In this age of technology, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses such as creative projects or simply to add an element of personalization to your area, Sukanya Samriddhi Yojana Scheme Tax Benefit have proven to be a valuable resource. We'll take a dive into the world of "Sukanya Samriddhi Yojana Scheme Tax Benefit," exploring their purpose, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Sukanya Samriddhi Yojana Scheme Tax Benefit Below

Sukanya Samriddhi Yojana Scheme Tax Benefit

Sukanya Samriddhi Yojana Scheme Tax Benefit -

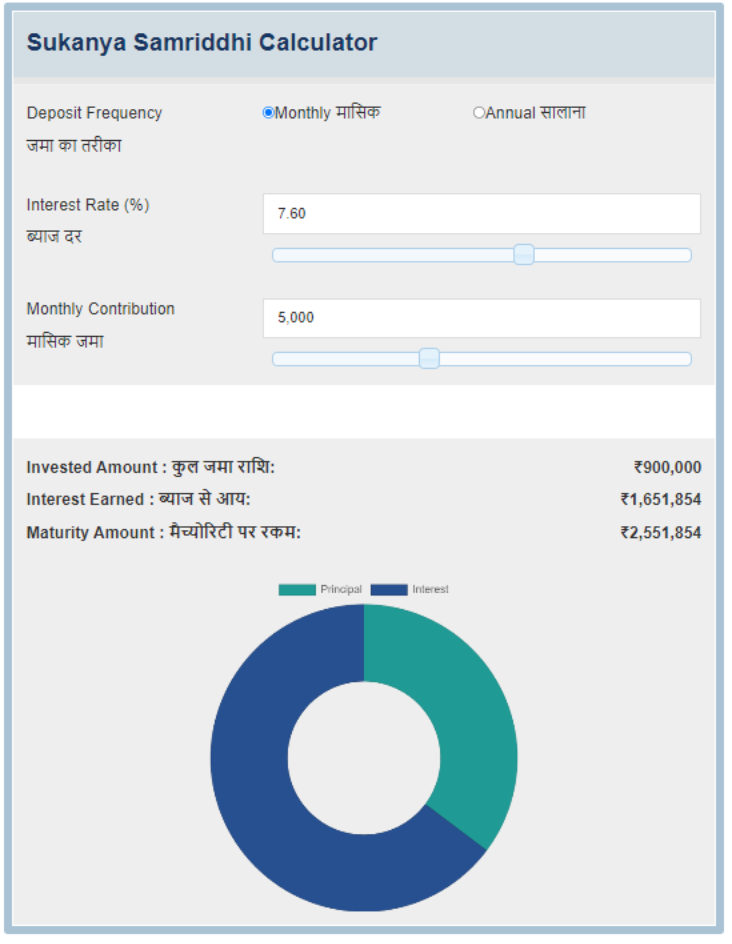

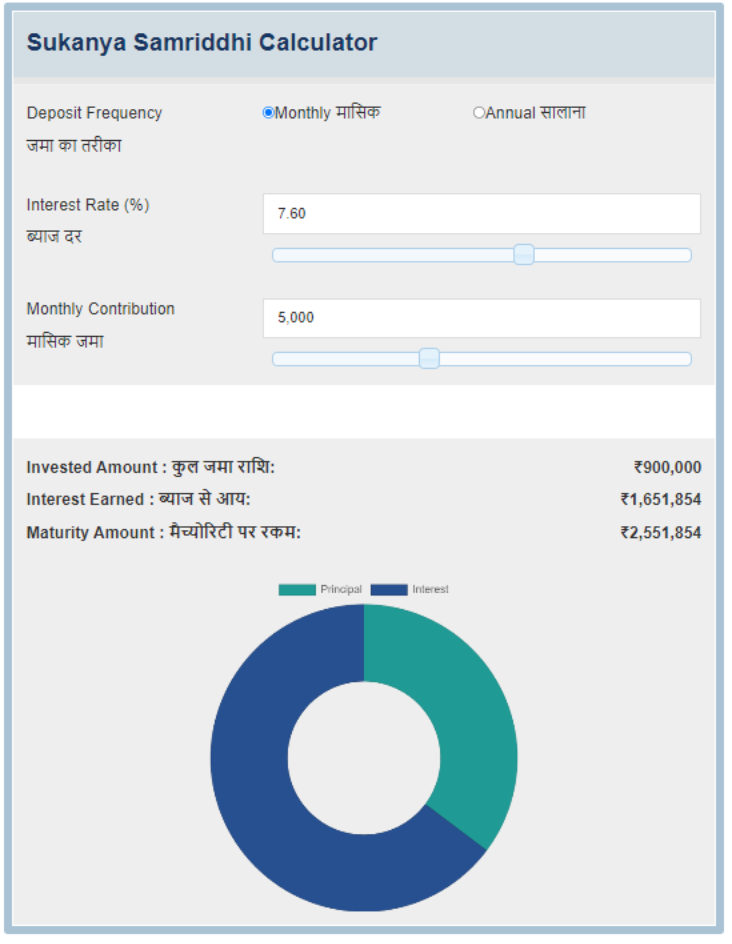

Tax benefits available in the Sukanya Samriddhi Yojana Currently SSY offers the highest tax free return with sovereign guarantee and comes with the exempt exempt exempt EEE status The annual deposit

Your investments towards Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act Deductions of up to 1 5 lakhs are allowed Should you choose to invest 1 5 lakh in the scheme

Sukanya Samriddhi Yojana Scheme Tax Benefit cover a large range of downloadable, printable materials available online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and many more. One of the advantages of Sukanya Samriddhi Yojana Scheme Tax Benefit lies in their versatility as well as accessibility.

More of Sukanya Samriddhi Yojana Scheme Tax Benefit

What Is The Benefit Of Sukanya Samriddhi Yojana Scheme

What Is The Benefit Of Sukanya Samriddhi Yojana Scheme

Sukanya Samriddhi Yojana qualifies for exemptions up to Rs 1 5 lakh under Section 80C of the Income Tax Act Also 80C deductions are not applicable if you choose the new regime The interest accrued on the maturity

Sukanya Samriddhi Scheme falls under the EEE Exempt Exempt Exempt tax category which means an investor is not liable to pay tax at all on three levels investment earning and

Sukanya Samriddhi Yojana Scheme Tax Benefit have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Personalization It is possible to tailor printing templates to your own specific requirements whether you're designing invitations planning your schedule or decorating your home.

-

Educational Value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, which makes them an essential tool for parents and educators.

-

Easy to use: Quick access to various designs and templates cuts down on time and efforts.

Where to Find more Sukanya Samriddhi Yojana Scheme Tax Benefit

Sukanya Samriddhi Yojana Eligibility Tax Benefits Interest Rate

Sukanya Samriddhi Yojana Eligibility Tax Benefits Interest Rate

Tax Benefit under Section 80C Payment on maturity to girl child Interest payment even after maturity if account is not closed Transferable anywhere in India Even girl child can operate

Sukanya Samriddhi Yojana scheme is eligible for tax deductions under section 80C Similar to other tax saving options like EPF PPF and ELSS this scheme offers high tax returns and comes under Exemption

After we've peaked your interest in Sukanya Samriddhi Yojana Scheme Tax Benefit, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Sukanya Samriddhi Yojana Scheme Tax Benefit for different reasons.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad variety of topics, including DIY projects to planning a party.

Maximizing Sukanya Samriddhi Yojana Scheme Tax Benefit

Here are some unique ways create the maximum value use of Sukanya Samriddhi Yojana Scheme Tax Benefit:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Sukanya Samriddhi Yojana Scheme Tax Benefit are an abundance of innovative and useful resources that cater to various needs and desires. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the world of Sukanya Samriddhi Yojana Scheme Tax Benefit to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can print and download these materials for free.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted in use. Make sure to read the terms and regulations provided by the designer.

