Today, with screens dominating our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes or creative projects, or simply adding the personal touch to your home, printables for free can be an excellent resource. Here, we'll take a dive in the world of "State Property Tax Deduction," exploring the different types of printables, where to find them and how they can add value to various aspects of your lives.

Get Latest State Property Tax Deduction Below

State Property Tax Deduction

State Property Tax Deduction -

Selling your residential property Tax Credit for Renovations Repairs Household Expenses From 2023 you can no longer claim an interest deduction if you borrow money for financing an improvement on your permanent home However costs for tradesmen performing renovations and repairs are tax deductible these are considered household expenses

What Is the Property Tax Deduction State and local property taxes are generally eligible to be deducted from the property owner s federal income taxes Deductible real estate

Printables for free include a vast selection of printable and downloadable materials available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and more. The benefit of State Property Tax Deduction is in their variety and accessibility.

More of State Property Tax Deduction

How Does Rental Property Tax Deduction Work New Silver

How Does Rental Property Tax Deduction Work New Silver

Tax on property You have to pay tax to the Finnish Tax Administration on inheritance valuable gifts rent income sales profits investment income and real estate for instance Rent income investment income sales profits and timber selling expenses will be taxed as capital income

The State and Local Tax SALT deduction allows U S taxpayers to deduct certain state and local taxes paid from their federal income tax returns Eligible taxes include state and local income taxes property taxes and either state and local sales taxes or

State Property Tax Deduction have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization You can tailor printing templates to your own specific requirements whether it's making invitations to organize your schedule or decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free cater to learners of all ages, making them a vital aid for parents as well as educators.

-

Affordability: instant access many designs and templates saves time and effort.

Where to Find more State Property Tax Deduction

The Personal Property Tax Deduction And What Can Be Claimed

/car-salesman-and-female-customer-in-driver-s-seat-of-new-car-in-car-dealership-showroom-922707694-f707b8227b334aaaa0ac55e90d4ec89f.jpg)

The Personal Property Tax Deduction And What Can Be Claimed

In this guide we ll explore everything homeowners need to know about deducting property taxes in California including eligibility requirements allowable deductions and strategies for maximizing tax benefits

Taxpayers who itemize deductions on their federal income tax returns can deduct state and local taxes specifically property taxes plus either income taxes or general sales taxes However the Tax Cuts and Jobs Act limits the total state and local tax deduction to 10 000

Since we've got your curiosity about State Property Tax Deduction Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of State Property Tax Deduction designed for a variety motives.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing State Property Tax Deduction

Here are some ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

State Property Tax Deduction are an abundance of creative and practical resources for a variety of needs and needs and. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the vast collection of State Property Tax Deduction right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can download and print these items for free.

-

Can I use free printables to make commercial products?

- It's based on the terms of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may have restrictions on usage. Make sure you read these terms and conditions as set out by the author.

-

How do I print State Property Tax Deduction?

- Print them at home with an printer, or go to a local print shop to purchase high-quality prints.

-

What software will I need to access printables at no cost?

- The majority of printed documents are in the format PDF. This is open with no cost programs like Adobe Reader.

