Today, where screens have become the dominant feature of our lives and the appeal of physical printed objects hasn't waned. Be it for educational use as well as creative projects or just adding the personal touch to your home, printables for free have become an invaluable resource. For this piece, we'll dive in the world of "Supplemental Estate Tax Return Statute Of Limitations," exploring the benefits of them, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Supplemental Estate Tax Return Statute Of Limitations Below

Supplemental Estate Tax Return Statute Of Limitations

Supplemental Estate Tax Return Statute Of Limitations -

Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty

If a supplemental estate tax return is filed reporting property not previously reported on an estate tax return the executor similarly has 30 days from the filing date of the supplemental estate tax return to file

Supplemental Estate Tax Return Statute Of Limitations include a broad collection of printable content that can be downloaded from the internet at no cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. The great thing about Supplemental Estate Tax Return Statute Of Limitations is their versatility and accessibility.

More of Supplemental Estate Tax Return Statute Of Limitations

STATUTE OF LIMITATIONS FOR PROMISSORY NOTES AND DEFICIENCY BALANCES

STATUTE OF LIMITATIONS FOR PROMISSORY NOTES AND DEFICIENCY BALANCES

To start the statute of limitation a gift must be adequately disclosed on the gift tax return Whenever a gift is made with assets that are hard to value e g a partnership

The general rule regarding the filing of tax returns is that the statute of limitations for assessment is three years from the date that the return was filed the 3 Year

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: There is the possibility of tailoring printables to fit your particular needs be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Worth: These Supplemental Estate Tax Return Statute Of Limitations can be used by students of all ages, making them an essential instrument for parents and teachers.

-

Accessibility: Quick access to a plethora of designs and templates can save you time and energy.

Where to Find more Supplemental Estate Tax Return Statute Of Limitations

4 Ways To Defend Price In A Negotiation Sales Marketing Negotiation

4 Ways To Defend Price In A Negotiation Sales Marketing Negotiation

The statute of limitations on claiming a refund of tax is generally three years after the date of filing or two years after the date of payment whichever is later You

Return to annual gift tax returns in section 442 a 4 C of the Economic Recovery Tax Act of 1981 Public Law 97 34 Prior to 1977 it was common to take

If we've already piqued your curiosity about Supplemental Estate Tax Return Statute Of Limitations and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Supplemental Estate Tax Return Statute Of Limitations for various reasons.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide array of topics, ranging all the way from DIY projects to party planning.

Maximizing Supplemental Estate Tax Return Statute Of Limitations

Here are some creative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Supplemental Estate Tax Return Statute Of Limitations are a treasure trove filled with creative and practical information which cater to a wide range of needs and desires. Their accessibility and versatility make them a valuable addition to both professional and personal lives. Explore the endless world of Supplemental Estate Tax Return Statute Of Limitations today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print these items for free.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright problems with Supplemental Estate Tax Return Statute Of Limitations?

- Some printables may come with restrictions concerning their use. Make sure to read these terms and conditions as set out by the designer.

-

How can I print Supplemental Estate Tax Return Statute Of Limitations?

- Print them at home using your printer or visit any local print store for premium prints.

-

What program must I use to open printables for free?

- The majority of printables are in PDF format, which is open with no cost software like Adobe Reader.

