Today, with screens dominating our lives but the value of tangible, printed materials hasn't diminished. If it's to aid in education project ideas, artistic or simply adding the personal touch to your area, Tax Cis Deduction can be an excellent source. The following article is a dive into the world "Tax Cis Deduction," exploring what they are, how you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Tax Cis Deduction Below

Tax Cis Deduction

Tax Cis Deduction -

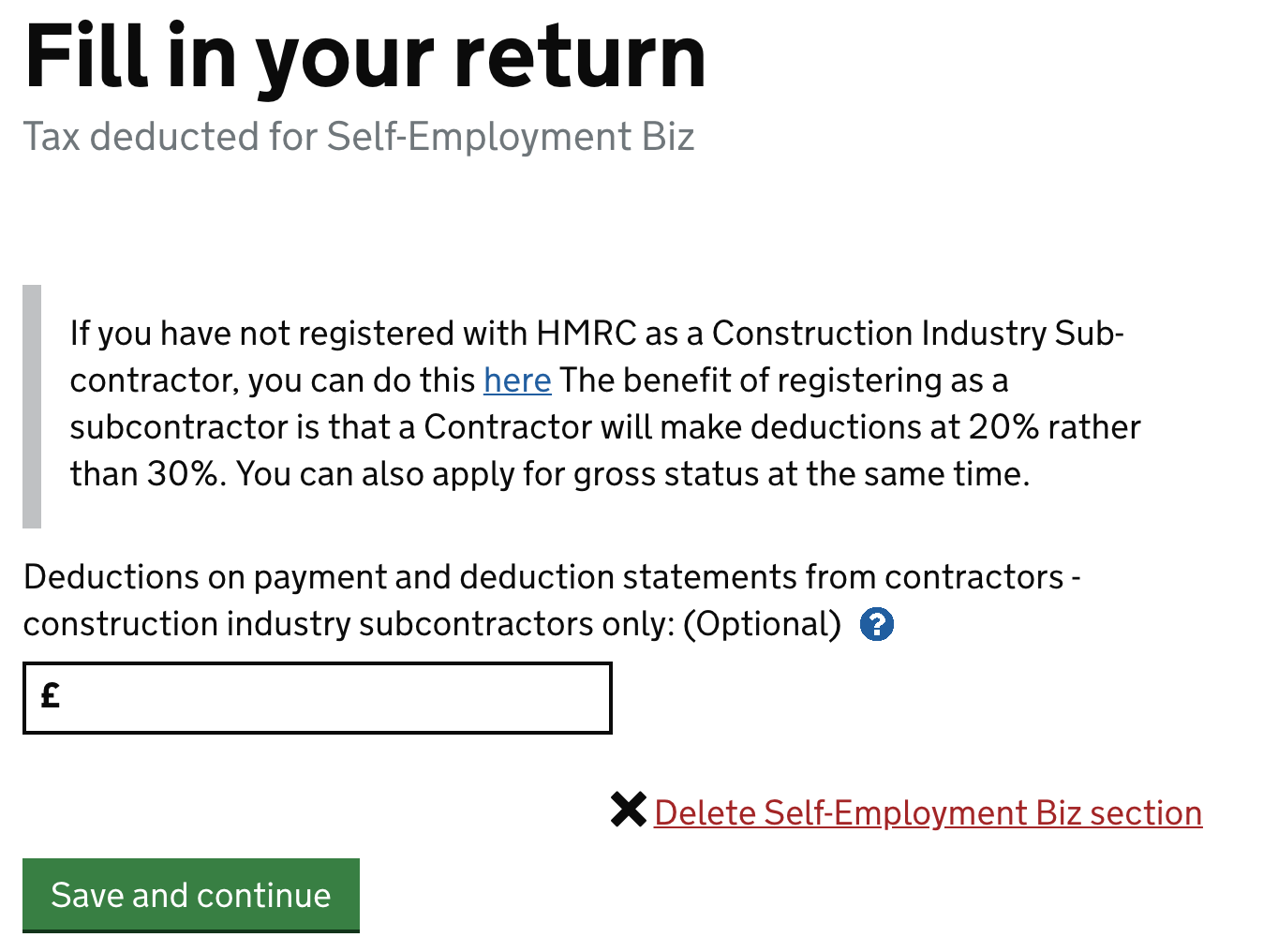

Your business tax account allows you to see all business tax in one place you may need to add the CIS service You can file CIS returns using your business tax account 3 Verify subcontractors with HMRC When you

When a contractor pays you under CIS they ll normally make deductions at the standard rate of 20 Contractors will make deductions at a higher rate of 30 if Your contractor should give

Tax Cis Deduction provide a diverse collection of printable materials online, at no cost. They are available in numerous forms, like worksheets templates, coloring pages and many more. The beauty of Tax Cis Deduction is in their variety and accessibility.

