In this day and age where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses, creative projects, or just adding some personal flair to your space, Tax Benefit On Charity Donations India are a great resource. Through this post, we'll take a dive deeper into "Tax Benefit On Charity Donations India," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Tax Benefit On Charity Donations India Below

Tax Benefit On Charity Donations India

Tax Benefit On Charity Donations India -

Verkko 10 hein 228 k 2022 nbsp 0183 32 iStock All NGOs or charitable institutions do not automatically qualify to provide their donors with a deduction u s 80G either Only those organizations approved by the Commissioner of Income

Verkko 28 jouluk 2020 nbsp 0183 32 Whenever someone donates to a charity they become eligible for Tax benefits under Section 80G of Income Tax Act However there are a few things one should keep in mind to become eligible for these tax benefits PS Find out How to avail the tax benefits in the last paragraph

Printables for free include a vast range of printable, free material that is available online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and many more. The value of Tax Benefit On Charity Donations India is in their versatility and accessibility.

More of Tax Benefit On Charity Donations India

Charity Donation Flyer Free PSD PsdDaddy

Charity Donation Flyer Free PSD PsdDaddy

Verkko 30 jouluk 2023 nbsp 0183 32 Both company and non company can claim a deduction under Section 80G of the Income Tax Act for donations made to eligible charitable institutions or funds The following persons can claim deduction under section 80G Individuals Companies Firms Hindu Undivided Firm HUF Non Resident Indian NRI Any other person

Verkko Not only does it benefit society but it also provides tax benefits to donors In India Section 80G of the Income Tax Act allows you to claim deductions on your income tax returns for donations made to charity This article will explore this 80G deduction tax benefits and how they can be availed

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization This allows you to modify printed materials to meet your requirements whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making these printables a powerful source for educators and parents.

-

The convenience of Instant access to many designs and templates, which saves time as well as effort.

Where to Find more Tax Benefit On Charity Donations India

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Verkko Individuals who donate to a registered NGO in India can claim a tax deduction of up to 50 of the donated amount under Section 80G of the Income Tax Act This deduction is available for both individuals and companies Donations to Specific Causes

Verkko 6 hein 228 k 2021 nbsp 0183 32 Any taxpayer individual or non individual who makes an eligible donation can avail the tax benefits subject to the limits and conditions of the Income Tax Act Mode of donation The donation must be made in monetary terms Donations up to Rs 2 000 can be made in cash but any amount above Rs 2 000 must be made

Now that we've ignited your interest in printables for free and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Tax Benefit On Charity Donations India for different goals.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Tax Benefit On Charity Donations India

Here are some fresh ways to make the most of Tax Benefit On Charity Donations India:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Tax Benefit On Charity Donations India are an abundance filled with creative and practical information for a variety of needs and passions. Their access and versatility makes them an essential part of your professional and personal life. Explore the plethora of Tax Benefit On Charity Donations India today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Benefit On Charity Donations India truly for free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printables for commercial use?

- It's based on the terms of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Tax Benefit On Charity Donations India?

- Certain printables may be subject to restrictions regarding their use. Be sure to read the terms and regulations provided by the designer.

-

How do I print Tax Benefit On Charity Donations India?

- Print them at home using any printer or head to a local print shop to purchase high-quality prints.

-

What program do I need to run printables that are free?

- The majority of printed documents are in the format of PDF, which can be opened using free software such as Adobe Reader.

