In this day and age in which screens are the norm and the appeal of physical, printed materials hasn't diminished. It doesn't matter if it's for educational reasons as well as creative projects or simply adding personal touches to your area, Tax Credit For Student Loan Repayment are now a useful source. Through this post, we'll dive into the world of "Tax Credit For Student Loan Repayment," exploring their purpose, where they are, and how they can enhance various aspects of your daily life.

Get Latest Tax Credit For Student Loan Repayment Below

Tax Credit For Student Loan Repayment

Tax Credit For Student Loan Repayment -

If you paid at least 600 up to 2 500 in interest on your student loans you can claim this money to lower the amount of your income taxed by the government Your gross income must be 65 000 per year or below as a single filing taxpayer

Taxes Advertiser Disclosure Student Loan Interest Is Tax Deductible But Who Can Claim Janet Berry Johnson CPA Taxes Expert Reviewed Elizabeth Aldrich Deputy Editor Banking

Tax Credit For Student Loan Repayment encompass a wide array of printable materials available online at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and much more. One of the advantages of Tax Credit For Student Loan Repayment is in their variety and accessibility.

More of Tax Credit For Student Loan Repayment

Money For Student Loan Repayment On A Table Stock Photo Image Of

Money For Student Loan Repayment On A Table Stock Photo Image Of

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status

The American Opportunity Tax Credit is a federal tax credit that allows you to lower your tax bill by up to 2 500 if you paid that much in undergraduate education expenses last year How

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization The Customization feature lets you tailor printed materials to meet your requirements such as designing invitations to organize your schedule or decorating your home.

-

Educational Use: Printing educational materials for no cost provide for students of all ages, which makes them an essential instrument for parents and teachers.

-

An easy way to access HTML0: Instant access to a variety of designs and templates will save you time and effort.

Where to Find more Tax Credit For Student Loan Repayment

Student Loan Repayment Plans Income Based Repayment Forgiveness

Student Loan Repayment Plans Income Based Repayment Forgiveness

Up to 2 500 of student loan interest paid each year can be claimed as a deduction on Schedule 1 of the Form 1040 For 2023 the break begins to phase out for single filers with modified

You can take a tax deduction for the interest paid on student loans that you took out for yourself your spouse or your dependent This benefit applies to all loans not just federal student loans used to pay for higher education expenses The maximum deduction is 2 500 a year Using IRA Withdrawals for College Costs

In the event that we've stirred your interest in printables for free Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Tax Credit For Student Loan Repayment for all reasons.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide range of interests, that range from DIY projects to party planning.

Maximizing Tax Credit For Student Loan Repayment

Here are some fresh ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Credit For Student Loan Repayment are an abundance of useful and creative resources that satisfy a wide range of requirements and interest. Their access and versatility makes them a great addition to any professional or personal life. Explore the vast collection that is Tax Credit For Student Loan Repayment today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credit For Student Loan Repayment truly absolutely free?

- Yes, they are! You can print and download these files for free.

-

Can I use free printouts for commercial usage?

- It's based on the usage guidelines. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Are there any copyright problems with Tax Credit For Student Loan Repayment?

- Some printables may have restrictions in their usage. Be sure to review the terms and conditions provided by the designer.

-

How do I print Tax Credit For Student Loan Repayment?

- Print them at home using any printer or head to a local print shop to purchase more high-quality prints.

-

What software do I need to open printables free of charge?

- A majority of printed materials are as PDF files, which can be opened using free programs like Adobe Reader.

