In a world where screens rule our lives however, the attraction of tangible printed material hasn't diminished. Whether it's for educational purposes or creative projects, or simply to add a personal touch to your home, printables for free are a great resource. This article will dive deep into the realm of "Spain Tax Return," exploring the benefits of them, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Spain Tax Return Below

Spain Tax Return

Spain Tax Return -

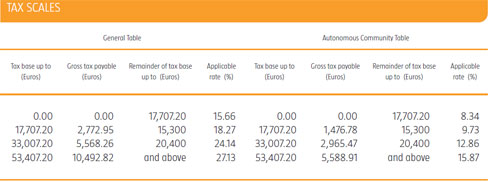

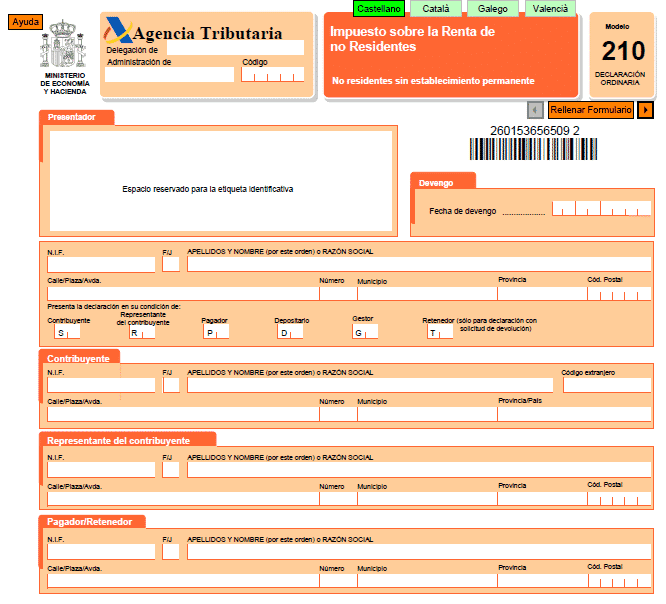

The Spanish system for direct taxation of individuals is mainly comprised of two personal income taxes Spanish personal income tax PIT for individuals who are resident in Spain for tax purposes and Spanish non residents income tax NRIT for individuals who are not resident in Spain for tax purposes who obtain income in Spain

In your first year of tax residency in Spain you ll need to file a tax return From the second year onwards you ll only need to file a return if your income from employment is greater than 22 000 as your income tax will have been calculated and deducted by your employer

Spain Tax Return offer a wide range of printable, free items that are available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages and much more. One of the advantages of Spain Tax Return is their versatility and accessibility.

More of Spain Tax Return

5 Tips About Real Estate When Doing Your Income Tax Return In Spain

5 Tips About Real Estate When Doing Your Income Tax Return In Spain

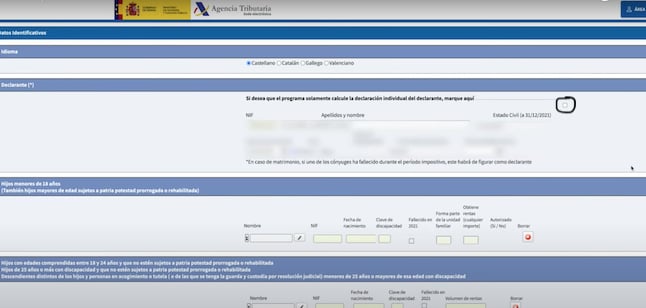

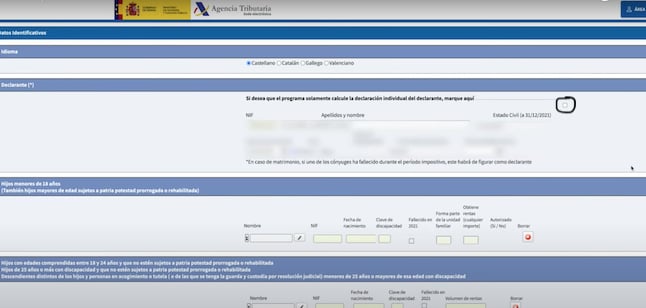

2022 Income Tax Campaign Access all the information and procedures for completing and filing your 2022 income tax return Latest updates on Income Tax Find out about the changes in the Personal Income Tax regulations and the new INFORMA references How should I file my tax return

Form 146 Personal Income Tax Pensioners with two or more payers Request for calculation of withholding amounts Form 147 IRPF Communication of the displacement to Spanish territory carried out by employed workers Form 149 IRPF Special regime applicable to workers professionals entrepreneurs and investors displaced to Spanish

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization It is possible to tailor printing templates to your own specific requirements, whether it's designing invitations planning your schedule or decorating your home.

