In this day and age where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. For educational purposes such as creative projects or simply to add the personal touch to your home, printables for free are now an essential resource. We'll take a dive to the depths of "Supplemental Standard Property Tax Deduction," exploring what they are, where they are, and how they can be used to enhance different aspects of your daily life.

Get Latest Supplemental Standard Property Tax Deduction Below

Supplemental Standard Property Tax Deduction

Supplemental Standard Property Tax Deduction -

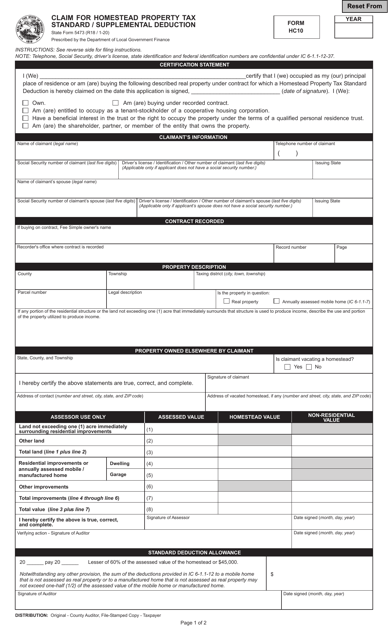

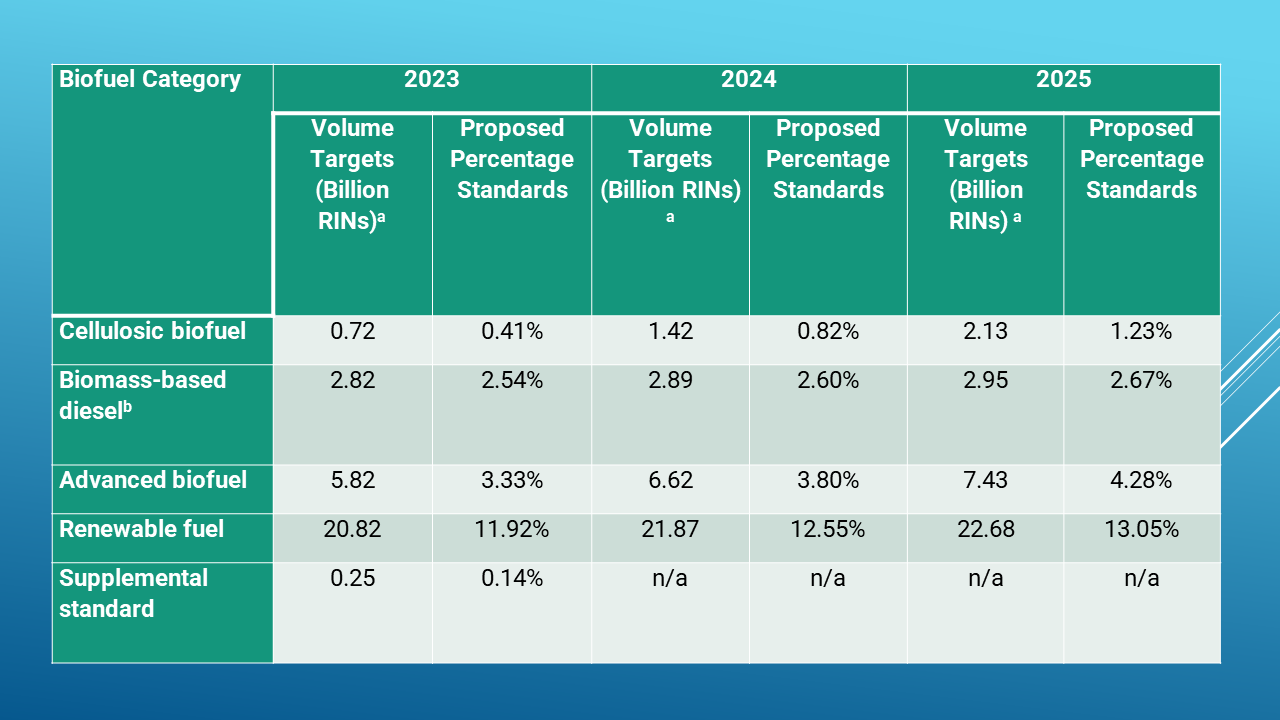

Supplemental Homestead Deduction 6 1 1 12 37 5 Equal to the sum of the following 1 35 of the homestead assessed value after the standard deduction has been applied that is less than 600 000 2 25 of the homestead assessed value after the standard deduction has been applied that is more than 600 000

Indiana Code 6 1 1 12 37 5 Supplemental deduction for homesteads Current as of 2023 Check for updates Other versions Sec 37 5 a A person who is entitled to a standard deduction from the assessed value of property under section 37 of this chapter is also entitled to receive a supplemental deduction from the assessed

Printables for free include a vast array of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and many more. The benefit of Supplemental Standard Property Tax Deduction is in their variety and accessibility.

