In a world where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons as well as creative projects or just adding the personal touch to your area, Tax Benefit On Home Loan For Rented Property can be an excellent source. The following article is a dive into the sphere of "Tax Benefit On Home Loan For Rented Property," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Tax Benefit On Home Loan For Rented Property Below

Tax Benefit On Home Loan For Rented Property

Tax Benefit On Home Loan For Rented Property -

The government is supporting first time and main home buyers by increasing the Higher Rates for Additional Dwellings in Stamp Duty Land Tax on the purchases of second homes buy to let residential

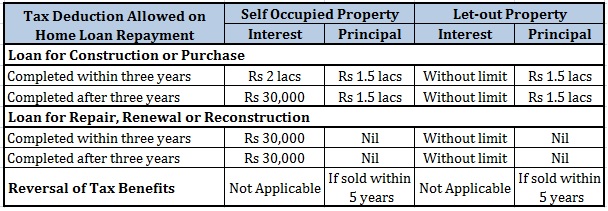

If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

Tax Benefit On Home Loan For Rented Property provide a diverse assortment of printable, downloadable material that is available online at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and much more. The value of Tax Benefit On Home Loan For Rented Property is their versatility and accessibility.

More of Tax Benefit On Home Loan For Rented Property

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Yes you can claim an income tax exemption on both the house rent allowance HRA and repayment of the home loan If you are living in a house on rent and servicing a home loan on another property even if both the properties are located in the same city you can claim tax benefits for both

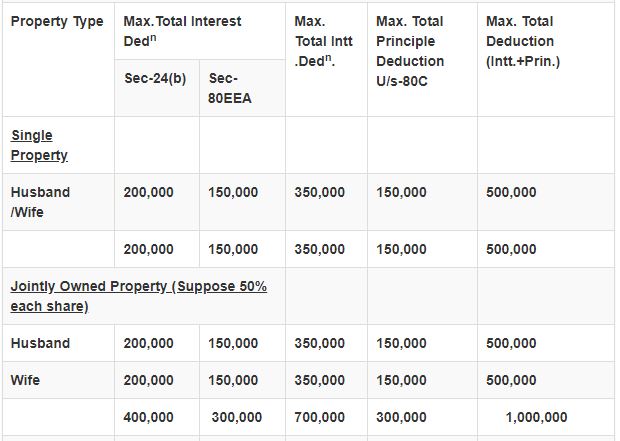

As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self occupied as well as vacant residential properties In case of let out or rented residential properties there no cap on tax deduction

The Tax Benefit On Home Loan For Rented Property have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

customization: This allows you to modify printing templates to your own specific requirements such as designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making them a useful tool for teachers and parents.

-

Accessibility: Access to various designs and templates will save you time and effort.

Where to Find more Tax Benefit On Home Loan For Rented Property

How To Claim Tax Benefits On Home Loan Bleu Finance

How To Claim Tax Benefits On Home Loan Bleu Finance

The rule foregoes tax benefit on a home loan on a self occupied property The tax rules still allow deduction on interest paid towards loan on a rented property under section 24

Tim says With the rate at which no stamp duty is charged for home movers due to fall from 250 000 to 125 000 anyone purchasing a property over this amount could face paying up to 2 500 more in stamp duty land tax Meanwhile the threshold rate at which first time buyers do not pay stamp duty is likely to fall from 425 000 to 300 000

If we've already piqued your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Benefit On Home Loan For Rented Property to suit a variety of goals.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing Tax Benefit On Home Loan For Rented Property

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Benefit On Home Loan For Rented Property are an abundance of creative and practical resources that meet a variety of needs and interests. Their accessibility and flexibility make them a valuable addition to any professional or personal life. Explore the vast array of Tax Benefit On Home Loan For Rented Property now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Benefit On Home Loan For Rented Property truly available for download?

- Yes, they are! You can print and download these items for free.

-

Do I have the right to use free printouts for commercial usage?

- It's determined by the specific terms of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright issues with Tax Benefit On Home Loan For Rented Property?

- Some printables may have restrictions in use. Be sure to check the terms and conditions provided by the author.

-

How do I print printables for free?

- Print them at home using printing equipment or visit the local print shops for better quality prints.

