In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education in creative or artistic projects, or just adding personal touches to your area, Tax Credit For Home Working have become a valuable source. With this guide, you'll take a dive deeper into "Tax Credit For Home Working," exploring the benefits of them, where they are, and how they can add value to various aspects of your daily life.

Get Latest Tax Credit For Home Working Below

Tax Credit For Home Working

Tax Credit For Home Working -

Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off if they exceed 2 of adjustable gross income As is the case with most tax matters taxpayers may be required to show receipts and other documentation of

The tax credit for household expenses reduces the amount of tax you have to pay You can claim the credit if you pay for work to be done in your home such as cleaning child care renovation or computer installation You can also claim the credit for work done at a holiday home that you own

Tax Credit For Home Working provide a diverse array of printable resources available online for download at no cost. These resources come in various formats, such as worksheets, templates, coloring pages, and much more. The attraction of printables that are free is their versatility and accessibility.

More of Tax Credit For Home Working

Service Request R pit Ressource Montr al

Service Request R pit Ressource Montr al

How much you can claim You can either claim tax relief on 6 a week from 6 April 2020 for previous tax years the rate is 4 a week you will not need to keep evidence of your extra costs

How to claim Leave and gaps in your employment Eligibility You can only make a claim for Working Tax Credit if you already get Child Tax Credit If you cannot apply for Working Tax

Tax Credit For Home Working have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization You can tailor print-ready templates to your specific requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Education-related printables at no charge can be used by students of all ages, making them a useful resource for educators and parents.

-

The convenience of instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Credit For Home Working

Inflation Reduction Act 30 Tax Credit For Home Remodeling

Inflation Reduction Act 30 Tax Credit For Home Remodeling

If you re using an area of your home exclusively to work whether that s a shed in the backyard or a dedicated office you may be able to deduct it The word exclusive is very important Garofalo says

To claim for tax relief for working from home employees can apply directly via GOV UK for free Once their application has been approved the online portal will adjust their tax code for

We hope we've stimulated your interest in printables for free Let's find out where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of goals.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning materials.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs covered cover a wide range of topics, everything from DIY projects to planning a party.

Maximizing Tax Credit For Home Working

Here are some inventive ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Credit For Home Working are an abundance of practical and innovative resources which cater to a wide range of needs and preferences. Their availability and versatility make these printables a useful addition to each day life. Explore the plethora that is Tax Credit For Home Working today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printables to make commercial products?

- It depends on the specific rules of usage. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download Tax Credit For Home Working?

- Certain printables could be restricted in their usage. Be sure to read the terms and conditions offered by the author.

-

How can I print printables for free?

- You can print them at home using either a printer or go to an in-store print shop to get high-quality prints.

-

What software do I require to open printables for free?

- Many printables are offered as PDF files, which is open with no cost software such as Adobe Reader.

