In this day and age where screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses such as creative projects or simply to add some personal flair to your area, Spousal Income Tax Credit are now a vital resource. Through this post, we'll take a dive into the sphere of "Spousal Income Tax Credit," exploring what they are, where to find them and how they can enrich various aspects of your lives.

Get Latest Spousal Income Tax Credit Below

Spousal Income Tax Credit

Spousal Income Tax Credit -

Married filing separately is a tax status that you can choose to file if you do not want to be responsible for any of your spouse s income or taxes If you re married and file a separate tax return you re only responsible for that

If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return and any allowable amounts on line 32600 of your return Only one spouse or common law partner can claim the amount on line 30300 for each other for the same year

Spousal Income Tax Credit offer a wide assortment of printable materials that are accessible online for free cost. These printables come in different types, such as worksheets coloring pages, templates and much more. The benefit of Spousal Income Tax Credit lies in their versatility and accessibility.

More of Spousal Income Tax Credit

Can You Use Spousal Income For A Car Loan Autorama

Can You Use Spousal Income For A Car Loan Autorama

If you are married and you file your tax return using the filing status married filing separately you may be eligible for the Premium Tax Credit if you meet the criteria in section 1 36B 2 b 2 of the Income Tax Regulations which allows certain victims of domestic abuse and spousal abandonment to claim the Premium Tax Credit using the

A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor designs to suit your personal needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: Downloads of educational content for free provide for students from all ages, making them a useful instrument for parents and teachers.

-

Easy to use: Access to many designs and templates helps save time and effort.

Where to Find more Spousal Income Tax Credit

The VA Loan And Spousal Income How Does It Work Hawaii VA Home Loans

The VA Loan And Spousal Income How Does It Work Hawaii VA Home Loans

If you and your spouse or common law partner were separated for only part of the year due to a breakdown in your relationship you can still claim this tax credit as long as you do not claim any support amounts paid to your spouse

Complete Schedule S2 Provincial or Territorial Amounts Transferred from your Spouse or Common Law Partner to claim the corresponding provincial or territorial non refundable tax credit Enter the result on line 58640 of your provincial or territorial Form 428

We hope we've stimulated your interest in Spousal Income Tax Credit Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Spousal Income Tax Credit designed for a variety goals.

- Explore categories such as decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free, flashcards, and learning tools.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs covered cover a wide variety of topics, from DIY projects to planning a party.

Maximizing Spousal Income Tax Credit

Here are some ideas that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Spousal Income Tax Credit are an abundance of practical and innovative resources that cater to various needs and needs and. Their accessibility and flexibility make them a valuable addition to your professional and personal life. Explore the vast collection that is Spousal Income Tax Credit today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes they are! You can download and print these files for free.

-

Do I have the right to use free templates for commercial use?

- It's all dependent on the terms of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with Spousal Income Tax Credit?

- Certain printables may be subject to restrictions in their usage. Make sure you read the terms and condition of use as provided by the designer.

-

How do I print Spousal Income Tax Credit?

- You can print them at home using the printer, or go to an area print shop for premium prints.

-

What program do I require to view printables that are free?

- Many printables are offered in the PDF format, and is open with no cost software, such as Adobe Reader.

Spousal IRAs A Tax smart Way To Save For Retirement When One Spouse

Is Spousal Support Tax Deductible 2023 Onyx Law Group

Check more sample of Spousal Income Tax Credit below

Spousal Support Tax Changes In 2019

Can You Use Spousal Income For A Car Loan Autorama

Medicaid 101 Part 7 Spousal Monthly Income Allowance Taps Sutton

Canadian Income Tax Conditions For Claiming Spousal Credit Aww 9GAG

Single Source Administration Platform Taylor Sons

How To Determine The Most Tax Friendly States For Retirees

https://www.canada.ca/en/revenue-agency/services/...

If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return and any allowable amounts on line 32600 of your return Only one spouse or common law partner can claim the amount on line 30300 for each other for the same year

https://www.investopedia.com/articles/tax/10/...

