In the digital age, where screens have become the dominant feature of our lives but the value of tangible printed material hasn't diminished. Be it for educational use, creative projects, or simply to add an individual touch to your area, Student Loan Interest Deduction Instructions are a great source. We'll take a dive in the world of "Student Loan Interest Deduction Instructions," exploring their purpose, where they are, and the ways that they can benefit different aspects of your life.

Get Latest Student Loan Interest Deduction Instructions Below

Student Loan Interest Deduction Instructions

Student Loan Interest Deduction Instructions -

Can I claim a deduction for student loan interest The following set of questions will help you determine for 2023 2022 or 2021 how to claim your Student Loan Interest

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

Student Loan Interest Deduction Instructions encompass a wide array of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and many more. The appeal of printables for free lies in their versatility and accessibility.

More of Student Loan Interest Deduction Instructions

Student Loan Interest Deduction A 2020 Guide Templateroller

Student Loan Interest Deduction A 2020 Guide Templateroller

Student loan interest is deductible if your modified adjusted gross income or MAGI is less than 70 000 145 000 if filing jointly If your MAGI was between 70 000

The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your adjusted gross income AGI if

Student Loan Interest Deduction Instructions have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: We can customize print-ready templates to your specific requirements whether it's making invitations to organize your schedule or even decorating your home.

-

Educational value: The free educational worksheets can be used by students of all ages, making them a valuable tool for teachers and parents.

-

Convenience: The instant accessibility to numerous designs and templates will save you time and effort.

Where to Find more Student Loan Interest Deduction Instructions

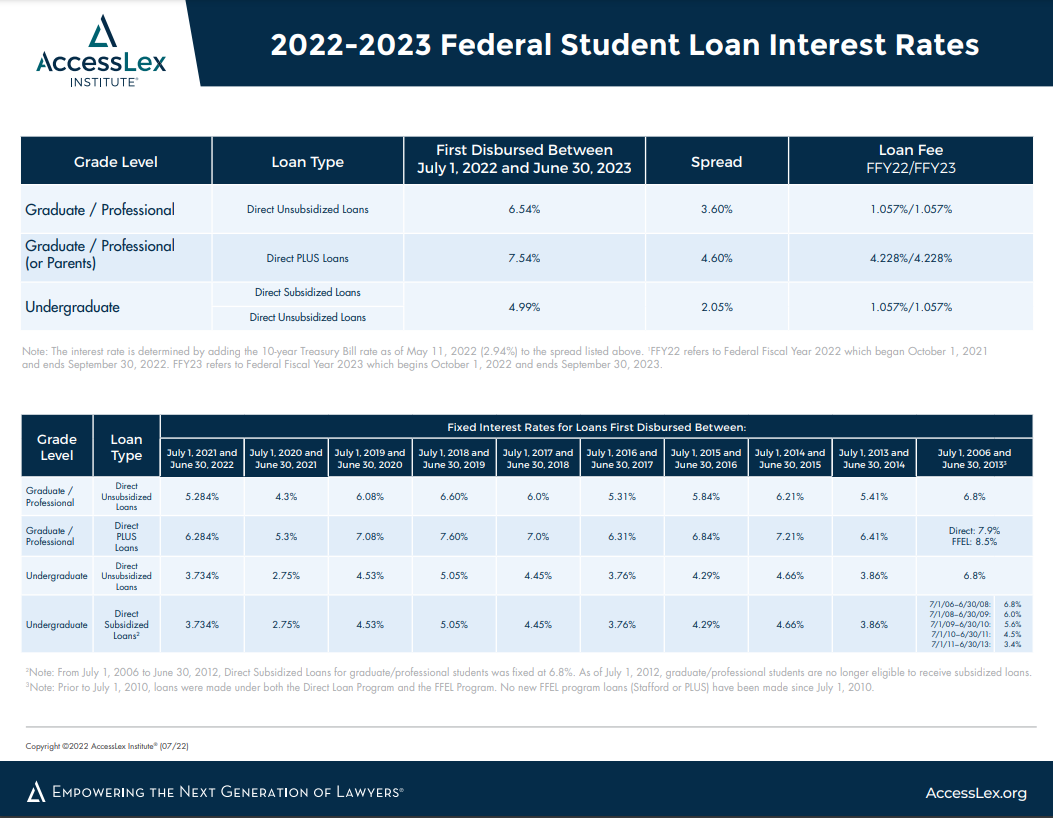

Federal Student Loan Interest Rates AccessLex

Federal Student Loan Interest Rates AccessLex

To calculate your interest deduction you take the total amount you paid in student loan interest for the tax year from January 1 to December 31 for most

Here s the formula Interest paid x MAGI MAGI CAP 15 000 or 30 000 if you re filing jointly Reduction amount Using the example above here s how the formula works 900 x 73 000

Now that we've ignited your interest in printables for free we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Student Loan Interest Deduction Instructions for a variety purposes.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs are a vast array of topics, ranging including DIY projects to planning a party.

Maximizing Student Loan Interest Deduction Instructions

Here are some innovative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Student Loan Interest Deduction Instructions are a treasure trove with useful and creative ideas designed to meet a range of needs and passions. Their availability and versatility make them a great addition to both professional and personal lives. Explore the endless world of Student Loan Interest Deduction Instructions and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can print and download these tools for free.

-

Does it allow me to use free printables for commercial use?

- It's all dependent on the conditions of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns with Student Loan Interest Deduction Instructions?

- Certain printables could be restricted on use. Be sure to check the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home with any printer or head to an in-store print shop to get the highest quality prints.

-

What program do I need in order to open printables free of charge?

- The majority are printed in the format PDF. This is open with no cost software such as Adobe Reader.

How To Claim Your Student Loan Interest Deduction

Student Loan Interest Deduction 2013 PriorTax Blog

Check more sample of Student Loan Interest Deduction Instructions below

Student Loan Interest Deduction Who s Eligible And How To Apply For A

Student Loan Interest Deduction A Tax Move You Must Make

Student Loan Interest Deduction Are You Eligible LendEDU

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

Claiming The Student Loan Interest Deduction

How To Claim A Student Loan Interest Deduction TheStreet

www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

www.investopedia.com/terms/s/…

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

Student Loan Interest Deduction A Tax Move You Must Make

Claiming The Student Loan Interest Deduction

How To Claim A Student Loan Interest Deduction TheStreet

Student Loan Interest Deduction Who Qualifies And How To Claim It

Student Loan Interest Deduction How Much Can You Really Save

Student Loan Interest Deduction How Much Can You Really Save

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax