Today, in which screens are the norm and the appeal of physical, printed materials hasn't diminished. For educational purposes in creative or artistic projects, or simply to add an extra personal touch to your home, printables for free are now an essential source. Here, we'll dive deeper into "Student Loan Interest Deduction Calculator 2022," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Student Loan Interest Deduction Calculator 2022 Below

Student Loan Interest Deduction Calculator 2022

Student Loan Interest Deduction Calculator 2022 -

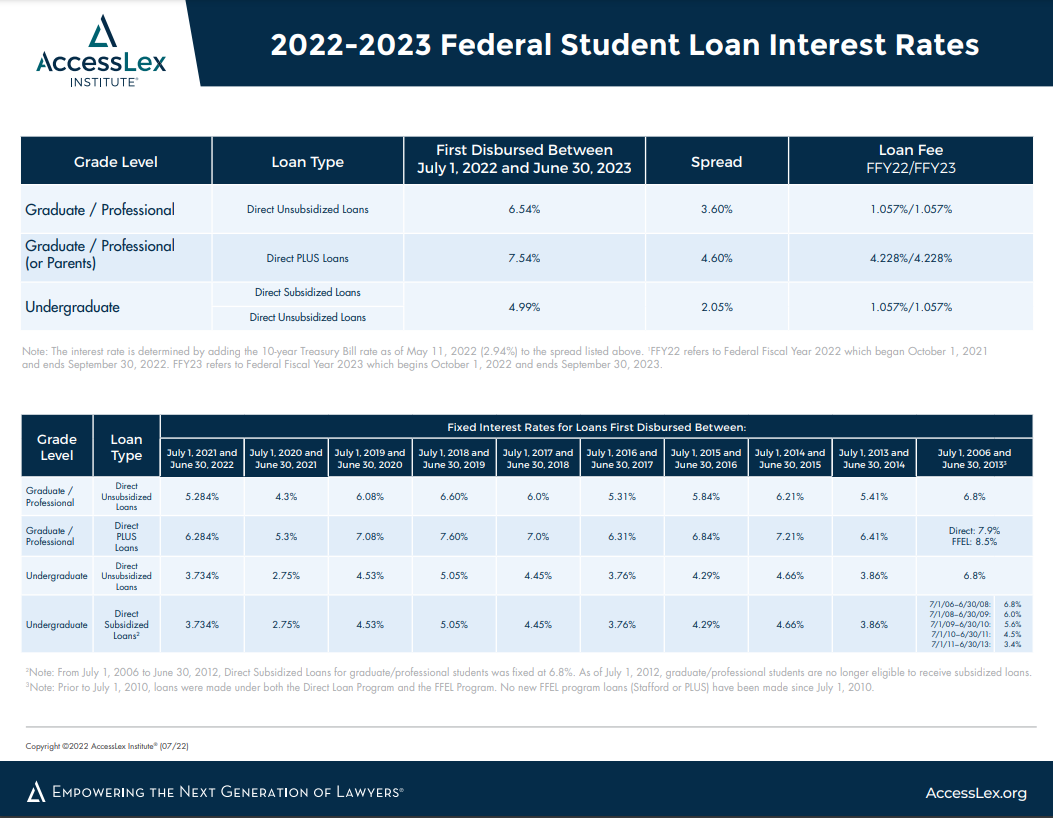

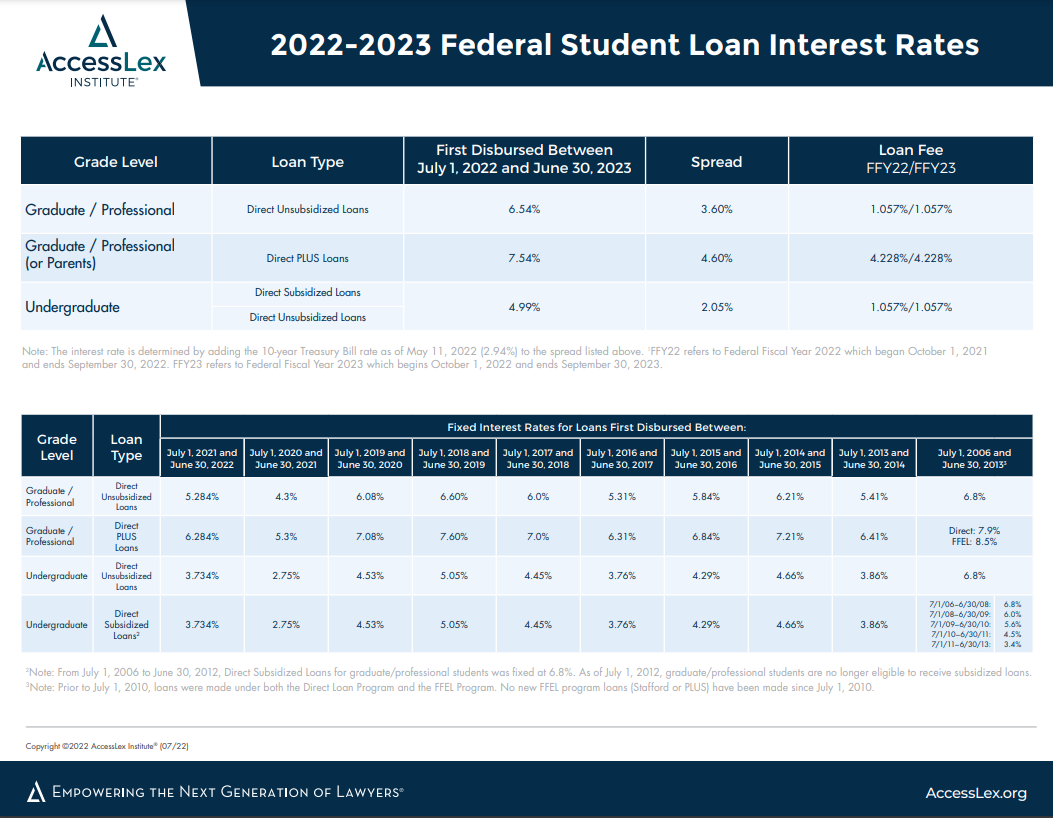

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal

Student Loan Interest Deduction Calculator 2022 include a broad collection of printable materials available online at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and many more. The appealingness of Student Loan Interest Deduction Calculator 2022 is their versatility and accessibility.

More of Student Loan Interest Deduction Calculator 2022

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

To calculate your deduction you can use the student loan interest deduction worksheet included in the IRS instructions for Form 1040

The tax deduction for student loan interest can be tricky to calculate Use this calculator to help estimate the value of your student loan interest deduction as well as your average tax

Student Loan Interest Deduction Calculator 2022 have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: It is possible to tailor the design to meet your needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value: The free educational worksheets provide for students from all ages, making these printables a powerful tool for teachers and parents.

-

Accessibility: Access to numerous designs and templates is time-saving and saves effort.

Where to Find more Student Loan Interest Deduction Calculator 2022

How Do Student Loans Affect Your Taxes Earnest

How Do Student Loans Affect Your Taxes Earnest

To calculate your interest deduction you take the total amount you paid in student loan interest for the tax year from January 1 to December 31 for most people and deduct it from your taxable income The deduction is

Calculation 3 000 2 616 your income minus the Plan 4 threshold 384 9 of 384 34 56 This means the amount you d repay each month would be 34 If your income

