In this age of electronic devices, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whether it's for educational purposes for creative projects, simply adding an element of personalization to your home, printables for free are now an essential source. The following article is a take a dive to the depths of "Tax Benefits In Pakistan," exploring the benefits of them, where to find them, and how they can enrich various aspects of your life.

Get Latest Tax Benefits In Pakistan Below

Tax Benefits In Pakistan

Tax Benefits In Pakistan -

Table of Contents 1 Compliance With The Law 2 Building Your Credit Score 3 Claiming Refunds 4 Avoiding Penalties 5 Better Financial Planning 6 Contributing To The Country s Development 7 Visa Processing 8 Business Opportunities 9 Fostering Transparency Who Should File Tax Returns

Being on the ATL gives you certain benefits Lower rates of tax deduction at source by banks on both profits and cash withdrawals Reduction on withholding tax tax already deducted from your income and gains when registering and transferring motor vehicles Lower rate of tax on buying and selling of property

Tax Benefits In Pakistan provide a diverse variety of printable, downloadable materials available online at no cost. These printables come in different forms, including worksheets, coloring pages, templates and many more. One of the advantages of Tax Benefits In Pakistan is in their versatility and accessibility.

More of Tax Benefits In Pakistan

Income Tax Returns In Pakistan 2022 Step By Step Process

Income Tax Returns In Pakistan 2022 Step By Step Process

Pakistan Individual Deductions Individual Deductions Last reviewed 23 January 2024 Employment income exemptions Significant exemptions available under salary income are as follows Medical allowance expenses Reimbursement of expenses on medical treatment or hospitalisation or both received by an employee is exempt from tax

Taxable income is calculated under five different types of income as follows Salary Property Business Capital gains Income from other sources which includes income from dividends royalties profit on debt interest ground rent sub lease of land or building lease of building inclusive of plant or machinery prize money winnings etc

Tax Benefits In Pakistan have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization It is possible to tailor the design to meet your needs such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value Downloads of educational content for free offer a wide range of educational content for learners from all ages, making these printables a powerful source for educators and parents.

-

Accessibility: Access to a variety of designs and templates saves time and effort.

Where to Find more Tax Benefits In Pakistan

Tax Benefits Of Commercial Real Estate Investing

Tax Benefits Of Commercial Real Estate Investing

A tax credit is a benefit given by the state to taxpayers who have already paid their taxes It is a form of relief that reduces the tax liability of the taxpayer

Under the Income Tax Ordinance 2001 all Income are broadly divided into following five heads of Income Salary Income from property Income from business Capital gains and Income from Other Sources

We've now piqued your interest in Tax Benefits In Pakistan, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Tax Benefits In Pakistan for different objectives.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets, flashcards, and learning materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast variety of topics, from DIY projects to planning a party.

Maximizing Tax Benefits In Pakistan

Here are some ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special events like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Benefits In Pakistan are a treasure trove of practical and innovative resources which cater to a wide range of needs and passions. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the plethora of Tax Benefits In Pakistan now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can download and print these items for free.

-

Can I utilize free printables for commercial purposes?

- It's dependent on the particular conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may have restrictions on use. Be sure to read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home using an printer, or go to an in-store print shop to get better quality prints.

-

What program is required to open printables that are free?

- The majority of printed documents are in PDF format. These is open with no cost software, such as Adobe Reader.

How To Use Azelaic Acid Benefits Best Products In Pakistan The

PM Imran s Tax Payment Rises During First Year In Office Pakistan

Check more sample of Tax Benefits In Pakistan below

Employee Benefits In Pakistan Laws Importance

How To Become Filer In Pakistan

Major Benefits Of Being A Tax Filer In Pakistan Zameen Blog

NTN Benefits In Pakistan Advantages FBR National Tax Number Urdu

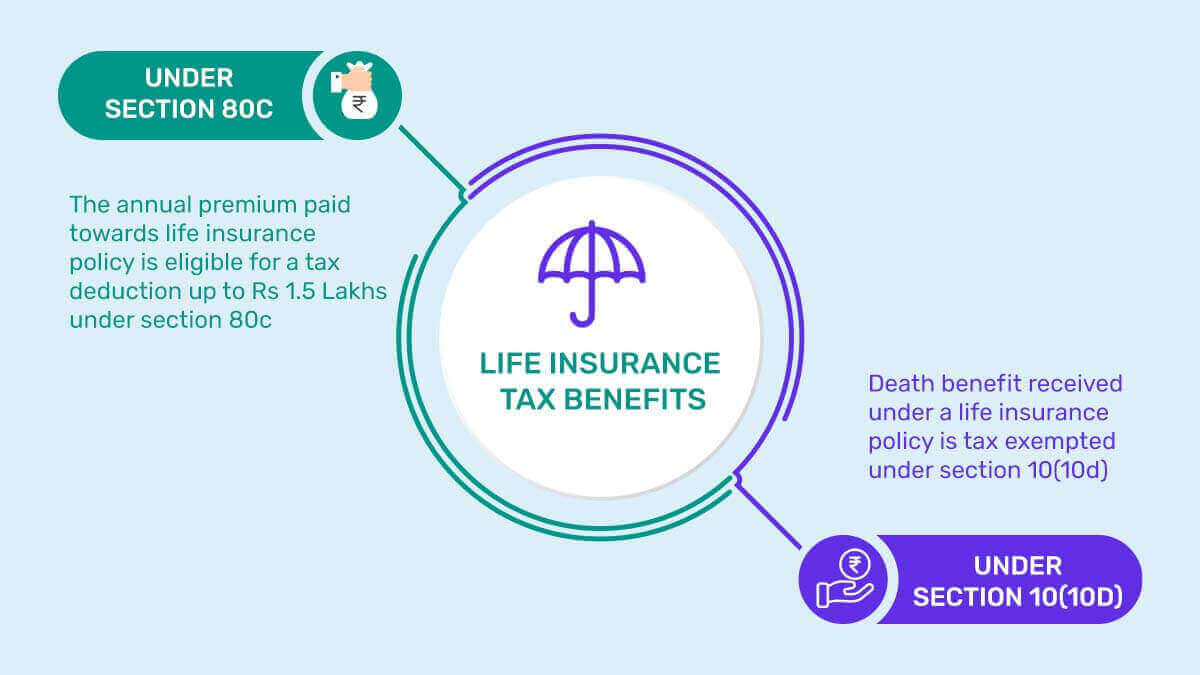

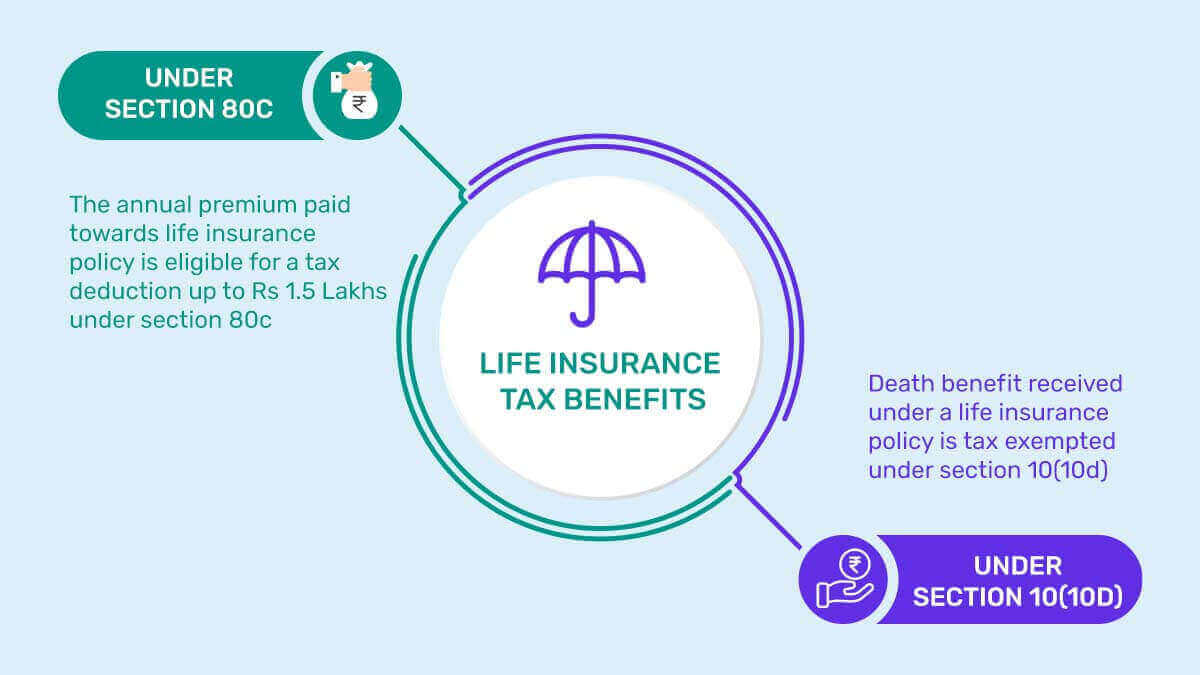

Sovereign Gold Bond Tax Benefits In India Angel One

Benefits Of Being Tax Filer In Pakistan Hamza And Hamza

https://www. fbr.gov.pk /categ/active-taxpayer-list...

Being on the ATL gives you certain benefits Lower rates of tax deduction at source by banks on both profits and cash withdrawals Reduction on withholding tax tax already deducted from your income and gains when registering and transferring motor vehicles Lower rate of tax on buying and selling of property

https:// taxsummaries.pwc.com /pakistan/individual/...

Last reviewed 23 January 2024 Pakistan levies tax on its residents on their worldwide income A non resident individual is taxed only on Pakistan source income including income received or deemed to be received in Pakistan or deemed to accrue or arise in Pakistan Salary is considered Pakistan source income to the extent to which it relates

Being on the ATL gives you certain benefits Lower rates of tax deduction at source by banks on both profits and cash withdrawals Reduction on withholding tax tax already deducted from your income and gains when registering and transferring motor vehicles Lower rate of tax on buying and selling of property

Last reviewed 23 January 2024 Pakistan levies tax on its residents on their worldwide income A non resident individual is taxed only on Pakistan source income including income received or deemed to be received in Pakistan or deemed to accrue or arise in Pakistan Salary is considered Pakistan source income to the extent to which it relates

