In this digital age, when screens dominate our lives yet the appeal of tangible printed objects hasn't waned. In the case of educational materials and creative work, or just adding personal touches to your area, State Automobile Tax Deduction have become a valuable source. With this guide, you'll take a dive in the world of "State Automobile Tax Deduction," exploring their purpose, where you can find them, and what they can do to improve different aspects of your life.

Get Latest State Automobile Tax Deduction Below

State Automobile Tax Deduction

State Automobile Tax Deduction -

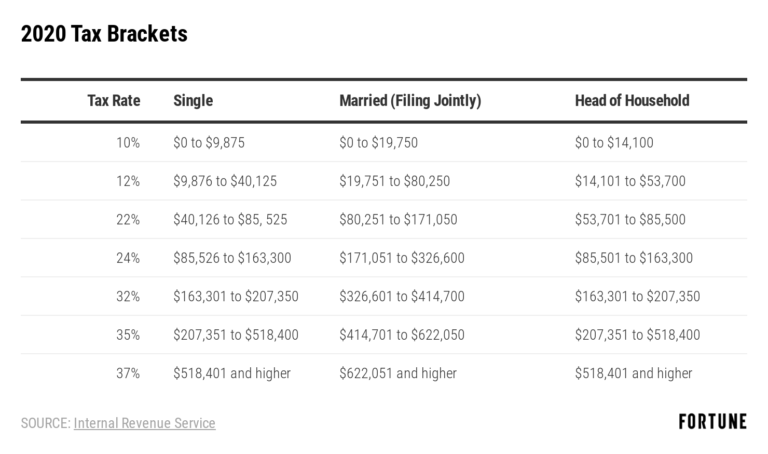

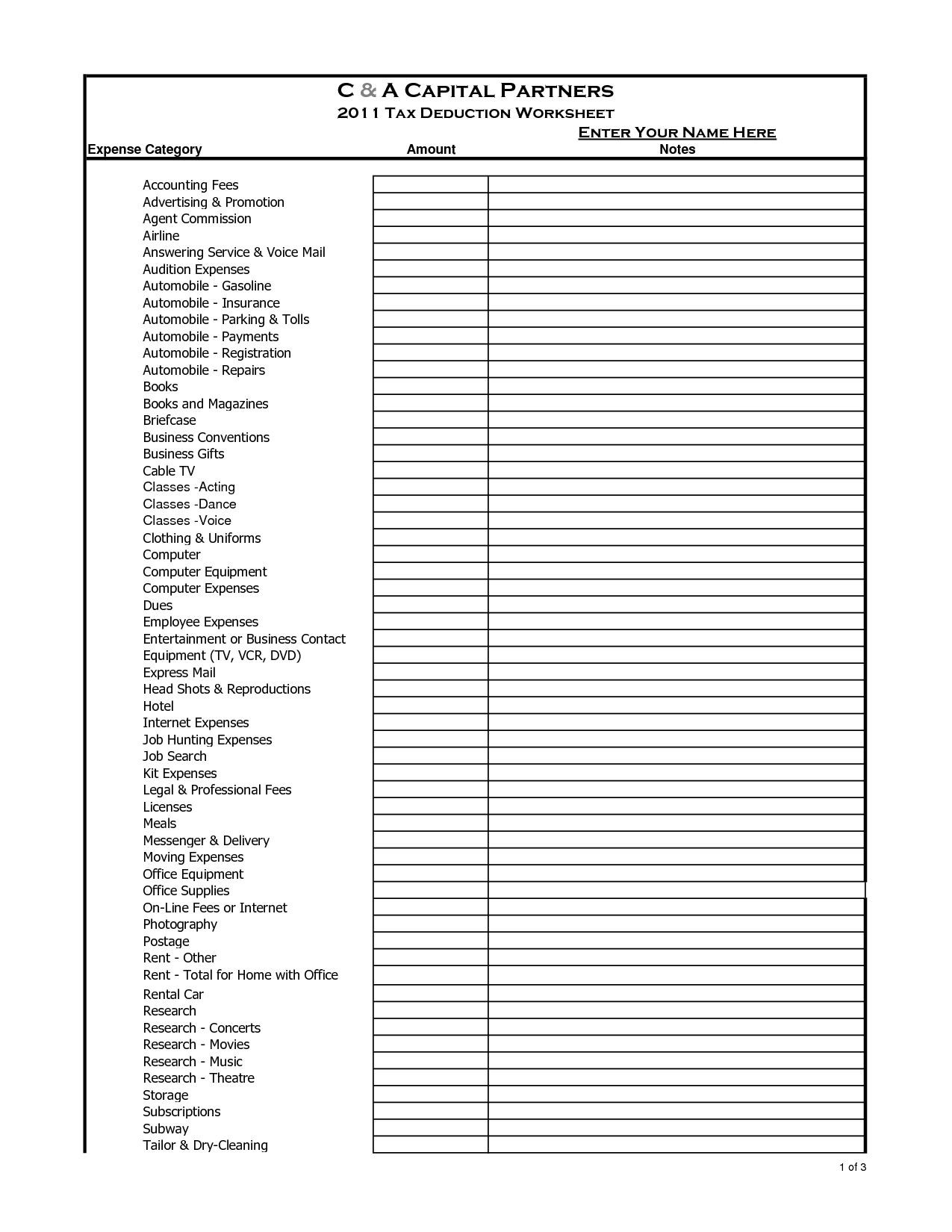

Verkko Sales Tax You can elect to deduct state and local general sales taxes instead of state and local income taxes as an itemized deduction on Schedule A Form 1040 You