-

What software do I need in order to open printables that are free?

- Many printables are offered in PDF format. These can be opened using free software such as Adobe Reader.

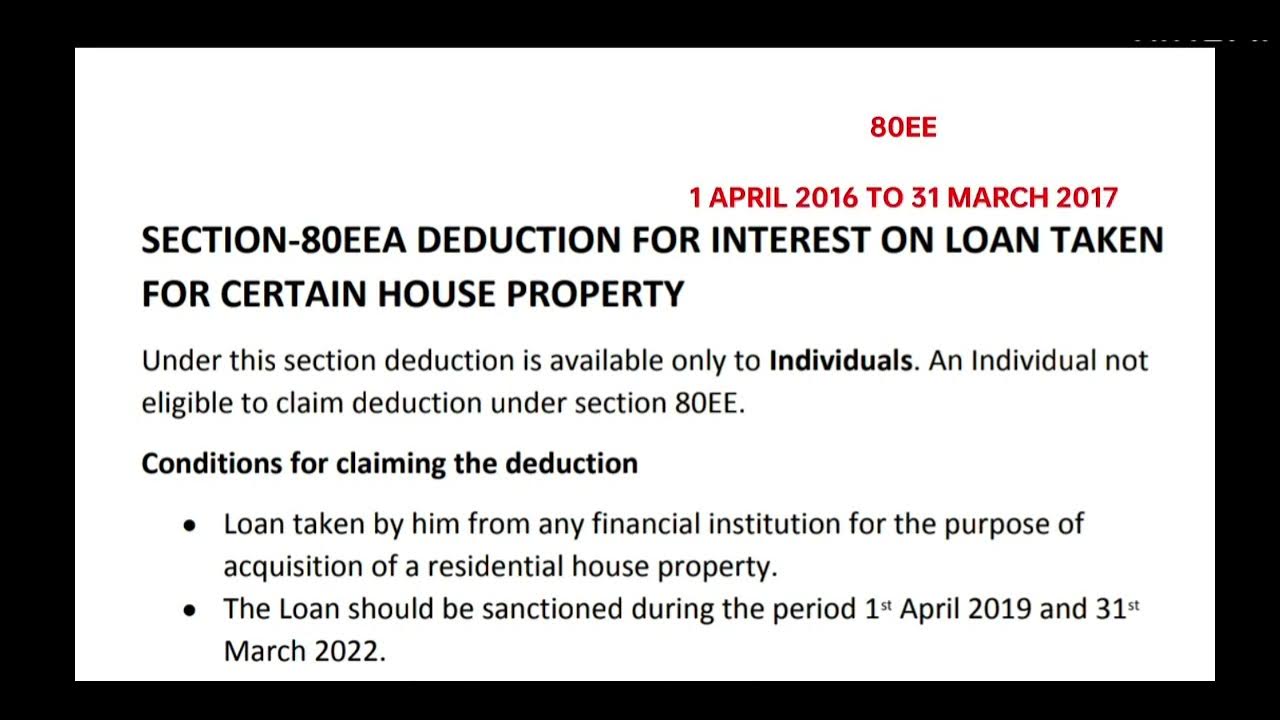

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

Home Loan Tax Benefits As Per Union Budget 2020

Check more sample of Tax Benefit On Home Loan For Rented Property below

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

20151209 Tax Benefits On A Home Loan Personal Finance Plan

How To Claim Stamp Duty Exemption On Property 2023

Know How You Can Get Tax Benefits On Home Loan

https://cleartax.in

If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

https://cleartax.in › house-property

Tax Deduction on Home Loans a Tax Deduction on Home Loan Interest Section 24 Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family resides in the house property The same treatment applies when the

If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

Tax Deduction on Home Loans a Tax Deduction on Home Loan Interest Section 24 Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family resides in the house property The same treatment applies when the

20151209 Tax Benefits On A Home Loan Personal Finance Plan

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

How To Claim Stamp Duty Exemption On Property 2023

Know How You Can Get Tax Benefits On Home Loan

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

What Are The Tax Benefit On Home Loan FY 2020 2021

What Are The Tax Benefit On Home Loan FY 2020 2021

Income Tax Benefits On Home Loan Loanfasttrack