NTN Benefits In Pakistan Advantages FBR National Tax Number Urdu

How To Become Filer In Pakistan

Sovereign Gold Bond Tax Benefits In India Angel One

Benefits Of Being Tax Filer In Pakistan Hamza And Hamza

Benefits Of Investment In Pakistan Stock Exchange

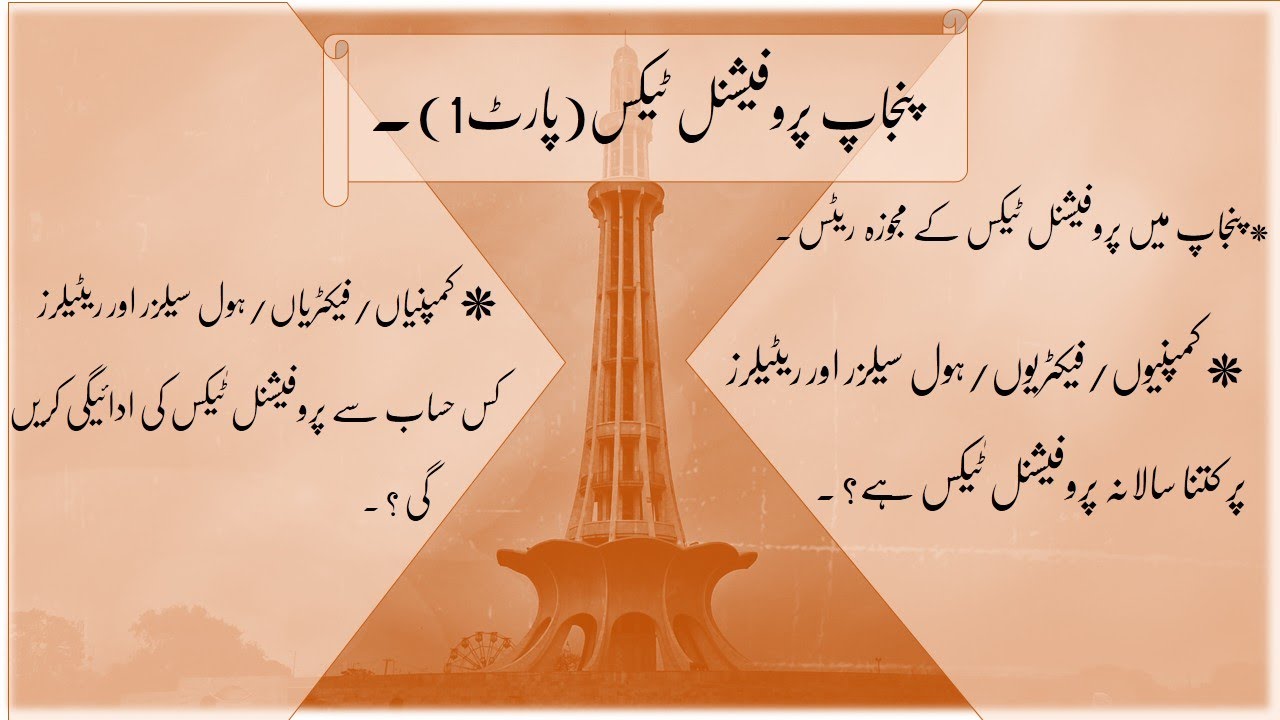

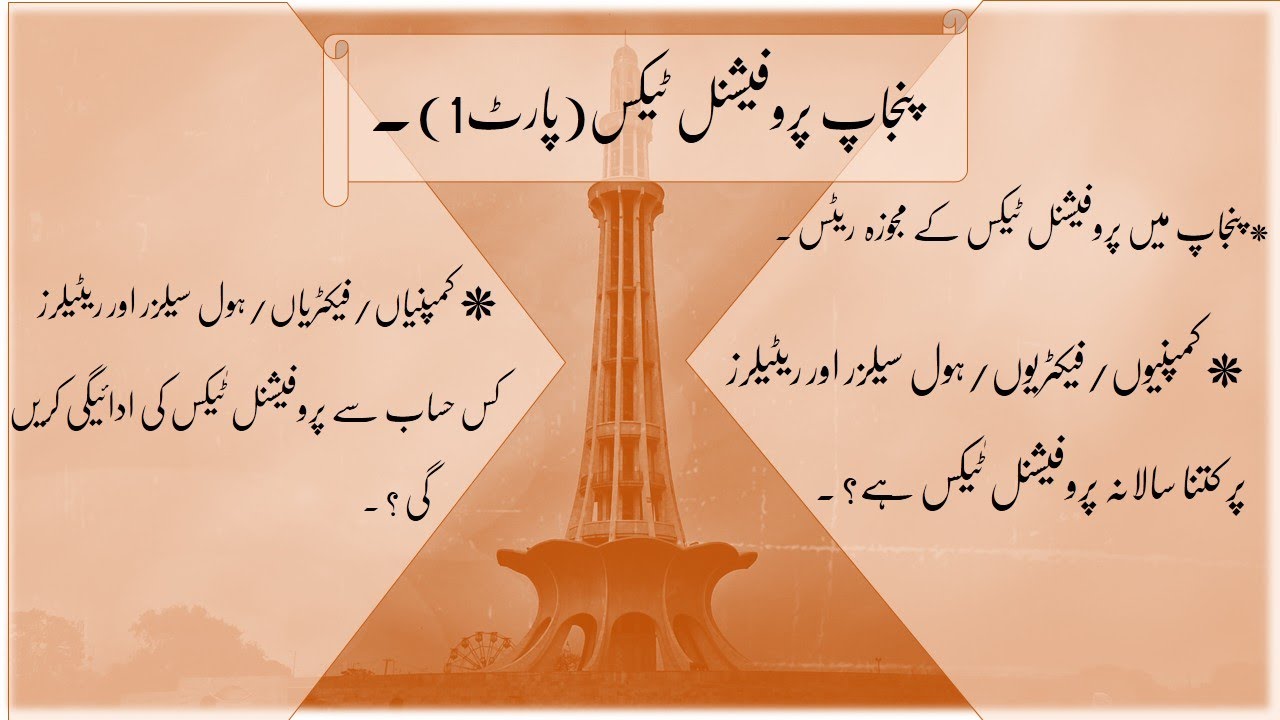

Professional Tax Punjab Part I

Professional Tax Punjab Part I

Benefits Of Real Estate Investments In Pakistan Agency21 Blog