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Tax Credit Is Renewed

Check more sample of Tax Credit For Home Working below

How To Get A Solar Tax Credit For A Home Office Zero Down Solar

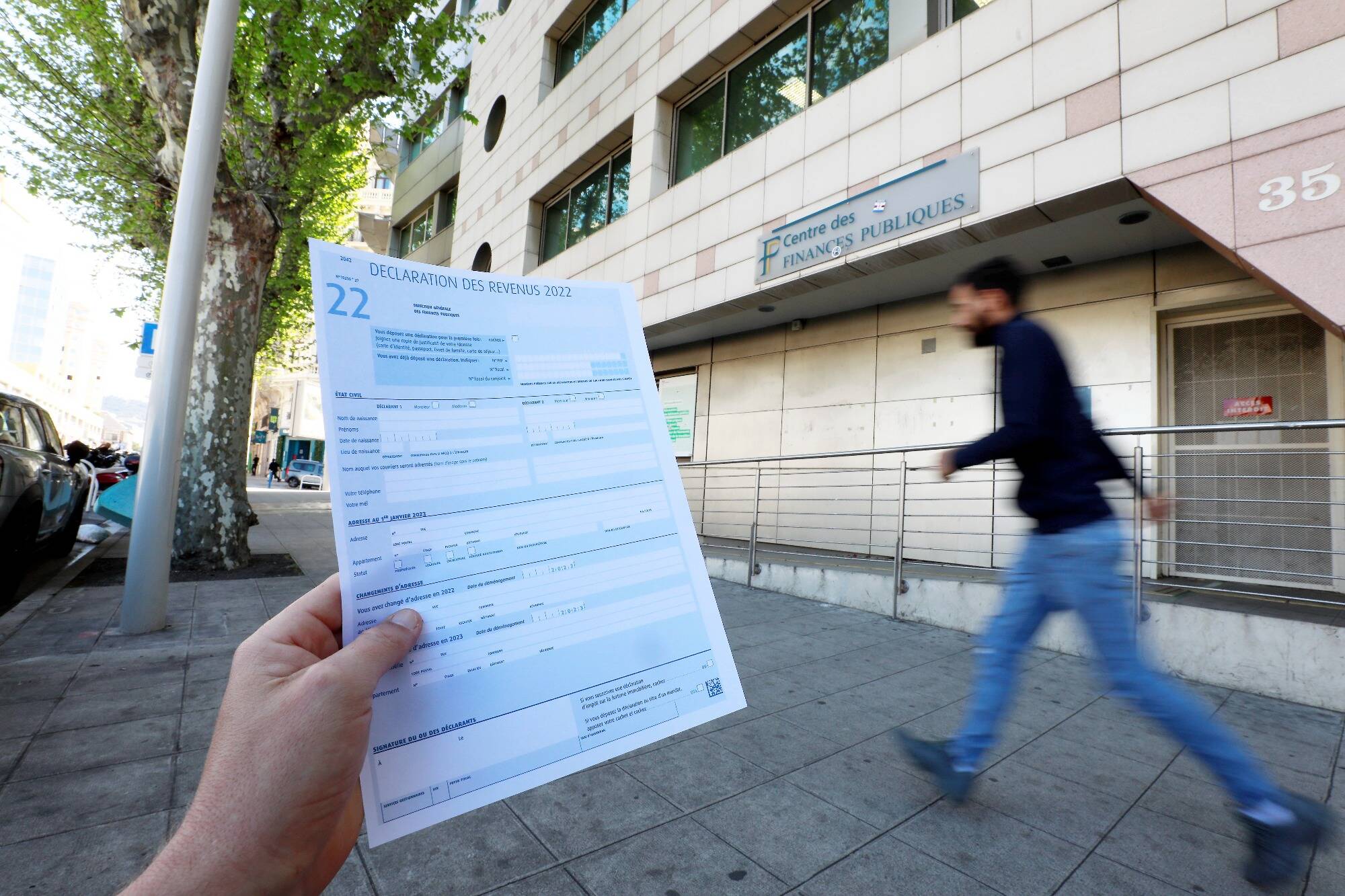

Lost In Your Tax Return Ask All Your Questions To Our Specialist

Section 45L Homebuilders Claim 2021 Section 45L Atlanta CPA

Is It Time To Put Your House On The Market Colorado Vault Safe

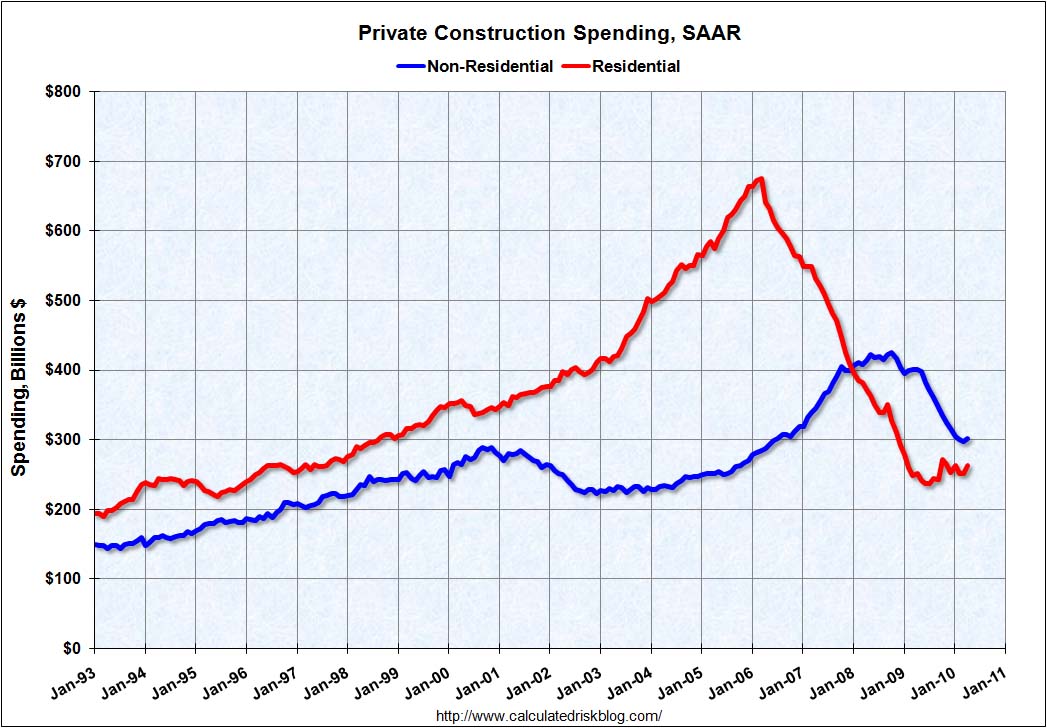

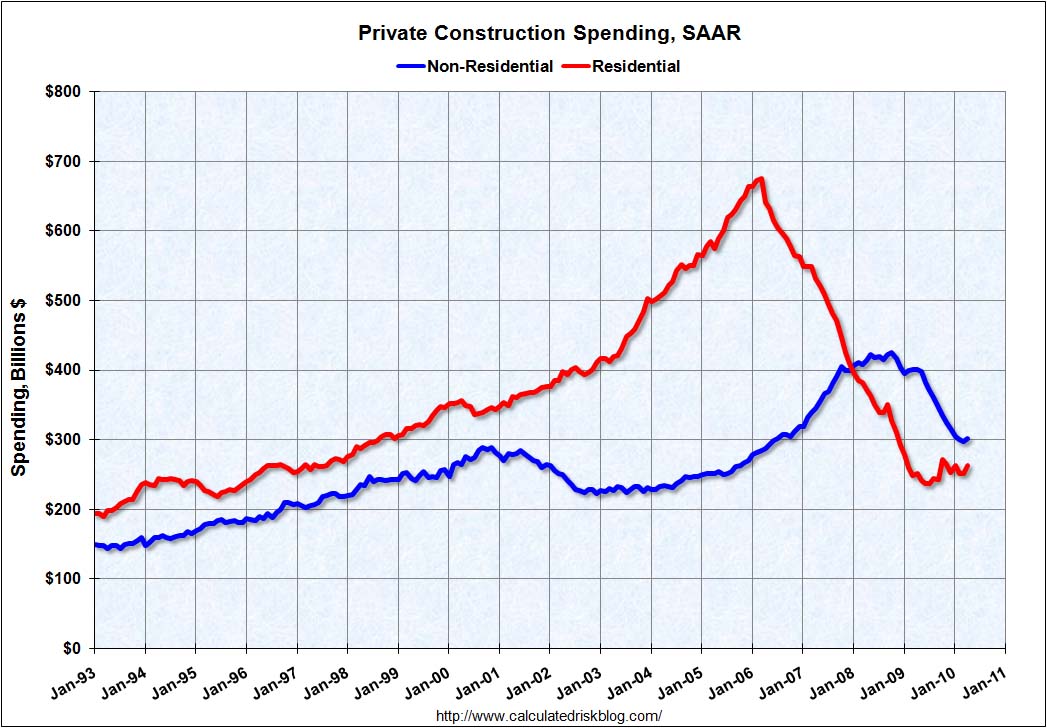

Construction Spending Increases Will It Subside Seeking Alpha

Get 150 Tax Credit For Home Energy Audit AND Discover How To Decrease

https://www.vero.fi/en/individuals/tax-cards-and...

The tax credit for household expenses reduces the amount of tax you have to pay You can claim the credit if you pay for work to be done in your home such as cleaning child care renovation or computer installation You can also claim the credit for work done at a holiday home that you own

https://www.vero.fi/en/individuals/tax-cards-and...

You can claim tax credit if some of the following work has been done at your home or holiday home cleaning cooking laundering ironing and garment care yard maintenance and gardening snow shovelling Nursing and caregiving include nursing and caring for children elderly people and disabled people washing dressing feeding and other

