In this day and age where screens have become the dominant feature of our lives, the charm of tangible printed objects isn't diminished. Whether it's for educational purposes, creative projects, or simply adding personal touches to your area, Tax Credit For Donations have become a valuable source. In this article, we'll take a dive deep into the realm of "Tax Credit For Donations," exploring the different types of printables, where to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Tax Credit For Donations Below

Tax Credit For Donations

Tax Credit For Donations -

Tax credits for donations You can claim 33 33 cents for every dollar you donated to approved charities and organisations You can only claim on donations that added up to the same

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation

Tax Credit For Donations offer a wide range of printable, free content that can be downloaded from the internet at no cost. These printables come in different types, like worksheets, coloring pages, templates and many more. The benefit of Tax Credit For Donations lies in their versatility and accessibility.

More of Tax Credit For Donations

Bunching Up Charitable Donations Could Help Tax Savings

Bunching Up Charitable Donations Could Help Tax Savings

Tax credits can be requested on charitable donations and while details may vary according to the level of income tax paid tax free donations generally amount to approximately 45 of the value of the donation

Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to 60 of

Tax Credit For Donations have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: We can customize printables to your specific needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Education Value Educational printables that can be downloaded for free provide for students from all ages, making these printables a powerful tool for parents and teachers.

-

Easy to use: The instant accessibility to numerous designs and templates cuts down on time and efforts.

Where to Find more Tax Credit For Donations

Seniors Home Renovation Tax Credit In Canada Senior Protection

Seniors Home Renovation Tax Credit In Canada Senior Protection

Generally you can deduct contributions up to 60 of your adjusted gross income AGI depending on the nature and tax exempt status of the charity to which you re giving You can deduct contributions of appreciated

Donating to charity can help reduce your taxable income Here are some tips for how you can maximize tax deductible donations

Now that we've ignited your interest in Tax Credit For Donations Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Tax Credit For Donations for a variety motives.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide range of interests, including DIY projects to planning a party.

Maximizing Tax Credit For Donations

Here are some creative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Credit For Donations are an abundance of practical and innovative resources catering to different needs and interest. Their accessibility and flexibility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast world of Tax Credit For Donations to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's determined by the specific conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables could be restricted on use. Check the terms of service and conditions provided by the author.

-

How can I print Tax Credit For Donations?

- Print them at home with either a printer or go to a print shop in your area for the highest quality prints.

-

What software will I need to access Tax Credit For Donations?

- Most printables come as PDF files, which can be opened using free software like Adobe Reader.

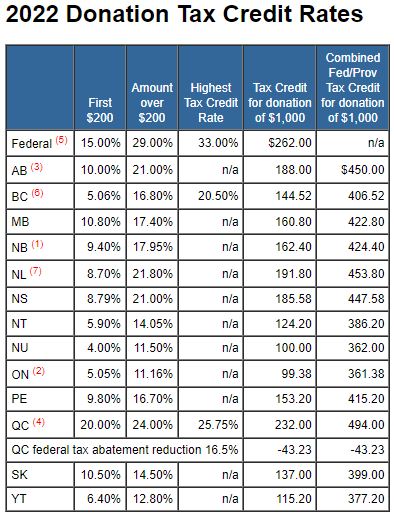

TaxTips ca 2022 Donation Tax Credit Rates

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Check more sample of Tax Credit For Donations below

