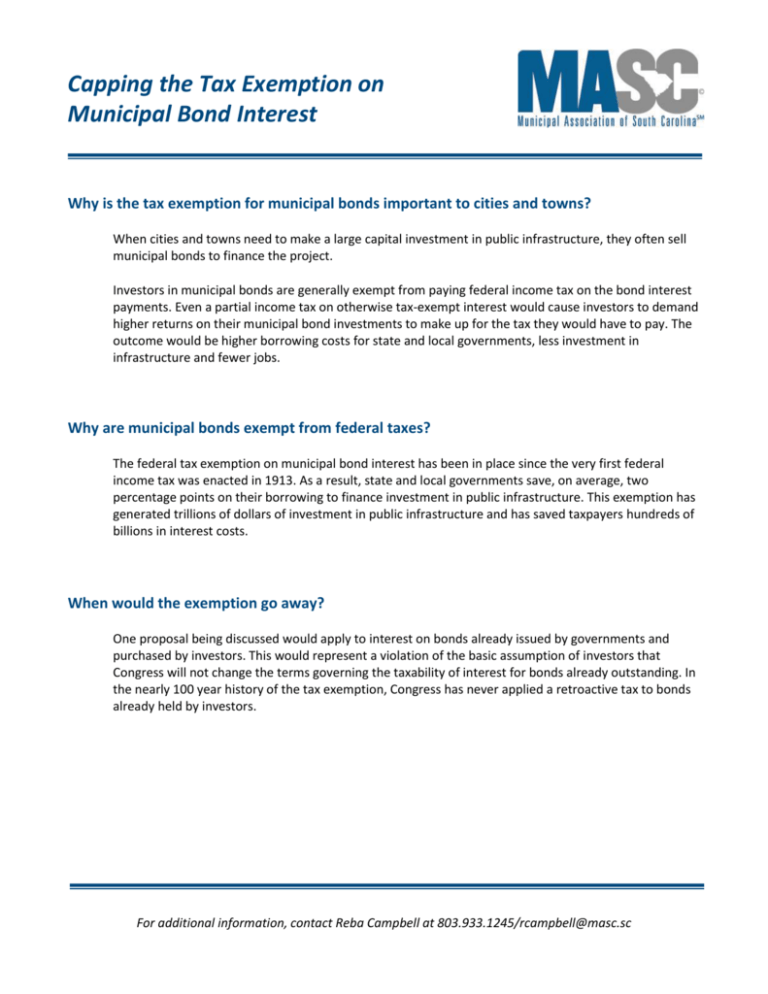

Municipal Bond Tax Exemption FAQ

Check more sample of Sovereign Gold Bond Tax Exemption Under Section 80c below

Capital Gain Exemption Section 54EC Bond Discontinued By NHAI

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

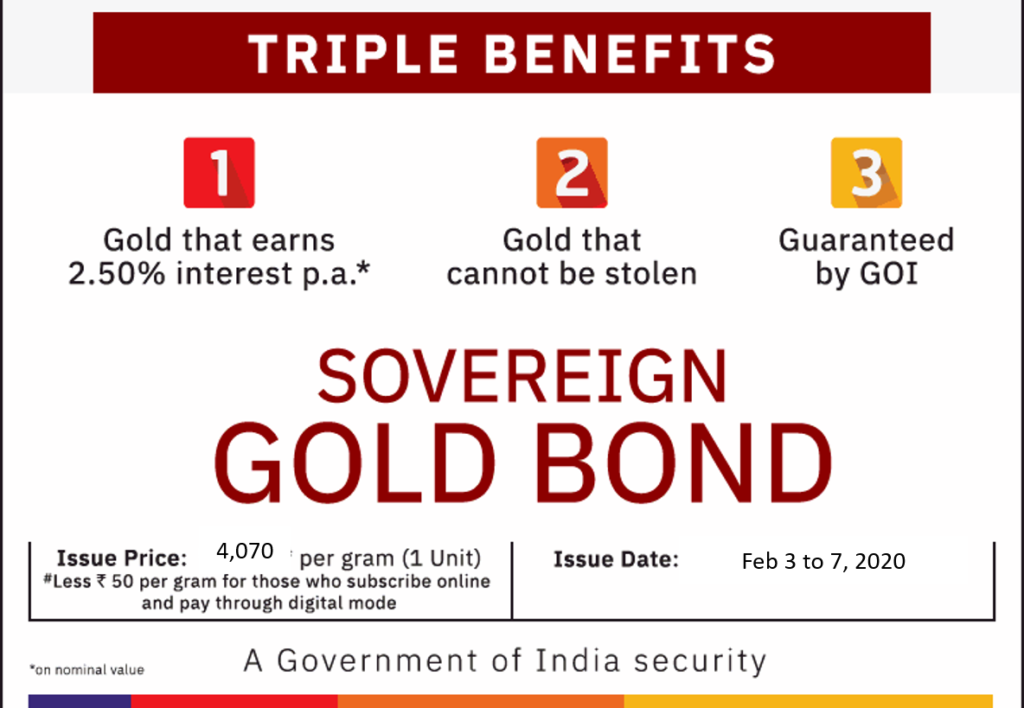

Sovereign Gold Bond February 2020 How To Buy Tax Benefits

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

https://www. icicidirect.com /ilearn/currency...

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds

https:// profitsolo.com /sovereign-gold-bond-tax...

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

Stamp Duty And Registration Charges Deduction U s 80C

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Sovereign Gold Bond Tax Exemption In 2023 STCG LTCG TDS