We've now piqued your curiosity about Student Loan Interest Deduction Calculator 2022 Let's find out where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Student Loan Interest Deduction Calculator 2022 to suit a variety of purposes.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a broad range of topics, everything from DIY projects to planning a party.

Maximizing Student Loan Interest Deduction Calculator 2022

Here are some creative ways ensure you get the very most of Student Loan Interest Deduction Calculator 2022:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities for teaching at-home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Student Loan Interest Deduction Calculator 2022 are an abundance of useful and creative resources catering to different needs and needs and. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the vast array of Student Loan Interest Deduction Calculator 2022 now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial purposes?

- It is contingent on the specific rules of usage. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright rights issues with Student Loan Interest Deduction Calculator 2022?

- Some printables may come with restrictions on usage. Check the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home with your printer or visit the local print shop for high-quality prints.

-

What program will I need to access printables at no cost?

- The majority of printed documents are in PDF format. They can be opened using free software, such as Adobe Reader.

Student Loan Interest Deduction A 2020 Guide Templateroller

2021 Student Loan Interest Deduction

Check more sample of Student Loan Interest Deduction Calculator 2022 below

Student Loan Interest Deduction Who s Eligible And How To Apply For A

Student Loan Interest Deduction 2013 PriorTax Blog

Claiming The Student Loan Interest Deduction

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

Student Loan Interest Deduction A Tax Move You Must Make

How To Claim Your Student Loan Interest Deduction

https://studentaid.gov › articles

The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal

https://www.irs.gov › taxtopics

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during

The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Interest Deduction A Tax Move You Must Make

How To Claim Your Student Loan Interest Deduction

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax

Student Loan Interest Deduction What You Need To Know

Student Loan Interest Deduction What You Need To Know

Awesome Loan Calculator Education References Educations And Learning