Short Essay On Charity

How To Claim Tax Benefits On Home Loan Bleu Finance

Check more sample of Tax Benefit On Charity Donations India below

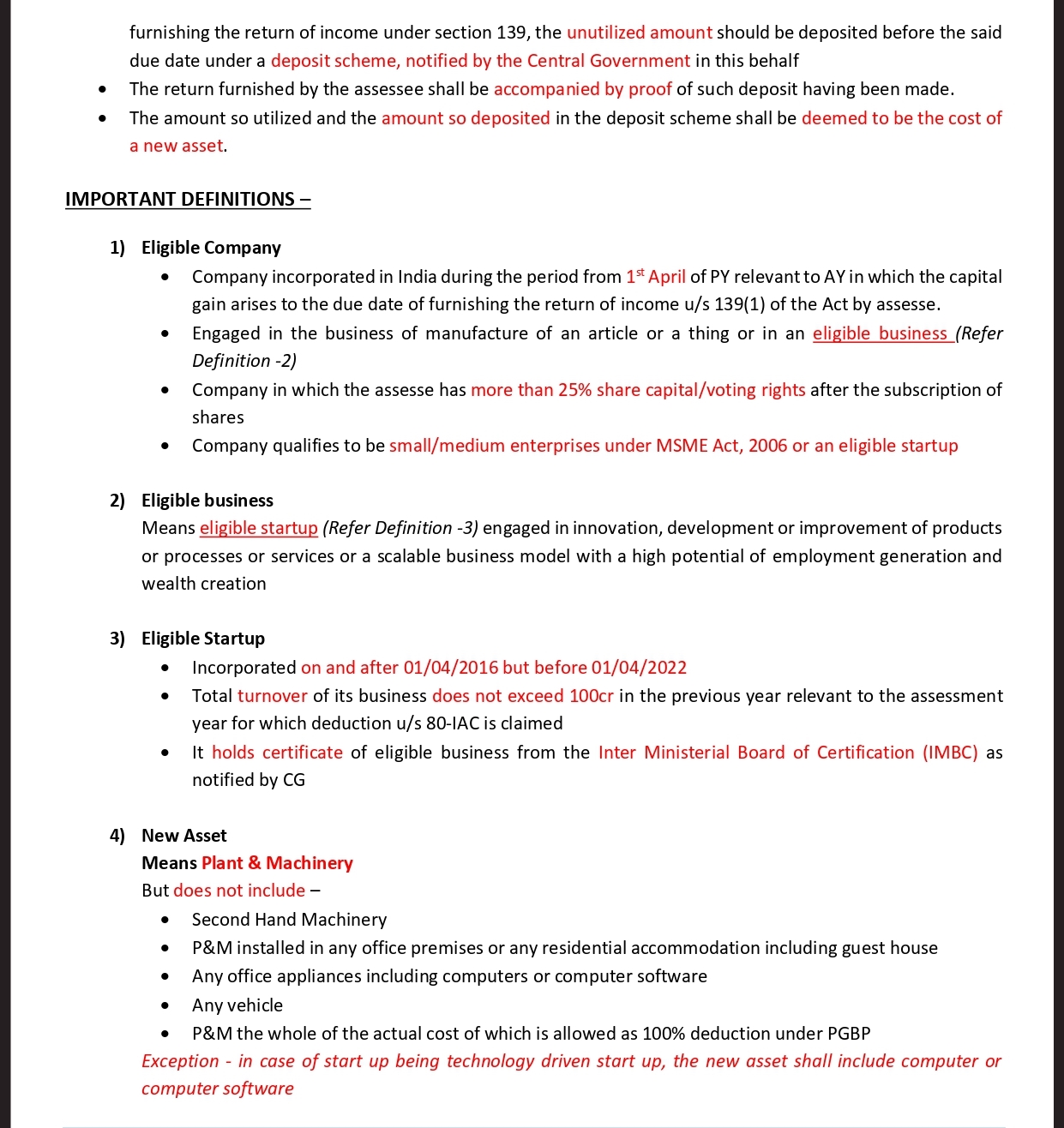

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Healthcare Donations CSR Projects India

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Political Parties Received Rs 11 234 Crore In Donations From Unknown

Report On Charity Donations Not Spent On Good Causes misleading

Charity Donation Card Template

https://serudsindia.org/tax-benefits-charity-india-2020

Verkko 28 jouluk 2020 nbsp 0183 32 Whenever someone donates to a charity they become eligible for Tax benefits under Section 80G of Income Tax Act However there are a few things one should keep in mind to become eligible for these tax benefits PS Find out How to avail the tax benefits in the last paragraph

https://economictimes.indiatimes.com/wealth/tax/check-before-you...

Verkko 16 helmik 2017 nbsp 0183 32 The tax benefits one forgoes by opting for the new tax regime include deductions under section 80C for a maximum of Rs 1 5 lakh claimed by investing in specified financial products section 80D for health insurance premium paid 80TTA for deduction on savings account interest earned from a bank or post office deduction

Verkko 28 jouluk 2020 nbsp 0183 32 Whenever someone donates to a charity they become eligible for Tax benefits under Section 80G of Income Tax Act However there are a few things one should keep in mind to become eligible for these tax benefits PS Find out How to avail the tax benefits in the last paragraph

Verkko 16 helmik 2017 nbsp 0183 32 The tax benefits one forgoes by opting for the new tax regime include deductions under section 80C for a maximum of Rs 1 5 lakh claimed by investing in specified financial products section 80D for health insurance premium paid 80TTA for deduction on savings account interest earned from a bank or post office deduction

Political Parties Received Rs 11 234 Crore In Donations From Unknown

Healthcare Donations CSR Projects India

Report On Charity Donations Not Spent On Good Causes misleading

Charity Donation Card Template

Charity Navigator Alphabetical Listing Charity Navigator Charity List

Pin On Charity

Pin On Charity

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits