In this day and age where screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes as well as creative projects or simply adding an individual touch to the space, Student Loan Repayment Tax Deduction are a great source. For this piece, we'll take a dive to the depths of "Student Loan Repayment Tax Deduction," exploring the benefits of them, where to find them and how they can improve various aspects of your lives.

Get Latest Student Loan Repayment Tax Deduction Below

Student Loan Repayment Tax Deduction

Student Loan Repayment Tax Deduction -

If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan interest deduction Below are some questions and answers to help you learn more about reporting student loan interest payments from IRS Form 1098 E on your 2023 taxes

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during

Printables for free cover a broad range of downloadable, printable items that are available online at no cost. They come in many types, like worksheets, templates, coloring pages and much more. The appeal of printables for free is their flexibility and accessibility.

More of Student Loan Repayment Tax Deduction

Student Loan Repayment Tax Credit NewDEAL

Student Loan Repayment Tax Credit NewDEAL

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan Your filing status isn t married filing separately Your MAGI is less than a specified amount which is set annually and

A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans Here s more about how student loans and educational expenses can affect your taxes TABLE OF CONTENTS The American Opportunity Tax Credit The Lifetime Learning Credit IRS Form 8863 Click to expand

Student Loan Repayment Tax Deduction have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Modifications: Your HTML0 customization options allow you to customize printables to your specific needs for invitations, whether that's creating them to organize your schedule or even decorating your house.

-

Educational Value Free educational printables cater to learners from all ages, making the perfect tool for parents and teachers.

-

Convenience: Instant access to numerous designs and templates helps save time and effort.

Where to Find more Student Loan Repayment Tax Deduction

Is Student Loan Repayment Tax Deductible US Student Loan Center

Is Student Loan Repayment Tax Deductible US Student Loan Center

To be eligible for the full 2 500 deduction in the tax year 2020 filed in 2021 your Modified Adjusted Gross Income MAGI can t exceed 70 000 for singles or 140 000 for married filing jointly But as explained below you may still qualify for a smaller student loan interest deduction if your income exceeds these limits

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid from your

In the event that we've stirred your curiosity about Student Loan Repayment Tax Deduction We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Student Loan Repayment Tax Deduction to suit a variety of uses.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide variety of topics, including DIY projects to party planning.

Maximizing Student Loan Repayment Tax Deduction

Here are some ideas create the maximum value of Student Loan Repayment Tax Deduction:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Student Loan Repayment Tax Deduction are a treasure trove of practical and innovative resources designed to meet a range of needs and pursuits. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the vast collection of Student Loan Repayment Tax Deduction right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes you can! You can print and download these resources at no cost.

-

Can I utilize free printables to make commercial products?

- It's determined by the specific terms of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with Student Loan Repayment Tax Deduction?

- Some printables may have restrictions in their usage. Make sure to read the terms and conditions set forth by the creator.

-

How do I print Student Loan Repayment Tax Deduction?

- You can print them at home with printing equipment or visit the local print shop for better quality prints.

-

What program do I need to run printables free of charge?

- Many printables are offered in PDF format. They can be opened with free software, such as Adobe Reader.

Student Loan Tax Deduction Milliken Perkins Brunelle

Budget Management Inflection Advisors

Check more sample of Student Loan Repayment Tax Deduction below

Is My Business Loan Repayment Tax Deductible IIFL Finance

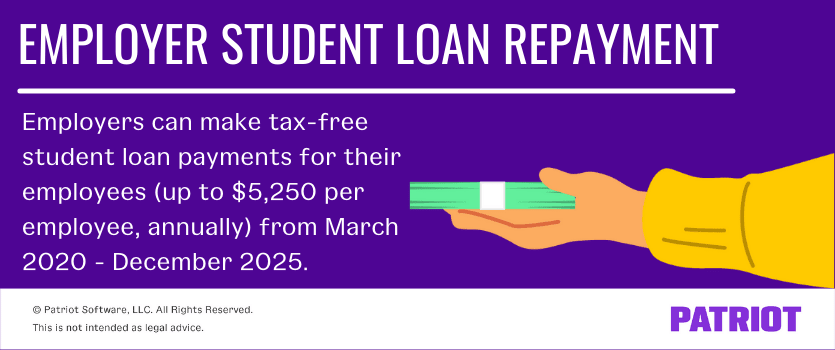

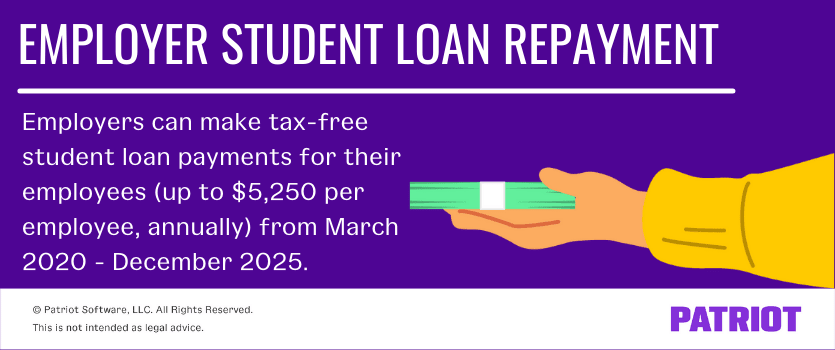

Employers Can Pay Off Student Loans For Employees INFOLEARNERS

Retirement Planning Inflection Advisors

Student Loan Interest Tax Deduction 2023

Debt Management Inflection Advisors

Stimulus Bill Extends Tax Free Status Of Employer Sponsored Student

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during

https://www.investopedia.com/terms/s/slid.asp

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student

Student Loan Interest Tax Deduction 2023

Employers Can Pay Off Student Loans For Employees INFOLEARNERS

Debt Management Inflection Advisors

Stimulus Bill Extends Tax Free Status Of Employer Sponsored Student

Student Loan Interest Tax Deduction 2023

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

/GettyImages-547124465-56a0a4fe3df78cafdaa38e3d.jpg)

Student Loan Interest Deduction Definition

Pin On Hist rias Foda