Verkko 18 elok 2023 nbsp 0183 32 If you itemize your personal deductions you can write off the state and local sales taxes paid on the new car Note that in

State Automobile Tax Deduction cover a large variety of printable, downloadable resources available online for download at no cost. These resources come in many kinds, including worksheets templates, coloring pages and many more. The appeal of printables for free lies in their versatility and accessibility.

More of State Automobile Tax Deduction

Enterprise Use Of Automobile Tax Deductions

Enterprise Use Of Automobile Tax Deductions

Verkko To deduct vehicle sales tax you can either Save all sales receipts and deduct actual sales taxes paid throughout the year or Use the IRS sales tax tables to figure your deduction These tables calculate the

Verkko 26 tammik 2023 nbsp 0183 32 The IRS has announced the 2023 inflation adjusted Code 167 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger automobiles including vans

State Automobile Tax Deduction have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the templates to meet your individual needs be it designing invitations planning your schedule or even decorating your home.

-

Educational Worth: These State Automobile Tax Deduction are designed to appeal to students of all ages. This makes the perfect resource for educators and parents.

-

Simple: Instant access to a plethora of designs and templates reduces time and effort.

Where to Find more State Automobile Tax Deduction

Buy A Truck Or SUV Get A Tax Break Section 179

Buy A Truck Or SUV Get A Tax Break Section 179

Verkko 4 lokak 2021 nbsp 0183 32 Vehicle Cost 80 000 x 60 48 000 Vehicle Expenses 7 000 x 60 4 200 Total deduction 52 200 If you re in a 25 tax bracket you will save

Verkko 29 hein 228 k 2019 nbsp 0183 32 Taxpayers who have deducted the business use of their car on past tax returns should review whether or not they can still claim this deduction Some

If we've already piqued your interest in printables for free Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with State Automobile Tax Deduction for all reasons.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- These blogs cover a broad range of topics, starting from DIY projects to party planning.

Maximizing State Automobile Tax Deduction

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

State Automobile Tax Deduction are an abundance filled with creative and practical information that cater to various needs and hobbies. Their accessibility and flexibility make them a fantastic addition to each day life. Explore the vast collection of State Automobile Tax Deduction now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these tools for free.

-

Can I use free printables for commercial uses?

- It's contingent upon the specific terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations regarding usage. Make sure to read the terms and conditions set forth by the creator.

-

How do I print State Automobile Tax Deduction?

- You can print them at home using the printer, or go to any local print store for top quality prints.

-

What program will I need to access printables for free?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software such as Adobe Reader.

New York State Standard Deduction 2020 Standard Deduction 2021

2023 Automobile Deduction Limits Smith Sykes Leeper Tunstall LLP

Check more sample of State Automobile Tax Deduction below

Donate Automobile Tax Deduction YouTube

Tax Rules For Buying A SUV Or Truck To Deduct As A Business Expense

ARE CAR SEAT MANUFACTURER S ELIGIBLE FOR DEDUCTION UNDER INCOME TAX ACT

Automobile Tax

Vehicle Tax Deduction Section 179 Explained How To Write Off A

The Most Beautiful Cars Ever Built Donate Your Car Car Beautiful Cars

https://www.keepertax.com/posts/is-buying-…

Verkko 18 elok 2023 nbsp 0183 32 If you itemize your personal deductions you can write off the state and local sales taxes paid on the new car Note that in

https://www.blockadvisors.com/.../section-179-deduction-vehicle-list

Verkko 6 syysk 2023 nbsp 0183 32 Heavy Section 179 vehicles Any vehicle with at least 6 000 pounds GVWR but no more than 14 000 pounds 3 to 7 tons This includes many full size

Verkko 18 elok 2023 nbsp 0183 32 If you itemize your personal deductions you can write off the state and local sales taxes paid on the new car Note that in

Verkko 6 syysk 2023 nbsp 0183 32 Heavy Section 179 vehicles Any vehicle with at least 6 000 pounds GVWR but no more than 14 000 pounds 3 to 7 tons This includes many full size

Automobile Tax

Tax Rules For Buying A SUV Or Truck To Deduct As A Business Expense

Vehicle Tax Deduction Section 179 Explained How To Write Off A

The Most Beautiful Cars Ever Built Donate Your Car Car Beautiful Cars

SALT State And Local Tax Deduction

Solved Arlington LLC Purchased An Automobile For 60 000 On Chegg

Solved Arlington LLC Purchased An Automobile For 60 000 On Chegg

Protect Yourself From Online Scammers When You Donate Your Car To