In this day and age in which screens are the norm, the charm of tangible, printed materials hasn't diminished. Be it for educational use project ideas, artistic or just adding personal touches to your space, Tax Benefit In Scss are now a vital resource. For this piece, we'll take a dive into the world of "Tax Benefit In Scss," exploring what they are, how to find them and how they can enrich various aspects of your life.

Get Latest Tax Benefit In Scss Below

Tax Benefit In Scss

Tax Benefit In Scss -

Senior citizens can claim a tax deduction of up to Rs 1 5 lakh for investments in SCSS under Section 80 C of the Income Tax Act 1961 This tax benefit

Tax Benefits Investments made in the SCSS are eligible for tax benefits under Section 80C of the Income Tax Act up to a limit of

Tax Benefit In Scss offer a wide selection of printable and downloadable documents that can be downloaded online at no cost. They are available in numerous designs, including worksheets templates, coloring pages, and more. The attraction of printables that are free is their flexibility and accessibility.

More of Tax Benefit In Scss

Senior Citizen Savings Scheme SCSS Eligibility Interest Rate Tax

Senior Citizen Savings Scheme SCSS Eligibility Interest Rate Tax

Tax Benefit Under section 80C of the Income Tax Act SCSS is eligible for a tax deduction of up to Rs 1 5 Lakh per annum Simple Investment Process The

Fixed Income The interest rate declared during the time of investment remains fixed throughout the maturity tenure and is not affected by alterations in a later quarter

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: You can tailor printing templates to your own specific requirements whether you're designing invitations to organize your schedule or even decorating your home.

-

Educational Use: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them an essential tool for parents and educators.

-

Convenience: The instant accessibility to a myriad of designs as well as templates will save you time and effort.

Where to Find more Tax Benefit In Scss

SCSS 1

SCSS 1

SCSS depositors enjoy tax benefit of Section 80C of the Income Tax Act which allows them to categorize the scheme s investment under the personal tax exemption limit of INR 1 5 lakh per annum

This article provides a comprehensive understanding of the latest SCSS rules covering eligibility criteria investment options extension of tenure and income tax

If we've already piqued your interest in Tax Benefit In Scss Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Tax Benefit In Scss for all reasons.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Tax Benefit In Scss

Here are some new ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Benefit In Scss are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them a wonderful addition to any professional or personal life. Explore the vast world of Tax Benefit In Scss to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes, they are! You can print and download these materials for free.

-

Can I use the free printables for commercial purposes?

- It's based on the conditions of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright issues when you download Tax Benefit In Scss?

- Certain printables could be restricted in their usage. Be sure to check the terms and regulations provided by the designer.

-

How can I print printables for free?

- Print them at home using the printer, or go to a local print shop to purchase the highest quality prints.

-

What program is required to open printables that are free?

- Many printables are offered with PDF formats, which is open with no cost software, such as Adobe Reader.

Sass Variables Variables In SCSS YouTube

SCSS Calculator Excel Senior Citizen Saving Scheme VIDEO FinCalC Blog

Check more sample of Tax Benefit In Scss below

Senior Citizens Savings Scheme SCSS Interest Rate Kuvera

BUDGET 2023 HIGHLIGHTS I BENEFIT TO SENIOR CITIZEN SAVING SCHEME SCSS

Life Insurance And Income Tax Benefit With BIMTech In Hindi YouTube

17 Best Income Tax Saving Schemes Plans In 2023

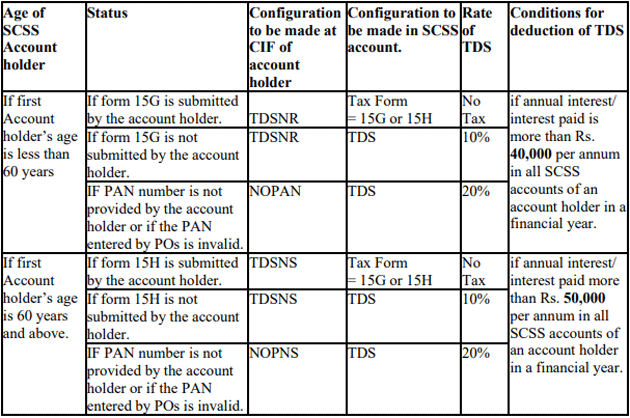

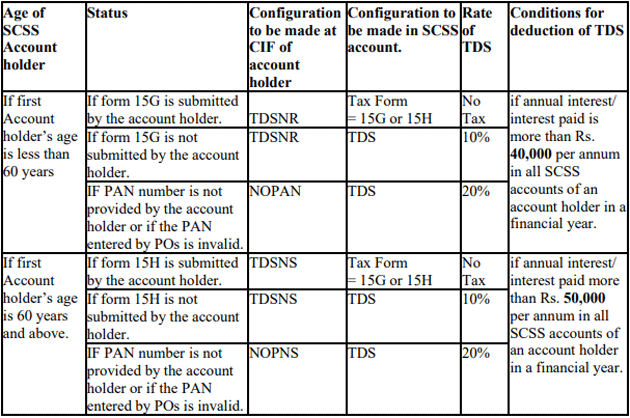

What Are The Rules Of TDS Deduction In Senior Citizens Savings Scheme

Bank Post Office Senior Citizen Savings Scheme SCSS 2021 Benefit

https://tax2win.in/guide/senior-citizen-saving …

Tax Benefits Investments made in the SCSS are eligible for tax benefits under Section 80C of the Income Tax Act up to a limit of

https://m.economictimes.com/wealth/tax/what-are...

Section 80C of the Income tax Act 1961 allows for a deduction for contributions to SCSS This tax benefit however is limited to the present annual limit

Tax Benefits Investments made in the SCSS are eligible for tax benefits under Section 80C of the Income Tax Act up to a limit of

Section 80C of the Income tax Act 1961 allows for a deduction for contributions to SCSS This tax benefit however is limited to the present annual limit

17 Best Income Tax Saving Schemes Plans In 2023

BUDGET 2023 HIGHLIGHTS I BENEFIT TO SENIOR CITIZEN SAVING SCHEME SCSS

What Are The Rules Of TDS Deduction In Senior Citizens Savings Scheme

Bank Post Office Senior Citizen Savings Scheme SCSS 2021 Benefit

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

Senior Citizen Savings Scheme SCSS Interest Rate 2023 Tax Benefits

Senior Citizen Savings Scheme SCSS Interest Rate 2023 Tax Benefits

Is A Tax Benefit Available For Opening A New SCSS Account Value Research