In this age of technology, where screens have become the dominant feature of our lives but the value of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or simply to add a personal touch to your area, Tax Credit Ira Contribution are now a vital resource. We'll dive into the world of "Tax Credit Ira Contribution," exploring what they are, how they are available, and ways they can help you improve many aspects of your life.

Get Latest Tax Credit Ira Contribution Below

Tax Credit Ira Contribution

Tax Credit Ira Contribution -

If you make certain contributions to an employer retirement plan or an individual retirement arrangement IRA or if you contribute to an Achieving a Better Life Experience

To get the most out of contributing to your IRA it s important to understand what these benefits mean and the limitations placed on them The benefits of contributing to an IRA include tax

Tax Credit Ira Contribution provide a diverse array of printable resources available online for download at no cost. These materials come in a variety of forms, including worksheets, coloring pages, templates and many more. One of the advantages of Tax Credit Ira Contribution is in their versatility and accessibility.

More of Tax Credit Ira Contribution

401k Max 2023 PELAJARAN

401k Max 2023 PELAJARAN

Contributions to a traditional IRA which is the most common choice are deductible in the tax year during which they are paid You won t owe taxes on the contributions or their

You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your IRA See IRA contribution limits

Tax Credit Ira Contribution have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: We can customize printed materials to meet your requirements for invitations, whether that's creating them, organizing your schedule, or even decorating your home.

-

Educational value: Downloads of educational content for free provide for students of all ages, making them a vital aid for parents as well as educators.

-

Simple: You have instant access a plethora of designs and templates, which saves time as well as effort.

Where to Find more Tax Credit Ira Contribution

IRA Contribution Deadline 2022 Lowering Your Tax Bill Fortune

IRA Contribution Deadline 2022 Lowering Your Tax Bill Fortune

Here s what you need to know about how to lower your taxes with last minute IRA contributions You have until April 18 2024 to contribute to an IRA up to 6 500 for tax year 2023 or a total

The Saver s Credit aka the Retirement Savings Contribution Credit is a lesser known highly advantageous tax credit that the IRS offers to incentivize low and moderate income taxpayers to make retirement

Now that we've ignited your curiosity about Tax Credit Ira Contribution we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Tax Credit Ira Contribution to suit a variety of needs.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Tax Credit Ira Contribution

Here are some fresh ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Tax Credit Ira Contribution are an abundance filled with creative and practical information that can meet the needs of a variety of people and preferences. Their accessibility and flexibility make them an invaluable addition to your professional and personal life. Explore the wide world of Tax Credit Ira Contribution and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes they are! You can download and print the resources for free.

-

Are there any free printables to make commercial products?

- It depends on the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations in their usage. Make sure to read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to any local print store for the highest quality prints.

-

What software do I need to open Tax Credit Ira Contribution?

- Most printables come in PDF format, which can be opened using free software like Adobe Reader.

IRA DEDUCTION AND CONTRIBUTION LIMITS 2019 ROTH Vs Traditional YouTube

Clean Hydrogen And Energy Investments From The Inflation Reduction Act

Check more sample of Tax Credit Ira Contribution below

2023 Roth Ira Limits W2023G

IRS Limits On Retirement Benefits And Compensation EisnerAmper Wealth

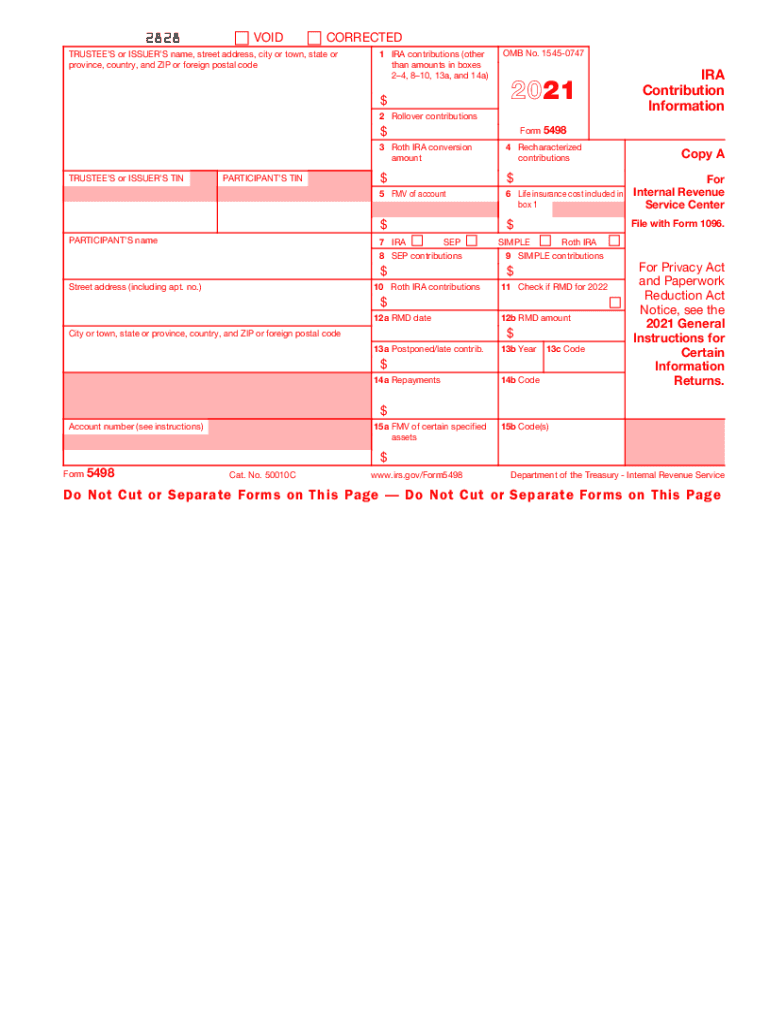

2012 Form 5498 Fill Out And Sign Printable PDF Template SignNow

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

High Resolution 2023 Tsp Maximum Contribution

How Much Of My Ira Contribution Is Tax Deductible Tax Walls

https://www.investopedia.com/articles/…

To get the most out of contributing to your IRA it s important to understand what these benefits mean and the limitations placed on them The benefits of contributing to an IRA include tax

