In this day and age when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons in creative or artistic projects, or just adding personal touches to your space, Tax Credit On Air Conditioner 2023 are now an essential resource. In this article, we'll take a dive into the sphere of "Tax Credit On Air Conditioner 2023," exploring the benefits of them, where to find them and how they can enrich various aspects of your daily life.

Get Latest Tax Credit On Air Conditioner 2023 Below

Tax Credit On Air Conditioner 2023

Tax Credit On Air Conditioner 2023 -

Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Tax Credit On Air Conditioner 2023 cover a large assortment of printable materials that are accessible online for free cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. The value of Tax Credit On Air Conditioner 2023 lies in their versatility as well as accessibility.

More of Tax Credit On Air Conditioner 2023

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are made As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following HVAC tax credits could be available if your state submits an

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Modifications: This allows you to modify the design to meet your needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Free educational printables provide for students of all ages, which makes them an invaluable instrument for parents and teachers.

-

Accessibility: immediate access numerous designs and templates can save you time and energy.

Where to Find more Tax Credit On Air Conditioner 2023

How To Reduce Home Cooling Cost Advance Financial Blog

How To Reduce Home Cooling Cost Advance Financial Blog

Homeowners can qualify for a tax credit worth up to 1 200 a year for installing high efficiency air conditioners or furnaces and also for making certain other upgrades to improve their home s energy efficiency such as adding insulation or replacing windows and doors

For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation The dollar limit that this credit maxes out at varies depending on what s being upgraded

In the event that we've stirred your interest in printables for free and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Tax Credit On Air Conditioner 2023 to suit a variety of reasons.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- The blogs are a vast range of interests, including DIY projects to planning a party.

Maximizing Tax Credit On Air Conditioner 2023

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Credit On Air Conditioner 2023 are an abundance of creative and practical resources designed to meet a range of needs and pursuits. Their access and versatility makes them a great addition to the professional and personal lives of both. Explore the plethora of Tax Credit On Air Conditioner 2023 and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credit On Air Conditioner 2023 really are they free?

- Yes they are! You can print and download these tools for free.

-

Do I have the right to use free templates for commercial use?

- It's all dependent on the usage guidelines. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to check the conditions and terms of use provided by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to any local print store for the highest quality prints.

-

What software do I require to open Tax Credit On Air Conditioner 2023?

- Most printables come with PDF formats, which is open with no cost software such as Adobe Reader.

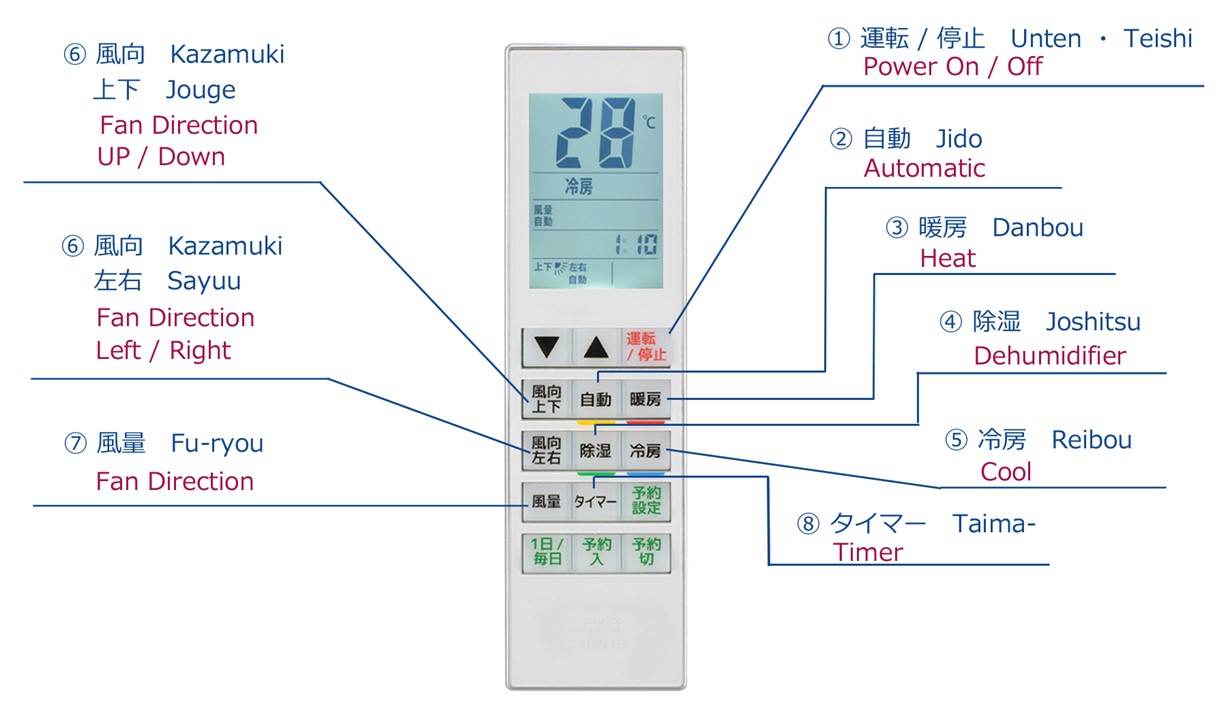

How To Translate The Remote Control Of Your Japanese Air Conditioner 2023

Quad 4 Zone Ductless Mini Split Air Conditioner

Check more sample of Tax Credit On Air Conditioner 2023 below

Tax Credit May Rev Up Carbon Capture And Sequestration Technology

List Of 10 Best Biotera Shampoo And Conditioner 2023 Reviews

How To Switch On Air Conditioner 2023

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

List Of 10 Best Magnavox Portable Air Conditioner 2023 Reviews

What Is An Air Conditioner Tax Credit with Pictures

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

https://www.honestairconditioning.biz/blog/...

Effective starting in 2023 homeowners can qualify for a tax credit equal to 30 of installation costs for highly efficient heating and cooling products up to 2 000 for qualifying heat pumps See the types of heat pumps that qualify for a tax credit

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Effective starting in 2023 homeowners can qualify for a tax credit equal to 30 of installation costs for highly efficient heating and cooling products up to 2 000 for qualifying heat pumps See the types of heat pumps that qualify for a tax credit

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

List Of 10 Best Biotera Shampoo And Conditioner 2023 Reviews

List Of 10 Best Magnavox Portable Air Conditioner 2023 Reviews

What Is An Air Conditioner Tax Credit with Pictures

C H 18000 BTU Ductless Heat Pump In Minisplitwarehouse Shop Our

Find The Best Gree Air Conditioner 2023 Reviews

Find The Best Gree Air Conditioner 2023 Reviews

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer