In this age of technology, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses such as creative projects or simply adding the personal touch to your area, Tax Credit For Fuel are a great resource. We'll take a dive through the vast world of "Tax Credit For Fuel," exploring what they are, how to locate them, and how they can enhance various aspects of your life.

Get Latest Tax Credit For Fuel Below

Tax Credit For Fuel

Tax Credit For Fuel -

A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual credit on Form 4136 you may be able to file Form 8849 Claim for Refund of Excise Taxes to claim a periodic refund or Form 720 Quarterly Federal Excise

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

Tax Credit For Fuel cover a large variety of printable, downloadable materials available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and many more. The value of Tax Credit For Fuel is their flexibility and accessibility.

More of Tax Credit For Fuel

Form 5695 Instructions Claiming The Solar Tax Credit EnergySage

)

Form 5695 Instructions Claiming The Solar Tax Credit EnergySage

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel users can get a credit for the taxes they ve paid by filing Form 4136

IRS offers expedited fuel tax credit refund process September 27 2022 The IRS has released procedures Notice 2022 39 for claiming the alternative fuel tax credits that were reinstated retroactively for 2022 The alternative fuel and alternative fuel mixture tax credits under Section 6426 had originally expired at the end of 2021

Tax Credit For Fuel have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize printing templates to your own specific requirements such as designing invitations to organize your schedule or even decorating your house.

-

Educational Value: Printing educational materials for no cost are designed to appeal to students of all ages, making these printables a powerful aid for parents as well as educators.

-

Affordability: immediate access numerous designs and templates saves time and effort.

Where to Find more Tax Credit For Fuel

Note The Bipartisan Budget Act Of 2018 Signed In February 2018

Note The Bipartisan Budget Act Of 2018 Signed In February 2018

To see which fuel credits are still available go to IRS Instructions for Form 4136 Credit for Federal Tax Paid on Fuels Go to IRS Publication 510 Excise Taxes Including Fuel Tax Credits and Refunds for definitions and information on nontaxable uses Note that any link in the information above is updated each year automatically and will take you to the most

Business Tax Credit For Fuel Use 1 min read You can claim a credit for federal excise tax you paid on fuels you used On a farm for farming purposes Ex fuel used to run a tractor while plowing On a boat used for commercial fishing For off highway business use

We hope we've stimulated your curiosity about Tax Credit For Fuel Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Tax Credit For Fuel for all motives.

- Explore categories such as decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing Tax Credit For Fuel

Here are some inventive ways to make the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Credit For Fuel are a treasure trove filled with creative and practical information designed to meet a range of needs and interests. Their accessibility and flexibility make them a wonderful addition to each day life. Explore the vast array of Tax Credit For Fuel today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes, they are! You can download and print these documents for free.

-

Can I make use of free printables for commercial uses?

- It depends on the specific usage guidelines. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations concerning their use. You should read the terms and conditions set forth by the creator.

-

How can I print Tax Credit For Fuel?

- You can print them at home using any printer or head to the local print shops for higher quality prints.

-

What program do I need in order to open printables that are free?

- Many printables are offered in PDF format. They can be opened with free software such as Adobe Reader.

Advance Front And Centre

Fuel Tax Credit Instructions Australia Instructions User Guide

Check more sample of Tax Credit For Fuel below

Coming Soon To A Police State Near You Oregon Begins Testing Pay Per

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

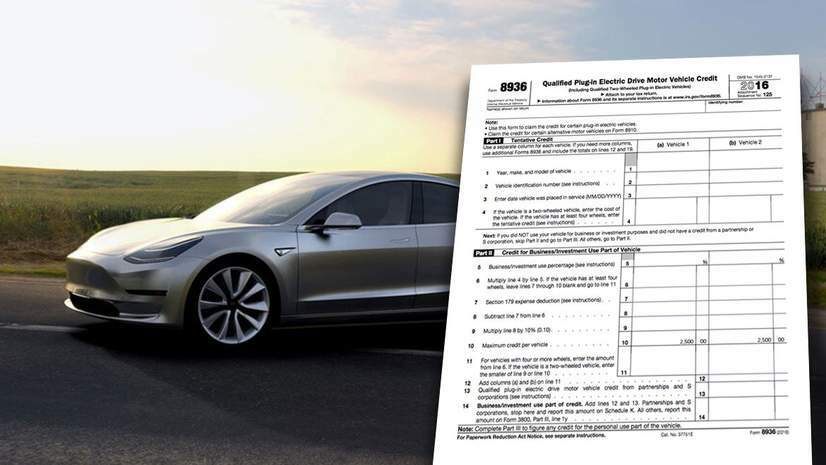

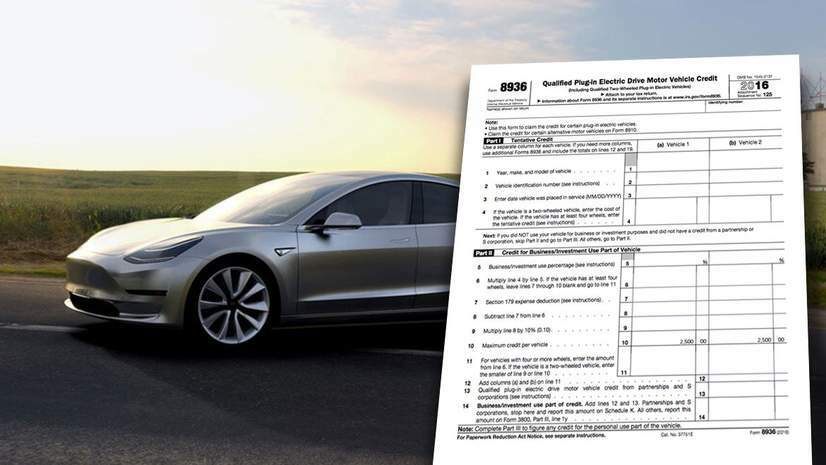

EV Tax Credits How To Get The Most Money For 2023

Oil Industry Front Group Launches Latest Attack On Electric Vehicle Tax

RESIDENTIAL RENEWABLE ENERGY TAX CREDIT

E15 Gas Is Cheap Should You Be Using This Alternative Fuel WVXU

https://www.investopedia.com/terms/f/fuel-credit.asp

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

?w=186)

https://www.ato.gov.au/businesses-and...

Note 3 Fuel tax credit rates change for fuel used in a heavy vehicle for travelling on a public road due to changes in the road user charge The heavy vehicle road user charge will increase by 6 each year over 3 years from 28 8 cents per litre for petrol and diesel in 2023 24 to 30 5 cents per litre in 2024 25 and to 32 4 cents per litre

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs The

Note 3 Fuel tax credit rates change for fuel used in a heavy vehicle for travelling on a public road due to changes in the road user charge The heavy vehicle road user charge will increase by 6 each year over 3 years from 28 8 cents per litre for petrol and diesel in 2023 24 to 30 5 cents per litre in 2024 25 and to 32 4 cents per litre

Oil Industry Front Group Launches Latest Attack On Electric Vehicle Tax

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

RESIDENTIAL RENEWABLE ENERGY TAX CREDIT

E15 Gas Is Cheap Should You Be Using This Alternative Fuel WVXU

11 Reasons For Business Owners To Consider An Electric F 150 For Their

National Budget Speech 2022 SimplePay Blog

National Budget Speech 2022 SimplePay Blog

Instructions For Filling Out IRS Form 5695 Everlight Solar