More of Tax Cis Deduction

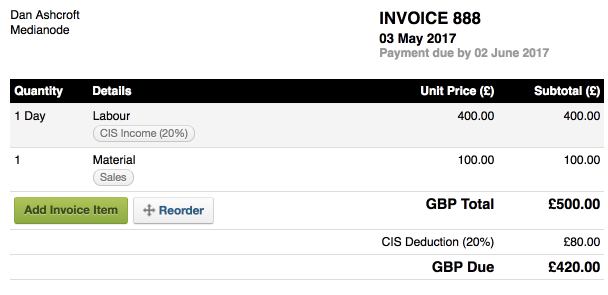

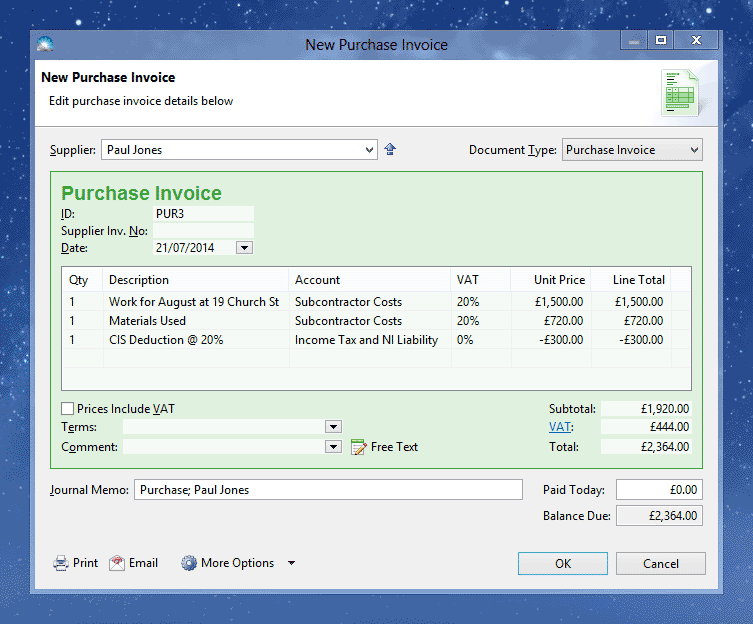

Show CIS Tax On Invoices Support QuickFile

Show CIS Tax On Invoices Support QuickFile

Before a contractor can make a payment to a subcontractor for construction work they may need to verify with us that the subcontractor is registered

If you are self employed in the building or construction trade then you should pay tax under the Construction Industry Scheme CIS This page explains what the CIS is how

Tax Cis Deduction have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization It is possible to tailor printed materials to meet your requirements for invitations, whether that's creating them making your schedule, or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making the perfect device for teachers and parents.

-

The convenience of You have instant access numerous designs and templates will save you time and effort.

Where to Find more Tax Cis Deduction

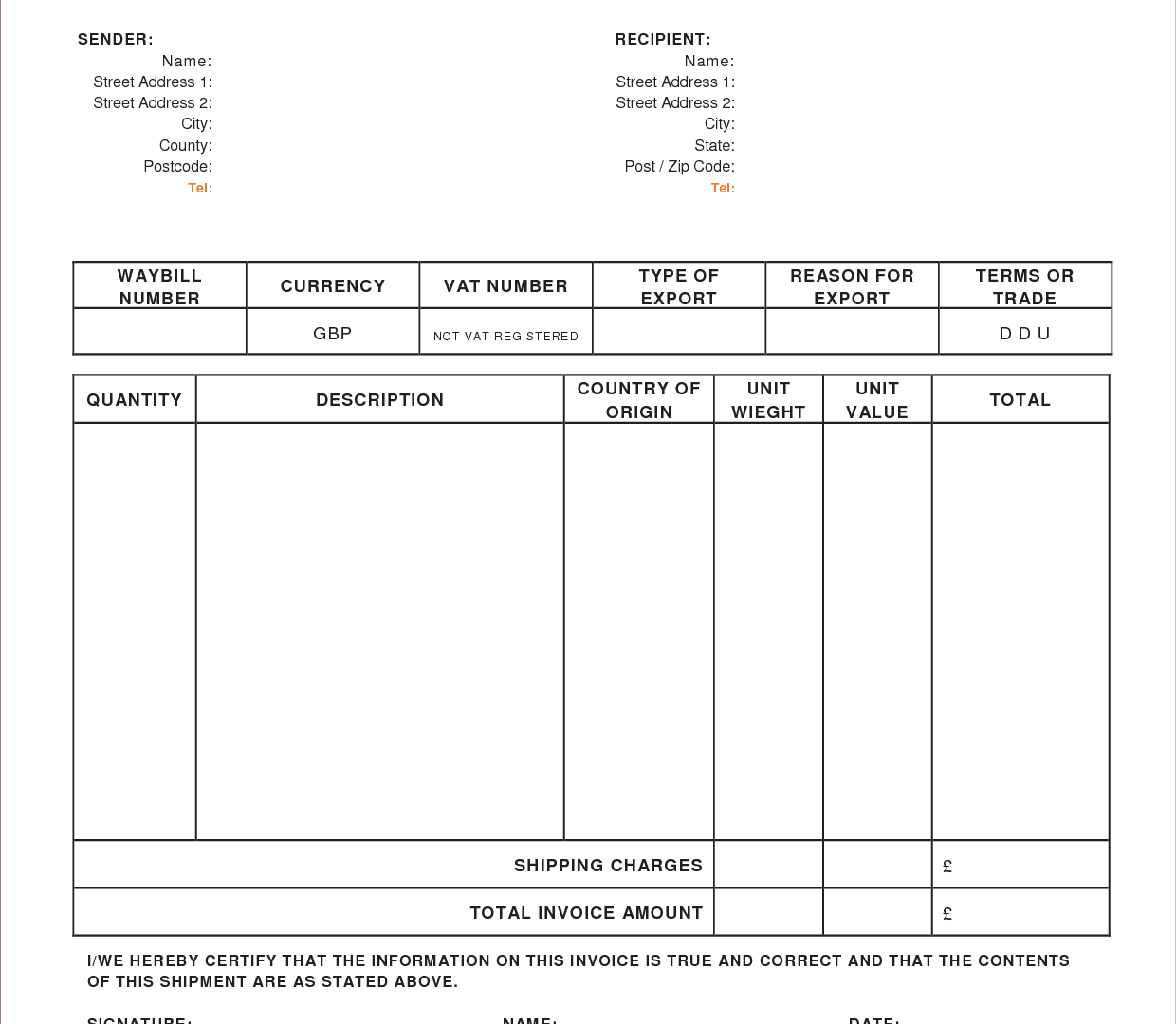

CIS Single Payment Deduction Statement Template Accountant s E shop

CIS Single Payment Deduction Statement Template Accountant s E shop

If you re a self employed individual under the CIS Construction Industry Scheme luckily for you there are a few CIS deductions you can use to maximise your rebate First of all let s explain what CIS actually is

As a CIS contractor you can make deductions and pay subcontractors for construction work This guide explains how to make a CIS deduction and pay deductions to HMRC

Now that we've piqued your interest in Tax Cis Deduction Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Tax Cis Deduction for various applications.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad selection of subjects, that includes DIY projects to planning a party.

Maximizing Tax Cis Deduction

Here are some inventive ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Cis Deduction are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and passions. Their availability and versatility make them a wonderful addition to both personal and professional life. Explore the wide world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can download and print these items for free.

-

Can I use the free templates for commercial use?

- It's contingent upon the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may come with restrictions concerning their use. Always read the terms and conditions provided by the creator.

-

How can I print Tax Cis Deduction?

- Print them at home using the printer, or go to the local print shops for more high-quality prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software like Adobe Reader.

CIS Self Bill Invoicing InTime InTime

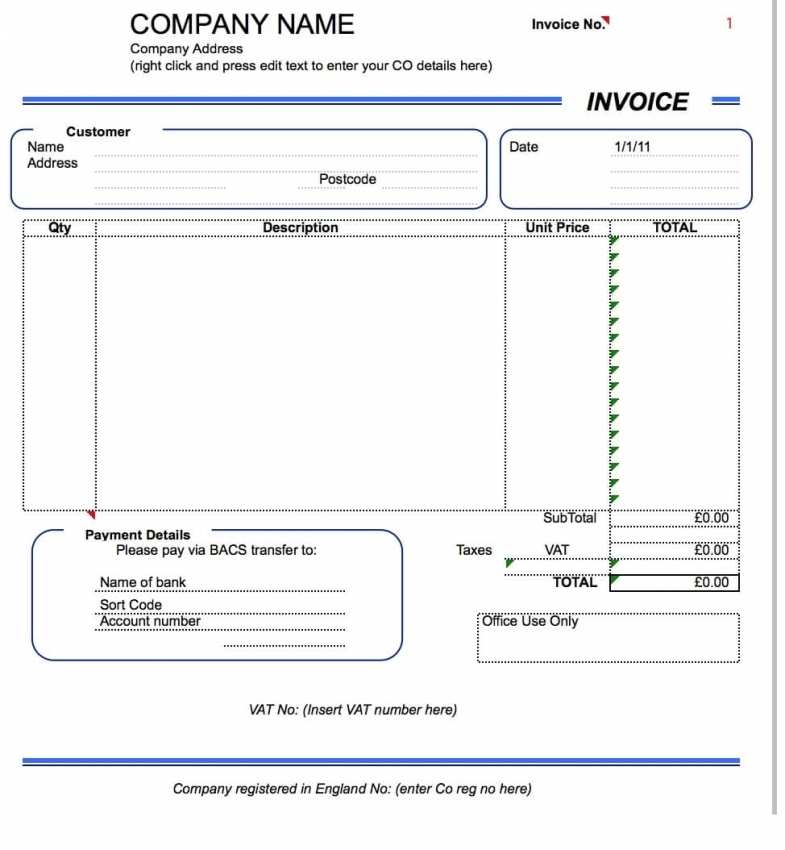

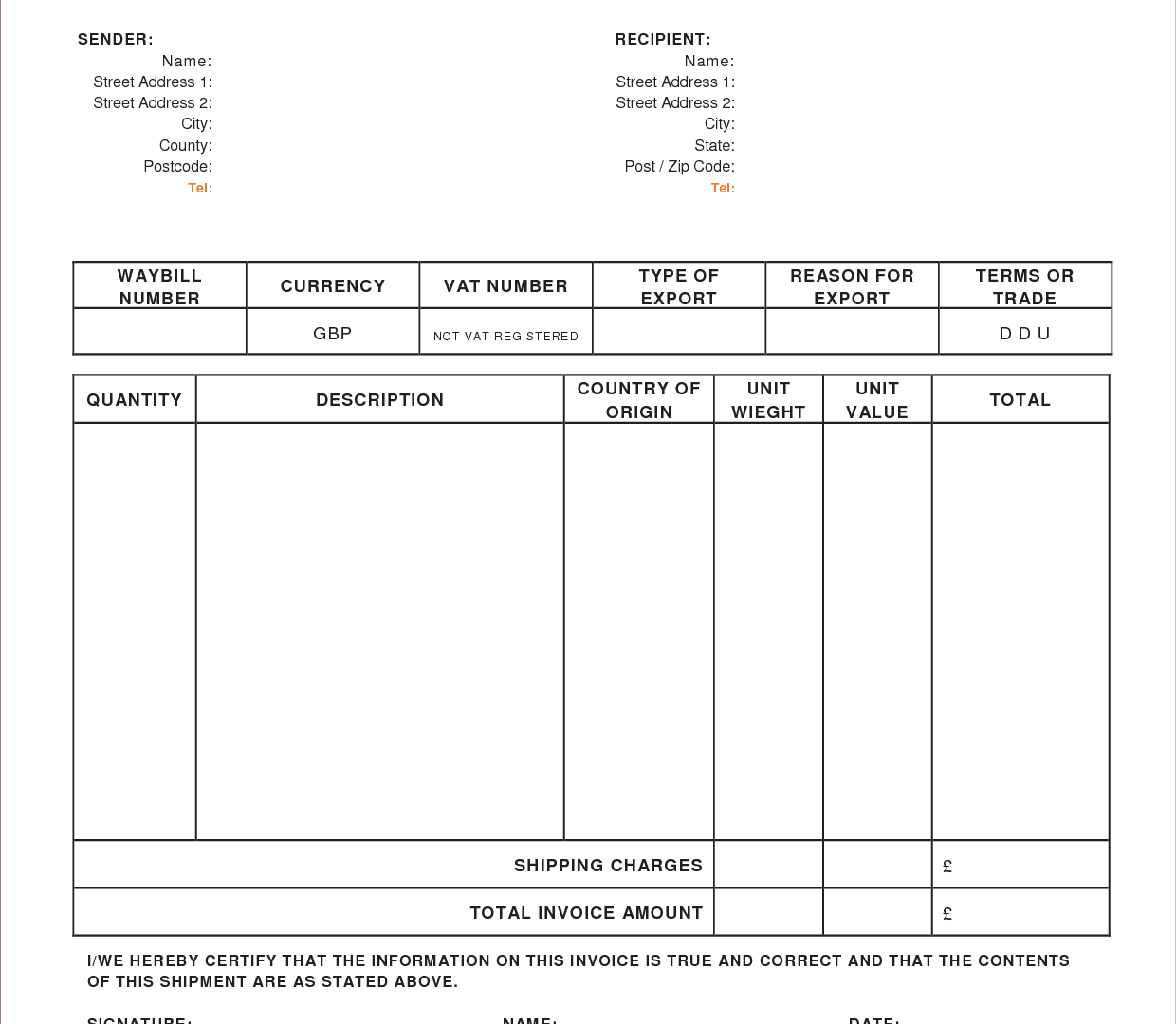

Invoice Template With Vat And Cis Deduction Cards Design Templates

Check more sample of Tax Cis Deduction below

Cis Invoice Template Subcontractor Vat Sample Tax Example Excel In Cis

UK CIS Single Payment Deduction Statement Template Accountant s E shop

UK CIS Single Payment Deduction Statement Template Accountant s E shop