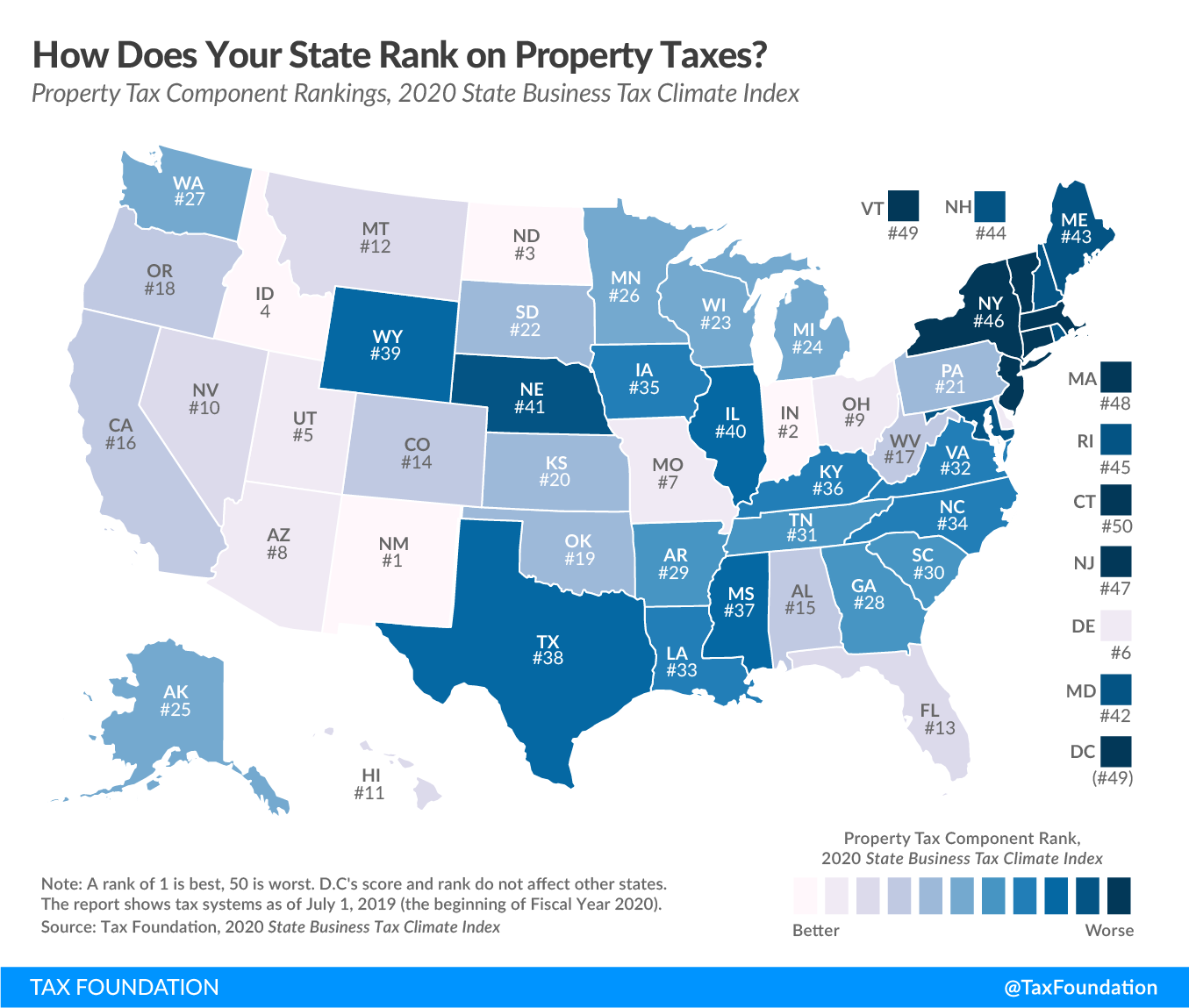

Lowest Property Tax by State Property Tax Estate Tax State Tax

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

Check more sample of State Property Tax Deduction below

Rental Property Tax Deduction Guide Picnic

State Individual Income Tax Rates And Brackets Tax Foundation

Monday Map State Income And Sales Tax Deductions Tax Foundation

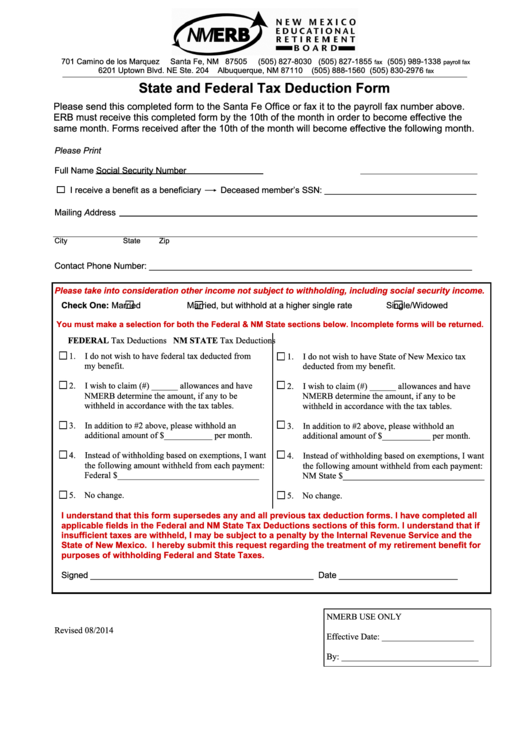

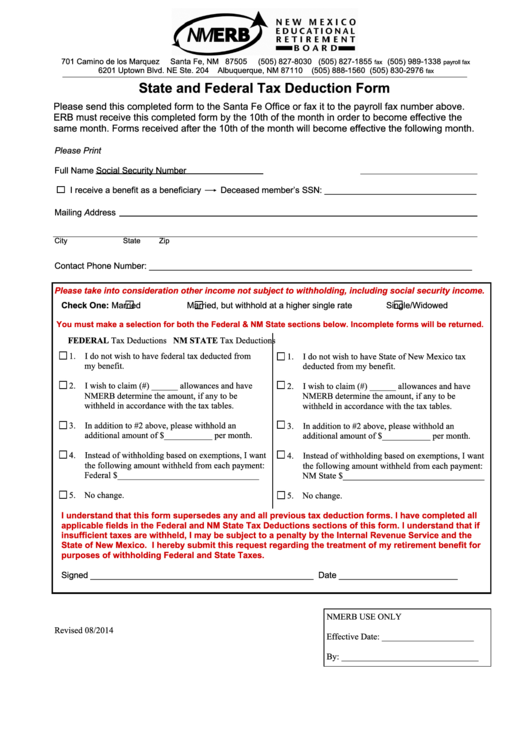

Fillable State And Federal Tax Deduction Form 2014 Printable Pdf Download

How To Deduct Property Taxes On IRS Tax Forms

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

https://www.investopedia.com › terms › property_tax...

What Is the Property Tax Deduction State and local property taxes are generally eligible to be deducted from the property owner s federal income taxes Deductible real estate

https://www.thebalancemoney.com

You no longer get a 12 000 deduction if you spend 6 000 on state income taxes and 6 000 on property taxes thanks to the TCJA You can claim 10 000 of these expenses but the law effectively forces you to leave 2 000 on the table unclaimed

What Is the Property Tax Deduction State and local property taxes are generally eligible to be deducted from the property owner s federal income taxes Deductible real estate

You no longer get a 12 000 deduction if you spend 6 000 on state income taxes and 6 000 on property taxes thanks to the TCJA You can claim 10 000 of these expenses but the law effectively forces you to leave 2 000 on the table unclaimed

Fillable State And Federal Tax Deduction Form 2014 Printable Pdf Download

State Individual Income Tax Rates And Brackets Tax Foundation

How To Deduct Property Taxes On IRS Tax Forms

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

House Tax Bill Would Put Property Tax Deduction Out Of Reach For Most

Avoid Mistakes With Your Property Tax Deduction Home Office Deduction

Avoid Mistakes With Your Property Tax Deduction Home Office Deduction

How To Claim The Property Tax Deduction DaveRamsey