In this day and age where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education such as creative projects or simply adding a personal touch to your space, Super Contributions Tax Rebate For Low Income Earners are a great source. In this article, we'll dive in the world of "Super Contributions Tax Rebate For Low Income Earners," exploring what they are, where to find them and how they can add value to various aspects of your life.

Get Latest Super Contributions Tax Rebate For Low Income Earners Below

Super Contributions Tax Rebate For Low Income Earners

Super Contributions Tax Rebate For Low Income Earners -

Web If you re eligible for a low income super tax offset the government will automatically refund the tax you paid on any before tax contributions like salary sacrifice and employer

Web If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO

Printables for free cover a broad selection of printable and downloadable material that is available online at no cost. These resources come in various forms, like worksheets templates, coloring pages and more. The value of Super Contributions Tax Rebate For Low Income Earners lies in their versatility and accessibility.

More of Super Contributions Tax Rebate For Low Income Earners

Council Tax Rebates For Low Income Earners Lowesrebate

Council Tax Rebates For Low Income Earners Lowesrebate

Web 22 lignes nbsp 0183 32 From 1 July 2017 the government introduced the low income super tax offset LISTO to assist low income earners to save for their retirement If you earn an

Web 13 juin 2023 nbsp 0183 32 That means if you earn under the lower threshold of 42 016 you ll need to add 1 000 of your own money to your super to get the maximum 500 co contribution from the government That entitlement

Super Contributions Tax Rebate For Low Income Earners have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize the templates to meet your individual needs such as designing invitations and schedules, or even decorating your home.

-

Educational Impact: Printing educational materials for no cost provide for students of all ages, which makes these printables a powerful source for educators and parents.

-

The convenience of Access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Super Contributions Tax Rebate For Low Income Earners

Fair Go For Low Income Earners

Fair Go For Low Income Earners

Web 12 nov 2021 nbsp 0183 32 The low income super tax offset will pay up to 500 a year into your chosen super fund provided you meet certain eligibility criteria They include that you must earn 37 000 or less in a financial year and

Web The government will pay 15 of the before tax contributions made into your super account back into your super up to a maximum of 500 per financial year If you re

We hope we've stimulated your curiosity about Super Contributions Tax Rebate For Low Income Earners We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Super Contributions Tax Rebate For Low Income Earners designed for a variety uses.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Great for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Super Contributions Tax Rebate For Low Income Earners

Here are some unique ways ensure you get the very most of Super Contributions Tax Rebate For Low Income Earners:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Super Contributions Tax Rebate For Low Income Earners are an abundance filled with creative and practical information that meet a variety of needs and preferences. Their availability and versatility make them an essential part of both professional and personal lives. Explore the vast array of Super Contributions Tax Rebate For Low Income Earners today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these resources at no cost.

-

Do I have the right to use free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may have restrictions in their usage. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print Super Contributions Tax Rebate For Low Income Earners?

- Print them at home with either a printer at home or in a local print shop to purchase top quality prints.

-

What program do I require to view Super Contributions Tax Rebate For Low Income Earners?

- Most PDF-based printables are available in PDF format. These can be opened with free programs like Adobe Reader.

WalletHub Tax Burdens For Low income Earners In Each State

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Check more sample of Super Contributions Tax Rebate For Low Income Earners below