More of Supplemental Standard Property Tax Deduction

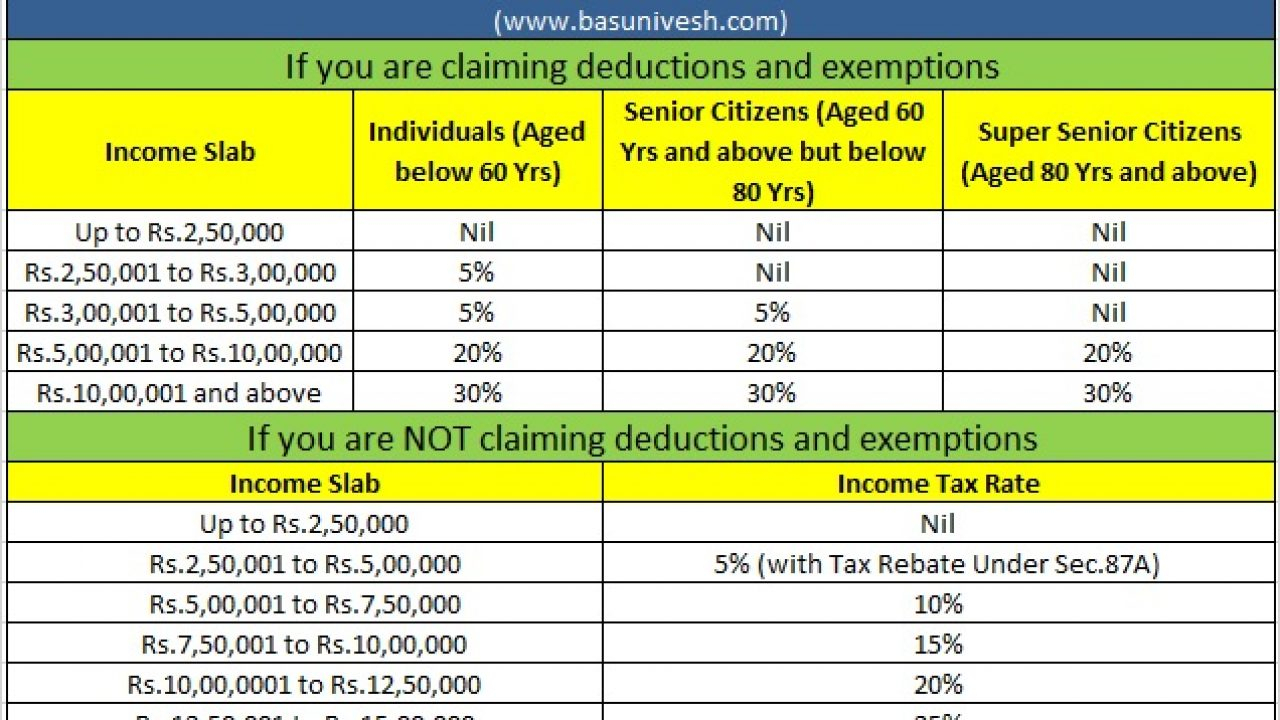

The Standard Deduction And Itemized Deductions After Tax Reform

The Standard Deduction And Itemized Deductions After Tax Reform

Homestead deduction should remain on the property for the 2019 pay 2020 property taxes and be removed for 2020 pay 2021 unless a new owner purchases the property and meets all eligibility requirements including filing for his own homestead standard deduction for 2020 pay 2021

The homestead supplemental credit is calculated as a 35 deduction from the assessed value of the property after the standard deduction has been subtracted For assessed values greater than 600 000 a 35 deduction will be applied for the 1st 600 000 of assessed value while a 25 deduction will be applied to the remaining assessed value

Supplemental Standard Property Tax Deduction have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization We can customize print-ready templates to your specific requirements, whether it's designing invitations planning your schedule or decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages. This makes these printables a powerful tool for teachers and parents.

