In this digital age, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses such as creative projects or just adding a personal touch to your area, Student Loan Interest Payment Tax Form are now a vital resource. We'll take a dive to the depths of "Student Loan Interest Payment Tax Form," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Student Loan Interest Payment Tax Form Below

Student Loan Interest Payment Tax Form

Student Loan Interest Payment Tax Form -

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the tax

If you receive student loan interest of 600 or more from an individual during the year in the course of your trade or business file this form and provide a statement or

Student Loan Interest Payment Tax Form provide a diverse variety of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and many more. The appealingness of Student Loan Interest Payment Tax Form lies in their versatility and accessibility.

More of Student Loan Interest Payment Tax Form

Loan Interest Calculator How Much Will I Pay In Interest

Loan Interest Calculator How Much Will I Pay In Interest

You may be able to deduct student loan interest that you actually paid in 2024 on your income tax return However you may not be able to deduct the full amount of interest reported on this

How to deduct student loan interest If you paid at least 600 in interest on your student loan your servicer should send you IRS Form 1098 E which will contain the amount of student loan

Student Loan Interest Payment Tax Form have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization They can make printed materials to meet your requirements when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Education Value Free educational printables cater to learners of all ages. This makes them an essential resource for educators and parents.

-

Easy to use: instant access a plethora of designs and templates reduces time and effort.

Where to Find more Student Loan Interest Payment Tax Form

Pin On Debt Advice

Pin On Debt Advice

If you pay 600 or more of interest on a qualified student loan during the year your lender or loan servicer should send you Form 1098 E Student Loan Interest showing

If you paid interest on a qualified student loan you may be able to deduct some or even all of that interest on your federal income tax return Student loan companies use IRS Form 1098 E to report how much you paid in interest

Now that we've ignited your interest in Student Loan Interest Payment Tax Form we'll explore the places the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Student Loan Interest Payment Tax Form designed for a variety applications.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Student Loan Interest Payment Tax Form

Here are some unique ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Student Loan Interest Payment Tax Form are an abundance of useful and creative resources catering to different needs and pursuits. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the vast collection of Student Loan Interest Payment Tax Form right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables for commercial use?

- It's based on the conditions of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues with Student Loan Interest Payment Tax Form?

- Some printables may come with restrictions in their usage. You should read the terms and conditions offered by the creator.

-

How can I print Student Loan Interest Payment Tax Form?

- You can print them at home using either a printer at home or in an in-store print shop to get higher quality prints.

-

What software do I need in order to open Student Loan Interest Payment Tax Form?

- The majority of printables are with PDF formats, which can be opened using free software, such as Adobe Reader.

Lower Your Student Loan Interest Rate NOW

Treasury Sets Student Loan Interest Rates Near Historic Lows

Check more sample of Student Loan Interest Payment Tax Form below

What Credit Score Is Needed For A Student Loan Student Loan Planner

Student Loan Interest Deduction 2013 PriorTax Blog

Certificate Courses Student Loans Higher Education Expand Goo

Consumer Loan Interest Rates And Monthly Payment Table Loan Interest

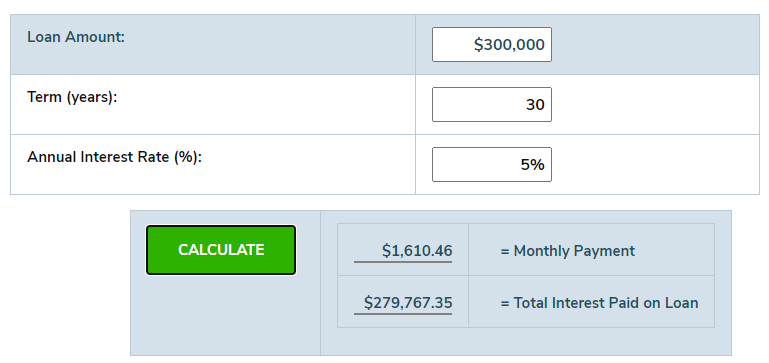

Student Loan Interest Payment Calculator LOAKANS

How To Get The Student Loan Interest Deduction NerdWallet

https://www.irs.gov › forms-pubs

If you receive student loan interest of 600 or more from an individual during the year in the course of your trade or business file this form and provide a statement or

https://www.irs.gov › taxtopics

If you paid 600 or more of interest on a qualified student loan during the year you should receive a Form 1098 E Student Loan Interest Statement from the entity to which you paid the student loan interest

If you receive student loan interest of 600 or more from an individual during the year in the course of your trade or business file this form and provide a statement or

If you paid 600 or more of interest on a qualified student loan during the year you should receive a Form 1098 E Student Loan Interest Statement from the entity to which you paid the student loan interest

Consumer Loan Interest Rates And Monthly Payment Table Loan Interest

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Interest Payment Calculator LOAKANS

How To Get The Student Loan Interest Deduction NerdWallet

Student Loan Interest Rates To Double This July HuffPost College

Everything You Need To Know About Deducting Student Loan Interest Earnest

Everything You Need To Know About Deducting Student Loan Interest Earnest

Student Loan Interest Rates 2019 BURSAHAGA COM