Tips On Tax Deductions For Donations

How Much Do You Need To Donate For Tax Deduction

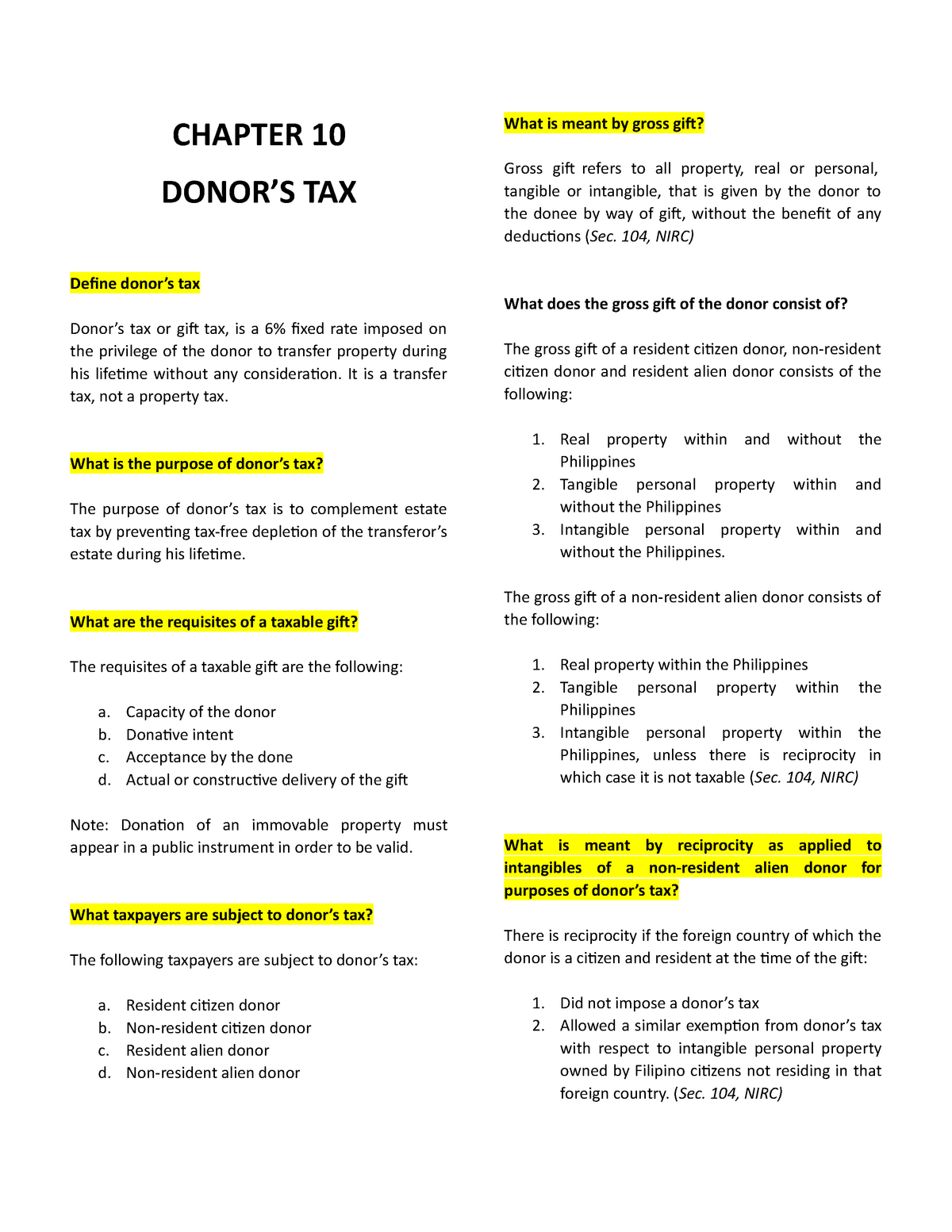

Chapter 10 ISTHMUS CHAPTER 10 DONOR S TAX Define Donor s Tax Donor

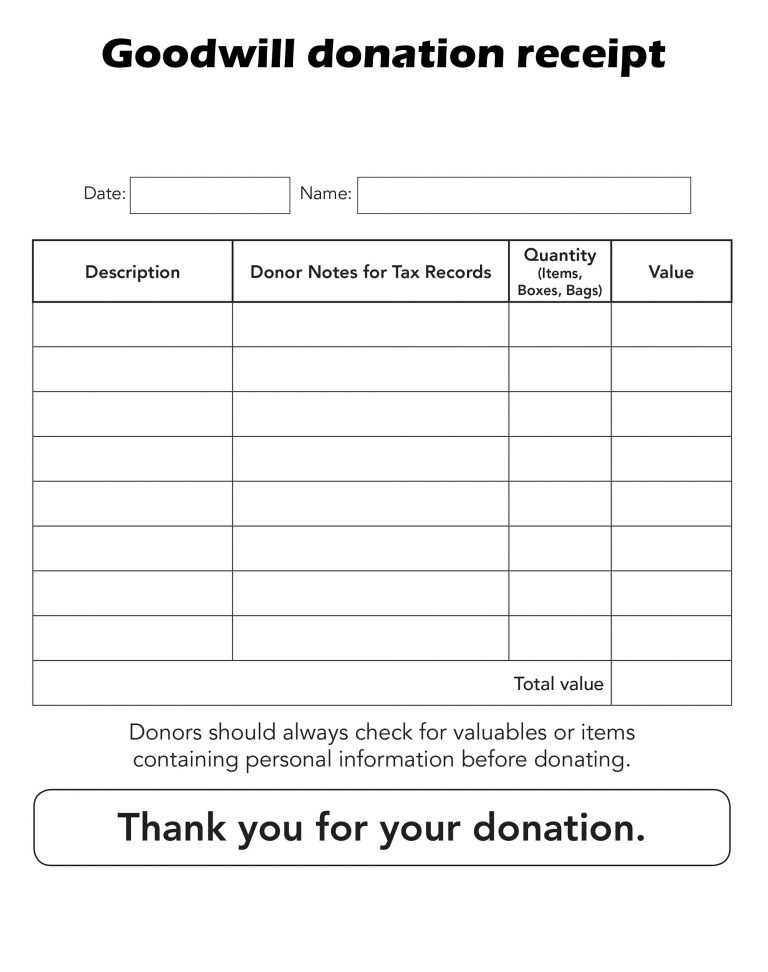

Free Sample Printable Donation Receipt Template Form

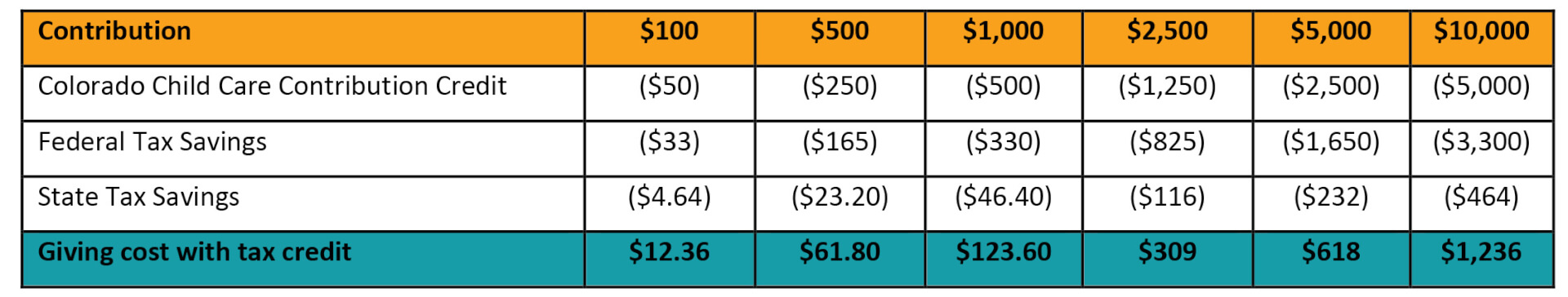

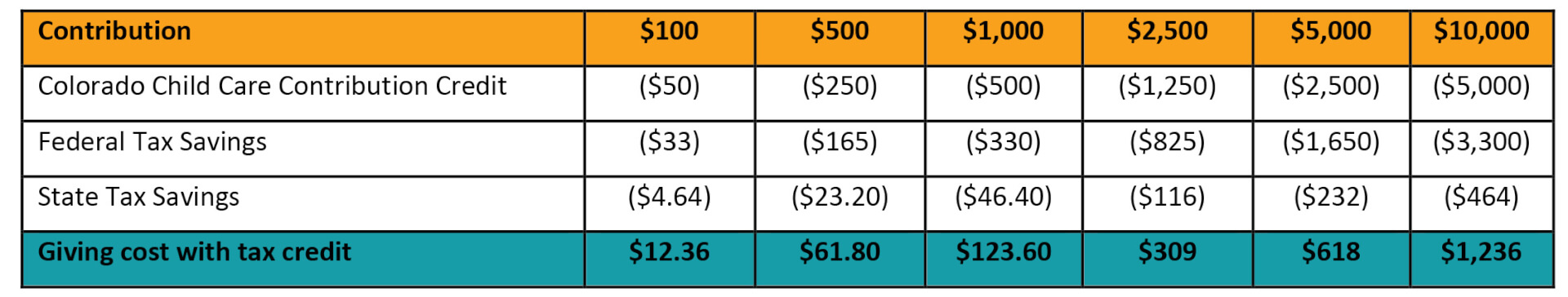

Tax credit donation page

Children s Promise Tax Credit For Business Canopy Children s Solutions

https://www.nerdwallet.com/article/tax…

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation

https://www.irs.gov/charities-non-profits/...

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income A corporation may deduct qualified contributions of up to 25 percent

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income A corporation may deduct qualified contributions of up to 25 percent

Free Sample Printable Donation Receipt Template Form

How Much Do You Need To Donate For Tax Deduction

Tax credit donation page

Children s Promise Tax Credit For Business Canopy Children s Solutions

Earned Income Credit Calculator 2021 DannielleThalia

What Is The New Child Tax Credit For 2022 A2022c

What Is The New Child Tax Credit For 2022 A2022c

Printable 501C3 Donation Receipt Template