https://www.nerdwallet.com/article/tax…

What is the saver s credit The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing jointly

To get the most out of contributing to your IRA it s important to understand what these benefits mean and the limitations placed on them The benefits of contributing to an IRA include tax

What is the saver s credit The retirement savings contribution credit the saver s credit for short is a nonrefundable tax credit worth up to 1 000 2 000 if married filing jointly

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest

IRS Limits On Retirement Benefits And Compensation EisnerAmper Wealth

High Resolution 2023 Tsp Maximum Contribution

How Much Of My Ira Contribution Is Tax Deductible Tax Walls

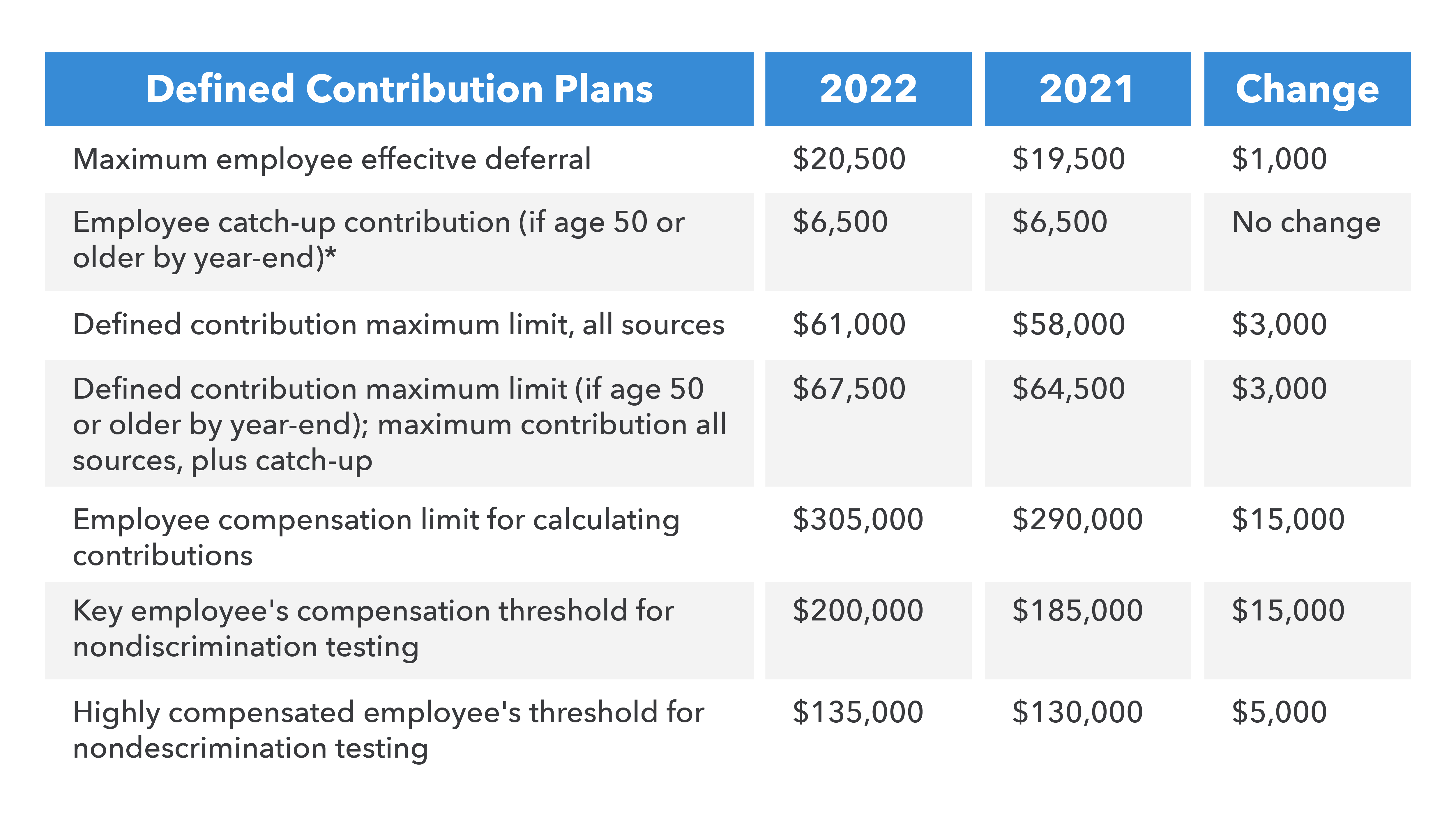

2021 Retirement Contribution Limits Early Retirement

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

Max Tsp Contribution 2020 2020 401 k Contribution Limits 2019 12 15