Statute Of Limitations On Gift Tax Returns Orlando Tax Attorney

What Is The IRS Statute Of Limitations On Tax Debt

Check more sample of Supplemental Estate Tax Return Statute Of Limitations below

Is There A Statute Of Limitations On IRS Tax Liens

Statute Of Limitations Criminal Tax Blog

Statute Of Limitations On Filing Tax Refund Claims

Tax Evasion Statute Of Limitations Her Lawyer

Gift Tax Return For Wrong Year Starts IRS Statute Of Limitations

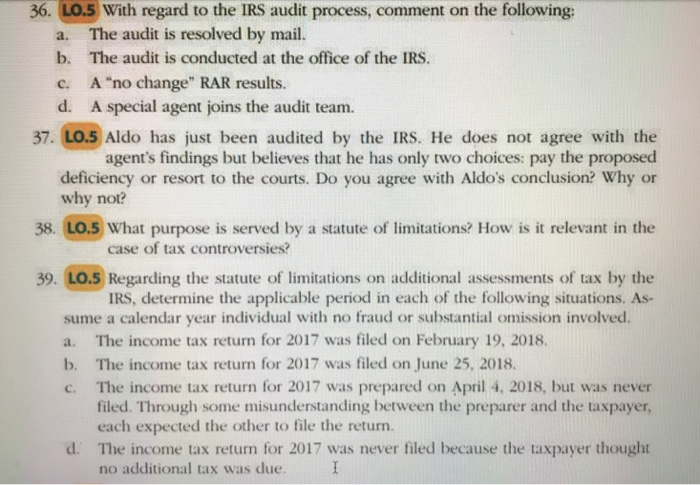

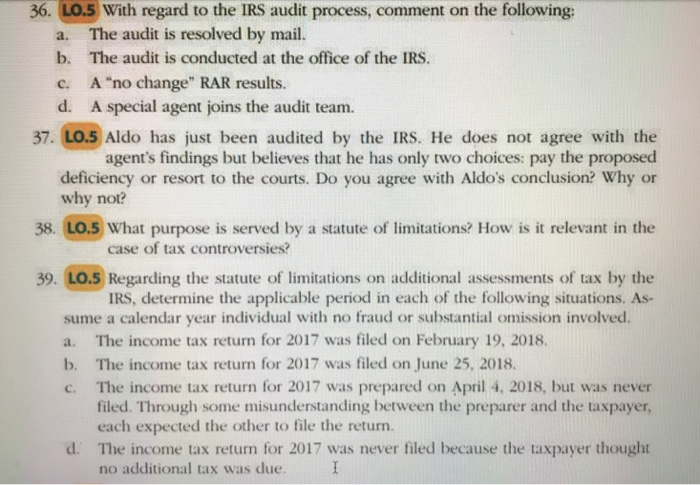

Solved 36 LO 5 With Regard To The IRS Audit Process Chegg

https://www.journalofaccountancy.co…

If a supplemental estate tax return is filed reporting property not previously reported on an estate tax return the executor similarly has 30 days from the filing date of the supplemental estate tax return to file

https://www.irs.gov/irm/part4/irm_04-025-007

Statute of Limitations The statute of limitations on assessment for IRC 6694 a and IRC 6695 expires three years from the date the related return or claim for

If a supplemental estate tax return is filed reporting property not previously reported on an estate tax return the executor similarly has 30 days from the filing date of the supplemental estate tax return to file

Statute of Limitations The statute of limitations on assessment for IRC 6694 a and IRC 6695 expires three years from the date the related return or claim for