The type of spousal support paid after a divorce can have varying tax implications Learn how to settle on the best tax solution for both parties

If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return and any allowable amounts on line 32600 of your return Only one spouse or common law partner can claim the amount on line 30300 for each other for the same year

The type of spousal support paid after a divorce can have varying tax implications Learn how to settle on the best tax solution for both parties

Canadian Income Tax Conditions For Claiming Spousal Credit Aww 9GAG

Can You Use Spousal Income For A Car Loan Autorama

Single Source Administration Platform Taylor Sons

How To Determine The Most Tax Friendly States For Retirees

The 10 Best Student Loan Refinance Companies For 2023

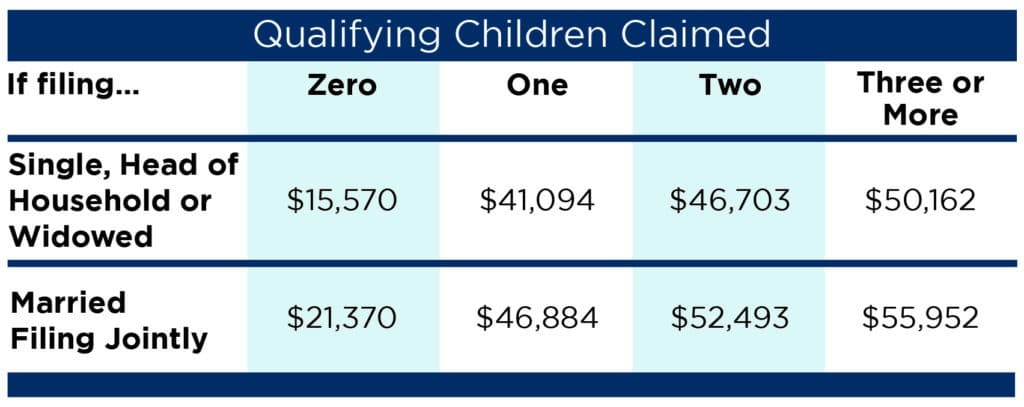

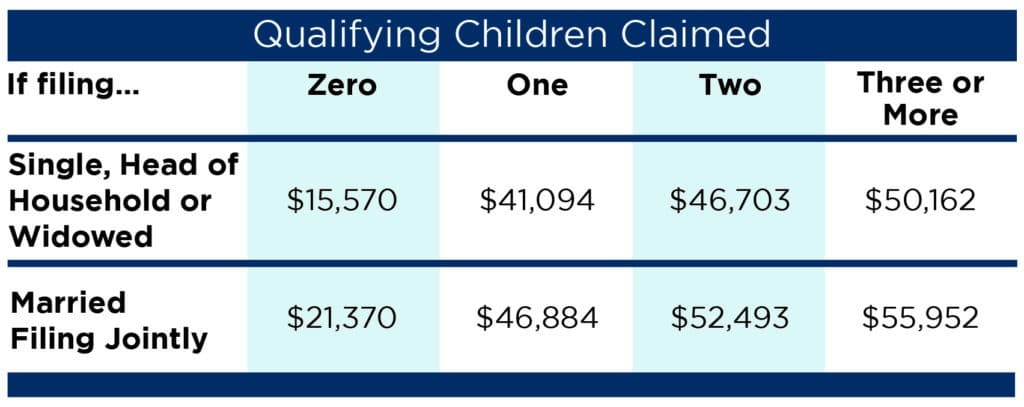

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

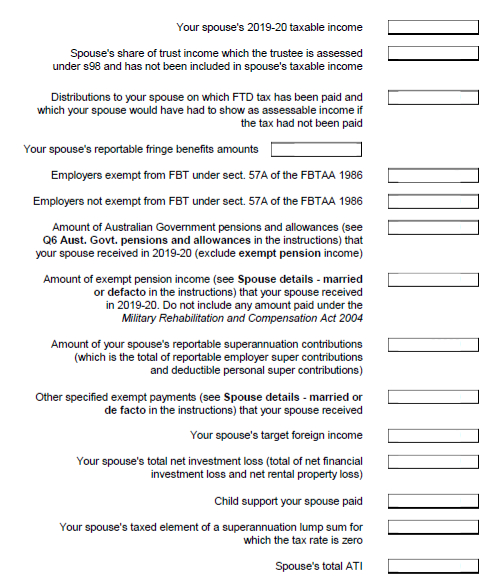

Spousal Income Refunded Pty Ltd