Maximum Super Contribution Base Ento

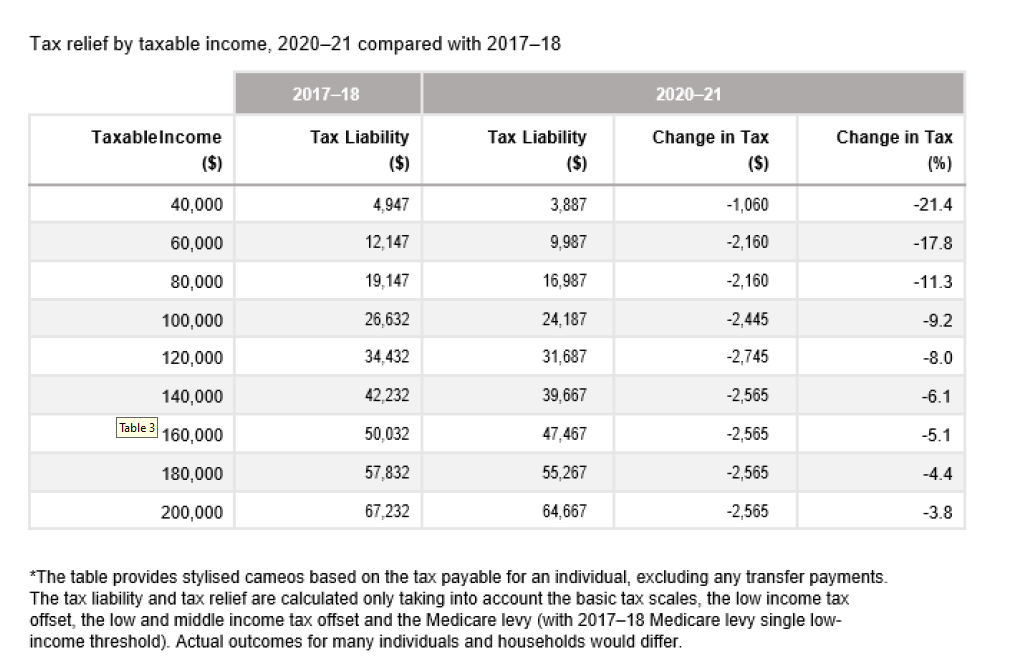

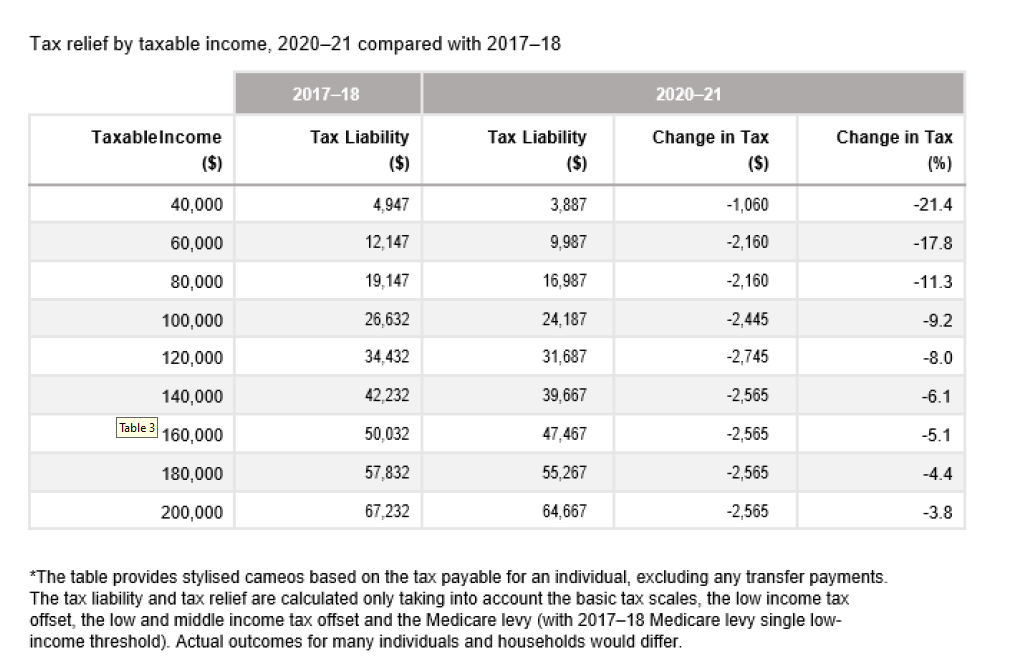

Budget 2020 Individuals Tax Accounting Adelaide

How To Claim Super Contributions On Tax Returns SMB Accounting

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

DiZoglio Criticizes State Tax Rebate Plan Because It Leaves Out Lowest

https://www.ato.gov.au/.../Low-income-super-tax-offset

Web If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO

https://www.ato.gov.au/.../2022/In-detail/Government-super-contributions

Web Eligibility for low income super tax offset You may be eligible for a low income super tax offset if all of the following apply to you your adjusted taxable income ATI was less

Web If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO

Web Eligibility for low income super tax offset You may be eligible for a low income super tax offset if all of the following apply to you your adjusted taxable income ATI was less

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

Budget 2020 Individuals Tax Accounting Adelaide

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

DiZoglio Criticizes State Tax Rebate Plan Because It Leaves Out Lowest

Is My Super Contribution Tax Deductible Section 290

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

After Tax Super Contributions How Much Can I Contribute