In this digital age, with screens dominating our lives and the appeal of physical, printed materials hasn't diminished. Be it for educational use in creative or artistic projects, or simply to add the personal touch to your home, printables for free are a great resource. This article will take a dive in the world of "Tax Credit For Home Loan Interest," exploring the different types of printables, where you can find them, and how they can enrich various aspects of your life.

Get Latest Tax Credit For Home Loan Interest Below

Tax Credit For Home Loan Interest

Tax Credit For Home Loan Interest -

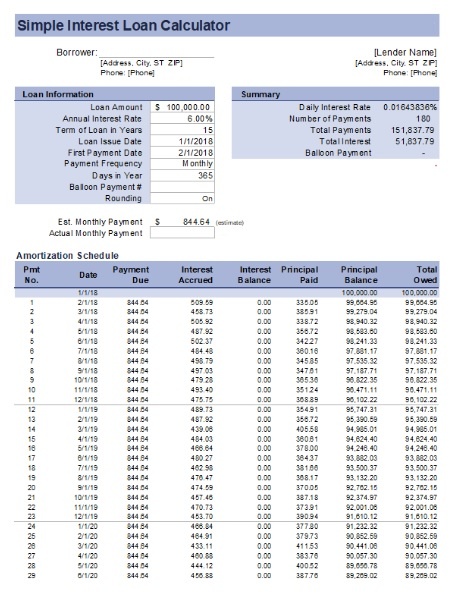

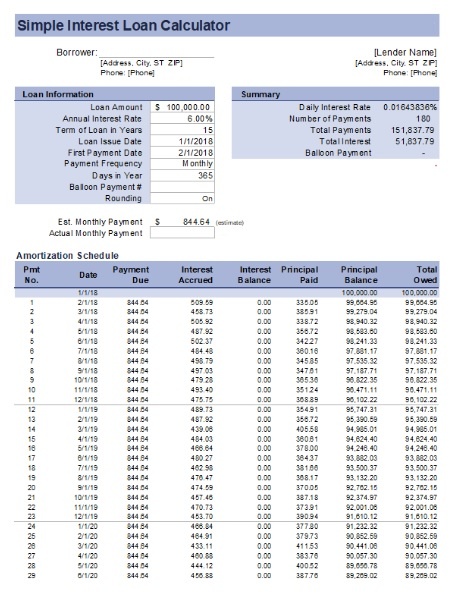

Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayer s home that secures the loan The loan must be secured by the taxpayer s

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Tax Credit For Home Loan Interest encompass a wide range of downloadable, printable materials that are accessible online for free cost. They are available in a variety of forms, including worksheets, coloring pages, templates and more. The great thing about Tax Credit For Home Loan Interest is in their variety and accessibility.

More of Tax Credit For Home Loan Interest

How To Download Home Loan Interest Certificate For Tax Proofs Submission

How To Download Home Loan Interest Certificate For Tax Proofs Submission

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one of

With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a lower tax bracket

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Customization: There is the possibility of tailoring printables to your specific needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Use: Free educational printables offer a wide range of educational content for learners of all ages, making these printables a powerful instrument for parents and teachers.

-

Affordability: instant access numerous designs and templates saves time and effort.

Where to Find more Tax Credit For Home Loan Interest

Application For Home Loan Interest Certificate Home Loan Application

Application For Home Loan Interest Certificate Home Loan Application

Home loan tax benefits can be claimed for multiple houses without restriction Self occupied properties allow deductions up to Rs 2 lakh for interest while let out properties

The IRS states that interest payments for home equity loans or a home equity line of credit are tax deductible when the proceeds are used to buy build or substantially improve the property

Since we've got your curiosity about Tax Credit For Home Loan Interest Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Tax Credit For Home Loan Interest to suit a variety of uses.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a broad selection of subjects, everything from DIY projects to planning a party.

Maximizing Tax Credit For Home Loan Interest

Here are some ideas how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Credit For Home Loan Interest are a treasure trove of practical and innovative resources for a variety of needs and passions. Their availability and versatility make them a wonderful addition to the professional and personal lives of both. Explore the many options of Tax Credit For Home Loan Interest now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes they are! You can print and download the resources for free.

-

Can I use free printables for commercial purposes?

- It's based on the rules of usage. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Tax Credit For Home Loan Interest?

- Some printables could have limitations in use. You should read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home using either a printer or go to any local print store for top quality prints.

-

What software must I use to open printables at no cost?

- The majority of printables are in the format of PDF, which can be opened with free programs like Adobe Reader.

Kentucky VA Loan Credit Score Requirements Fha Mortgage Mortgage

Improving Credit For Home Loan Savings YouTube

Check more sample of Tax Credit For Home Loan Interest below

Maintaining Good Credit For Home Loan And Business Expansion Flickr

PPT The Significance Of Establishing Strong Credit For Home Loan

How To Get A Solar Tax Credit For A Home Office Zero Down Solar

Bad Credit Home Loan In Australia Auzflow

All Banks Home Loan Interest Rate June 2022 LoanPaye

The Tax Credit For Home Insulation Windows And Doors In 2022

https://www.nerdwallet.com/article/tax…

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

https://www.bankrate.com/mortgages/mortgage-tax...

Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up

Bad Credit Home Loan In Australia Auzflow

PPT The Significance Of Establishing Strong Credit For Home Loan

All Banks Home Loan Interest Rate June 2022 LoanPaye

The Tax Credit For Home Insulation Windows And Doors In 2022

What Is A Good Credit Score To Buy A House Or Refinance

Portgase Blog

Portgase Blog

4 Ways To Improve Credit Score For A Home Loan