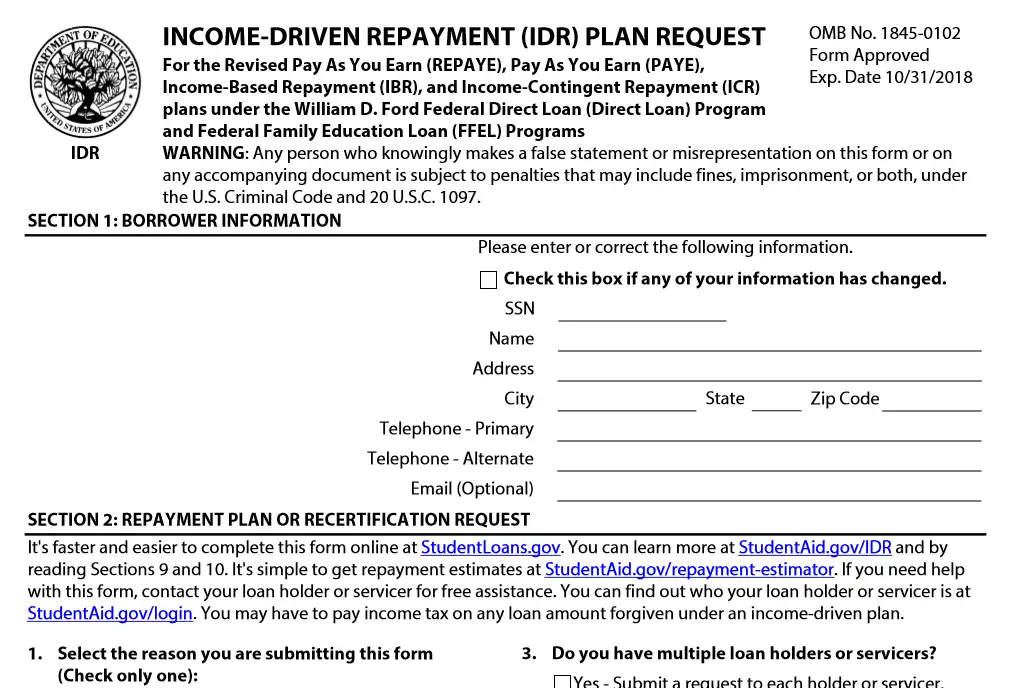

How To Apply For Income Based Student Loan Repayment UnderstandLoans

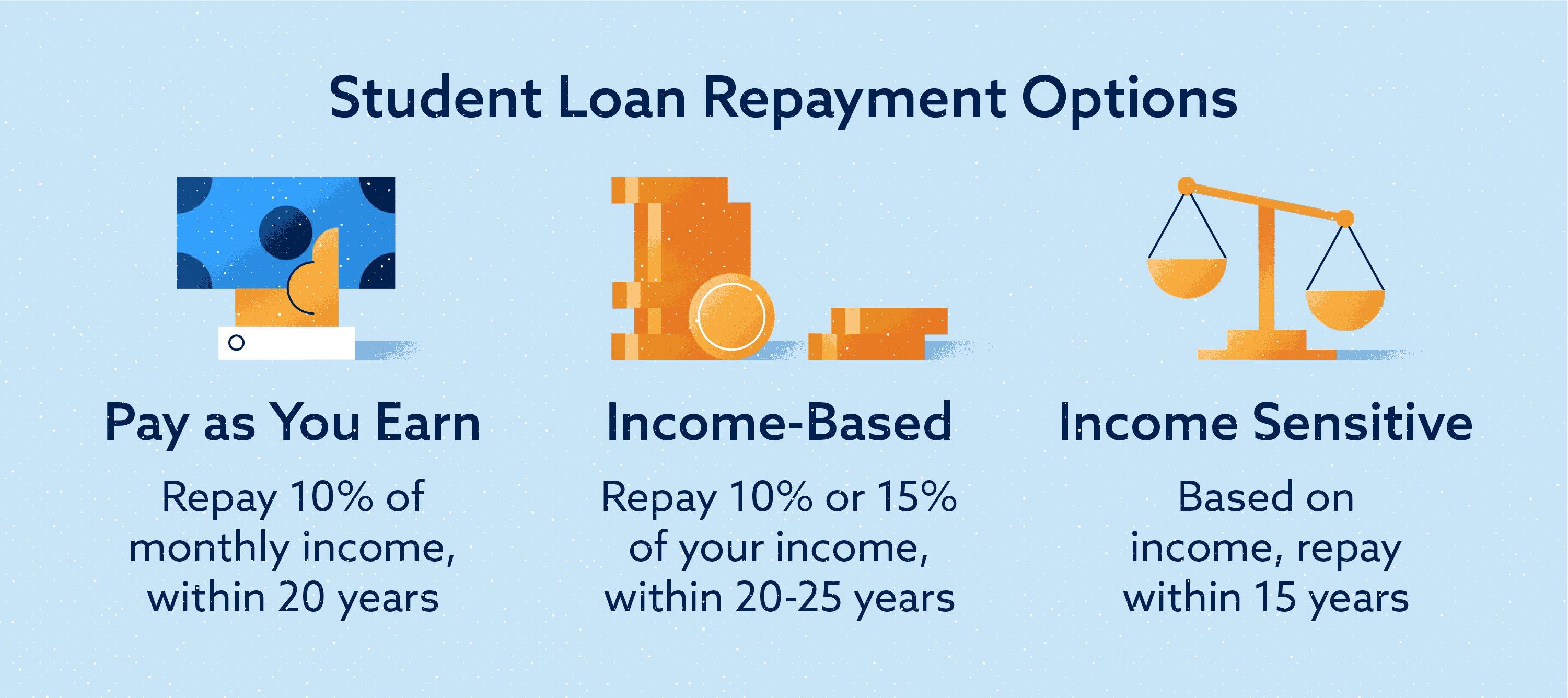

Options For Student Loan Repayment In 2021 The CreditPros

Check more sample of Tax Credit For Student Loan Repayment below

Do Student Loans Affect Your Credit Lexington Law

6 Ways To Prepare For Student Loan Repayment To Begin Again Federal

How To Save Money On Student Loan Repayment Student Loan Repayment

The Impact Of Filing Status On Student Loan Repayment Plans The Tax

List Of Government Grants For Student Loan Repayment

How To Apply For Student Loan Forgiveness

https://www.forbes.com/advisor/taxes/student-loan...

Taxes Advertiser Disclosure Student Loan Interest Is Tax Deductible But Who Can Claim Janet Berry Johnson CPA Taxes Expert Reviewed Elizabeth Aldrich Deputy Editor Banking

https://www.irs.gov/publications/p970

Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You can t claim the deduction if your MAGI is 90 000 or more 185 000 or more if you file a joint return See chapter 4

Taxes Advertiser Disclosure Student Loan Interest Is Tax Deductible But Who Can Claim Janet Berry Johnson CPA Taxes Expert Reviewed Elizabeth Aldrich Deputy Editor Banking

Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You can t claim the deduction if your MAGI is 90 000 or more 185 000 or more if you file a joint return See chapter 4

The Impact Of Filing Status On Student Loan Repayment Plans The Tax

6 Ways To Prepare For Student Loan Repayment To Begin Again Federal

List Of Government Grants For Student Loan Repayment

How To Apply For Student Loan Forgiveness

.jpg)

Smart Tips For Hassle Free Student Loan Repayment In 2023 Amber

ECSI Student Loan Tax Incentives

ECSI Student Loan Tax Incentives

FREE 6 Sample Income Based Repayment Forms In PDF