Invoice Template With Vat And Cis Deduction Cards Design Templates

What Is A CIS Deduction Certificate

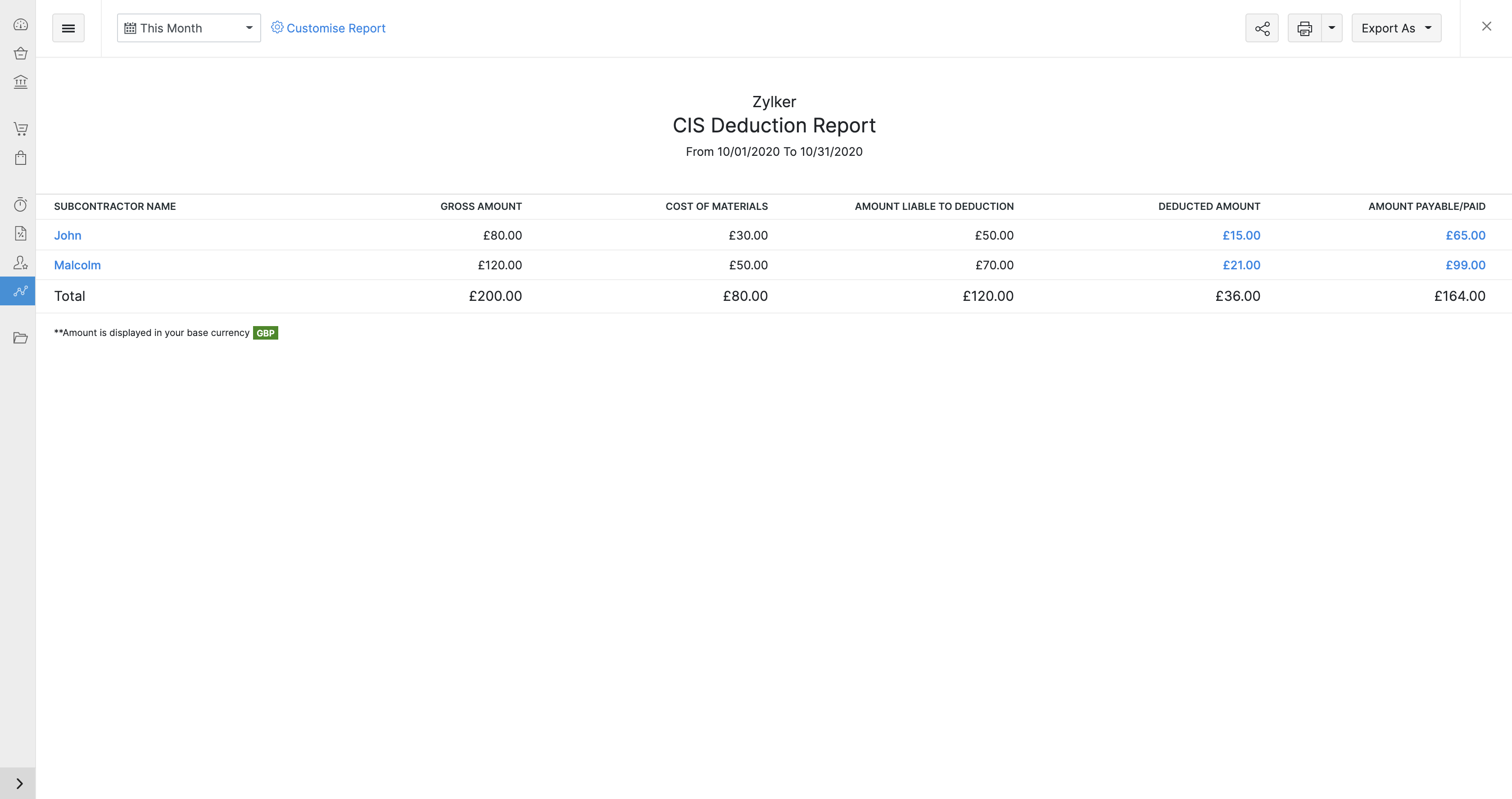

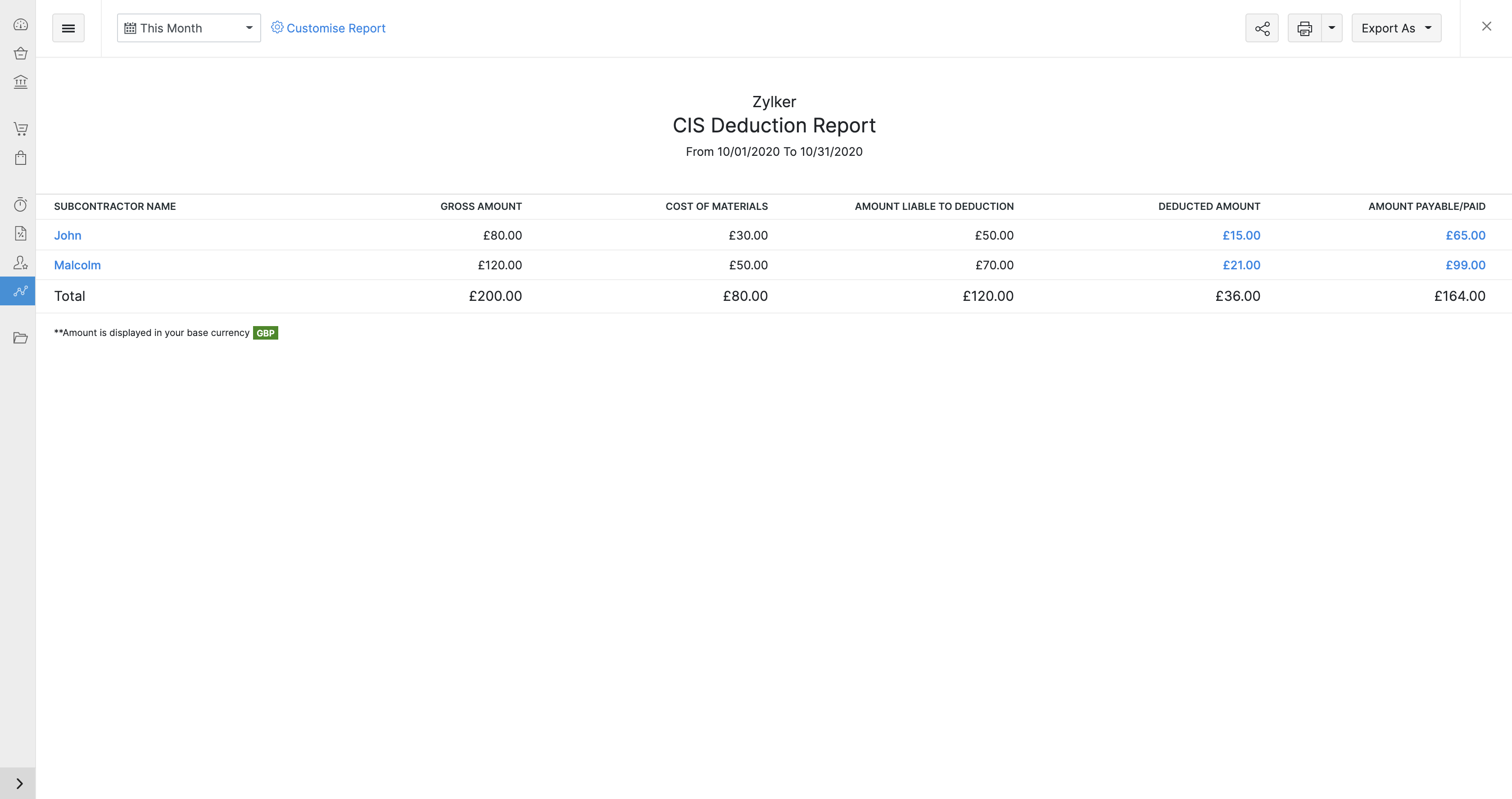

CIS Reports Help Zoho Books

https://www.gov.uk/what-you-must-do-as-a-cis-subcontractor/get-paid

When a contractor pays you under CIS they ll normally make deductions at the standard rate of 20 Contractors will make deductions at a higher rate of 30 if Your contractor should give

https://www.gov.uk/what-you-must-do-as-a-cis...