The tax credit for household expenses reduces the amount of tax you have to pay You can claim the credit if you pay for work to be done in your home such as cleaning child care renovation or computer installation You can also claim the credit for work done at a holiday home that you own

You can claim tax credit if some of the following work has been done at your home or holiday home cleaning cooking laundering ironing and garment care yard maintenance and gardening snow shovelling Nursing and caregiving include nursing and caring for children elderly people and disabled people washing dressing feeding and other

Is It Time To Put Your House On The Market Colorado Vault Safe

Lost In Your Tax Return Ask All Your Questions To Our Specialist

Construction Spending Increases Will It Subside Seeking Alpha

Get 150 Tax Credit For Home Energy Audit AND Discover How To Decrease

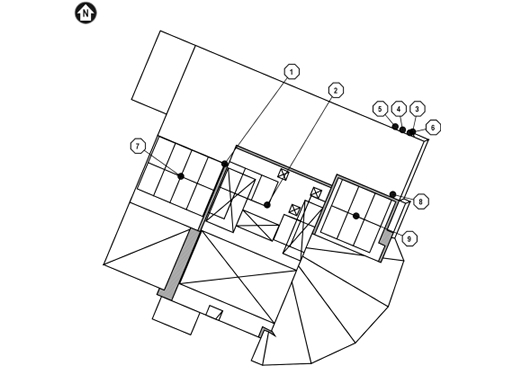

Blueprints Beach Buggy

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

The Tax Credit For Home Insulation Windows And Doors In 2022