-

How can I print printables for free?

- Print them at home using your printer or visit any local print store for top quality prints.

-

What program will I need to access printables free of charge?

- A majority of printed materials are in PDF format. These can be opened using free programs like Adobe Reader.

Sukanya Samriddhi Yojana And Tax Benefits

Sukanya Samriddhi Yojana SSY Interest Rate 2023 Tax

Check more sample of Sukanya Samriddhi Yojana Scheme Tax Benefit below

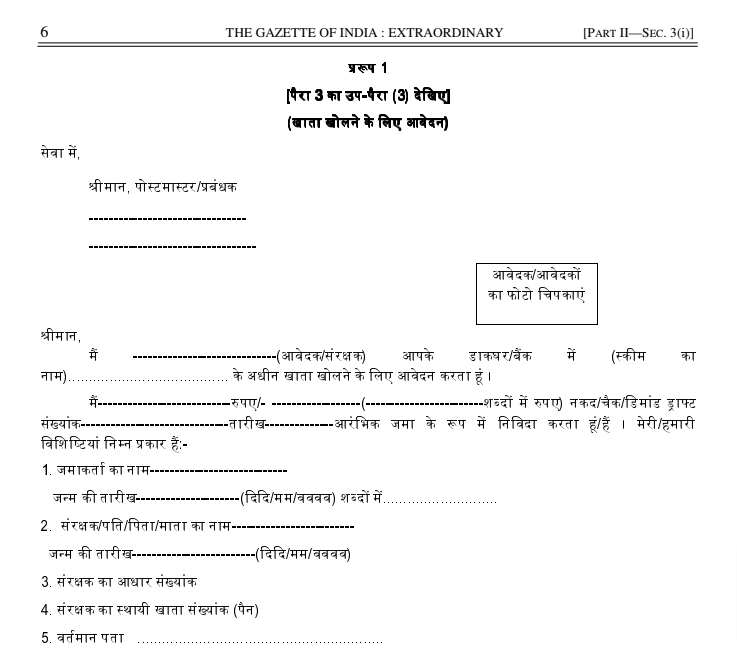

PDF Sukanya Samriddhi Yojana Scheme Application Form PDF Govtempdiary

Government Scheme Sukanya Samriddhi Yojana Is Offering 3 Times Return

Sukanya Samriddhi Yojana Account Interest Tax Benefits Fintrakk

2023 Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana 2020 New Rules Give Your Daughter A Safe

Sukanya Samridhi Yojana Slogans On Nature Clean India Posters Psd

https://www.etmoney.com › ... › sukany…

Your investments towards Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act Deductions of up to 1 5 lakhs are allowed Should you choose to invest 1 5 lakh in the scheme

https://taxguru.in › income-tax › sukany…

1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest accrued on the investment is also eligible for tax exemption 3

Your investments towards Sukanya Samriddhi Yojana are eligible for tax deductions under Section 80C of the Income Tax Act Deductions of up to 1 5 lakhs are allowed Should you choose to invest 1 5 lakh in the scheme

1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest accrued on the investment is also eligible for tax exemption 3

2023 Sukanya Samriddhi Yojana

Government Scheme Sukanya Samriddhi Yojana Is Offering 3 Times Return

Sukanya Samriddhi Yojana 2020 New Rules Give Your Daughter A Safe

Sukanya Samridhi Yojana Slogans On Nature Clean India Posters Psd

Sukanya Samriddhi Yojana 2 11

Sukanya Samriddhi Yojana Know Investment Returns Interest Rate

Sukanya Samriddhi Yojana Know Investment Returns Interest Rate

Sukanya Samriddhi Yojana SSY Guide With Revised Rules In Scheme