You must pay these deductions to HMRC they count as advance payments towards the subcontractor s tax and National Insurance bill How to make a CIS deduction

When a contractor pays you under CIS they ll normally make deductions at the standard rate of 20 Contractors will make deductions at a higher rate of 30 if Your contractor should give

You must pay these deductions to HMRC they count as advance payments towards the subcontractor s tax and National Insurance bill How to make a CIS deduction

Invoice Template With Vat And Cis Deduction Cards Design Templates

UK CIS Single Payment Deduction Statement Template Accountant s E shop

What Is A CIS Deduction Certificate

CIS Reports Help Zoho Books

CIS Subcontractors FreeAgent

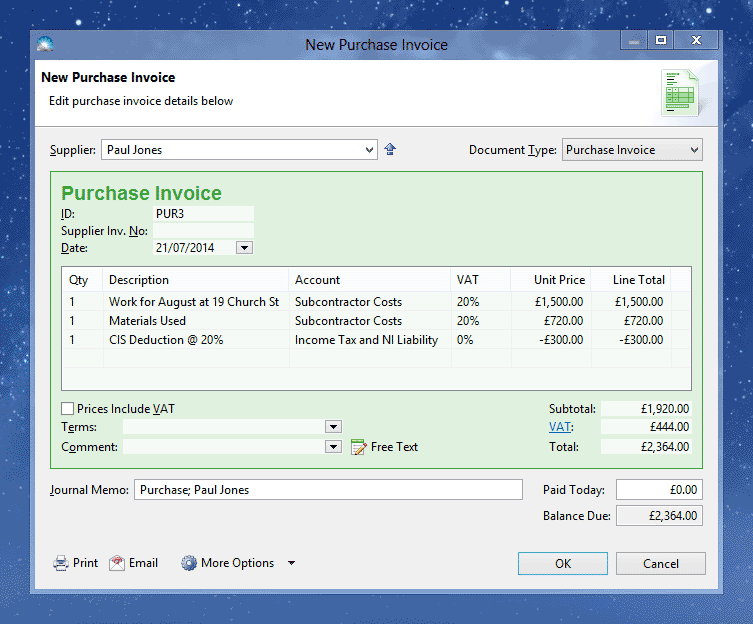

CIS Notes For Contractors Solar Accounts Help

CIS Notes For Contractors Solar Accounts Help

What Is A CIS Statement Guide To CIS Statement Of Earnings Brian