In the digital age, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Be it for educational use and creative work, or simply to add the personal touch to your area, Tax Credit For Home Appliances are now a vital source. Here, we'll dive into the world "Tax Credit For Home Appliances," exploring what they are, how they can be found, and how they can enhance various aspects of your daily life.

Get Latest Tax Credit For Home Appliances Below

Tax Credit For Home Appliances

Tax Credit For Home Appliances -

If you earn Up to 80 percent of the median HHI in your area you get up to 100 percent of the cost of the new appliance or up to 840 whichever is less More than 80 percent but less than 150

Specifically credit limits will be the following Home energy audits 150 Exterior doors 250 per door up to 500 per year Exterior windows and skylights central A C units electric panels and related equipment natural gas propane and oil water heaters furnaces or hot water boilers 600

Printables for free cover a broad assortment of printable, downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and many more. The appeal of printables for free is in their variety and accessibility.

More of Tax Credit For Home Appliances

Service Request R pit Ressource Montr al

Service Request R pit Ressource Montr al

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Tax Credits for Homeowners One of the key goals of the Inflation Reduction Act is to help businesses boost clean energy production However the bill also offers several tax credits and rebates

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: It is possible to tailor printables to your specific needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages, making them an invaluable resource for educators and parents.

-

Simple: Access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Credit For Home Appliances

U S Existing Home Sales Unexpectedly Fall The Globe And Mail

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/7NNVGIGZ7NF4XA7KNIZA3COKFQ)

U S Existing Home Sales Unexpectedly Fall The Globe And Mail

Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits

There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to newer more efficient models

After we've peaked your interest in Tax Credit For Home Appliances Let's look into where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Tax Credit For Home Appliances for all reasons.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs are a vast selection of subjects, from DIY projects to party planning.

Maximizing Tax Credit For Home Appliances

Here are some new ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Credit For Home Appliances are a treasure trove of useful and creative resources that can meet the needs of a variety of people and needs and. Their availability and versatility make them a great addition to both professional and personal life. Explore the world of Tax Credit For Home Appliances today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial purposes?

- It's all dependent on the conditions of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Make sure you read the terms and conditions set forth by the author.

-

How can I print Tax Credit For Home Appliances?

- Print them at home using either a printer or go to the local print shop for better quality prints.

-

What program do I need in order to open printables for free?

- Most PDF-based printables are available in the PDF format, and can be opened using free programs like Adobe Reader.

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Inflation Reduction Act 30 Tax Credit For Home Remodeling

Check more sample of Tax Credit For Home Appliances below

The Tax Credit Is Renewed

How To Get A Solar Tax Credit For A Home Office Zero Down Solar

Lost In Your Tax Return Ask All Your Questions To Our Specialist

Is It Time To Put Your House On The Market Colorado Vault Safe

Section 45L Homebuilders Claim 2021 Section 45L Atlanta CPA

Get 150 Tax Credit For Home Energy Audit AND Discover How To Decrease

https://turbotax.intuit.com/tax-tips/going-green/...

Specifically credit limits will be the following Home energy audits 150 Exterior doors 250 per door up to 500 per year Exterior windows and skylights central A C units electric panels and related equipment natural gas propane and oil water heaters furnaces or hot water boilers 600

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Specifically credit limits will be the following Home energy audits 150 Exterior doors 250 per door up to 500 per year Exterior windows and skylights central A C units electric panels and related equipment natural gas propane and oil water heaters furnaces or hot water boilers 600

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Is It Time To Put Your House On The Market Colorado Vault Safe

How To Get A Solar Tax Credit For A Home Office Zero Down Solar

Section 45L Homebuilders Claim 2021 Section 45L Atlanta CPA

Get 150 Tax Credit For Home Energy Audit AND Discover How To Decrease

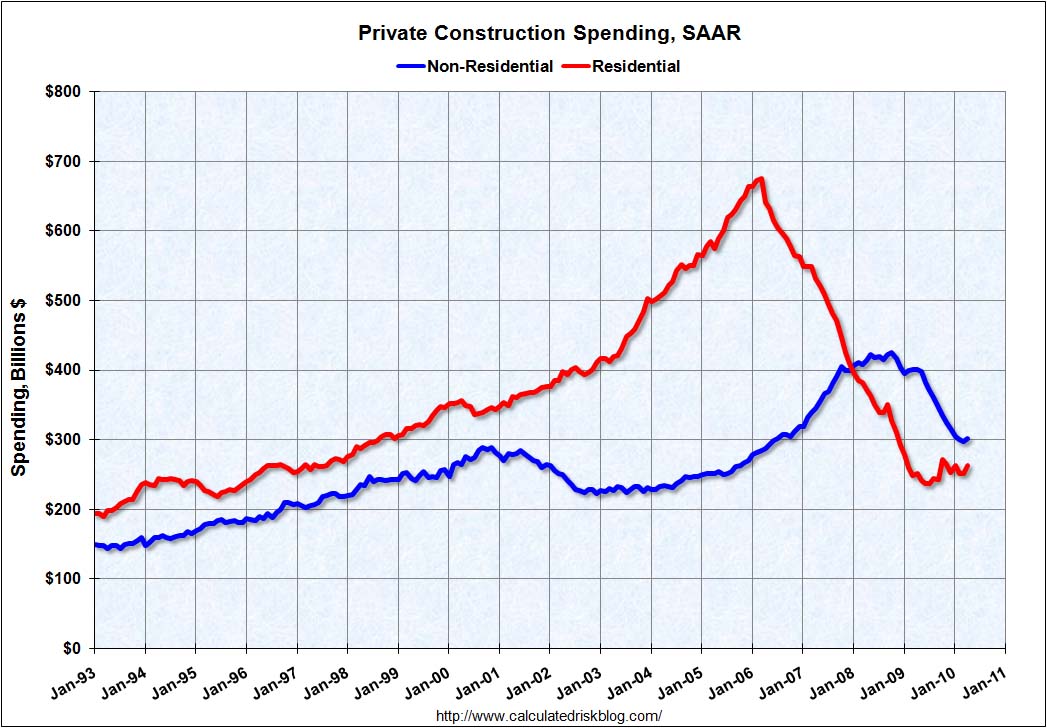

Construction Spending Increases Will It Subside Seeking Alpha

Blueprints Beach Buggy

Blueprints Beach Buggy

Kentucky VA Loan Credit Score Requirements Fha Mortgage Mortgage