Tax Evasion Statute Of Limitations Her Lawyer

Statute Of Limitations Criminal Tax Blog

Gift Tax Return For Wrong Year Starts IRS Statute Of Limitations

Solved 36 LO 5 With Regard To The IRS Audit Process Chegg

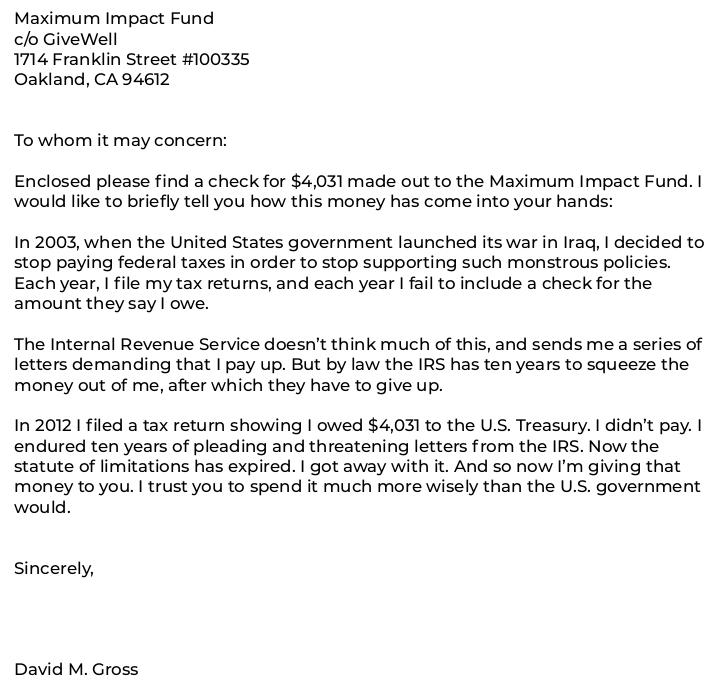

I m Redirecting My Taxes To The Maximum Impact Fund TPL

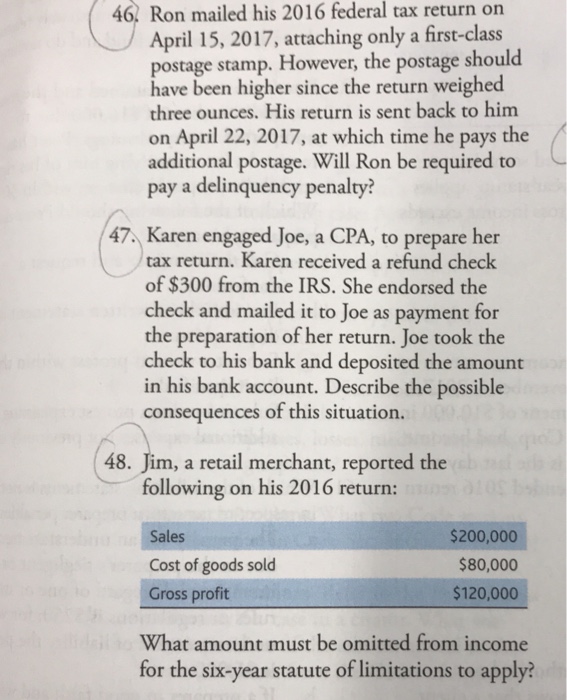

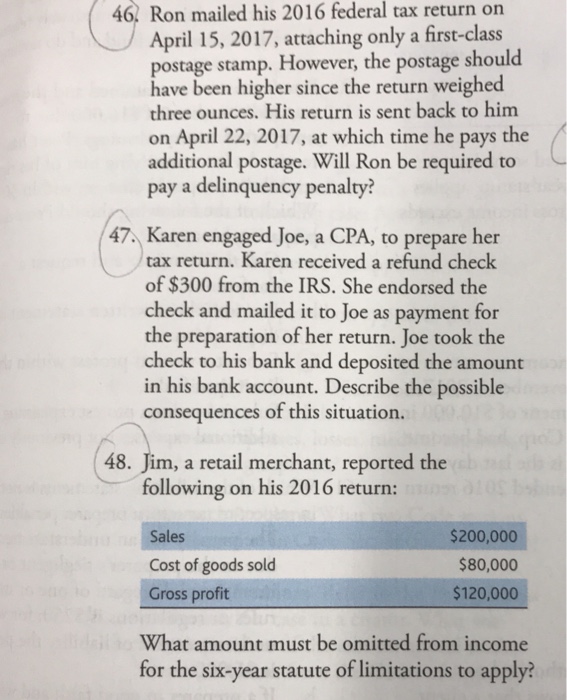

Solved 46 Ron Mailed His 2016 Federal Tax Return On April Chegg

Solved 46 Ron Mailed His 2016 Federal Tax Return On April Chegg

What Is The Statute Of Limitations For Federal Tax Fraud