-

Educational value: The free educational worksheets offer a wide range of educational content for learners from all ages, making them a vital resource for educators and parents.

-

The convenience of The instant accessibility to the vast array of design and templates will save you time and effort.

Where to Find more Spain Tax Return

Tax Return 2018 Holiday Rentals Income Tax In Spain

Tax Return 2018 Holiday Rentals Income Tax In Spain

It is the first year that you are filing a tax return in Spain READ ALSO La Renta The important income tax deadlines in Spain in 2023 Check the draft Before submitting the form you will typically see a draft of what the tax authorities believe your personal income tax will be according to the data they have

When is the income tax return due in Spain Filing your PIT declaraci n IRPF as a Spanish tax resident From 1st April to 25th June Filing your NRIT as a non resident taxpayer Income obtained from selling a property Within three months since the date of the sale Income obtained from lease On a quarterly basis

Now that we've ignited your interest in printables for free, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Spain Tax Return designed for a variety objectives.

- Explore categories such as the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free, flashcards, and learning materials.

- This is a great resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide range of interests, including DIY projects to planning a party.

Maximizing Spain Tax Return

Here are some fresh ways of making the most use of Spain Tax Return:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Spain Tax Return are a treasure trove of useful and creative resources which cater to a wide range of needs and pursuits. Their accessibility and flexibility make them a great addition to both professional and personal lives. Explore the endless world that is Spain Tax Return today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes, they are! You can download and print these documents for free.

-

Can I use the free templates for commercial use?

- It's based on the terms of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Always read the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to the local print shop for higher quality prints.

-

What software do I need to open printables at no cost?

- Many printables are offered in PDF format, which can be opened with free programs like Adobe Reader.

Tax Return 2018 Holiday Rentals Income Tax In Spain

1040 Form Income Tax Return Presidential Campaign Rules

Check more sample of Spain Tax Return below

Offshore Tax US Or Spain Tax Return Which Should Be Filed First

Offshore Tax With HTJ Tax Offshore Tax US Or Spain Tax Return Which

The 2019 Ultimate Guide To Spanish Residency Permit Visa Rules And

Renta 2019

How To Complete Spain s Declaraci n De La Renta Tax Return At The Last

Taxes In Spain An Introductory Guide For Expats Expatica

https://www.expatica.com/es/finance/taxes/income-tax-spain-101437

In your first year of tax residency in Spain you ll need to file a tax return From the second year onwards you ll only need to file a return if your income from employment is greater than 22 000 as your income tax will have been calculated and deducted by your employer

https://taxsummaries.pwc.com/spain/individual/tax-administration

Tax returns and payment of tax As a general rule Spanish tax returns should be filed and paid between 11 April and 30 June following the end of the tax year The period for declaring and paying PIT is established annually by a ministerial order It usually ends on 30 June

In your first year of tax residency in Spain you ll need to file a tax return From the second year onwards you ll only need to file a return if your income from employment is greater than 22 000 as your income tax will have been calculated and deducted by your employer

Tax returns and payment of tax As a general rule Spanish tax returns should be filed and paid between 11 April and 30 June following the end of the tax year The period for declaring and paying PIT is established annually by a ministerial order It usually ends on 30 June

Renta 2019

Offshore Tax With HTJ Tax Offshore Tax US Or Spain Tax Return Which

How To Complete Spain s Declaraci n De La Renta Tax Return At The Last

Taxes In Spain An Introductory Guide For Expats Expatica

Taxes In Spain For Residents Non Residents Expatra

Tax System In Spain 2021 Smartcitizenship

Tax System In Spain 2021 Smartcitizenship

Capital Gains Tax Germany Non Resident Individuals