-

It's easy: Instant access to an array of designs and templates cuts down on time and efforts.

Where to Find more Supplemental Standard Property Tax Deduction

Hecht Group Who Pays Supplemental Property Tax

Hecht Group Who Pays Supplemental Property Tax

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040 If you itemize you can t take the standard deduction This section explains what expenses you can deduct as a homeowner

Your standard homestead deduction is 45 000 and your supplemental deduction is 47 250 Without any deduction the tax rate would be applied to the AV of 180 000 But with the homestead deduction the tax bill is calculated based on a net AV of 87 750

Now that we've ignited your curiosity about Supplemental Standard Property Tax Deduction Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Supplemental Standard Property Tax Deduction for various objectives.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of topics, from DIY projects to party planning.

Maximizing Supplemental Standard Property Tax Deduction

Here are some ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Supplemental Standard Property Tax Deduction are an abundance of fun and practical tools that meet a variety of needs and desires. Their accessibility and flexibility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the world of Supplemental Standard Property Tax Deduction today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can print and download these documents for free.

-

Can I download free printables to make commercial products?

- It's contingent upon the specific terms of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with Supplemental Standard Property Tax Deduction?

- Some printables could have limitations on use. Check the terms and conditions provided by the designer.

-

How do I print Supplemental Standard Property Tax Deduction?

- You can print them at home with your printer or visit a print shop in your area for the highest quality prints.

-

What program must I use to open printables for free?

- A majority of printed materials are in PDF format, which is open with no cost software such as Adobe Reader.

Federal Supplemental Tax Rate 2021 Federal Withholding Tables 2021

ANSI SCTE 231 Pdf Free Download ANSI Standards

Check more sample of Supplemental Standard Property Tax Deduction below

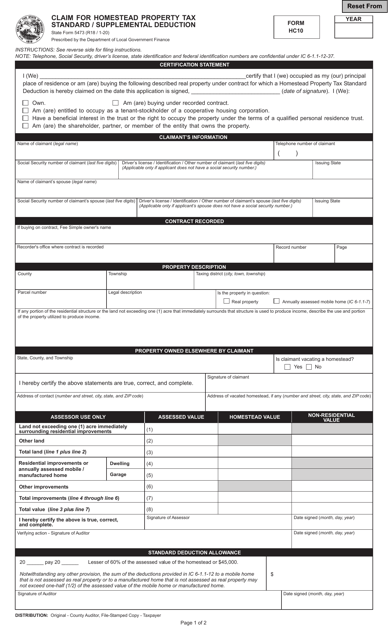

EPA s Proposed Volume Standards For 2020 2021 And 2022 Christianson

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

PEO Central Oregon Chapter News And Meeting Announcement Sign Up For

State Form 5473 HC10 Download Fillable PDF Or Fill Online Claim For

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Printable Itemized Deductions Worksheet

https://www.lawserver.com/law/state/indiana/in...

Indiana Code 6 1 1 12 37 5 Supplemental deduction for homesteads Current as of 2023 Check for updates Other versions Sec 37 5 a A person who is entitled to a standard deduction from the assessed value of property under section 37 of this chapter is also entitled to receive a supplemental deduction from the assessed

https://www.in.gov/dlgf/deductions-property-tax

Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property Application for deductions must be completed and dated not later than December 31 annually Taxpayers do not need to reapply for deductions annually

Indiana Code 6 1 1 12 37 5 Supplemental deduction for homesteads Current as of 2023 Check for updates Other versions Sec 37 5 a A person who is entitled to a standard deduction from the assessed value of property under section 37 of this chapter is also entitled to receive a supplemental deduction from the assessed

Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property Application for deductions must be completed and dated not later than December 31 annually Taxpayers do not need to reapply for deductions annually

State Form 5473 HC10 Download Fillable PDF Or Fill Online Claim For

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Printable Itemized Deductions Worksheet

A First Look At EPA s RFS2 Proposal For 2023 2025 Transport Energy

Free Of Charge Creative Commons Real Estate Property Tax Deduction

Free Of Charge Creative Commons Real Estate Property Tax Deduction

How To Deduct Property Taxes On IRS Tax Forms